Image: Pixabay

The year 2020 was off to a bad start as the coronavirus began spreading from Wuhan, where the first case was reported late in 2019. As the virus spread, countries including India, opted for lockdowns to curb infections as the human toll began to mount. The restrictions wrecked economies and benchmark indices crashed 40 percent in March but after hitting multi-year lows, markets started rebounding in the last week of March.

As lockdown measures eased, the market extended the rally sharply in the second half of 2020. Fiscal stimulus, improving economic data, vaccine progress, better-than-expected September quarter earnings and central banks' moves to shore up the economy with ample liquidity lifted the sentiment.

The BSE Sensex and Nifty50 ended 2020 with 15 percent gains and hit fresh highs levels on December 31.

"The indexes have moved up, gaining mainly from the accommodative fiscal and monetary policy, both facilitating an unprecedented liquidity expansion. It is the low-interest rates and the easy liquidity that have helped the economy recover to some extent and prompted the markets to move up. These favourable conditions also helped the overall sentiment," Joseph Thomas, Head of Research at Emkay Wealth Management told Moneycontrol.

Technology and pharma topped the gainers' list, rising 55 percent and 60 percent, respectively. The banking sector was the worst hit, down nearly 3 percent—PSU bank index fell 30.6 percent and private bank declined 3 percent.

The broader markets—midcap and smallcap—outperformed the benchmarks, rising more than 21 percent in 2020 and gained 90 percent and 110 percent from March lows.

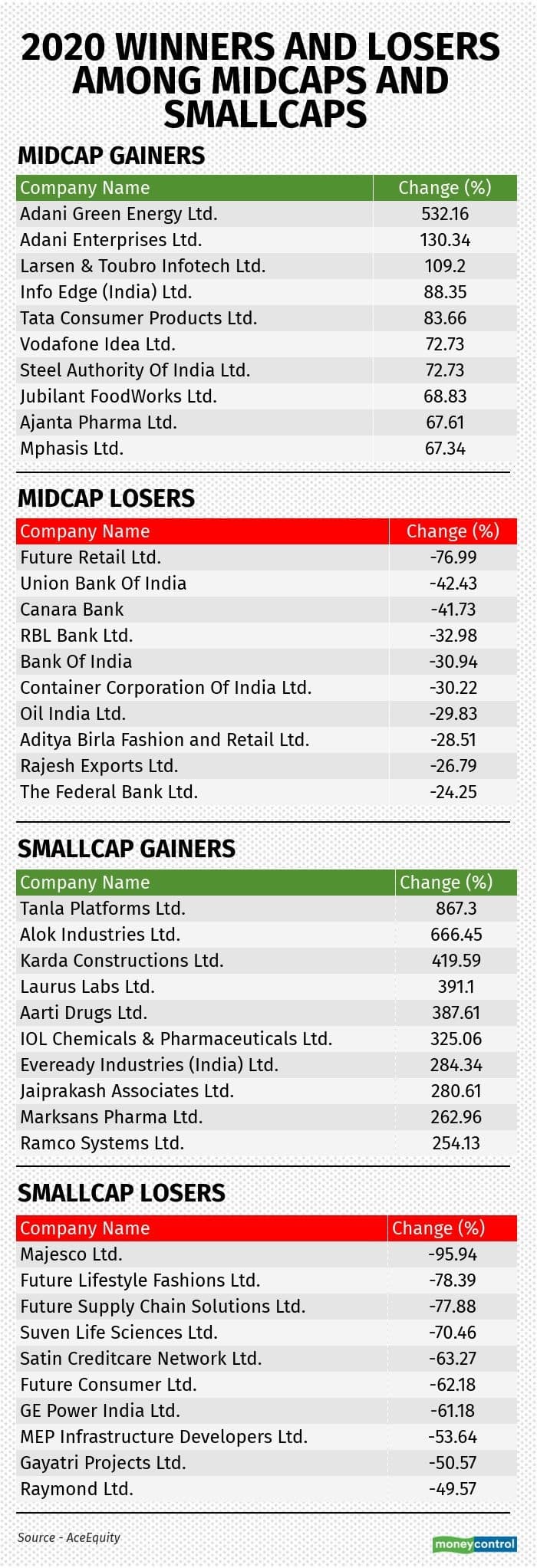

Among midcaps, Adani Green Energy, Adani Enterprises, L&T Infotech, Info Edge (India) and Tata Consumer Products were the biggest gainers, while Bank Of India, RBL Bank, Canara Bank, Union Bank Of India and Future Retail were the top losers.

In the smallcap space, Tanla Platforms, Alok Industries, Karda Constructions, Laurus Labs and Aarti Drugs topped the buying list, while the biggest losers were Majesco, Future Lifestyle Fashions, Future Supply Chain Solutions, Suven Life Sciences and Satin Creditcare Network.

Global wrap

Global markets had tanked more than 30 percent by March but the liquidity boost and vaccine progress along with hope that 2021 will not see COVID-19-like crisis helped markets recover the losses and march further.

The United States continued to report around 1-2 lakh infections daily in November and December but the market, which looks forward instead of the current situation, continued to move up. Hence, as a result the Dow Jones and S&P500 hit record highs on the last day of the year, rising 7.3 percent and 16.3 percent in 2020.

The Nasdaq composite, the tech-heavy index, gained the most among the three US indices, rallying more than 43 percent this year.

The best performing sector was the technology with 42 percent gains, whereas the energy index hit hard with a loss of 36 percent.

The biggest gainer in S&P500 index was Tesla (up 743 percent) and the worst was Occidental Petroleum (down 58 percent). The best performing Dow Jones stock was Apple (up more than 80 percent) and the biggest loser was Boeing (down 34 percent).

The volatility increased significantly during the year. The CBOE Volatility Index (VIX) was up 65 percent in the year.

"The containment of the pandemic is key to bringing back a high velocity of economic activity back into the global economy. It may be too early to say anything about further stimulus measures in the major economies. The US has a huge stimulus package already unveiled and there could be more coming from the new dispensation. The ECB had two rounds of quantitative easing and liquidity injection," Joseph Thomas of Emkay Wealth Management said.

"The departure from complete lockdown to partial lockdown selectively has resulted in the generation of a higher level of activity. We can hopefully look forward to better times in 2021," he added.

Europe has been hit hard by the second wave of the coronavirus, which has again forced nations like the UK, France and Germany to bring back lockdowns. Given the impact of lockdown, equity benchmark indices underperformed global counterparts.

The Stoxx 600 index closed 2020 with nearly 4 percent loss. Britain's FTSE was down more than 14 percent, France's CAC40 down 7 percent, Italy's FTSE MIB index down over 5 percent and Spain's IBEX index plunged nearly 15 percent during the year, whereas Germany's DAX was up more than 3 percent.

Among Asian counterparts, South Korea's Kospi was the biggest gainer with more than 30 percent gains followed by Japan's Nikkei 225 Average with 16 percent rise and China's Shanghai Composite was up nearly 14 percent but Singapore's Straits Times Index plunged nearly 14 percent and Hong Kong's Hang Seng was down 3.4 percent.

Commodities

Silver was the best performing commodity, gaining around 45 percent in the year 2020, while gold registered 25 percent gains amid a liquidity boost and a weak dollar index. Copper gained more than 24 percent due to a significant turnout in demand from China.

Oil markets also curtailed some losses towards the end of the year, supported by optimism over the coronavirus vaccine and the new stimulus measures in the US. WTI crude oil prices plunged 14 percent and Brent futures lost 15 percent during the year.

The US dollar index fell around 7 percent, while cryptocurrency Bitcoin shot up more than 300 percent in 2020.