Novavax Stock Is up Over 2,900% This Year. How Much Higher Can It Go?

Returns smart, Novavax (NVAX) has undoubtedly been probably the most profitable coronavirus inventory of all of them, with 2020 good points hitting an incredible 2920%. However, heading into the yr’s last stretch, the vaccine specialist’s COVID-19 vaccine candidate NVX-CoV2373 has been at hazard of getting reduce adrift from the competitors.

Both Moderna’s (MRNA) mRNA-1273 and Pfizer (PFE)/BioNTech’s (BNTX) BNT162b2, have already been granted emergency use authorization and are already being distributed throughout the U.S. and the world.

But now Novavax can lastly work towards closing the hole. At lengthy final, on Monday, the corporate introduced the U.S. and Mexico Phase 3 research’s carry off.

The PREVENT-19 trial evaluating NVX-CoV2373 has been launched in 115 places and 30,000 individuals are anticipated to enroll in this system. With greater than 25% of individuals over the age of 65, and black/African American sufferers making up an extra 15%, the research has been specifically designed to evaluate the vaccine candidate’s influence on as various a inhabitants as potential.

Novavax already has a completely enrolled Phase 3 scientific trial in course of within the U.Ok. with an interim information readout anticipated shortly.

The firm is likely to be lagging behind the competitors, however its providing has distinctive properties differentiating it from the already obtainable vaccines. Unlike Moderna’s vaccine which should be stored in a freezer and Pfizer/BioNTech’s providing which requires much more excessive ultra-cold temperatures, NVX-CoV2373 might be saved in a fridge.

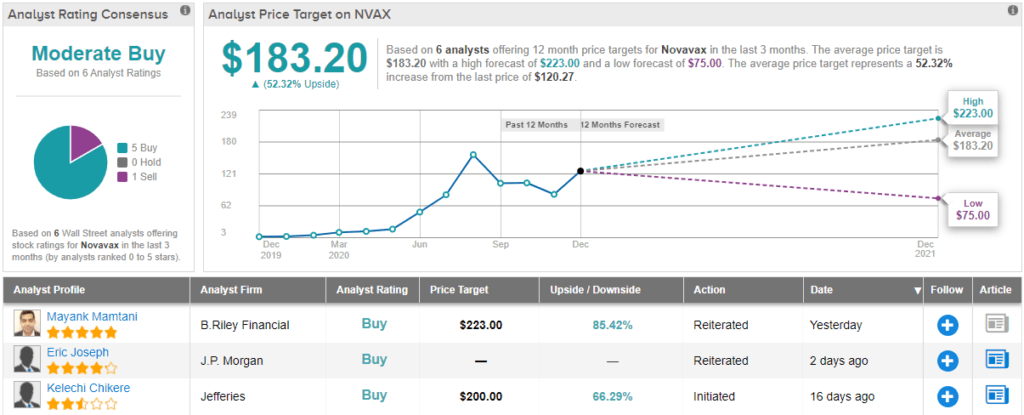

B.Riley analyst Mayank Mamtani says a primary interim information readout from the U.S. research is probably going in early 2Q21. The analyst believes Novavax’ providing may nonetheless have a starring function within the international distribution of Covid-19 vaccines and tells buyers to purchase the current dip.

“We stay favorably biased in direction of our bull case state of affairs of NVAX’s best-in-class immunogenicity translating into 90%+ VE and differentiated goal product profile when it comes to reactogenicity to place ‘2373 as a preferred global vaccine solution,” the 5-star analyst said. “We believe NVAX 12/28 equity weakness (-10%), largely attributed to AZ’s positive comments regarding AZD1222 being reviewed by U.K. regulators this week, presents a compelling buying opportunity.”

Accordingly, Mamtani’s score stays a Buy, while the $223 value goal stays, too. Gains of 85% may very well be within the playing cards, ought to the goal be met over the following 12 months. (To watch Mamtani’s monitor file, click here)

Barring 1 Sell, all 5 different present analyst opinions price Novavax a Buy. NVAX’s Moderate Buy consensus score is backed by a $183.20 common value goal, implying potential upside of 52% within the yr forward. (See NVAX stock analysis on TipRanks)

To discover good concepts for coronavirus shares buying and selling at engaging valuations, go to TipRanks’ Best Stocks to Buy, a newly launched software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analyst. The content material is meant for use for informational functions solely. It is essential to do your individual evaluation earlier than making any funding.