The market gained for the fifth consecutive session and ended at a fresh record closing high on December 29, with support from banking and financial stocks.

The BSE Sensex rose 259.33 points to 47,613.08, while the Nifty50 jumped 59.40 points to 13,932.60 and formed a small bullish candle on the daily charts.

On a daily basis, "the Nifty50 closed above the level of 13,900, which is positive for the market and we expect it to stabilise at these levels. Also, it could invite buying at major supports," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities told Moneycontrol.

He feels the Nifty50 would trade between 13,800 and 14,100 levels for the next two days. "Keep long stop loss at 13,700 for the same," he said.

Subash Gangadharan, Technical and Derivative Analyst at HDFC Securities expects the index to make new life highs in the coming sessions.

However, the broader markets underperformed benchmark indices and closed flat with a negative bias.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 13,872.47, followed by 13,812.33. If the index moves up, the key resistance levels to watch out for are 13,980.17 and 14,027.73.

Nifty Bank

The Nifty Bank climbed 441.50 points or 1.43 percent to end at 31,322.50 on December 29, outperforming the Nifty50. The important pivot level, which will act as crucial support for the index, is placed at 31,096.96, followed by 30,871.43. On the upside, key resistance levels are placed at 31,453.67 and 31,584.83.

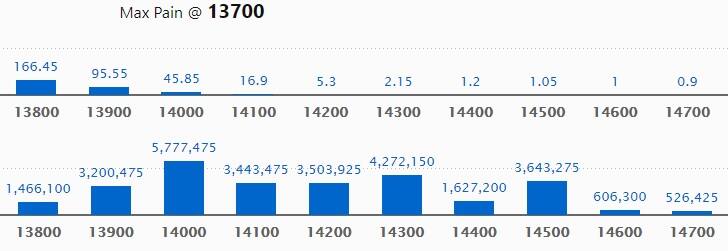

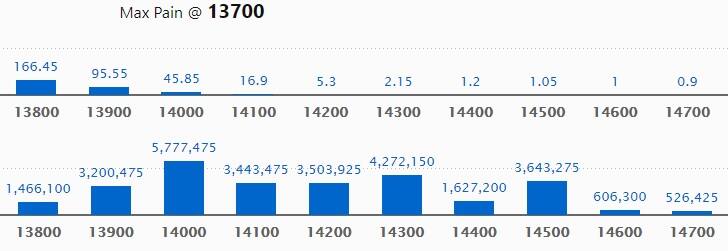

Call option data

Maximum Call open interest of 57.77 lakh contracts was seen at 14,000 strike, which will act as a crucial resistance level in the December series.

This is followed by 14,300 strike, which holds 42.72 lakh contracts, and 14,500 strike, which has accumulated 36.43 lakh contracts.

Call writing was seen at 14,300 strike, which added 17.94 lakh contracts, followed by 14,100 strike which added 12.97 lakh contracts and 14,000 strike which added 10.63 lakh contracts.

Call unwinding was seen at 13,800 strike, which shed 6.67 lakh contracts, followed by 13,700 strike which shed 4.91 lakh contracts and 14,500 strike which shed 3.15 lakh contracts.

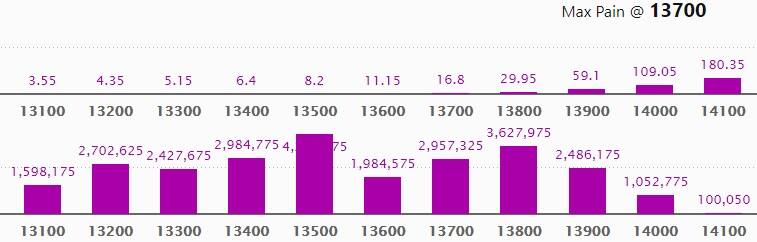

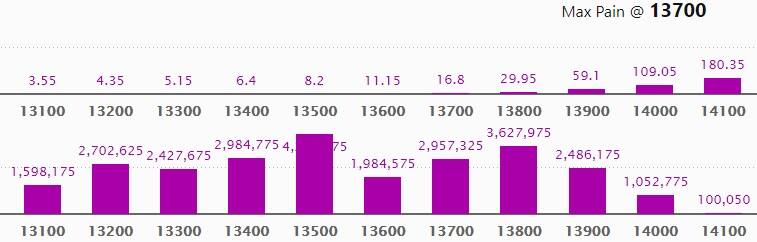

Put option data

Maximum Put open interest of 42.71 lakh contracts was seen at 13,500 strike, which will act as a crucial support level in the December series.

This is followed by a 13,800 strike, which holds 36.27 lakh contracts, and 13,400 strike, which has accumulated 29.84 lakh contracts.

Put writing was seen at 13,900 strike, which added 12.85 lakh contracts, followed by 13,800 strike, which added 8.55 lakh contracts and 14,000 strike which added 4.26 lakh contracts.

Put unwinding was seen at 13,200 strike, which shed 2.7 lakh contracts, followed by 13,600 strike, which shed 2.75 lakh contracts and 13,700 strike which shed 2.56 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

25 stocks saw long build-up

Based on the open interest future percentage, here are the 10 stocks in which a long build-up was seen.

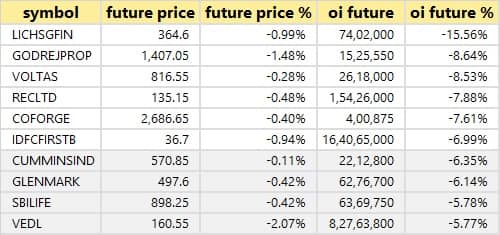

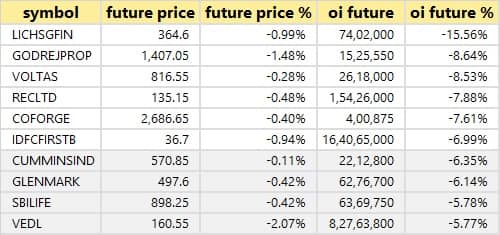

51 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

32 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

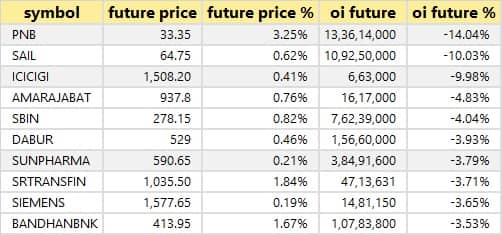

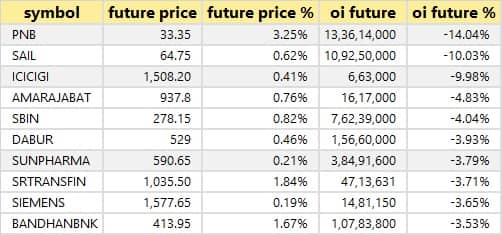

29 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

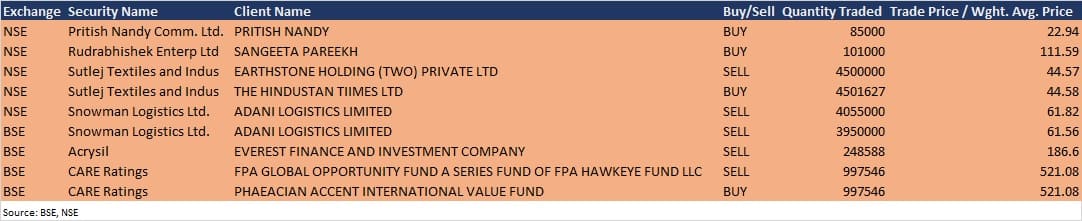

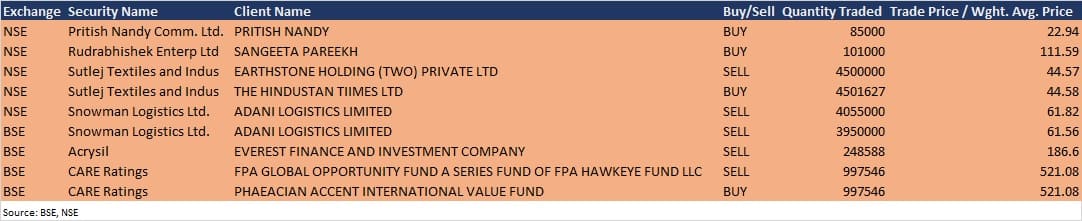

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

LG Balakrishnan & Bros: Board meeting is scheduled on January 28 to consider December quarter results.

Ramco Systems: Board meeting is scheduled on February 3 to consider December quarter results.

Sonal Adhesives: Board meeting is scheduled for February 12 to consider December quarter results.

Stocks in the news

Paisalo Digital: Elara India Opportunities Fund reduced stake in the company to 1.76% from 4.37% earlier by selling 2.6% stake via open market transaction.

UPL: Company completed the pre-payment of $410 million of 3.25% Senior Notes due October 2021. This prepayment is in line with its commitment to reduce debt.

Jindal Steel & Power: Company gets 'regular supplier' status from Indian Railways to supply 60kg 880 grade (90UTS) Rails.

IFGL Refractories: ICRA upgraded credit rating assigned for Rs 173 crore line of credit of the company.

Jindal Stainless Hisar: Board of directors of Jindal Stainless (JSL) and Jindal Stainless (Hisar) (JSHL) approved the merger of JSHL into JSL. As per the approved share swap ratio, 195 equity shares of JSL will be issued for every 100 equity shares of JSHL.

IIFL Securities: Company to open its Rs 90-crore share buyback on December 30.

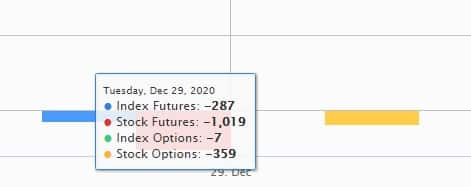

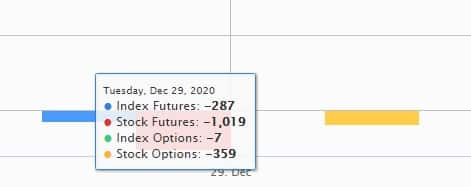

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,350 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,020 crore in the Indian equity market on December 29, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Punjab National Bank and SAIL - are under the F&O ban for December 30. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

_2020091018165303jzv.jpg)