Table of Contents

- Documents required for property registration in Telangana

- Fees and timelines for Telangana land and property registration

- How to calculate stamp duty and registration charges in Telangana?

- Checklist for creating sale deed in Telangana

- How to register property in Telangana?

- How to check the market value of land in Telangana using Dharani Portal?

- Telangana land and property registration: Latest news

- FAQs

Property buyers in Telangana have to register the sale with the Telangana Registration and Stamp Department. A buyer, along with the seller and witnesses, needs to visit the sub-registrar’s office, nearest to the location of the property, to pay the stamp duty and registration charges as applicable in Telangana state. A part of the Telangana property and land registration can be done online, where you have to upload all the documents online.

Documents required for property registration in Telangana

The buyer has to upload all the documents online on the portal, before visiting the sub-registrar’s office for sale deed registration. The documents required are:

- Original documents, with the signature of all parties.

- Encumbrance certificate.

- Demand draft/bank challan of payment of full stamp duty.

- Property card

- Section 32A photo form of executants and witnesses.

- Identity proof of the buyer, seller and witnesses.

- PAN card.

- Power of attorney.

- Aadhaar card.

- Address proof of the buyer and seller.

- Photograph of the property’s exterior.

- Pattadar passbook for agricultural land.

See also: Hyderabad master plan 2031

Fees and timelines for Telangana land and property registration

The property owner will be required to pay stamp duty, registration fee and transfer duty, during the registration as given below:

Fees for document registration

| Document | Stamp duty | Transfer duty | Registration fee |

| Sale of apartment/flat (semi-furnished) | 4% | 1.5% | 0.5% |

| Sale agreement with possession | 4% | 0 | 0.5% (minimum Rs 5,000, maximum Rs 20,0000) |

| Sale agreement without possession | 0.5% | 0 | 0.5% (minimum Rs 5,000, maximum Rs 20,0000) |

| Sale agreement-cum-GPA | 5% | 0 | Rs 2,000 |

| Will | 0 | 0 | Rs 1,000 |

Timelines for document registration

| Service | Time frame | Officer responsible |

| Document registration including sale deed, lease deed, agreement, etc. | 24 hours (After registration, the document will be scanned, certified and returned to the parties). | Sub-registrar |

| Issue of encumbrance certificate | 1 hour (After conducting a search of the computer records, a certificate in a fixed format is issued to parties). | Junior/senior assistant |

| Issue of market value | 1 hour (On application by the party, a computer-generated value slip is issued) | Junior/senior assistant |

See also: A guide to calculating and paying property tax online in Hyderabad

How to calculate stamp duty and registration charges in Telangana?

Property buyers can easily calculate stamp duty and registration charges on land using following steps:

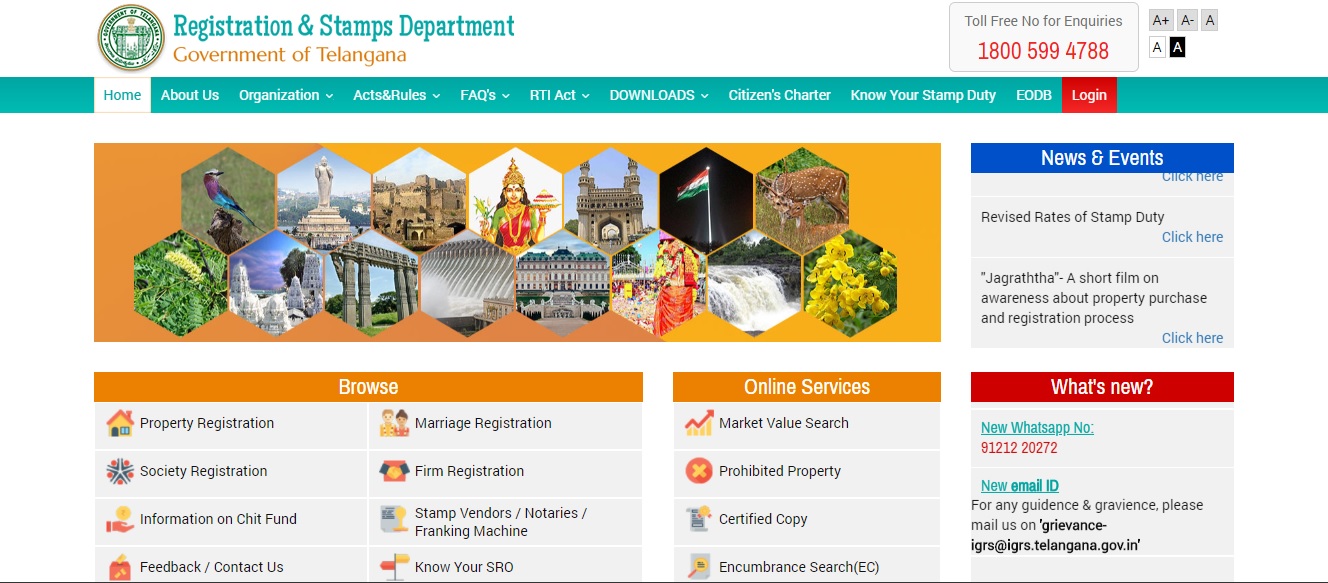

Step 1: Visit the Registration and Stamp department portal of Telangana

Step 2: Choose the nature of transaction from the drop-down menu and enter the consideration value.

Step 3: Write Y/N if the property has been identified. If the property is identified, mention the measurements and boundary length.

Step 4: Click ‘Calculate’ and you will be able to see the values calculated.

Checklist for creating sale deed in Telangana

A property owner should get the sale deed drafted by the legal draftsman on a non-judicial stamp paper of the requisite value. The parties should use five non-judicial stamp papers, while the remaining amount has to be paid through the challan system or any other medium, as mentioned by the state government. The sale deed should have following clauses:

Name of the deed: The document should clearly mention which type of deed it is. The parties could decide on the basis of mutual consent, what type of deed will be prepared for the document for property transfer.

Parties to sale deed: The sale deed should have the names, age and addresses of parties involved in the transaction. The deed should be duly signed by all the parties.

Description of the property in context: The property in content should be clearly mentioned in the sale deed. It should have the full description of the property, including the identification number, plot area, location, etc.

Sale consideration clause: A sale deed must have all the information related to the sale amount as mutually decided by the seller and the buyer. It should clearly mention the amount paid for transferring the property rights from one party to another.

Mode of payment and advance payment: A sale deed should also have clear information about how a buyer is going to pay the sale amount and the amount of token, if paid as an advance.

Possession status and date: The deed should also mention when the immovable property will be transferred to the seller. There should be a mention of the actual date of possession.

Indemnity clause: The sale deed should have an indemnity clause, which means the seller is liable to bear all the statutory charges including property tax, electricity charges, water bill and all other charges in relation to the property, before the sale deed is executed.

Check out property prices in Hyderabad

How to register property in Telangana?

Here is a step-by-step process to register property in Telangana:

Step 1: Visit the Telangana Property Registration portal (click here) and create your login ID.

Step 2: Upload all the documents as required on the portal and pay the stamp duty and registration fee.

Step 3: Book the time slot for visiting the sub-registrar’s office (SRO).

Step 4: Visit the SRO.

- Get your check slip prepared by the officer at the SRO, based on the details provided during document upload, making necessary changes if required.

- After generation of the check slip, an E-KYC is conducted, where fingerprints of the registering parties are collected and are verified against the Aadhaar database.

- After successful verification via Aadhaar, the payment of stamp duty, registration fees and other requisite fees will be verified through the challan provided.

- After successful verification of payment, endorsements are printed on the document being registered.

Step 5: The document will then be registered by the sub-registrar, by providing a document number and the thumb impression of the parties is collected.

Step 6: The registered document will then be scanned and uploaded on the portal, which the user can download from the portal.

Step 7: In case of verification being unsuccessful, the applicant will be directed to make necessary changes and re-submit the application.

Check out properties for sale in Hyderabad

How to check the market value of land in Telangana using Dharani Portal?

At present, the facility is available only for agricultural land. To check market value of the land parcels, follow the procedure step-by-step:

Step 1: Visit Dharani Portal and click on ‘Agriculture’.

Step 2: Click on ‘View Market Value of Lands for Stamp Duty’. You will be redirected to a new page.

Step 3: Choose the district, mandal, village, town, survey number from the drop-down menu and click ‘Fetch’.

Step 4: The market value will be displayed on the screen.

Telangana land and property registration: Latest news

Update on December 29, 2020

The ‘Dharani’ portal launched last month, is still facing several hiccups. A number of issues have cropped up since its launch and the complaints have been registered by the authority. The portal is currently limited to only four types of land transactions, out of 20. Moreover, the user would need to pay additional Rs 300 for the passbook. In addition to this, the banks have stated that the loan would not be provided on the basis of these passbooks. Reacting to several complaints, the government assured farmers and other owners that corrections will be made in due course.

Though the non-agricultural land-related aspects are not operational now, the state government announced that these services would be launched soon.

The Telangana government had introduced the ‘Dharani’ portal, for facilitating online property registrations in the state in November, 2020. Currently, the portal is only being used for record-keeping of agricultural properties. The portal will also facilitate property registration and stamp duty and registration charge payment services. Currently, the matter is sub-judice, as the Telangana High Court has stayed the state government’s order that sought to make it mandatory for property owners to register on the portal, for selling the property. The court said:

“If a citizen did not register details of his properties in the Dharani portal, would he lose rights over the property and be barred from transferring the property to others? This would be a violation of Article 300A of the Constitution.”

FAQs

Is there an online facility for Telangana property registration?

Home buyers can visit the Telangana property portal at https://registration.telangana.gov.in/index.htm to upload documents and fix an appointment for appearing at the sub-registrar’s office.

What are the fees for registering a will in Telangana?

A flat fee of Rs 1,000 is charged for registration of wills.

What is the stamp duty for sale of property in Telangana?

Stamp duty of 4% of the transaction value is applicable on sale of property in Telangana.

Comments 0