Indian equities see-sawed into a deeper dip and come back this week. After a very rough start, a slow yet steady recovery erased the entire dent. Nifty started the week with a big drop of 3.2 percent losing nearly 450 points. In the following days, Nifty recovered from the selling pressure that came on the first day and in the rest of the sessions, Nifty gained nearly a percent a day to level itself with the previous week’s close.

Bank Nifty also saw huge selling pressure on the first day of the week. Bank Nifty lost 4.2 percent roughly 1300 points in a single day. Followed by the recovery in the next three sessions and gained nearly a percent in each of the second and third sessions and added a couple of percent on the last day of the week. However, that was not enough to undo the damage created early on. Bank Nifty shut shop this week with a loss of a percent.

Both indices did have momentum in the remainder 3 sessions of the week. Had it not been a truncated week the indices could have pushed themselves into fairly positive territory.

On the OI front, Nifty futures had a very classic bull run reaction to the fall. The price drop was reacted with a drop in OI. One of the largest falls on a day resulted in one of the highest unwinding in Nifty futures for a day of almost 10 percent. The rest of the sessions went in recovering the lost participation. Tiny longs in the last two sessions could not fill the gap of lost longs. Nifty ended this week almost 8 percent lighter in terms of OI.

Bank Nifty, on the other hand, saw an influx of short participation in futures upon the first session fall to the tune of nearly 16 percent. Well, most of them got covered in the next session itself. However, minor longs followed by unwinding in the last session left even Bank Nifty futures with about 2 percent lower week over week OI.

Aggregate stock futures OI did get augmented by nearly 5 percent. But the contribution was skewed to just a few stock futures. Most of the stock futures witnessed unwinding of longs, followed by unwinding despite weekly gains. Fresh longs were limited as most of the stocks declined this week.

Slicing the stock futures further we learn, most of the sectors this week witnessed unwinding this week. Cement stocks added shorts across the board. Profit booking was seen in IT except for WIPRO, which added longs. Led by massive unwinding in VEDL, Metal lost on OI tally. A lot of bargain hunting longs were seen being unwound in PSU Banks.

Sentimentally, fall instantly attracted a lot of Call writers pushing the OIPCR to near neutrality for Nifty. However, Put OI started coming in during the rest of the week pushing OIPCR into the moderately bullish zone.

Risk index India VIX also spiked above 20 at the start but then settled down to end the week with just a point gain. After the comeback, the current landscape indicates an expectation of a calmer expiry week.

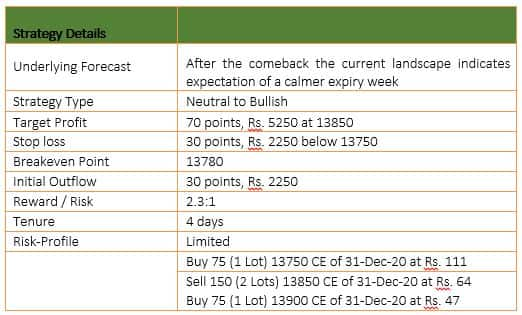

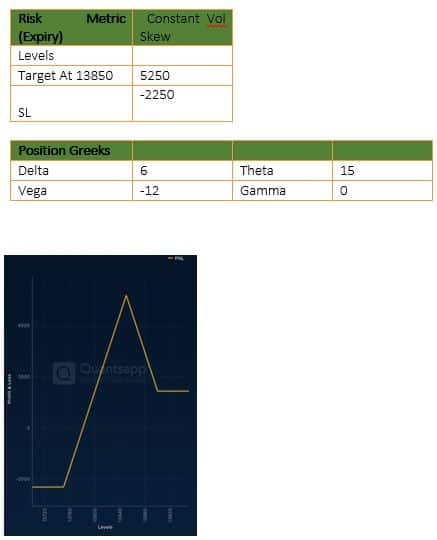

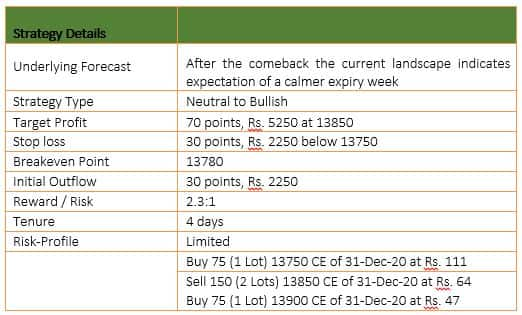

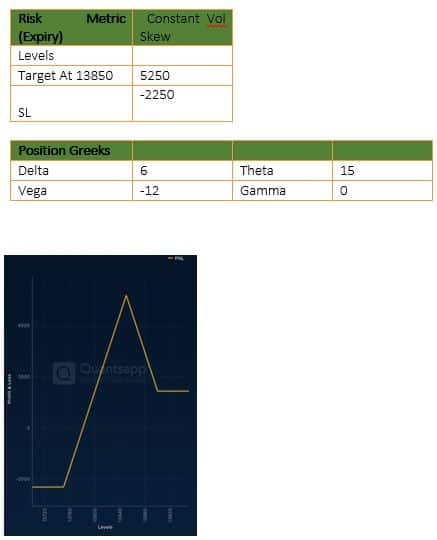

Finally, huge unwinding followed by recovery amid mild participation indicates a lack of directional push. Immediate Calls and Puts are congested in upcoming expiry indicating no large movement is expected by the option writers either. Undertone still remains positive hence a possibility of a steady move should be discounted. Considering reinstated longs along with calmer times inferred from sentimental indicators Modified Call Butterfly is advised.

Modified Call Butterfly is a 4-legged strategy where 1 lot of calls close to the current underlying level is bought against that 2 lots of higher strike calls are sold and 1 more lot of Call is bought but closer to the call sold strike. This keeps the lower but constant profits in case of an upward breakout. This is a fairly risk-averse and a universal strategy.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

_2020091018165303jzv.jpg)