In the midst of COVID-19’s toll lies yet another alarming statistic. Around 8 million die every year due to tobacco consumption. According to the World Health Organisation (WHO), of these, over 7 million are linked to direct tobacco use, while nearly 1.2 million can be traced to second-hand smoke that non-smokers are exposed to. India’s Health Ministry statistics put the country’s tobacco-related deaths at close to 1.3 million a year.

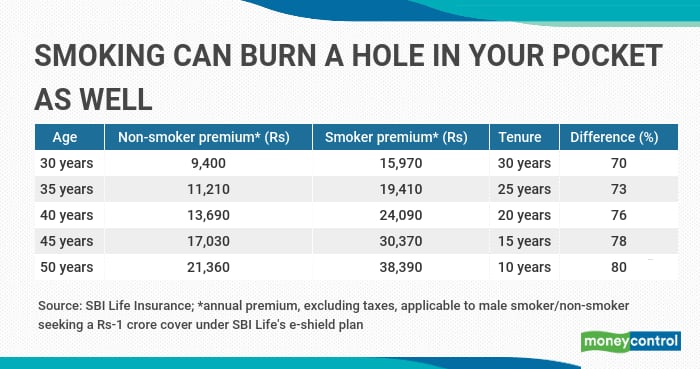

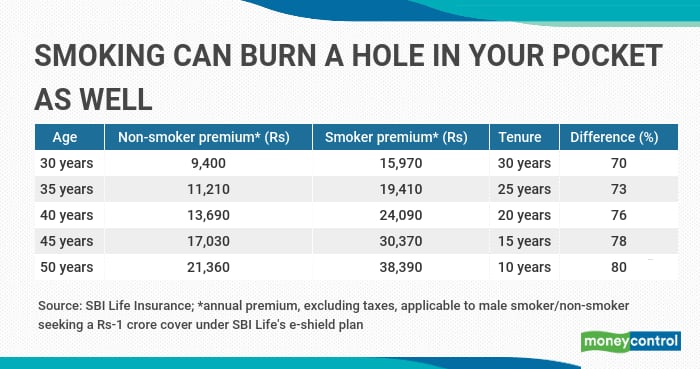

While COVID-19 has pushed many to buy health insurance policies and term insurance covers, did you know that if you are smoker, your premiums can be around 70 percent higher?

Smoking injurious to financial health, too

Given the alarmingly high mortality rate amongst smokers, life insurers charge substantially high insurance premiums while offering term covers. These policies do not offer any maturity benefit, but provide a large lump-sum – meant to be handed over to policyholders’ dependents if they die – at cost-effective rates. While term insurance rates in India have been low for nearly a decade now, smokers have to shell out substantially steeper premiums. Even those with diabetes and hypertension are charged higher premiums, but in the case of smokers, the loading – or the additional premium over and above the base premium – is clearly spelt out. ”The gap increases with age. If the age at entry is 50 or 60 years, the difference in premiums for smokers and non-smokers will be more pronounced, when compared to younger age-groups,” says Anilkumar Singh, Chief Actuarial Officer, Aditya Birla Life Insurance.

This trend of offering discounts on premiums to non-smokers started in 2010, with a slew of life insurance companies stating smoker and non-smoker premium rates upfront.

For example, SBI Life Insurance’s Rs 1-crore term cover with a 30-year-tenure costs Rs 15,970 annually for a 30-year-old male who smokes. However, a non-smoking male policyholder will have to pay just Rs 9,400 for the same cover. And, this gap only widens with age. A 50-year-old male will have to pay Rs 21,360 per year for a Rs 1-crore policy with 10-year tenure if he does not smoke and 80 percent more if he does. The stark difference in premiums for smokers and non-smokers is simply because the risk of insuring smokers is huge. “This is essentially because they are more prone to heart ailments as also throat and oral cancer, besides other lung diseases,” says Mahavir Chopra, Founder, Beshak.org.

Stringent health assessment

Usually, a smoker also has to face additional medical scrutiny before the policy can be issued. Since diagnostic tests can easily reveal whether you smoke or not, it is best to be transparent about your habits even if it means paying higher premiums.

Just because you have to pay an extra premium on account of your smoking habit, do not hesitate to buy a term cover. This is vital, as it’s important to secure your dependents’ financial future, particularly in these COVID-19 times. “COVID-19 is an infectious disease that primarily attacks the lungs. Smoking impairs the lung function, making it harder for the body to fight off coronaviruses and other diseases. Tobacco is also a major risk factor for noncommunicable diseases like cardiovascular disease, cancer, respiratory disease and diabetes which put people with these conditions at higher risk for developing severe illness when affected by COVID-19,” the WHO said in May this year.

Should smokers pay high premium and buy a term plan?

Yes, they should. While some companies do not insist on medical tests, getting check-ups done is a better option. “When companies offer separate smoker and non-smoker rates, usually they insist on a nicotine test. If the results are positive, you will be offered smoker rates and if it turns out to be negative, you will immediately get the benefit of much lower non-smoker rates,” says Singh.

In any case, you must ensure that you are completely transparent in your declaration of good health that companies ask for. “Even if you have stopped smoking, it’s good idea to make that disclosure as smoking deposits continue for long in the lungs,” says Vaidyanathan Ramani, Head, Products and Innovation, Policybazaar.com. Honest declarations will enable smoother claim settlement in future.

If you have already quit smoking, say, 1-5 years ago, you will be regarded as a non-smoker, depending on the minimum period specified by the insurer. “This depends entirely on the insurer. The proposal form itself will indicate the parameters, including the minimum non-smoking period, to be considered a non-smoker. Ensure that you go through these details thoroughly before signing up,” says Chopra.

_2020091018165303jzv.jpg)