Dollarama: A Dollar Store With A Strong Free Cash Flow Yield

Dollarama is a Canadian dollar store benefiting from the COVID-19 pandemic as the recent quarterly results have been strong.

The company is trading at a free cash flow yield of just around 4%, but should continue to grow in the next few years.

Rather than buying the stock at the current level, writing an out of the money put option may be a more ideal solution.

I like Dollarama as a long-term pick, but I don't think there's any rush to get in.

Introduction

Although I can’t say I’m a frequent visitor of dollar stores in North America, I have to confess I have a soft spot for Dollarama (OTC:DLMAF) and I regularly pop in for a visit whenever I’m in Canada. Not just because it has my favorite candy at Walmart prices, but it also is an excellent destination quickly stocking up on stationery and perhaps a drink to take back to the hotel room. Whenever I’m in Canada, I tend to end up at Dollarama at least once. Dollarama as a company has never been really cheap, but I’m getting ready to pull the trigger to initiate a long position as the dollar store has proven to be very resilient this year.

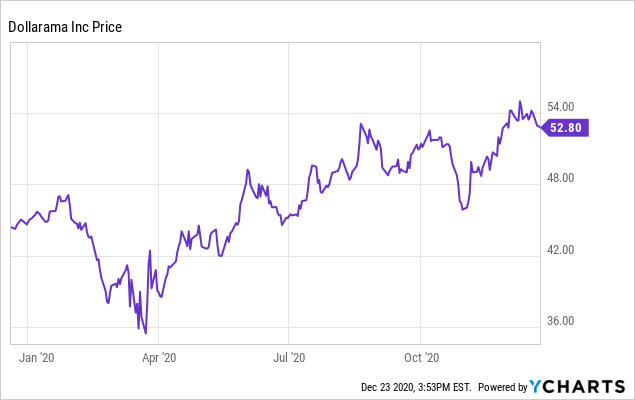

Data by YCharts

Data by YChartsThe Q3 results confirm Dollarama’s status as a cash cow

Dollarama’s financial year ends in January, so the company is currently in its final quarter of FY 2021 and has recently reported the financial results for Q3 FY 2021, which ended on Nov. 1.

The revenue increased by in excess of 10% to C$1.06B and as the COGS increased by a similar percentage, the gross profit jumped to almost C$469M and we see a similar percentage increase in the operating income which was boosted from C$212M to C$244M resulting in an operating margin evolving from 22.36% in Q3 FY 2020 to 22.93% in Q3 FY 2021.

The net financing expenses decreased as well as the lower market interest rates make borrowing money cheaper.

Source: financial statements

The bottom line shows a net income of almost C$162M for an EPS of C$0.52. An impressive increase compared to the C$139M and C$0.44 per share in the third quarter of the preceding year. The strong third quarter also helped the company to boost its 9M 2021 EPS to C$1.26 (slightly up from C$1.23 in 9M 2020) as the strong third quarter was a welcome addition to the EPS of C$0.74 in the first semester.

I was (and am) mainly interested in Dollarama for its free cash flow profile, and I’m not disappointed with the Q3 and 9M results.

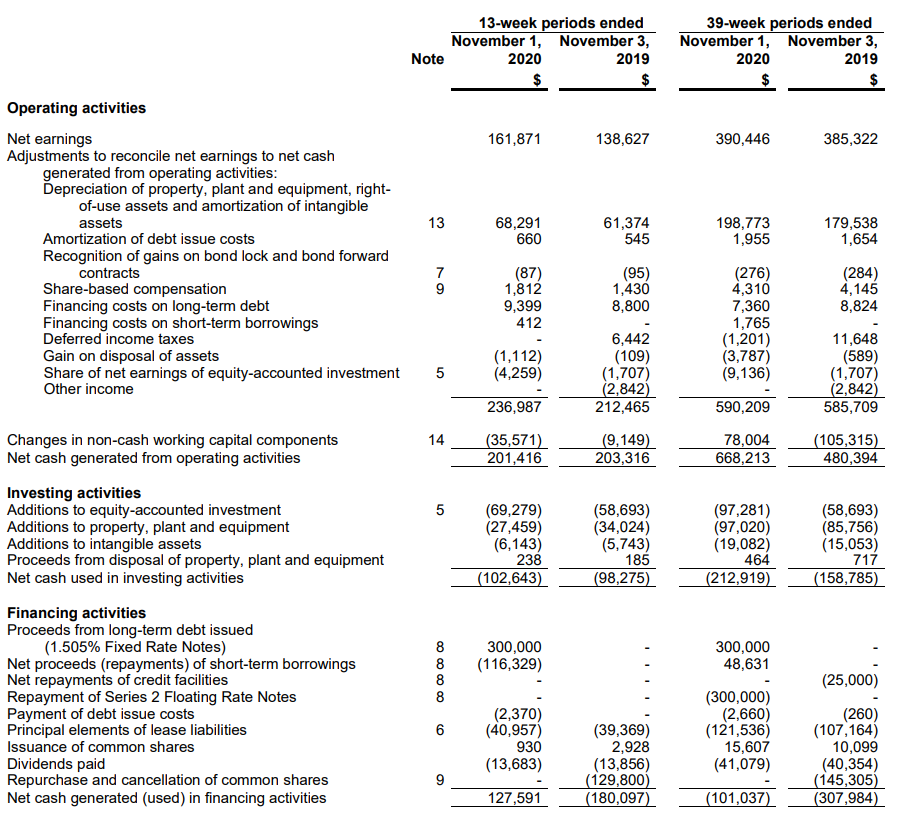

Dollarama reported an operating cash flow of C$237M before changes in the working capital position, and after deducting the C$41M in lease payments, the adjusted operating cash flow was C$196M.

Source: financial statements

As you can see in the image above, the total capex was just C$33.5M and this means Dollarama’s free cash flow exceeded C$162M in the third quarter, an impressive improvement compared to the C$133M in the same quarter in the previous year.

The strong third quarter pushed the 9M FY 2021 operating cash flow to almost C$469M, and as the capex came in at just C$116M, Dollarama generated C$353M in free cash flow in the first nine months of the year. That’s approximately C$1.13 per share.

Buying back stock is perhaps the best strategy to create additional value

In the previous financial year, Dollarama had a pretty active buyback program as in the first nine months of FY 2020, the company repurchased 3.09 million shares for a total amount of C$145.3M. This indicates the company paid on average C$47 per share. I think this was a smart move and I’m perhaps a little bit disappointed the dollar store hasn’t restarted a meaningful buyback program yet.

And that’s purely a choice of Dollarama’s board and management. The company received formal approval to repurchase 15.55 million shares starting on July 7, but not a single share has been repurchased as of the end of Q3 FY 2021.

While I understand the company wanted to play it safe and ensure its balance sheet remains in good shape during the COVID-19 pandemic, it has become pretty clear now Dollarama is actually thriving and the Q3 free cash flow per share of C$0.52 confirms Dollarama’s robust and resilient business model. The company has been investing in Dollarcity, and these investments are recorded as an equity accounted investment. Dollarama is acquiring this interest in Dollarcity based on a multiple of 5 times EBITDA which is on the lower end of the spectrum so I’m definitely fine with that.

Investment thesis

Dollarama is currently trading at a free cash flow yield of approximately 4% which is perhaps on the lower end of what I would consider for my investments. That being said, the put options have decent premiums and I could be interested in writing an out of the money put option. The April series put options with a strike price of C$46 and C$48 have option premium of respectively C$0.75 and C$1.10 (the midpoints between bid and ask) and this could be an attractive option to try to establish a long position at a slightly lower price.

I think Dollarama is an interesting long-term pick, but I will have to "time" my entry point and I think writing out of the money put options may be a useful tool to accomplish that.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!

NEW at ESCI: A dedicated EUROPEAN REIT PORTFOLIO!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.