The last few weeks have seen exceptional returns across a number of income sectors.

Some preferreds have lagged the rally, however, due to interplay of high prices and redemption risk.

Investors who have a constructive view on markets can tilt to preferreds with more upside such as non-callables and stocks with call dates further in the future.

Separately, stocks that have already been callable for a long time and/or have high insider ownership may have more upside also, all else equal.

We highlight a number of preferreds such as SOCGP, WFC.PL, PSA.PO and others.

This article was originally published on 15-Dec.

The last few weeks have seen exceptional returns across different income sectors. However, some investors in preferred stocks may have been disappointed by the relatively tepid returns of their holdings. In this article we take a look at why some preferreds have lagged the rally.

Our main takeaway is that when selecting series of the same issuer, those with no redemption feature or with call dates further out in the future have more upside if markets continue to rally. On a more standalone basis, a number of callable stocks that have been trading for decades above their "par" levels as well as those with significant insider ownership may have less risk of redemption and, therefore, more upside. However, this second strategy requires much more individualized research and is not for everyone.

We also highlight a number of preferreds that can see more upside due to their structural features which we hold across our Income Portfolios, such as

- Wells-Fargo 7.5% Series L (WFC.PL), a split high-yield/investment-grade rated non-callable stock with a 5% yield.

- Southern California Gas Co 6% Series A (OTCQB:SOCGP), an investment-grade rated utility with a 4.17% yield.

- Public Storage 3.9% Series O (PSA.PO), an investment-grade REIT with a late 2025 call date and a 3.55% YTW (3.84% stripped yield).

Market Recap

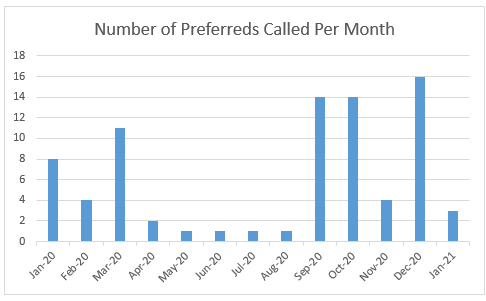

Looking at the chart of monthly redemptions in the retail preferreds market we can see the seize-up of redemption activity over 5 months following the March shock. Starting in September, as both risk appetite and prices of preferreds recovered, companies began taking advantage of lower risk free rates and narrowing credit spreads by refinancing their callable preferreds. Redemption activity has been running at a fast clip since then. Despite a market that was effectively shut for nearly half the year about 5-7% of the current retail market was refinanced by our estimate.

Source: Systematic Income, Quantumonline

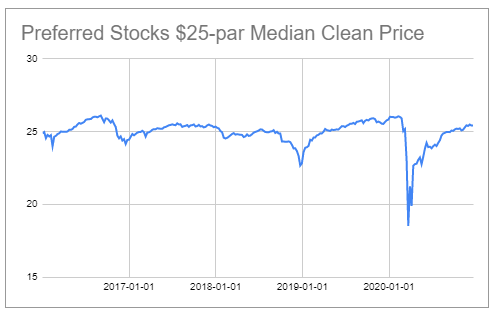

It was not a coincidence that the recovery in redemptions a few months ago coincided with the median price trading up and above the liquidation preference or "par" amount.

Source: Systematic Income, Quantumonline

The Mechanics Of Upside

Our first recommendation for investors who wish to participate in further rally is to seek out non-callable preferreds. Fortunately, there are not very many of these. One complicating factor is that many of the non-callable preferreds are convertible into common stock which adds an entirely different layer of analysis. However, some of these are busted convertibles which means that the conversion feature can, by and large, be ignored.

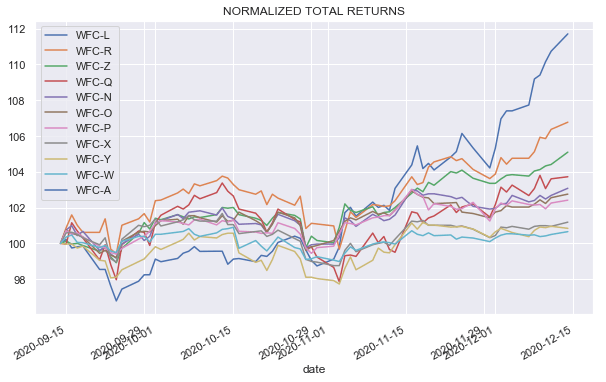

A couple of such bank busted convertibles is the pair of Wells Fargo 7.5% Series L (WFC.PL) and the Bank of America 7.25% Series L (BAC.PL). If we take a look at the performance of the WFC preferreds since the market more or less stabilized this summer we see a sharp outperformance by the non-callable series WFC.PL (the legend in the chart is sorted by total return).

Source: Systematic Income

The reason that non-callable preferreds can outperform their callable counterparts in a strong market is that the non-callable stocks are not constrained by the liquidation preference or "par" figure. For instance, the "par" amount of WFC-L is $1,000 and the stock is now trading around $1,500. Most callable preferreds, on the other hand, are going to cluster around their "par" amounts because of the risk of redemption.

This means that when callable preferreds have reached levels of a few points above "par", further upside is much harder going due to both the potential capital loss to investors for stocks currently callable or an unattractive yield-to-call.

Apart from these two there are a number of other non-callables such as the two Southern California preferreds: Southern California Gas Co. 6% Series A (OTCQB:SOCGP) and Souther California Gas Co. 6% (OTCQB:SOCGM). SOCGP is the more liquid of the two.

Investors with a heavy dose of patience (maybe those still under lockdown) can try their luck in a few highly illiquid non-callable preferreds such as the Wisconsin Electric Power Co 6% (OTCQB:WELPM) or the PacifiCorp, 6.00% (OTCPK:PPWLO).

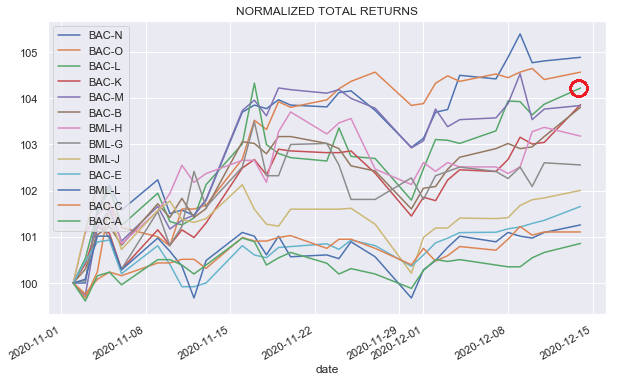

Now if we take a look at the performance of Bank of America preferreds we see that the non-callable series has done very well but it hasn't topped the list of issuer preferreds by performance since November - which brings us to the second recommendation for investors who want to select those series among the issuer's preferreds that are likely to have more upside if the market continues to rally from here on. And that is, to select preferreds with call dates further out in the future.

Source: Systematic Income

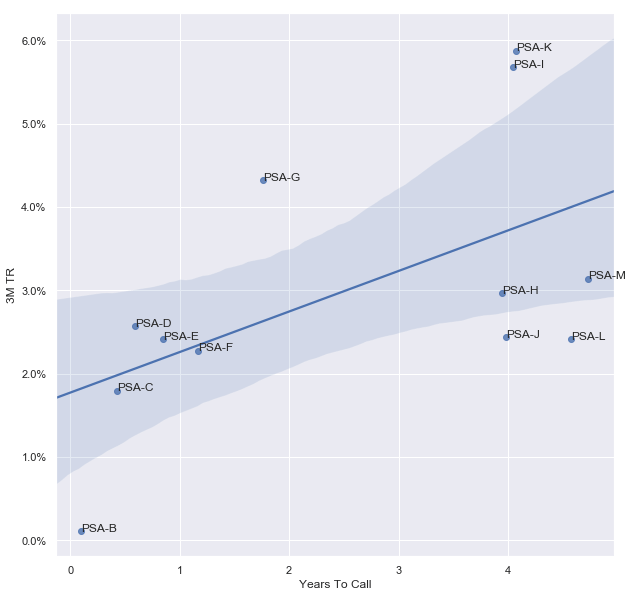

If we take a look at the returns of the Public Storage suite of preferreds over the past 3 months as a function of the number of years to the first call date we see a clear pattern. Those series with a longer period to the first call date have performed better over the past 3 months.

Source: Systematic Income

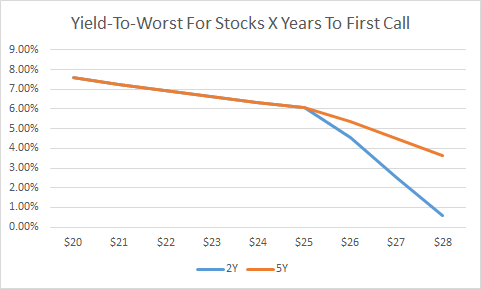

Why is this the case? The reason has to do with the fact that the yield-to-call drops less quickly for each dollar above "par" for a stock with a first call further out in the future. Intuitively, this is because a stock trading at $26 and callable at $25 has to amortize a potential $1 pull-to-par loss over more years, resulting in a higher yield-to-call, all else equal.

We continue to like Public Storage 3.9% Series O (PSA.PO), which isn't on the chart because it is recently issued. However, over the past month it has put in the second highest return among the 14 PSA preferreds, which reflects, in our view, the fact that its call date is the furthest away in the suite.

The chart below shows how the yield-to-call responds in two stocks trading above "par" where one is 2 years from its first call date and the other 5 years. The stock with a call date further out in the future has a less steep decline in its yield-to-call. This means that for an equivalent fall in yield-to-call the stock with the farthest call date in the future can move up to a higher dollar price, all else equal.

Source: Systematic Income

Finally, preferreds with lower fixed coupons or lower reset yields will tend to trade at lower dollar prices, all else equal. This means that they have an easier appreciation runway towards "par" than higher coupon and, hence dollar-price, preferreds which will struggle to rise as much over "par".

Bank of America preferreds are quite useful in this example as they have a number of floored floaters set at 3% and 4%, resulting in the lowest fixed coupons among the suite: Bank of America Floating Rate Series 1 (BML.PG) and Bank of America Floating Rate Series 2 (BML.PH). These two 3% series have two of the three highest returns across BAC preferreds over the last 3 months, owing to this easier runway. They are also trading below $22 in clean price terms where as the other preferreds are trading around or above $25

It's worth making a quick point about yield-to-call and that it is calculated assuming the stock is called at the first opportunity. Obivously, not a whole lot of stocks are called at the first opportunity and some remain outstanding a long time past their call dates, even those that are trading above "par".

If you ask some old hands with years of experience in the preferreds market about how to deal with redemption risk - the answer you'll usually get is something like - what a silly thing to worry about - you should just do some deep research and estimate which stocks have low likelihood of redemption and then, if they are attractive on a stripped yield basis, just buy them and ignore everything else. This type of advice is both correct and deeply unhelpful for the average investor. It's akin to a recommending that people build their own house rather than buy one since you'll be able to ensure everything is exactly how you want it. This means that while yield-to-call is not a perfect forecast of actual yield that will be experienced by investors, it should only be ignored if you know exactly what you are doing.

Another aspect to consider is insider ownership. The view is that if there is significant ownership by the very people who make decisions about redemption then their incentive is not always aligned with common shareholders. If the coupon on the preferred is attractive enough they may just keep the preferred ticking along.

Preferreds that have been mentioned in this context are some Gabelli CEF preferreds (a number have been recently redeemed so this strategy is not fool-proof) and CHS Inc. preferreds such as the CHS Inc Series 6.75%, for example (CHSCM).

We should also mention that a number of preferreds, particularly some illiquid utilities, have remained callable while trading above "par" for decades such as Connecticut Light & Power 4.5% (OTCPK:CNLHP) and Kansas City Southern 4% (KSU.P). Those experienced investors who have done their research, are confident in their view and have had the patience to acquire these very illiquid preferreds probably have better things to do with their time than reading this article.

Takeaway

Given the sharp rally we have seen over the last few weeks, some income investors may be disappointed by the relatively low returns of their preferreds holdings. Investors with a constructive view on the market and who wish to maximize their upside among the preferreds of a given issuer should tilt to non-callable series, if they exist, or alternatively, seek out series with call dates further out in the future as well as low-dollar price series where the redemption constraint is not as hard.

We are raising the cost of the service in 2021 so get in now and best the rise!

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the closed-end fund, open-end fund, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis - sign up for a 2-week free trial!

Disclosure: I am/we are long WFC.PL, SOCGP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.