U.S.-China Trade Tensions Could Tip The Scale In Favor Of Nova Measuring Instruments

NVMI is on track to have a record year in 2020 after posting double-digit quarterly increases in revenue and net income.

Demand for process control tools from NVMI is driven by a number of industry trends, and the U.S. government may have created a whole new one.

Certain Chinese companies have been banned from using U.S. equipment, which means they have to look for suppliers not from the U.S.

Growth at NVMI could go up another level now that it has an opportunity to fill a gap in a market free from its primary competitor.

Nova Measuring Instruments Ltd. (NVMI) is heading for a record year in 2020 after double-digit quarterly increases in revenue and net income. The company was already poised to head for new all-time revenue highs, but recent U.S. sanctions limiting sales of semiconductor equipment to certain Chinese companies may have made such an outcome even more inevitable. Why that is so will be covered next.

Q3 FY2020 quarterly report

Q3 quarterly numbers from NVMI easily sailed past expectations. Q3 revenue increased by 32.3% YoY to $69.49M to set a new all-time record. GAAP and non-GAAP net income increased by 62.3% and 43.5% YoY to $13.9M and $16.5M respectively. Growth was broad-based as product revenue, optical CD standalone and software sales reached record highs.

Logic and foundry constituted 65% of product revenue, with memory accounting for the remaining 35%. The U.S. market outperformed by contributing more than 20% of product revenue in Q3. The other two regions contributing more than 20% were China and Taiwan. NVMI had four customers contributing 10% or more to revenue. Two were foundry customers and two were memory customers.

(GAAP) | Q3 FY2020 | Q2 FY2020 | Q3 FY2019 | QoQ | YoY |

Revenue | $69.485M | $62.586M | $52.507M | 11.02% | 32.33% |

Gross margin | 57% | 58% | 52% | (100bps) | 500bps |

Operating margin | 22% | 16% | 12% | 600bps | 1000bps |

Operating income | $15.528M | $10.315M | $6.474M | 50.54% | 139.85% |

Net income | $13.896M | $8.672M | $8.562M | 60.24% | 62.30% |

EPS | $0.48 | $0.30 | $0.30 | 60.00% | 60.00% |

(Non-GAAP) | |||||

Revenue | $69.485M | $62.586M | $52.507M | 11.02% | 32.33% |

Gross margin | 58% | 59% | 53% | (100bps) | 500bps |

Operating margin | 26% | 25% | 18% | 100bps | 800bps |

Operating income | $18.099M | $15.395M | $9.383M | 17.56% | 92.89% |

Net income | $16.511M | $13.774M | $11.507M | 19.87% | 43.49% |

EPS | $0.57 | $0.48 | $0.40 | 18.75% | 42.50% |

(Source: NVMI Form 6-K)

Guidance calls for Q4 revenue of $66-73M, an increase of 7.6% YoY at the midpoint. GAAP EPS is forecast to be $0.32-0.43, a decrease of 12.8% YoY at the midpoint. On a non-GAAP basis, EPS is expected to decrease by 1% YoY to $0.45-0.56.

Q4 FY2020 (guidance) | Q4 FY2019 | YoY (midpoint) | |

Revenue | $66-73M | $64.6M | 7.59% |

GAAP EPS | $0.32-0.43 | $0.43 | (12.79%) |

Non-GAAP EPS | $0.45-0.56 | $0.51 | (0.98%) |

NVMI looks poised to reach new heights after recovering from a downturn

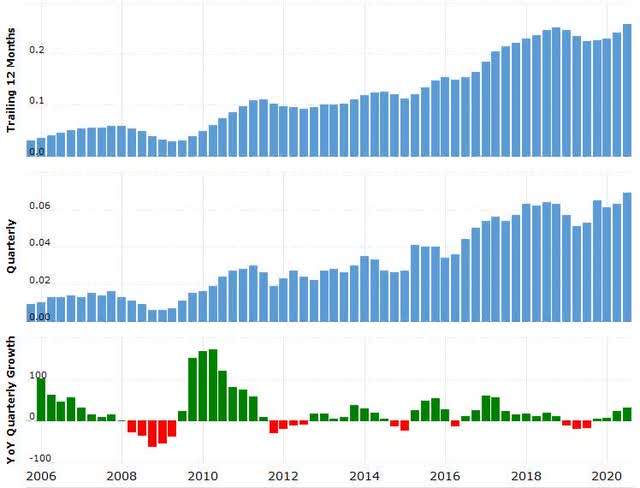

FY2019 was not a good year for NVMI, but it looks like FY2020 will turn out to be different with one quarter to go. The chart below shows how the company experienced a downturn in FY2019 with three straight quarterly contractions in revenue. But it started to recover in the last quarter of FY2019. Growth has gained strength in each of the last four quarters.

If revenue in the first nine months of FY2020 was $193M and Q4 guidance is set at $66-73M, then FY2020 revenue is projected to end up at $259-266M, as shown below. FY2020 GAAP EPS is projected to wind up at $1.50-1.61, with Q4 guidance set at $0.32-0.43 and EPS of $1.18 in the first nine months of FY2020. NVMI seems to have recovered from the downturn and could be on the way to breaking the old highs in FY2018 to reach new heights.

Revenue | Operating income | EPS | |

FY2020 (projected) | $259-266M | N/A | $1.50-1.61 |

FY2019 | $225M | $36M | $1.23 |

FY2018 | $251M | $60M | $1.89 |

FY2017 | $222M | $58M | $1.63 |

FY2016 | $164M | $10M | $0.35 |

FY2015 | $149M | $12M | $0.57 |

FY2014 | $121M | $17M | $0.67 |

FY2013 | $112M | $12M | $0.38 |

FY2012 | $96M | $11M | $0.43 |

FY2011 | $103M | $25M | $1.04 |

FY2010 | $87M | $22M | $0.86 |

NVMI addresses an important issue in the Q3 earnings call

While NVMI did not issue any guidance for the new year, it did provide additional color as to what FY2021 could look like. From the Q3 earnings call:

"Exiting 2020, we expect the healthy revenue stream from foundry customers to continue in 2021 as well as they prepare for growing demand in several key applications and manage structural changes in manufacturing dynamics across customers and territories."

Furthermore, the company expects memory to have a better year in FY2021 after struggling the year before.

"Although this quarter was weighted towards logic, we continued to see high utilization in the memory side and expect recovery in 2021. The relative softness in memory during 2020 allowed us to further penetrate this segment and enabled us to continue the proliferation of our new and existing products in this segment."

However, there was one other issue NVMI had to address, and that had to do with China. According to the latest Form 20F, China contributed $56.38M, or 25% of the $224.91M in FY2019 revenue. China is the second-largest market behind Taiwan for NVMI, which means that anything that could potentially disrupt access to that market is very much relevant to the company.

This could happen in the form of increased U.S.-China trade tensions leading to the U.S. imposing sanctions on China. The U.S. government has recently issued new rules, which stipulate a license from the U.S. government is required before companies using U.S. technology can provide semiconductor manufacturing equipment and related services to China.

NVMI apparently will not be affected by these rules as presently constituted.

"So most of the demand in SMIC for our tools came for the OCD tools that are coming from Israel. Therefore, we don't see any shift in demand. We do see pool-in of part of the tools as an overall of phenomena of SMIC trying to pool-in tools from the rest of the vendors. So we see it as well. We don't see a reduction in capacity nor the demand."

Some people had expressed concerns recent U.S. sanctions against Chinese companies could impact growth at NVMI, but management has sought to dampen these worries. Not being cut off from its customers in China could become an advantage for NVMI, especially since other semiconductor equipment suppliers located elsewhere are not as fortunate with consequences for them, as elaborated in another article.

It could give NVMI a leg up on the competition, especially those from the U.S which are bound by U.S. laws and cannot do business with Chinese companies subject to U.S. sanctions as a result. NVMI could fill a gap left by these companies. Even companies not currently affected by U.S. sanctions may still want to re-evaluate their supply chains and lessen the risk of depending on suppliers from countries likely to resort to punitive sanctions. NVMI fits that description.

NVMI vs. the competition

NVMI is a supplier of semiconductor manufacturing equipment from Israel, specializing in metrology equipment for process control. It competes against several companies, but its main competitor is probably KLA Corporation (KLAC) from the U.S. KLAC is generally considered the dominant player in the market for process control tools. The table below shows how the two stack up against each other.

NVMI | KLAC | |

Market cap | $2.00B | $40.11B |

Enterprise value | $1.80B | $41.59B |

Revenue ("ttm") | $257.72M | $5.93B |

EBITDA | $59.05M | $2.20B |

FCF | $15.63M | $1.22B |

Trailing P/E | 44.31 | 31.55 |

Forward P/E | 27.47 | 21.01 |

P/S | 7.98 | 6.88 |

P/B | 5.70 | 14.60 |

EV/revenue | 7.00 | 7.01 |

EV/EBITDA | 29.38 | 21.68 |

(Source: Yahoo Finance)

KLAC and NVMI have gained 46% and 85% respectively YTD. In comparison, the iShares PHLX SOX Semiconductor Sector Index ETF (SOXX) consists of 30 companies in the semiconductor space with KLAC included. SOXX has gained 48% YTD. If KLAC is prevented from doing business with some or all Chinese companies and NVMI is not, the divergence between the two could increase.

(Source: Wikimedia Commons)

Investor takeaways

The market for process control equipment is supported by a number of trends in the semiconductor industry. For instance, as the industry moves towards smaller and smaller geometries in wafers, manufacturing defects and other deviations can increasingly affect yields. The use of new materials also plays a role. A greater number of circuits or layers per wafer increases the likelihood of manufacturing errors, which, in turn, increases the need for process control tools from suppliers like NVMI. Recent quarterly numbers from NVMI are a reflection of the increased need for such equipment.

However, NVMI is not the only supplier out there. Big companies like KLAC from the U.S. have traditionally overshadowed smaller companies like NVMI. But policy moves on the part of the U.S. could open the door for NVMI to make inroads and gain market share. To be more exact, the U.S. has issued new rules that practically ban certain Chinese companies from using U.S. equipment, forcing them to resort to using equipment from non-U.S. suppliers.

What has happened is that there is a gap in the market. Furthermore, this segment of the market is set to grow with China, having made it known it needs to beef up its own semiconductor manufacturing, since the U.S.-China trade war has made it clear it cannot depend on supplies from the U.S. China is already one of the three biggest markets for fab equipment, which means there's a big and growing market out there for equipment suppliers from Israel, Europe, Japan and elsewhere.

Chinese companies are unlikely to want to invest heavily in U.S. equipment when there's no guarantee the use of that equipment could be denied to them at any time. Companies could respond by introducing products free of U.S. technology, which can then be marketed to China as being sanctions-proof. It would be similar to what happened in the satellite business.

Even companies not from China have reason to seek out alternatives to U.S. suppliers. Since companies have no way of knowing whether they'll be next to be subject to U.S. sanctions, they may want to take precautions and diversify their supply chains. Companies cannot afford to have production disrupted by relying on a single source for wafer fab equipment, especially if that source happens to come from the U.S.

It used to be that Chinese companies would have no issue with relying on a single source, but one of the most enduring lessons from the U.S.-China trade war is that doing so comes at too great a risk. Companies are more likely to consider multiple suppliers. This may not be good news for established incumbents that have the market to themselves, but it's excellent news for smaller players that can now expect to come under consideration when that wasn't always the case in the past.

I am bullish NVMI. The company was already riding a wave of growth that looks set to continue with the industry moving towards more and more complex semiconductors. That growth could gear up to another level now that the company has, for all intents and purposes, gained new opportunities others are unable to take part in.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.