A Buying Opportunity In The Making On Athene Holding

Athene Holding offers annuities and retirement services to individuals and institutions.

The company has seen decent earnings and revenue growth in recent years, but those growth rates are expected to jump sharply in 2021.

The chart for Athene is very intriguing and it looks like a buying opportunity is in the making if the stock falls a little farther.

Athene Holding (ATH) is an insurance company that provides annuities and retirement services to individuals and institutions. The company was formed in 2009 and is headquartered in Des Moines, Iowa. It's incorporated in Bermuda.

The company came to my attention because of its fundamental ratings in Investor’s Business Daily and I have been following for a while now. The company scores a 91 on IBD’s EPS rating system and it gets an A on the SMR grading scale. The EPS rating measures earnings growth while the SMR measures sales growth, profit margin, and return on equity.

In the case of Athene, the company’s earnings have grown by 1% per year over the last three years, but they jumped by 14% in the third quarter. Analysts expect earnings to decline by 27% for 2020 as a whole, but they expect them to jump by 59% in 2021.

Sales have grown by 5% per year over the last three years and they declined by 29% in the third quarter. Sales are expected to rebound and grow by 8% in the fourth quarter which would cause them to match 2019’s figures. Analysts expect revenue to grow by 18.8% in 2021.

As for the management efficiency measurements, Athene has a return on equity of 12.2% and a profit margin of 9.5%. The operating margin is at 14.9%.

The earnings and revenue growth aren’t great, but they aren’t bad either. Given the state of the global economy and the volatility in global markets, being able to sustain any growth is probably a plus.

The valuations for the stock are very low with a trailing P/E of 8.1 and a forward P/E of 5.42. This makes the stock attractive to value investors, but the company doesn’t pay a dividend and that could be a deterrent for some investors.

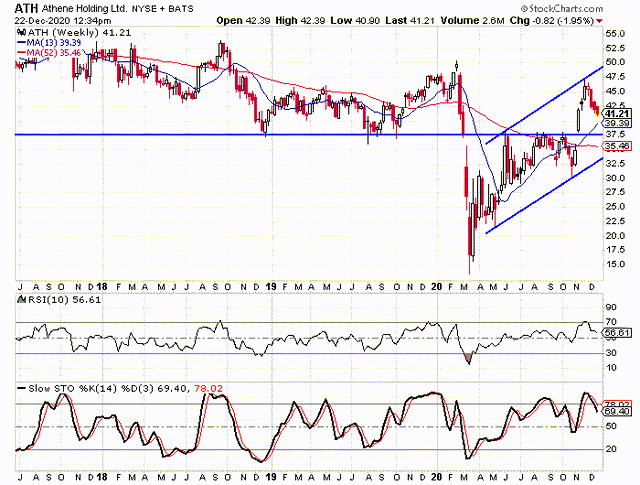

Trend Channel Forms After March Low

When I first looked at the weekly chart for Athene, I took note of the $37.50 area and how important it had been in recent years. It had acted as support at the end of 2018 and throughout 2019. The price came in to play on a few occasions and the stock dropped below $37.50 in a few weeks, but it never closed a week below that price level.

After dropping through the support in March, the rally stalled at $37.50 in June, August, and again in October. The stock would finally gap through the resistance in November.

The second thing that came to my attention about the chart was the trend channel that has formed since April. The lows from May and October connect to form the lower rail and the parallel upper rail connects the highs from June and November. The lower rail is currently down around $33.75 and is climbing pretty fast. The line could be in the $37.50 area in the next few weeks and that could create a strong support level should the stock continue to fall. The stock has dropped for four straight weeks at this point.

The spread between the lower rail and the upper rail is approximately $17, so should the stock fall to the lower rail and then rally to the upper rail once again, it would be a pretty solid return.

Sentiment Toward Athene Is Mixed

The three sentiment indicators that I like to check for stocks are all telling us something a little bit different about Athene. Analysts are a little skewed to the bullish side, short sellers are a little skewed to the bearish side, and option traders are more bearish toward the stock than they are the average stock.

There are 12 analysts following the stock at this time with nine “buy” ratings and three “hold” ratings. This gives us a buy percentage of 75% and that's at the end of the average range.

The short interest ratio is at 3.5 and that too is at the high end of the average. The number of shares sold short fell from 4.53 million to 3.33 million during the month of November and that could have helped push the stock higher throughout the month. When short sellers are forced to close their positions, it adds buying pressure. Athene rallied 38.2% during the month of November.

The options market for Athene was particularly interesting to me. There are 6,950 puts open at this time and 6,515 calls. This gives us a put/call ratio of 1.07 and that's slightly above average. However, something that happened to jump out at me was the amount of call open interest that exists in the June ’21 option series. Of the 6,515 calls that are open, 4,115 are in the June ’21 series. If we look at the options for the months between now and May, there are 6,888 puts open and only 2,400 calls. This gives is a put/call ratio of 2.87 and that is extremely high.

My Overall Take on Athene Holding

I’ll be honest, I have seen better fundamental indicators than Athene is displaying right now. The current growth rates in earnings and revenue are good, but not great. The ROE, profit margin, and operating margin are in the average range. The growth rates are expected to improve greatly in 2021.

That being said, I believe you have to look at the whole picture—the fundamentals, the sentiment and the technicals. The sentiment for Athene does show some signs of pessimism and that's what I want to see as a contrarian. On the technical side, the upwardly sloped trend channel is a strong driver for a bullish posture and the strong support at the $37.50 area is certainly appealing. If the lower rail of the channel were to converge with the stock price in the $37.50 area, I believe that would be a great entry price.

I’m not ready to jump in just yet, but I'm going to exercise some patience to see if Athene drops back down to $37.50 and at that point I will look to buy the stock with a target in the $54-$55 range.

If you would like to learn more about protecting and growing your portfolio in all market environments, please consider joining The Hedged Alpha Strategy.

One new intermediate to long-term stock or ETF recommendation per week

One or two option recommendations per month

Bullish and bearish recommendations to help you weather different market conditions

A weekly update with my views on the market, events to keep an eye on, and updates on active recommendations

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.