Sun Life: A Bright Opportunity At 14.2x TTM P/E

Sun Life is trading at a fair valuation of 14.2x TTM P/E and is still 14.5% off of 52-week highs.

Sun Life's results have been resilient throughout COVID with an underlying net income of $842 million reported in Q3 2020, an increase of $33 million (4.1%) from the prior year.

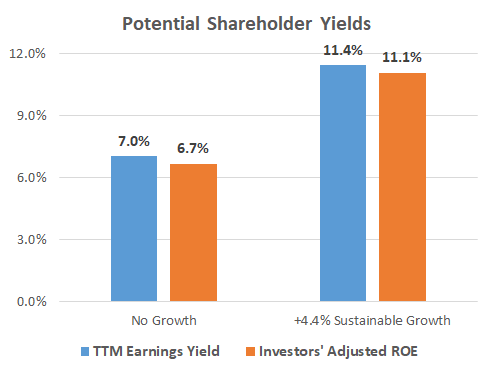

At the current valuation, Sun Life looks able to return 6.7% based on an investors' adjusted ROE analysis.

With a sustainable growth rate calculated to be 4.4%, this could potentially increase returns up to 11.1% if the company is able to continue to grow globally as it has done in the past.

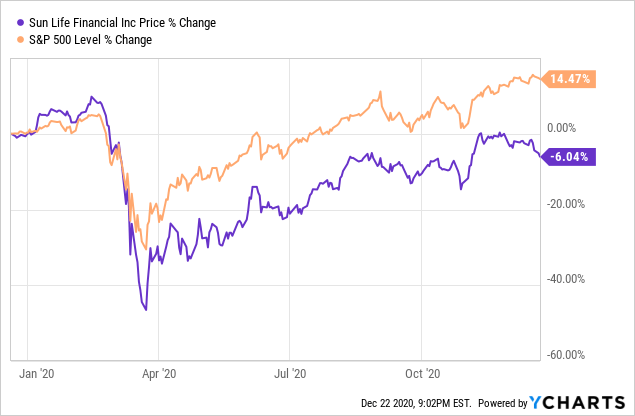

Sun Life (SLF) is a great company trading at a decent valuation of 14.2x TTM P/E in today's expensive market and is still 14.5% off of 52-week highs reached pre-COVID. The company has not been a name I have held for a while but at its favorable valuation and 3.9% dividend, it might be a place I look to store some of the excess cash building up in my portfolio. This article will take a look at Sun Life's profitability and growth while using the investors' adjusted ROE with a sustainable growth rate to conduct a valuation analysis and give investors an idea of the long-term returns they can expect at current stock prices.

Data by YCharts

Data by YCharts

Introduction to the Company

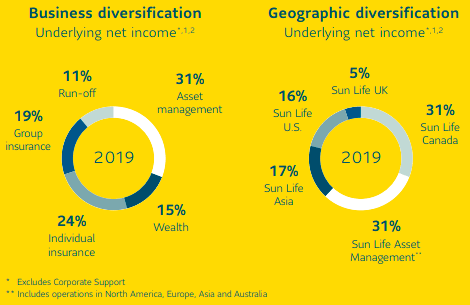

Sun Life is a global insurance and asset management company with offices in 27 markets, 40,600 employees, and 125,900 advisors selling their products. In its latest fiscal year 2019, the company surpassed $1 trillion in assets under management for the first time. The company's results have been resilient throughout COVID with underlying (adjusted) net income of $842 million reported in Q3 2020, an increase of $33 million (4.1%) from the prior year. In Q3 2020, the asset management business generated a 25% increase in year-over-year sales and Sun Life reached approximately $1.2 trillion in assets under management.

The company's "Four Pillar" strategy puts focus on creating value through being a leader in insurance and wealth management in their home market of Canada, being a leader in U.S. group benefits, being a leader in Asia through distribution excellence in higher growth markets, and being a global leader in asset management. These are great targets and the company has been doing a good job of growing outside their home market of Canada which only makes up 31% of net income in the latest year as can be seen below.

Sourced from 2019 annual report

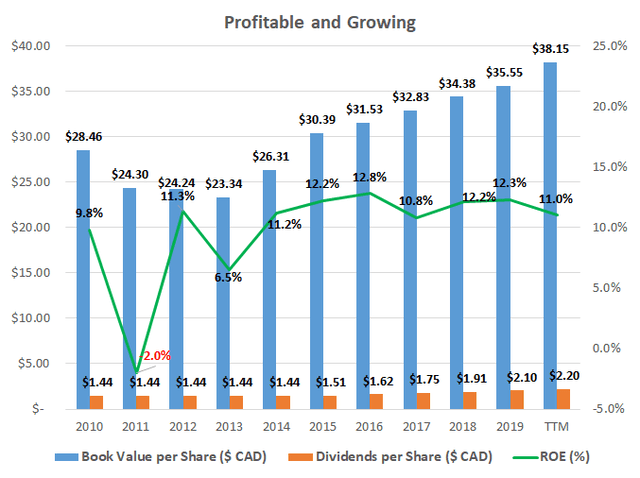

Profitable & Growing

Sun Life's strong brand and capabilities in insurance and asset management have allowed the company to achieve an average return on equity (ROE) of 9.7% over the past decade. While this level of profitability is below my rule of thumb of 15% ROE, the growing book value and steady revenue growth show the company is able to maintain and increase its intrinsic value over a business cycle. While the ROE is lower than what I ideally like to see, it all comes down to the price investors are currently paying for the equity as will be discussed later.

Source data from Morningstar

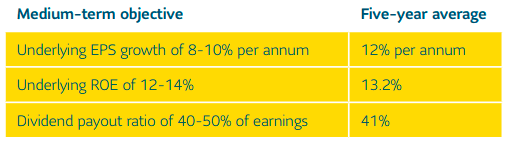

In terms of growth, over the past decade, revenues and net income have grown at an average annual compound rate of 4.8% and 5.1%, respectively. The company's medium-term objective as stated in their 2019 annual report is to grow EPS at a range of 8-10% annually as can be seen below. That might be a bit of a lofty target based on historical longer-term growth rates but we will take a look at what the sustainable growth rate can be calculated at as well to get a second opinion.

Sourced from 2019 annual report

What does a Sustainable Growth Rate look like for Sun Life?

A company's sustainable growth rate is the growth that can be achieved through reinvesting retained earnings not paid out as dividends. As such, it is a good tool to use to assess Sun Life's growth potential as the company needs to retain some of its net income in order to be able to grow and underwrite new insurance policies.

With an average ROE of 9.7% as discussed earlier and a dividend payout ratio of 54.5% over the last twelve months based on unadjusted income, Sun Life's sustainable growth rate would be calculated as 4.4% (9.7% ROE x [100% - 54.5% payout rate]). This forecasted long-term growth rate is right around the historic growth rate discussed in the previous section but below management's more optimistic 8-10% ratio.

Getting a Sense of Valuation

Sun Life's 14.2 TTM P/E ratio can also be expressed as a 7.0% earnings yield, but I also always like to examine the relationship between average ROE and price-to-book value in what I call the investors' adjusted ROE. For a predictable business with a stable capital structure such as Sun Life, an investors' adjusted ROE is a great way to get an idea of potential long-term yields. Investors' adjusted ROE examines the average ROE over a business cycle and adjusts that ROE for the price investors is currently paying for the company's book value or equity per share.

With Sun Life earning an average ROE of 9.7% over the past decade and shares currently trading at a price-to-book value of 1.45x when the price is $42.87 this would yield an investors' adjusted ROE of 6.7% for an investors' equity at that purchase price, if history repeats itself. This is below the 9% that I like to see, but we could add the sustainable growth rate of 4.4% on top which could increase this potential total return up to 11.1%.

Risks

While the industry faces nice growth opportunities from the aging population and growing middle-class in Asia, Sun Life will still have to compete for those opportunities with other global companies. Like many areas in finance, insurance and wealth management can be considered commoditized businesses as money is hard to differentiate between providers... no matter what special factors management claims their products have. Sun Life's Four Pillar strategy has lofty global targets and the competition will be tough.

Takeaway

Sun Life looks to be trading at a reasonable valuation unlike some areas of the market and should be able to return 6.7% based on an investors' adjusted ROE analysis before adding any potential growth. The company's business has proved resilient throughout COVID and there is lots of growth potential ahead for the company even if it does not live up to management's lofty 8-10% EPS growth goal. With a well covered 3.9% dividend yield, Sun Life looks like a good place to put some excess cash.

If you enjoyed this article and would like to read more of my work, click the "Follow" button at the top of the page to receive notifications when I post a new article.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in SLF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: While the information and data presented in my articles are obtained from company documents and/or sources believed to be reliable, they have not been independently verified. The material is intended only as general information for your convenience, and should not in any way be construed as investment advice. I advise readers to conduct their own independent research to build their own independent opinions and/or consult a qualified investment advisor before making any investment decisions. I explicitly disclaim any liability that may arise from investment decisions you make based on my articles.