Value Line: Not A Value Pick

The company is an excellent business if we use profitability margins and returns on capital as yardsticks.

But its quality is hard to exploit if reinvestment opportunities are nowhere to be found.

The company’s main product, its investment research publication service is facing, what appears to be, a secular decline.

The company trades at approximately 16x earnings, which is in-line with its historical average.

There is nothing too exciting about Value Line, Inc. (VALU). The company is an excellent business if we use profitability margins and returns on capital as yardsticks, but its quality is hard to exploit if reinvestment opportunities are nowhere to be found. That is the case with Value Line.

The company has return approximately 8% to investors in the past 10-years. We believe, at current rates, Value Line could still see 8% annual returns but risks are higher now. The company’s main product, its investment research publication service is facing, what appears to be, a secular decline. Competition has intensified with investment services populating the internet, and financial information now becoming a commodity. Value Line has taken steps to push for more online services with the introduction of special newsletters, but its print publication is declining at a faster rate than new online subscriber growth. That said, they do have a loyal following as appreciated by its average renewal rate of 85%.

Is Value Line a buy at current prices? We don’t think so. The company trades at approximately 16x earnings, which is in-line with its historical average. Investors would be getting an earnings yield of 6% plus any growth on top of it. For the past 10-years, the company has grown earnings at a 6% rate, however, we would not put too much weight on future earnings growth, as the core business model looks to be in a secular decline. While we are currently neutral on Value Line, we would like to revisit the idea if it gets cheaper. At a lower earnings multiple, we would increase our prospective returns while adding a margin of safety.

Business Overview

For those unfamiliar with the company, Value Line is the value investor’s first line of research. It would not be too farfetched to say that every value investor legend has used the investment survey. Super investor Walter Schloss is cited as mainly using Value Line for its investment decisions. Between 1956 and 2000, his investment fund earned a compounded annual return of 15.7%, compared to the market’s 11.2% return over the same period. For full disclosure, we also use Value Line as our main research source, as we find the compactness of financial data on one sheet extremely useful.

Value Line generates revenues through three main sources: Investment Periodical & Publications, Copyright fees, and Management fees.

Revenues from its periodicals & publication include its comprehensive Value Line Investment Survey and several niche newsletters to capture the interest of different types of investors (dividends, ETF’s, special situations). The company sells its services to individual investors, colleges, libraries, and institutional clients.

The company also derive fees from copyright services made available for use in third party products such as unit investment trusts, variable annuities, managed accounts, and ETF’s. The sponsors would use Value Line’s trademarks with their products and use the company’s Proprietary Ranking Systems including its Timeliness, Safety, Technical and Performance ranks. Value Line would receive a fee based upon the market value of assets invested in each product portfolio that uses Value Line’s proprietary data.

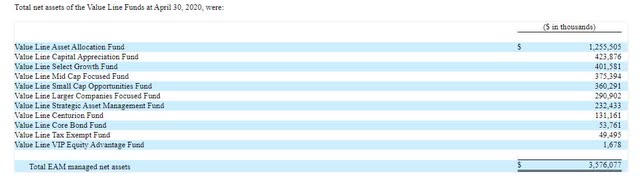

Finally, the company receives management fees from its non-voting revenue and non-voting profit interests in EULAV Asset Management (EAM), which serves as the investment advisor to the Value Line Funds following the restructuring of its asset management and distribution business in 2010. The Company’s non-voting revenues and non-voting profits interests in EAM entitle it to receive a range between 41% to 55% of EAM’s revenues from EAM’s mutual fund and 50% of the residual profits of EAM. Below is a table of the total net assets of Value Line Funds managed by EAM as of April 2020:

Source: 2020 annual report

The Big Picture

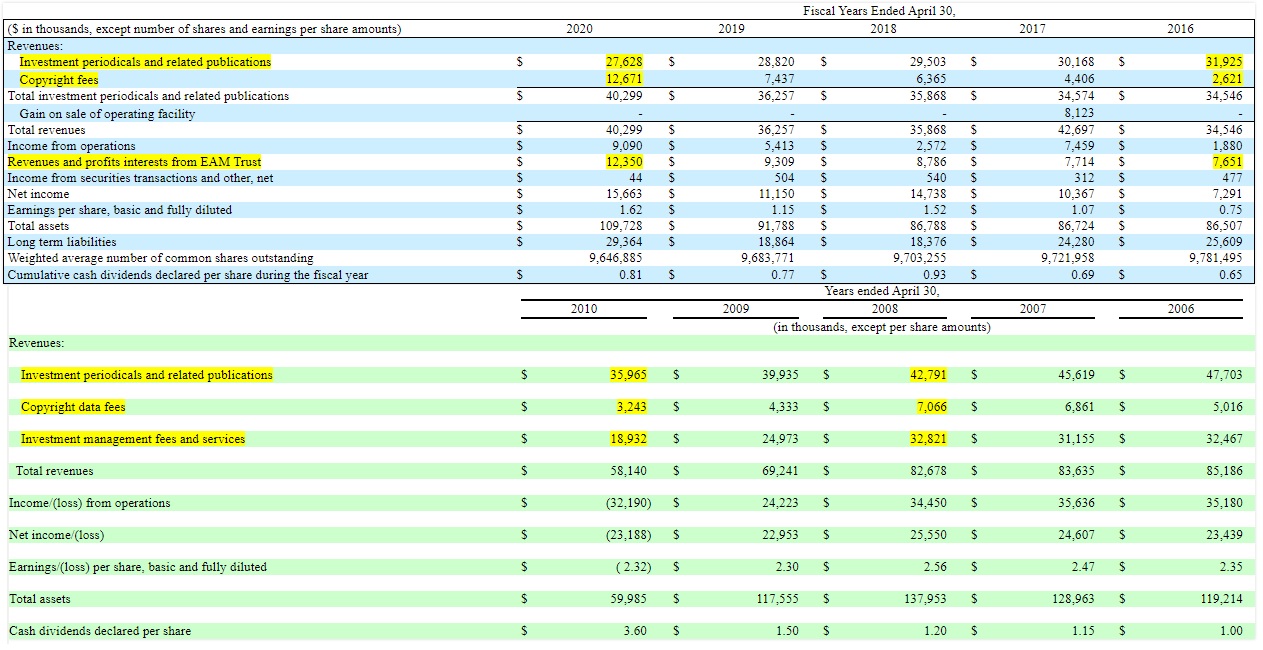

Source: 2010 and 2010 Annual reports

From the table above there are two clear observations to be made. First, we can observe the secular decline in the company’s core product (Investment periodicals and related publications), going from generating $47 million in sales in 2006 to $28 million at the end of 2020 or a decline of almost 42% in a 14-year window. Second, Value Line’s fee derived revenues are highly volatile and unpredictable.

As one could imagine, driving the decrease in the publication business is the secular decline in print subscriptions, somewhat offset by more stable digital memberships. In 2011, print accounted for $22 million, or 63% of total Investment Periodical sales, while digital revenue was $13 million. Today, print accounts for $12 million in sales or 43% of total Investment Periodical revenues, while digital has increased to $15 million or 54% of core sales. Print sales have decreased by 45% or approximately at a declining rate of 6% annually. The rate of decline in print sales is worrisome because the increase in digital sales at a rate of 1.6% is clearly not enough. As management said in its annual shareholder meeting: “We continue to deal with, what I call a torrent of free information or "free" because some of it isn't worth anything either”. Sure, the company can expand its newsletter publication to cover other investment niches, but competition would remain fierce with no barriers to entry. We wouldn’t be surprised if the downtrend continues.

The company’s two other sources of revenues are more volatile but there have 100% profit margins, or at least close to it. The unpredictability is what could hurt shareholders in the long-term. For example, we can observe the positive upward trend in management fees from 2016 to 2020 (almost doubling in size) but if compared to the peak of 2008 is still down 62% from its highs, keeping in mind that we have been through a 10-year bull market.

While copyright fees have shown volatility, it is currently the only growth driver for the company. That could be due to the popularity of ETF’s in the past years, but it also a competitive field:

And we're competing effectively in the ETFs field. That's our main copyright sources, exchange-traded funds, operated by others using our systems. We're competing quite effectively in that competitive environment, but it is a very competitive situation. It's a good feel to be in. We were really one of the very first to work with the ETF community. But others want in on a good thing, and that's inevitable. – 2020 Annual shareholder meeting

Management is doing what a business with no reinvestment opportunities should do, return cash to shareholders via dividends and buybacks. The company currently pays a quarterly dividend of $0.21, which at the current share price, yields approximately 2.7%. However, management reduced the dividend from $1.50 in 2009 to $0.60 (excluding a special dividend) in 2010, as the great recession shook the market; and while it has increased gradually from there, it still has ways to go before it reaches the previous peak. As a result, a constant growing dividend is not something to be expected. With buybacks, the company has a more conservative approach, having just repurchased approximately 3.6% of its outstanding shares in an 8-year period.

The Bottom Line

Is there an investment case in Value Line? Not right now. We believe at 16x earnings, the company trades at a fair valuation, however, slightly tilted to the risk side of the equation. The company could face severe headwinds from its declining core business, but also from an end to the bull market. If that becomes the case, we could expect fee revenues from both its copyright and management side of the business to decline. Considering these are extremely high margin revenues, the impact on the bottom line could be detrimental. Value Line could become interesting if starts trading at bargain multiples. At that point, we would revisit the risk/reward scenario to see if there is a margin of safety. At bargain prices, they might even become an acquisition target.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.