ReWalk Robotics: A Turbulent Journey In The Right Direction

ReWalk shares have recently moved up in spite of new equity issuance.

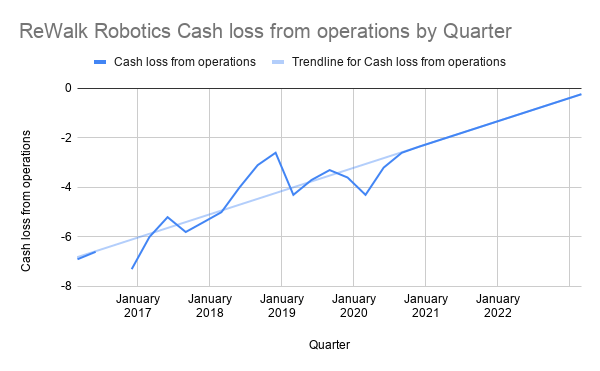

The third quarter saw reduced revenues due to Covid-19 but still managed to use less cash in operations, which is trending strongly towards a break-even point in 2023.

As some risks recede, the question of fair valuation and evaluating growth prospects become more important to address.

ReWalk Robotics (RWLK), the Israeli company developing robotic exoskeletons and other technology used in helping those recovering from certain types of injuries be able to walk again, has been a fascination of mine for several years. While the company is not exactly a start-up, much less a hot IPO, in several respects it remains young in a field that is largely in its infancy as a commercially viable product. Whether or not the whole industry of robotic-assisted recovery ever develops into a mature market is far from certain. Observing both the business and technological progress at ReWalk Robotics is a little bit like having a window into the whole nascent segment.

ReWalk wasn't born yesterday - the company has been around since 2001, had its initial product approved by the FDA in mid 2014, and became a publicly-traded company later that same year. While its technology has certainly delivered incredible value to hundreds, perhaps thousands of lives, its acceptance among insurance carriers have been slow to develop, clearly holding back the opportunity to create value for shareholders in the last 6 years. For such a thinly-traded nano cap in the context of broader markets at all-time highs, I do not want to read too much into recent trends on its valuation, but I think it is time to start considering valuation assumptions more carefully.

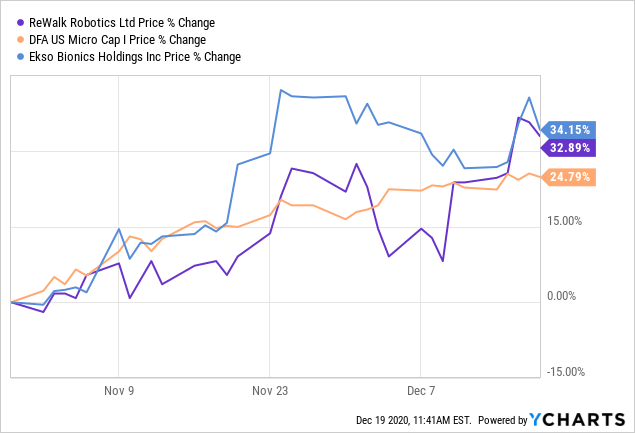

ReWalk has moved up noticeably over the last month and managed to hold well above $1.25, in spite of expanding its share count by 5.6 million new commons (about 30% more), with additional warrants priced at $1.34. In fact, both ReWalk and its peer Ekso Bionics (EKSO) have seen a strong return since November heading into year end, outperforming a basket of micro cap names in the DFA US Micro Cap fund (MUTF:DFSCX).

Data by YCharts

Data by YCharts

Whether or not this is the beginning of a new direction for ReWalk is an intriguing question, as longtime shareholders have seen value destruction on a spectacular scale, and have every right to be skeptical.

Just Crossing the Starting Line

Some of the best stories about the beneficiaries from ReWalk's exoskeleton involve people using the individual ReWalk 6.0 suit to complete marathons. I am aware of handful of these, dating back to the London marathon in 2012, and another in 2018, while an American veteran completed the New York City race last year. Behind each of these examples is a tremendous story of grit, determination and the potential for technology to truly help people lead lives that would otherwise be unavailable to them.

I've been an on again/off again runner for the last 15 years, having completed perhaps 25 half-marathons, but never attempted a full marathon, and I will attest that even in a half marathon, for me crossing the finish line is always a feeling of both relief and accomplishment. In larger races, however, with thousands of runners, the organizers plan it so that runners are grouped in sections behind the starting line, based on expected finishing times (the elite runners go in front, slow runners at the back, etc.), so for someone like me, it can take a while just to move up to the starting line.

I think this is something of an appropriate metaphor for ReWalk as a viable business. All the past steps were merely preparation for getting to the starting line - the success in proving out the technology, the investments in getting the FDA and European approvals, developing the ReStore soft suit as a second product line for stroke patients, getting German health insurers to start covering the original ReWalk hard suit, and now inching closer to a breakthrough for getting American insurers to do the same, it is like the actual event is just now getting started.

I am not the first to apply the marathon metaphor to the industry, as reported by the website Exoskeleton Report in its summary of the industry convention in 2017, and recalled by the same site in its reporting on ReWalk's victory in getting the billing codes assigned by the Centers for Medicare and Medicaid earlier this year. Back in 2017 Parker-Hannifin's (NYSE:PH) executive Achilleas Dorotheou (whose company has developed the competing product, Indego) was clearly stating the industry as a whole would be years still in development, and it seems his predicted timeline is bearing out.

For context with regards to ReWalk, the reimbursement picture for ReWalk's individual use devise (such as used in the marathons) has really turned quite positive in Germany. One week after announcing the equity raise earlier this month, the company also started its contract (which was actually announced on the 3rd quarter call) for coverage with a private German insurer, the first such agreement, and supplements multiple agreements already in hand with German statutory insurers (this link supplies a handy overview in English of the German health insurance landscape). As that coverage continues to expand, over the long-term, obviously more claims will be filed and paid in Germany, which I believe is the baseline for normalizing revenue that has been unpredictable over the last few years. ReWalk management has worked diligently to expand margins, and the cash burn picture has improved quarter by quarter.

In fact, even with revenue taking a tumble to only $0.75 million in the 3rd quarter, cash loss from operations improved by another $0.60 million to $2.6 million. I wrote in my last update in August 2020 that:

If cash burn declines to $2.5 million per quarter and just stays there without further improvement, that still leaves more than 20 months of runway

ReWalk basically hit that figure in Q3, and with the additional $8 million in cash from the new shares issued, that runway will be longer, even in a steady state, but should continue to improve as the world moves past the Covid-19 pandemic. While I am leery of projecting too much into the future based on the historical trend, there appears to be a reasonable chance that cash from operations would be approaching break even by mid 2023, which would correlate with management's hopes of having American insurers on board more broadly by mid 2022, and perhaps greater contributions from the ReStore suit that is marketed and sold to rehabilitation centers.

Source: author's spreadsheet; the r-squared for the data from Q1 2016 through Q3 2020 is ~0.765; data sourced from ReWalk Robotics quarterly reports

As of the end of Q3 2020, ReWalk had already done reasonably well at managing its overall cash position. Making some assumptions for where things will stand at year end in broad strokes; I will be looking for net cash of around $20 million ($18.1 million at close of Q3, less $3.4 million debt, less cash used in operations of $2.5 million during Q4, and plus cash from financing of $8.0 million). With around $20 million, the company could sustain a quarterly cash burn of $2.5 million for 2 more years, and much longer if the cash generated from the business continues to improve. Ori Gon, ReWalk's CFO, stated on the 3rd quarter call in response to a question that:

on the cash burn side, we - it will be reduced at the end of Q1 [2021]... you see this quarter landing at about $2.6 million in operating cash burn. So that's also a very positive improvement if you compare to previous quarters and a year before that. So we've done a very significant effort there and with the growth that we hope would come in the future, we can even take it lower.

While this latest round of dilution may not be last, I think there clear signs pointing to ReWalk becoming a viable business, on the basis of being able to get to a point in which its operations can produce positive cash contribution.

Is Establishing A Fair Valuation Feasible?

Had 2020 been a more normal year without the Covid-19 tragedy, starting to come up with a reasonable valuation framework for ReWalk might have been easier. I say that because the second quarter featured one data point that I thought was particularly important, namely that every ReWalk individual use suit sold that quarter in Germany was paid for by insurance, and I was hoping to see more of the same in the following quarter. However, Q3 was more severely disrupted, with minimal sales activity, and as a result, I expect to see Q4 hit fairly substantial numbers due to delayed sales, along with the number of pending insurance claims that were open in Germany (84) and the United States (12). I anticipate the majority of German claims to eventually pay, but would not count on any of the American claims without knowing if any of them were within the Veterans Affairs agreement.

Additionally, ReWalk is broadening its sales base from being so purely reliant on favorable insurance decisions. Primarily, the ReStore soft suit developed for stroke patients had to largely be put on hold while many rehab centers hit pause during Covid, but ReWalk is also now distributing MyoCycle and MediTouch products, which incorporates a tele-medicine aspect. While these are all positive steps - expectation of a strong 4th quarter, restarting sales of ReStore, and getting into a rhythm with MyoCycle and Meditouch - it is enough moving parts without historical reference points making sales projections more difficult to establish.

With those uncertainties understood, we can consider what the market might be implying about expectations for the future. With negative earnings and cash flow and limited competitors, the metrics that can be reviewed are not that deep. The Seeking Alpha valuation page for ReWalk shows a forward price to sales ratio of 7.67, which at $1.45 a share works out to forward sales expectation of $4.68 million. The starting question becomes whether or not this is a fair estimate for 2021 sales.

Through 3 quarters of 2020, total sales have been $3.2 million, and my expectation is that Q4 will at least match, if not exceed Q2's total of $1.6 million, bringing 2020 full-year total to ~ $4.8 million or more. At a forward expectation on sale of 7.67, there is certainly zero growth for 2021 built in, so perhaps Seeking Alpha's valuation metric here is estimating out only to the next quarter. Turning to Reuters for comparison, the figures on the surface at first glance work out a little differently, with P/S of 5.71, which might make you think it would mean sales of $6.3 million, implying a nice bump. However, Reuters has not yet adjusted ReWalk's market cap and share count for the newly issued shares [at least as of this writing on Sunday afternoon 12/20/20], whereas Seeking Alpha has made the adjustment. Based on the old figures, Reuter's reported P/S of 5.71 works out to sales of $4.9 million, so in line across both sources.

My contention is that those sales projections are far too conservative. With 84 insurance cases pending in Germany as of the end of 3rd quarter, I could imagine easily 15 to 20 positive decisions in Q4, with an unknown new number of claims submitted. Even if the replacement rate of new claims was less than the claims approved, I think 15 positive German decisions per quarter through 2021 is within reach, meaning 60 units for the year. On the basis of the existing German cases pending, this would only assume about a 70% success rate spread over 12 months, which does not seem overly optimistic. This result alone, at a selling price of $89k per unit, is annual revenue of $5.34 million. While not a blockbuster beat on sales forecast at $4.9 million, it assumes absolutely nothing in American sales for the units, much less the relaunch of sales for ReStore, Myocycle or Meditouch.

Whatever the ratio, figuring out if it is appropriately valued would be most helpful in the context of comparison to peers. Unfortunately, publicly-traded peers are somewhat hard to come by, and they tend to be imperfect comparisons in terms of business models and maturity. Aside from Ekso Bionics, there is the Japanese company Cyberdyne (CYQBY) (CYQBF) that trade on the pink sheets, Canadian firm Bionik Laboratories (OTCQB:BNKL) that is even more nano cap than ReWalk; formerly public Rex Bionics was de-listed back in 2017. Other competing products tend to be relatively small projects within much larger business, such as Parker-Hannifin's Indego suit. Essentially Ekso Bionics is left as the best point of comparison, and Seeking Alpha shows it with forward P/S of 4.92. Applying a similar P/S of 5.0 to ReWalk would point to revenue of ~$7.2 million, which could be a stretch for 2021, but not wildly out of line.

To look at it another way, if keeping the same P/S of 7.67, and looking for a more modest $6.0 million in 2021 revenue (and I think $5 million from German claims alone is perfectly reasonable to hope for), then based on the current share count of 24.76 million shares, the company is undervalued by ~20%, as the implied value to shares would be roughly $1.85. If either the ReStore or another product line truly starts adding meaningful sales, or if American insurance enters into contracts similar to the German ones for the personal use device, or both, then I think shares would absolutely shoot up two or three fold.

Conclusion

I want to make certain I am as clear as I can be - ReWalk is highly risky venture, but the risks today are somewhat less than the risks were one year ago. The biggest issue with ReWalk Robotics as an investment story, in my view, has simply been the slowness of a business model relying on lining up insurance payments; the process has dragged on years longer than was originally envisioned, and remains unsettled. The issuance of the HCPC code for billing American insurance is an important step, but whether or not the American insurers will ever agree to start coverage like has now happened in Germany is clearly the major question. However, I do not think there is any further question that ReWalk is capable of surviving. This is not to suggest with 100% certainty that it will, or that it will enrich its owners, but only that it can get enough traction with approved claims in Germany alone to be a company with $6 to $7 million in regular annual revenue, a 50% gross margin, and simply be a viable small business, at least for a time.

Since the ambitions are greater than that, the risks are necessarily greater too. As I expect some stability of approved German claims to under gird operations while efforts are made to crack the American market, I do not think the valuation is unduly stretched. Since it has been stuck treading water for so long, new investors have not missed the growth phase; new investors have to answer the question of whether or not they think the growth will materialize. Even if shares might be undervalued by 20% or so currently, I would not advise that such a limited upside potential is worth the risks in this name. The attractive opportunity here, if there is one, is for out-sized gains in 12 to 24 months with reduced downside risks of the company absolutely folding.

For disclosure, I am long ReWalk, and have been averaging down in small batches over the last 15 months. Between its move up and my averaging down, I have gone from being down more than 90% at its 52-week lows, to being down "merely" 75%, with roughly half of a full position. Due to its risk profile, I have no specific plans to necessarily build a full position, but I anticipate continuing to add slowly into 2021.

Disclosure: I am/we are long RWLK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.