Table of Contents

Much has changed since the Coronavirus hit the world in December 2019. Amid countries applying extreme measures to contain the pandemic, businesses came to a grinding halt across the world, forcing monetary agencies to slash growth forecasts for the global economy, India included.

In its World Economic Outlook October 2020 report titled, ‘A Long and Difficult Ascent’, the International Monetary Fund (IMF) has said that the Indian economy would grow at a -10.3% rate in 2020 – a downgrade of -5.8 percentage points from the agency’s June estimate.

As on November 25, 2020, India reported a total of 92,21,998 COVID-19 infections.

After the gross domestic product (GDP) numbers for the first quarter of FY21 showed a decline of 23.9% over the same quarter last fiscal earlier, global rating agencies S&P, Moody’s and Fitch also projected Indian economy to contract by 11.5% and 10.5%, respectively, in the current fiscal.

S&P Global Ratings, on September 14, 2020, cut its FY21 growth forecast for India to -9% against -5% estimated earlier, as the number of infections in the country touch record levels. “One factor holding back private economic activity, is the continued escalation of the COVID-19,” S&P Global Ratings Asia-Pacific economist, Vishrut Rana said.

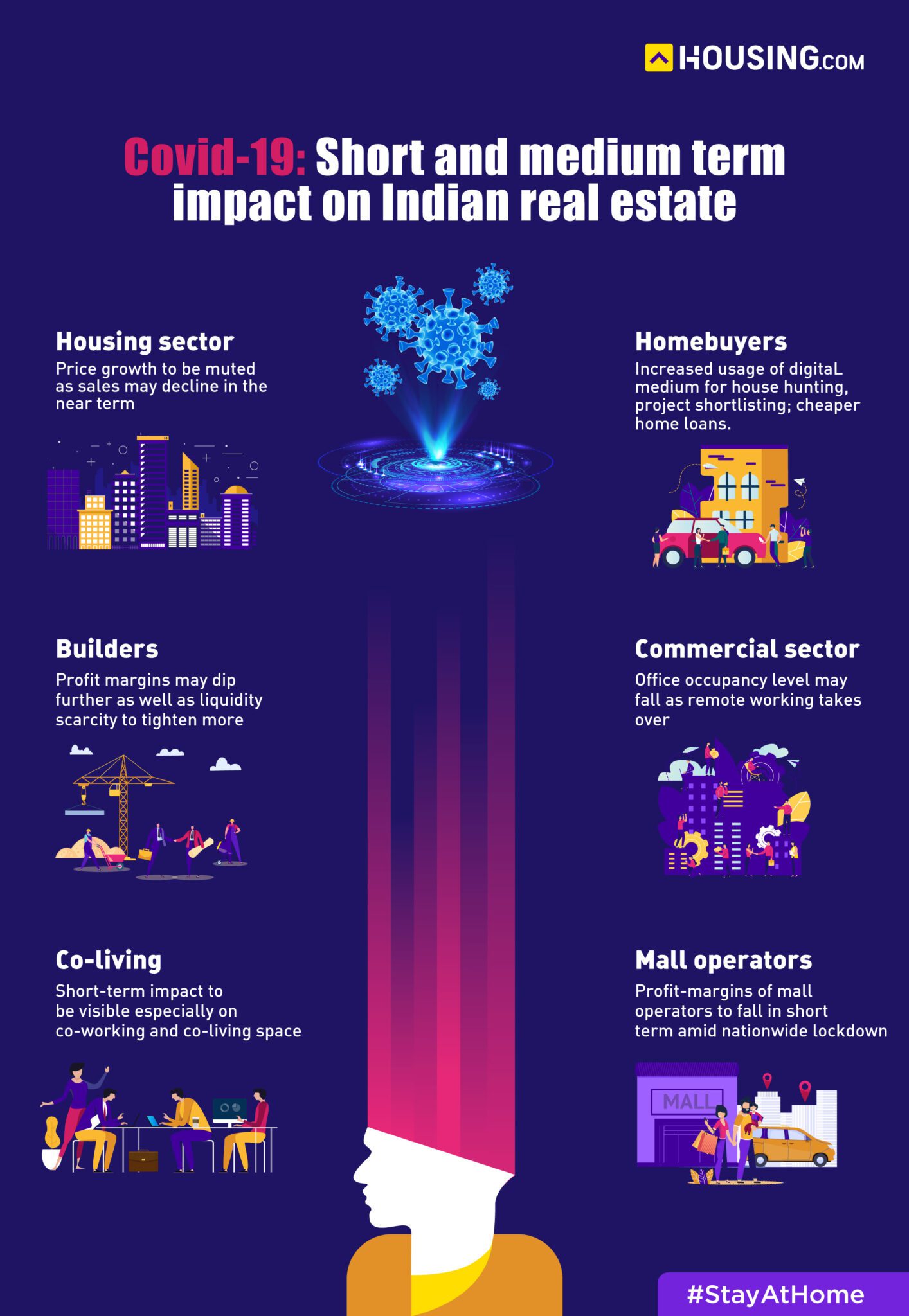

While the adverse effects of the pandemic are already being felt across the world, varying opinions are emerging on COVID-19’s impact on the real estate sector, a health emergency that force-launched the biggest ever work-from-home experiment globally, putting a question mark on the relevance of workspaces in a post-Coronavirus world.

In India, where the economic contraction indicates towards a delayed start of the long-arduous road to recovery, a prolonged lockdown — which started from from March 25, 2020, and was eventually extended till June 7, 2020, amid a dramatic rise in the number of infections — worsened the situation in Asia’s third-largest economy.

As is evident, research agencies are predicting a near-term halt in growth of real estate in India. PropTiger.com data show housing sales in India’s eight major cities declined by 66% in the period between July-September 2020.

“While the Chinese economy has been reeling under the impact of the Coronavirus contagion since December 2019, the situation started to get worrisome in India only in March 2020. The lockdown, which virtually brought to a standstill most economic activity in the country, has hurt all sectors, including real estate. The adverse impact of the Coronavirus is visible on housing sales in the last quarter of the last fiscal because March is usually one of the biggest month for sales,” says Dhruv Agarwala, group CEO, Housing.com, Makaan.com and PropTiger.com.

“With several macro-economic indicators showing a positive trend in September, we may well be on the road to a more sustained recovery and the upcoming festival season will be critical, in determining the growth trajectory in the sector over the next twelve months,” he adds.

Although deal volumes in office space in India increased 27% year-on-year in 2019, to an all-time high of over 60 million sq ft, the growth momentum in India’s commercial segment is also likely to get derailed due to the virus attack.

Any positive predictions about its growth made before the sudden outbreak of the global calamity stand retracted, as the government gets busy devising plans to stop businesses in general and the economy in particular from sinking deeper into a slump, amid impending fears of the rupee declining to a low of Rs 78 against the US dollar.

While the real extent of the damage is hard to grasp in a scenario where every day is making a great difference, one thing is for certain – India’s real estate sector will suffer short-term shocks on account of the contagion.

Housing market in India’s top 8 cities (April-June 2020)

| Sales | Down 79% |

| Project launches | Down 81% |

| Inventory | 738,335 units |

Source: PropTiger DataLabs

COVID-19 impact on Indian housing market

The Coronavirus spread has further delayed a recovery that might have seemed possible, because of various government measures to revive demand, even though, right now, it does not seem like prices will go down immediately.

Niranjan Hiranandani, national president, NAREDCO, states that “Salvaging Indian realty, the second-largest employment generator is critical, not only from the GDP growth perspective but also for employment generation, since the sector has a multiplier effect on 250-plus allied industries.”

The centre in the recent past had announced higher tax breaks and lower interest rates on home loans to make purchases more lucrative, apart from setting up an Rs 25,000-crore stress fund for stuck projects.

The demand slowdown in the residential segment has already curtailed housing sales, project launches and price growth in India’s residential realty sector, which has been reeling under the pressure caused by mega regulatory changes, such as the Real Estate Regulatory Authority (RERA), the Goods and Services Tax (GST), demonetisation and the benami property law.

According to rating agency ICRA, the pandemic, if not contained soon, would not only significantly impact the economy but also adversely hit developers’ cash flows and project delivery capabilities.

“In case of a longer outbreak though, the impact on overall economic activity is likely to be deeper and more sustained, which would result in a more significant impact on developer cash flows and project execution abilities, giving rise to wider credit-negative implications,” ICRA said in a recent note while also adding that the three-month moratorium announced by the RBI on March 28 on loans will provide some comfort to builders. This moratorium, which was subsequently extended by the RBI, on May 22, 2020, till August 31, 2020, may see further extension as the economic situation is seen deteriorating.

“The injected liquidity of Rs 3.74 lakh crore (by the RBI) along with the moratorium on all term loans by financial institutions will alleviate short-term liquidity concerns and help developers, as well as home buyers . It is a big relief for developers and buyers to help them mitigate the challenges faced by them currently,” says Ramesh Nair, CEO & Country Head of JLL India.

Expecting delays in project completion and extending support to the builder community, the the government has also said developers could get project deadlines extended by six months through the RERA citing the force majeure clause.

You may like to read: What is force majeure and how it works in real estate?

“Due to the lockdown announced on account of the COVID-19 outbreak, both, construction and sales activity, have come to a complete halt across the entire real estate sector. On several sites, construction workers, too, have gone back to their home towns. Even after the lockdown, activity will only recommence gradually, which will cause project delays of anywhere between 4 to 6 months at the least,” said Sharad Mittal, CEO and head, Motilal Oswal Real Estate Funds.

“Delivery of existing projects may get pushed back, depending on how quickly the input supply-chain and labour availability are restored. So, the fall in new supply may continue for the next few quarters, as developers wait for demand revival,” says, Mani Rangarajan, Group COO, Elara Technologies.

COVID-19 impact on home buyers in India

If low interest rates (home loan interest rates are at below 7% now) and high tax exemption (rebate against home loan interest payment is as high as Rs 3.50 lakhs per annum) were going to make a change in the consumer behavior, the Coronavirus outbreak is likely to halt that shift, at least in the near to medium term.

With property seekers unwilling or unable to undertake site visits, this could result in the postponing of purchase decisions. “With the Coronavirus pandemic impacting all sectors of the economy, the troubles have compounded for India’s realty sector, which has been dealing with a ‘challenging scenario’ since the economic and policy reforms were introduced. The slowdown since February-end is apparent and while site visits are almost non-existent, the decision-making process is hugely delayed,” says Hiranandani.

The fact that businesses would scale down their workforce would also force many prospective buyers to wait for clarity on their job security, before making a final decision on property purchase.

Even though the RBI has announced several rate cuts, bringing the repo rate down to 4%, any positive effect of the move on buyer sentiment would be seen only in the medium to long term. The step, however, would come as a major support for existing buyers, who might struggle to pay EMIs in the short-term or medium-term, because of the lockdown or in the event of job loss.

However, the pandemic has also made buyers realise the value of home ownership, thus, giving a sold sentiment boost to residential real estate.

In a survey conducted by Housing.com in collaboration with NARECCO, 53% respondents said they have put their plans to buy a property on hold only for six months and plan to return to the market after that. Nearly 33% respondents in the survey also said they would have to upgrade their homes, in order to work from home. In a renters’ survey, 47% respondents said they would like to invest in property if it was rightly priced.

“We are seeing increasing digitisation of real estate with significant growth in online demand, as developers and buyers adopt products such as virtual tours, drone shoots, video calls and online booking platforms. We may be seeing a shift in the real-estate sector, where technology will play a significant role in property renting and buying and property registration may move online in some states. While physical site visits will remain important, buyers will use technology to discover new homes with some buyers booking online and buyers will likely make fewer site visits than before,” says Rangarajan.

See also: What will buyers expect in a post-COVID-19 world?

COVID-19 impact on builders in India

Slump-hit builders were pinning their hopes on government support to shed the increasing unsold stock even as an ongoing crisis in the country’s non-banking finance sector, a key source for housing sector funding, made borrowing extremely difficult, jeopardising their plans to deliver projects within the promised timeline.

Developers were sitting on an unsold stock worth approximately Rs 6 lakh crores, as of September 2020, show PropTiger.com data. A near-halt situation on construction activity amid a lockdown in India to contain the virus and delay in supply of manufacturing material and equipment from China, will further push delivery timelines of ongoing projects, consequently increasing the overall cost for developers. Through furious efforts, China, the country where the virus originated, has been able to rein-in the pandemic, with workers returning to offices. However, amid tension between the two neighnours, builders here will be forced to postpone orders.

Several measures announced by the government in its Coronavirus-specific stimulus package and the EMI holiday for developers during the crucial period are some steps that might offer some relief to the builder community.

“The pandemic menace has hit at a particularly sensitive time. Across realty companies, this is the time when statutory payouts and streamlining of balance sheets happens,” Hiranandani added.

COVID-19 impact on office space in India

Even though people are gradually coming back to work in sectors where working from home is not an option, remote working continues to be the main way of functioning for companies as of now.

“During the lockdown, India coped very well with the shift in workplace and has continued to do so with limited re-opening. We do believe that going forward, the workplace will no longer be a single location but an ecosystem driven by locations and experiences, to support convenience, functionality and wellbeing,” says Anshul Jain, MD – India and SE Asia, Cushman & Wakefield.

Earlier, as infections increased drastically, companies worldwide announced remote working for employees to contain the virus spread, triggering a debate if work-from-home could replace office spaces in future. While the answer to that question depends on the ultimate level of success achieved by businesses through remote working, a near-term jolt to the commercial real estate segment in India is unavoidable.

Even though developers in this segment remain optimistic, because of better access to liquidity and lower risk of defaults, the impact of the virus is visible on the office space, too. According to international property brokerage JLL, net leasing of office space fell by 50% in the quarter of July to September 2020, across seven major cities to 5.4 million sq ft as corporates and co-working players continued to defer their expansion plans following the pandemic. The net absorption of office space stood at 10.9 million sq ft in the year-ago period across seven cities, including Delhi-NCR, Mumbai, Kolkata, Chennai, Pune, Hyderabad and Bengaluru. During the January-September period of 2020, the net office space leasing fell by 47% to 17.3 million sq ft from 32.7 million sq ft in the same period in 2019. The remote working concept contributed to the fall in demand for office space, JLL said. “Increased office space consolidation and optimisation strategies of corporate occupiers, resulted in subdued net absorption levels, which could not keep pace with new completions. This resulted in overall vacancy increasing from 13.1% in Q2 2020 to 13.5% in Q3 2020,” JLL said in a statement.

Experts, however, expect the pre-COVID-19 growth momentum in this segment to get restored eventually.

According to a report by global property brokerage Knight Frank, in fact, of the total private equity investment of USD 2.31 billion across 11 deals in the first nine months of 2020, the office sector claimed 81% share, followed by warehousing at 10% and residential with 9%. “Private equity investors have taken advantage of this period of economic slowdown to scout for Grade A assets with strong growth potential, for investments. As a result, assets in the office segment saw positive investment activities. The average deal size for office investments was also seen to be remarkably higher in 2020 so far, as compared to full year 2019,” said Shishir Baijal, CMD, Knight Frank India. While stating that the sector continues to attract investors, because of its strong fundamentals, the report also pointed out that investment in this asset class will remain positive in the medium-to-long term.

While stating that the work-from-home run was a reaction to the nationwide lockdown to contain the Coronavirus outbreak and it is unlikely to become a permanent concept in real estate strategies, Anshuman Magazine, chairman and CEO, India, south-east Asia, middle east and Africa, CBRE, says the demand for commercial real estate will remain robust. “This is due to challenges such as psychological impact on employees, data security and monitoring productivity,” Magazine was quoted in the media as saying.

According to numbers available with CBRE, gross office space absorption touched a historic high of 63.5 million sq ft in 2019, nearly 30% higher than 2018. Office stock across seven leading cities is expected to cross 660 million sq ft by the end of 2020.

See also: How to prepare for the reopening of your office

COVID-19 impact on mall developers in India

A total of 54 malls were expected to be launched across India in 2020. These projections were, however, made before the Coronavirus pandemic struck. As a result, only five news malls started operations in some of the leading cities of the country, including Gurugram, Delhi, Bengaluru and Lucknow. This also reflects the state of crisis in India’s retail segment.

The anxiety surrounding the virus spread resulted in footfall in malls in India reducing by half before the government ordered a complete lockdown. This segment continues to suffer even though the government has lifted restrictions, allowing malls to operate, albeit by following strict rules. A survey by the Retailers Association of India (RAI) showed that lockdown relaxations did not benefit retailers as business remained lacklustre.

“Low footfalls and subsequent closure of malls will impact developers’ debt servicing against the project. Even a relaxation from banks for the short-to-medium term should not have a big impact. However, if the virus scare continues beyond one to two quarters, debt servicing challenges may last for a longer period,” points out Rohan Sharma, research head, Cushman and Wakefield.

“Eventually, footfalls will limp back to normalcy as people will take time to regain confidence to throng public places in large numbers. This will also bring a fundamental shift in how mall owners will now look at their properties. An increased focus on air quality, improving hygiene and sanitisation and awareness is what will bring back people to their malls,” Sharma adds.

“The impact of COVID-19 in the form of shutdown of retail outlets and malls as also entertainment and fitness centers has put commercial real estate deals on a wait-and-watch mode,” points out Hiranandani.

According to Nair, mall operators have been the most affected, and they would have to act reasonable to tide over the crisis amid projects of rising vacancies in shopping malls.

COVID-19 impact on warehousing in India

On the assumption that e-commerce will grow significantly in the post-COVID-19 world, there have been projections that the warehousing sector in India would stand to gain immensely. More importantly, this growth will not be limited only to the big cities but it will be spread across smaller cities, as well.

According to property consulting firm Savills India, the supply of new warehousing space in 2020 could be only 12 million sq ft as against the earlier projection of 45 million sq ft. However, as the demand grows in

the long term, a significant capacity increase could be expected in 30-35 new tier-2 and tier-3 cities.

See also: Coronavirus impact on warehousing in India

Indian real estate after Coronavirus: Top 11 projections

|

Outlook for Indian real estate in 2021

Even though the pandemic drastically impacted the sector in 2020, better days are expected in 2021. Amid growing importance of home ownership among buyers and investors, the demand for residential real estate would be high in the coming year.

“In these extraordinary times, stakeholders across sectors have an opportunity to structurally re-imagine their strategies, to ensure sustained recovery. Doing so, would require shifting from traditional approaches and embracing new, transformational methods — which would be accelerated by widespread tech adoption, sustained policy impetus and accelerated investor interest in India,” says Anshuman Magazine, chairman and CEO, India, South East Asia, Middle East and Africa, CBRE.

FAQs

Will COVID-19 impact home sales?

Housing sales might see a drop in the aftermath of the virus outbreak as businesses might cut jobs to offset losses.

Will COVID-19 impact property prices?

Prices might not undergo any significant change as the overall cost of projects is likely to increase.

Comments