America's Car-Mart Is Likely To Make New Highs

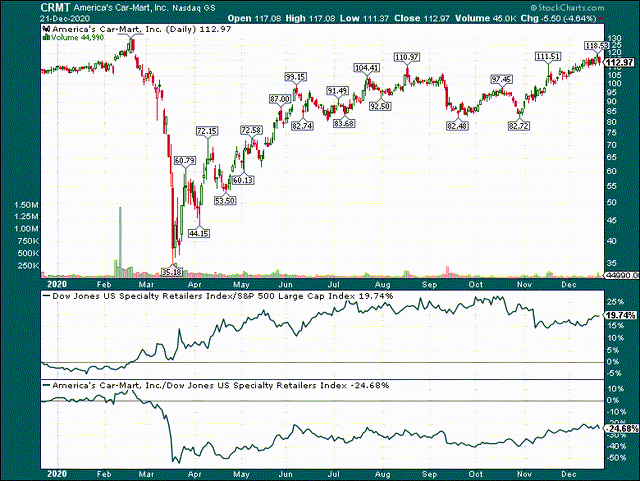

CRMT has rallied enormously since the bottom, but it has failed to challenge its highs.

With estimates booming higher, this disconnect shouldn't last long.

The stock is very cheap and with better-than-ever fundamentals, which should warrant a higher multiple.

Car dealerships have been unbelievably resilient this year. I incorrectly thought at the outset of the pandemic that the historic job losses being suffered in the US would seriously derail the car buying business. However, consumers have turned out in huge numbers to buy new cars, producing massive rebound rallies in a variety of related names.

One such name is America’s Car-Mart (CRMT), which is making a bid for new highs on its current rally attempt.

CRMT made a double bottom at $82 a couple of months ago, and has been off to the races ever since. The prior breakout level was ~$111, and we are very slightly above that now. I believe that level will hold on the current pullback, and that CRMT will make its bid for new highs at $130.

Part of this is because the chart looks great, but the other reason is that despite the move we’ve seen from $35 to $112, shares are still cheap. CRMT has proven it can deliver over the long term, and with the stock being as cheap as it is, the risk/reward firmly favors the bulls.

Scale in a fragmented industry

We all know that car retailing is a fragmented market. This is true in all forms of car retailing, but in particular, for used cars. If we further drill down into lower-priced, lower credit quality, it is a sector dominated by disparate “mom and pop” shops that have no scale advantages. That’s where CRMT comes in as it seeks to gain scale in a segment where that sort of thing can be an advantage.

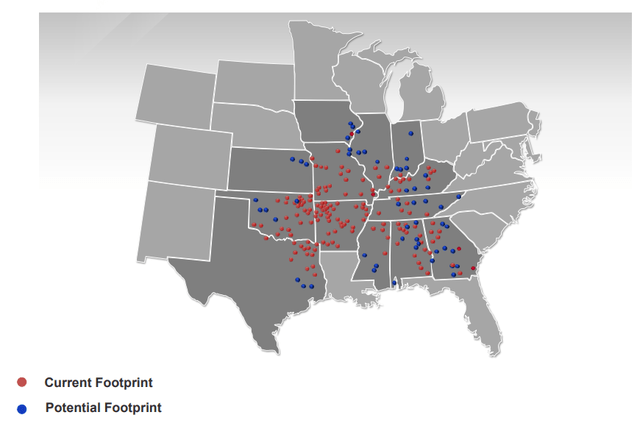

The company has 151 dealerships in 12 states, and is focused on the buy-here-pay-here segment of the car retailing landscape. Of course, this sort of business primarily caters to those individuals with poor credit, so selling prices tend to be lower, but margins are excellent. The one caveat is that sizable credit losses are the norm, so in a much larger way than would be typical for a car dealership, credit quality is king for CRMT.

Source: Investor presentation

The company’s footprint is relatively concentrated, meaning it has a very long runway for location expansion in the future. Car retailing occurs everywhere in the country, and low credit quality occurs everywhere, so there is no reason why CRMT’s model couldn’t work in any number of locations. It tends to focus on more rural locations because that’s where its customers are, but there are plenty of suitable locations in the US.

I like CRMT’s scale because it provides the company with marketing leverage, a broad view of market conditions, infinitely more data than a mom and pop shop would have, and the ability to apply best practices across markets. In a segment that is extremely fragmented, these are real competitive advantages.

Proven growth

CRMT has used this to its advantage over the years, producing truly outstanding growth in the top line.

Source: Investor presentation

We can see that CRMT has managed nearly 11% annualized revenue growth since 2002, a feat which very few companies can match. Given the way it is performing, and the long runway for further location expansion, I see no reason why the party has to stop here.

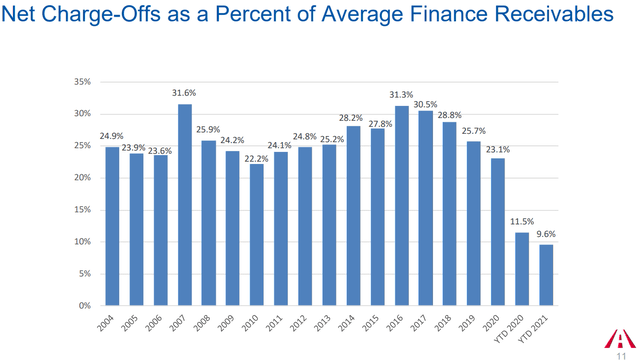

Of course, credit quality is paramount given how important in-house financing is to CRMT, as it finances substantially all of its customers’ purchases.

Source: Investor presentation

Net charge-offs as a percentage of receivables has actually improved markedly in the past few years from some truly eye-popping numbers. CRM has a number of years in this dataset that exceed 25% charge-offs, which is a bit difficult to believe. It has, therefore, the very worst credit quality I can remember seeing for any business. This is to be expected to an extent because it caters to customers with very poor credit profiles on purpose. However, it has made great strides since 2016 to reduce charge-offs, and that translates directly into profitability, which then translates into earnings, which then translates into a higher share price.

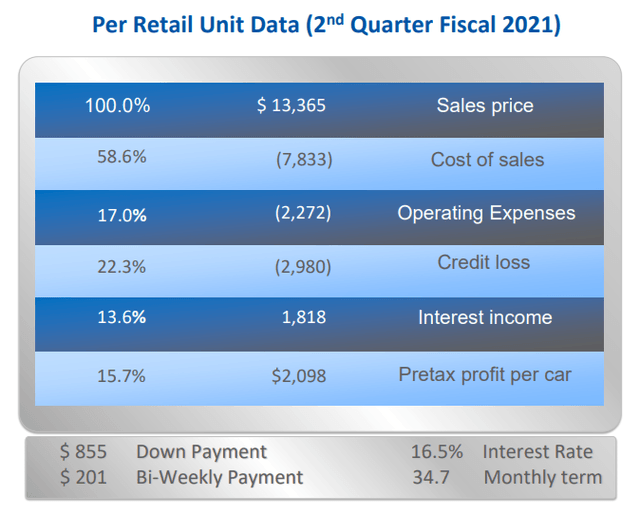

To illustrate the impact on earnings from the various components of a vehicle sale for CRMT, let’s use some data from the most recent quarter.

Source: Investor presentation

Average sales price of $13.4k is quite low in comparison to bigger names like CarMax (KMX), Carvana (CVNA), and certainly new car dealerships. Low prices help consumers with low or no credit more easily afford their payments, and this will almost certainly never change for CRMT as that is its model.

The interesting thing is that the cost of the car being sold is only ~59% of the sales price. That means CRMT has enormous margins on its cars in an industry where gross profit is generally less than 15%, but this figure can vary significantly depending upon the company you’re looking at. At any rate, the point is that CRMT’s model affords it the ability to capture huge amounts of margin on vehicle sales, but there is a catch.

Because it is catering to consumers that presumably have limited options for vehicle purchases, it must endure sizable credit losses to facilitate those sales. Credit loss came in at ~$3k per vehicle in the most recent quarter, which is typical for CRMT. It makes up most of that on its 16.5% average vehicle loan yield, but the point I’m trying to make is that credit losses are an expected part of the cost of doing business. CRMT charges enormous interest rates on its loans because it has to, and even then, it isn't nearly enough to make up for defaults.

Even with these massive credit losses, the company is still making ~$2k per car in pretax profit. That’s very impressive and it is why CRMT has been able to produce such large earnings growth in the past few years. Lower credit losses translate directly into profits, and CRMT is executing beautifully on that front.

The stock is still cheap

Despite all of this, CRMT is still very cheap to my eye.

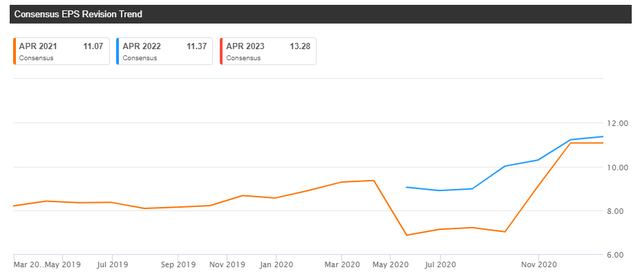

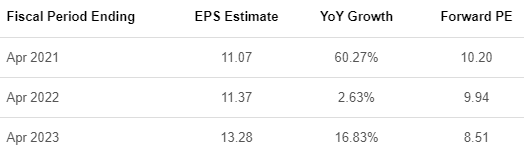

Source: Seeking Alpha

Shares trade for just 10 times this year’s earnings, and just 8.5 times earnings for ~2.5 years from now. That’s a low multiple on an absolute basis, but it is also low against the company’s historical multiples, which we’ll get to in just a bit.

But first, I wanted to point out that EPS revisions have improved massively, and not just since the bottom earlier this year.

Source: Seeking Alpha

The revision cycle for this year’s earnings has seen EPS estimates move substantially higher than pre-pandemic levels, but recall the stock hasn’t even regained its pre-pandemic high yet. That’s a disconnect, and one that I think investors have time to exploit.

Back to the valuation, CRMT’s price-to-normalized-forward-earnings is below for the past decade, and what we can see is that the stock is cheap.

Source: TIKR.com

Shares are below the bottom end of the historical range right now, even after the gargantuan rally we’ve seen. In other words, while CRMT has been rising, it hasn’t risen quickly enough to match rising expectations. That’s why I think the stock is cheap, and that it has legs to at least 13x forward earnings. The multiple could end up being higher given that credit quality is much better now than it was five years ago, so we could see a move back to 16x earnings or so eventually. But for now, 13x earnings provides plenty of upside.

CRMT has a business model that is subject to certain weaknesses, namely, credit quality among those in the bottom tiers of the credit ladder. However, it has found a formula that works, estimates continue to rise, and the stock is cheap. If you want exposure to the booming car industry, I think you can do a lot worse than CRMT.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in CRMT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.