Kala Pharmaceuticals Should Have Limited Downside With Eysuvis Now Approved

Kala Pharmaceuticals got its second ocular therapy, Eysuvis, approved on October 27.

Peak sales estimates range from $500 million to over $1 billion due to its unique targeting of acute, episodic dry eye that is more common rather than the chronic version.

Despite this progress, Kala stock has tanked of late, creating a huge opportunity to scoop up shares of this quality company for a discount.

Kala Pharmaceuticals (KALA) is a platform technology company with already marketed products. Its most important product, Eysuvis, was just approved last month with a launch to follow in December, and expectations are high, with $500 million in peak sales being the lowest estimate I’ve seen. In this article, I review Kala’s proprietary technology, assess Eysuvis in light of both current and future competitors, and discuss the company's valuation and potential upside.

Kala’s Technology Platform has Already Resulted in Two Marketed Products

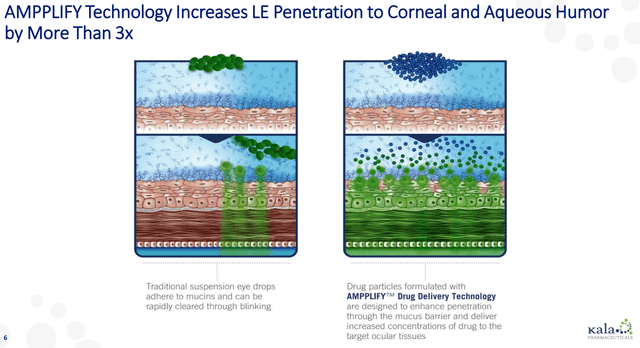

Kala’s products rely on its AMPPLIFY technology platform, which stems from research that originated at Johns Hopkins. AMPPLIFY is a nanoparticle delivery system that allows a drug to not be bound up by mucus and then eliminated by the mucus membranes. This mucus binding ordinarily would allow the eye to eliminate things like dirt, but it can also make it difficult for drugs to penetrate the ocular surface.

Figure 1: Kala’s AMPPLIFY Technology

(Source: Kala’s October 2020 Investor Presentation)

This nanoparticle delivery system not only allows the particles to get into the pores on the ocular surface, but it also makes them neutral from an electrostatic standpoint, which again lets the drug particles get through at higher rates. Increased amounts of the drug then actually make it to the back of the eye, where it can have its effect.

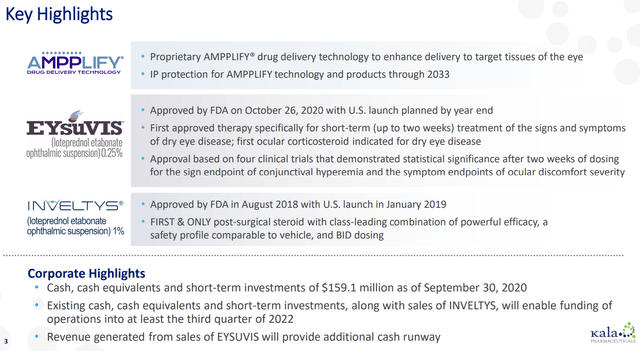

Figure 2: Kala Key Highlights

(Source: Kala’s October 2020 Investor Presentation)

Kala has applied this technology so far in two areas: Eysuvis and Inveltys. From what I’ve heard management discuss, the company originally looked at other areas like pulmonology and oncology, but the sole focus at present and for the foreseeable future is ophthalmology.

Eysuvis is a treatment for acute, short-term dry eye symptoms, and it received FDA approval in October 2020. Eysuvis is a corticosteroid eye drop where the patient typically takes one to two drops up to four times per day. Dry eye disease is caused by ocular surface inflammation, and steroids are well-known to effectively quell inflammation, both in the eye and throughout the body.

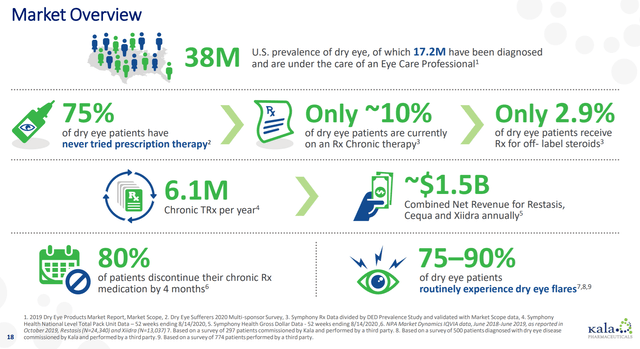

As far as competitors go, there are multiple dry eye therapies currently available, both over-the-counter and prescription. Restasis, Xiidra, and Cequa look to be the only other FDA-approved prescription drugs at the moment, but their target is really more focused on chronic dry eye. 75-90% of dry eye patients typically have acute flares and a more episodic type of disease though. Patients with episodic disease typically have five to six episodes per year that last one to two weeks on average.

None of these current drugs have a rapid onset of activity intended to treat these types of events. Xiidra has a two-week to six-week onset, and Restasis is a six-week to two-month onset. Also, Cequa advertises on its website that significant improvement was seen in its trials by the two-month mark.

Xiidra and Cequa are the most similar to Eysuvis and actually do function through reducing the underlying inflammation. Again though, the big differentiator is that their onset of action is far slower than Eysuvis'. Restasis just attempts to address tear production rather than the underlying inflammatory disease pathology. Restasis also didn’t even show a consistent improvement in symptoms in its trials - just an increase in tear production. Over-the-counter artificial tears, similarly, do not address the underlying inflammation.

Eysuvis both treats the underlying inflammation and shows a rapid onset of effect. In the two-week treatment seen in Eysuvis’ Phase 3 trials, improvement was seen within the first day and improved further over the course of that time frame. In addition, Eysuvis showed an actual decrease in symptoms - not just an increase in tear production like Restasis - in its trials, so the label reflects this, noting that Eysuvis is “indicated for the short-term (up to two weeks) treatment of the signs and symptoms of dry eye disease.” Thus, Eysuvis is uniquely positioned in the current market landscape.

There are a number of potential down-the-road competitors as well though. Ocular Therapeutix (OCUL) has two bioerodible implant therapies for dry eye in Phase 2, including one specifically for episodic dry eye. Glaukos has Intratus that is a topical lotion to be rubbed on the outside of the eyelid for the treatment of dry eye. Intratus, though, is still in preclinical testing. Additionally, an article published in the Review of Ophthalmology in February 2020 identified another 10 potential therapies for dry eye.

It’s certainly fair to say then that dry eye is a crowded space, and there will likely be competitors in the episodic space specifically in a few years. All that said, the dry eye market is large and growing. The market was estimated at $4.2 billion worldwide in 2019 and is growing at a roughly 7% compounded rate. This should help to create room for multiple therapies to achieve decent amounts of sales.

Figure 3: Dry Eye Market Opportunity

(Source: Kala’s October 2020 Investor Presentation)

Kala plans to launch Eysuvis in December, and peak sales estimates that I’ve seen for Eysuvis range from $500 million to $1 billion. Eysuvis’ timing is good in that it has made it to the market at a time where there are no other therapies addressing the episodic dry eye issues that it does. That will likely change in the next few years, but the first-mover advantage that Eysuvis will have should be significant. As you’ll see below, Kala’s current price only looks to encompass the very low-end of the range of estimates for Eysuvis peak sales, which is the only way I would feel comfortable potentially investing in a company with a product targeting such a competitive market.

Kala’s other product is Inveltys, which was approved in January 2019 to treat post-ocular-surgical pain and inflammation. This is actually the same corticosteroid as Eysuvis, and it’s dosed twice per day post-surgery versus the typical three-to-four times daily for competitor drops. This gives Inveltys a big edge over other drop-based therapies.

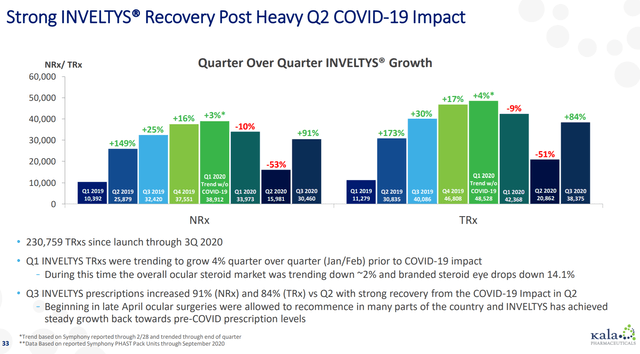

Inveltys had been showing strong growth before the COVID-19 pandemic, but along with any product that revolves around what is often an elective surgery, Inveltys has struggled mightily since.

Figure 4: Inveltys Prescription Data

(Source: Kala’s October 2020 Investor Presentation)

Q3 data showed a nice recovery with Inveltys logging $4.1 million in sales, but this was still below even where the product was in Q3 2019, not to mention Q4 before the pandemic began. As coronavirus case counts have skyrocketed this Fall, I worry that Inveltys may not be able to really regain traction until the middle of next year.

Inveltys also has to deal with a major competitor from Ocular Therapeutix, Dextenza. Dextenza is an implant that sits in the canaliculus in the side of the eye and slowly releases the corticosteroid, dexamethasone. Dextenza showed big growth in Q3, jumping to $5.4 million in net sales. Despite the competition though, the peak sales estimates I’ve seen for Inveltys have ranged from $270 million to $345 million. This should be meaningful supplemental income alongside what Kala gets from Eysuvis.

Kala also has preclinical candidates for retinal diseases and next-generation anti-inflammatories that I will not go into within this article. It is nice to see that the company does have products in the pipeline that could potentially contribute to long-term growth.

Kala has the Balance Sheet to Handle Ramping Up Product Sales

Kala reported having $159.1 million in cash and equivalents at the end of Q3. This compares to a net loss for the same period of $27.9 million, which annualizes to about $112 million. Kala says it has a runway to at least the third quarter of 2022, with more runway to be added on increased Eysuvis sales. I think this is potentially achievable given that R&D should start dropping off substantially with only preclinical therapies left in the pipeline.

That said, I would expect some type of cash raise in 2021 to shore up the cash position, especially considering that Kala also has $71 million in long-term debt. This debt is through the company’s credit facility with Athyrium, and Kala will have to pay back the principal in installments between late 2022 and 2024.

Noted biotech fund Orbimed has a 5.5 million share position at about a $9 per share average cost, well above where the company now trades. Also, the CEO, CSO, and CMO all own somewhere between 150k and 300k shares in the company, plenty to keep them incentivized to act in shareholders' best interest by promoting long-term compounded returns.

The big risk for a company like Kala is slow sales uptake, and while this is not a trivial risk at any time, product launches are especially difficult during the COVID-19 pandemic. If Kala sales substantially disappoint, the company could have to raise additional dilutive capital that could put a lid on future shareholder returns or even cause an outright loss of capital in a worst case. Also, a slow sales ramp-up could allow time for more competitors to enter the market, potentially meaning that Eysuvis and Inveltys might never live up to their potential. Investors in stocks like Kala need to carefully consider these types of issues before committing capital. That said, I view these value-trap scenarios as unlikely given what I discussed above about the strength of Kala’s products and the buy-in from management and Orbimed.

Kala’s Valuation Looks Largely De-Risked at Current Levels

Kala currently has a market cap of about $420 million, which is below even the low-end peak sales estimates of Eysuvis alone. It also trades nearly 50% below its highs from just this past summer. These facts suggest that Kala is likely meaningfully undervalued.

Figure 6: Kala Stock Chart

(Source: Finviz)

If you consider that a common industry average P/S ratio is around 4x-5x, then even at the low end of estimated Eysuvis peak sales alone, Kala should be worth around $2 billion, which would translate to a share price around $35, or over 4.5x the current price. To me, this leaves us a very wide margin of safety. The potential upside based on the same P/S ratios at the higher end of analyst sales estimates is over 9x where the stock trades currently. This is a good risk/reward if one is willing to potentially hold the stock for a few years.

Conclusion and Strategy

Kala Pharmaceuticals is a technology platform company like most of the companies I invest in, but the amount of competition Kala faces in both of its current markets keeps this from being a slam-dunk play on the technology alone. Company management seems to have done a good job positioning the balance sheet for its product launches, and a noted fund, Orbimed, seems to think Kala is a real value and not a value trap.

Finally, the point that stands out the most to me is the valuation. An investment in a company like Kala always carries substantial risk in any business climate simply due to how fickle product launches can be, and this has never been truer than with the ongoing pandemic. Thus, the margin of safety I see here is noteworthy in that potential downside looks limited, yet the upside could be big. I believe Kala’s current valuation is truly what legendary value investor Mohnish Pabrai describes as “Heads I win, tails I don’t lose much.”

This is a delayed release article from my Marketplace Service, Biotech Value Investing. Subscribers received this along with additional detail on valuation 30 days ago, but I believe the research is still applicable today. Biotech Value Investing provides in-depth coverage of my approach to finding high-quality, value-oriented companies in the biotech sector. This approach is intended to use the inherent volatility of the biotech sector to my advantage by sticking with high-quality companies for the long-haul and using options to help generate a high compounded return while ensuring optimal entry and exit points. Check us out today with a free trial.

Disclosure: I am/we are long KALA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I’m not a registered investment adviser. Please do not mistake this article, or anything else that I write or publish online, as any type of investment advice. This article and anything else that I post online are for entertainment purposes only and are solely designed to facilitate a discussion about investment strategy. I reserve the right to make any investment decision for myself without notification except where required by law. The thesis that I presented may change anytime due to the changing nature of information itself. Despite the fact that I strive to provide only accurate information, I neither guarantee the accuracy nor the timeliness of anything that I post. Past performance does NOT guarantee future results. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as a recommendation to buy or sell any form of security. Any buy or sell price that I may present is intended for educational and discussion purposes only. Please think of my articles as learning and thinking frameworks--they are not intended as investment advice. My articles should only be utilized as educational and informational materials to assist investors in your own due diligence process. You are expected to perform your own due diligence and take responsibility for your actions. You should consult with your own financial adviser for any financial or investment guidance, as again my writing is not investment advice and financial circumstances are individualized.