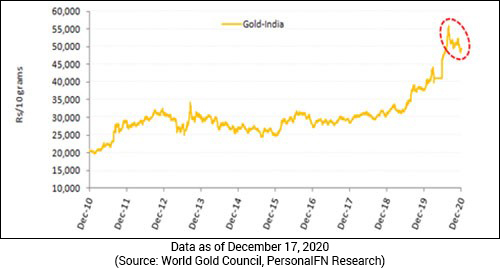

In March this year -- just before the outbreak of the Coronavirus or COVID-19 pandemic hit India in a big way - I wrote about how investors would benefit by investing in gold. And since then, the precious yellow metal has clocked nearly +18% absolute returns.

Gold has outperformed even equities on Year-to-Date (YTD) basis as of December 17, 2020, with handsome +27% absolute returns, while the bellwether S&P BSE Sensex (despite rallying relentlessly for nine months), has clocked just around +13% absolute returns.

That said, gold's Achilles heel has become more evident of late. Since the peak of August 2020, the price of gold has fallen 11% (as of December 17, 2020). This may have left you wondering if gold will lose its sheen further.

Well, investors have been surely booking profits after it scaled over Rs 50,000 per 10-gram levels. At elevated prices, there isn't enough demand supporting the precious yellow metal. Even Diwali -- the festival of lights -- failed to pent-up much of India's gold demand.

In November 2020, gold ETFs in India witnessed outflows worth Rs 141 crore for the first time in several months as investors were less enthused to buy gold.

--- Advertisement ---

Introducing...The Great Indian Wealth Project

After every economic crisis in the last few decades, India has emerged stronger and better.

For instance, after the 1991 economic crisis, India bounced back stronger than ever.

In the years of recovery and growth that followed, many companies generated 4-digit and 5-digit gains for investors, turning a Rs 1 lakh stake into crores of rupees.

And today, we stand on the threshold of a similar wealth generating opportunity.

As India recovers from the Covid-19 crisis... another... potentially much bigger... opportunity to create wealth is emerging.

And we are sharing full details with our readers at a special event on 30th December.

We will be revealing:

• Details on a powerful mega trend that is playing out in India right now

• Our #1 stock pick to ride this mega trend

• And how you could become a potential dollar millionaire in the long run

Since there are limited seats available, we would recommend registering for this FREE event at the earliest.

Click here for instant sign-up. It's free.

------------------------------

Globally, Gold Exchange Traded Funds (ETFs) reported net outflows to the tune of U.S. $6,766 million in November 2020 for the first time in twelve months (and the second-largest outflows ever), reveals the data released by the World Gold Council (WGC).

Speaking about the individual markets, the outflows from gold ETF were as high as 3% to 10% of the AUM in Europe; in the U.S. 3%; 1.5% in India; and 0.5% for the whole of Asia.

Central banks across the globe, after being net sellers in Q3 2020 (for the first time in the last nine years), bought in the ensuing month of October 2020, but the participation was muted - with mainly Uzbekistan (8t), Turkey (7t), UAE (6t), Qatar (2t), and India (2t) buying.

Why have investors shunned gold?

Well, the key factors responsible are:

It is also perceived that geopolitical tensions would reduce under U.S. President-elect Biden (as he is considered more predictable) and the world economy would do better. President-elect Joe Biden appointed former Federal Reserve (Fed) chief Janet Yellen as Treasury Secretary.

--- Advertisement ---

This set in a period of risk-on assets in many markets, including the emerging markets, which has imbued positive sentiments for equities supported by accommodative and liberal fiscal and monetary policies by the central banks. As a result, gold as an asset class considered a safe haven and store value during uncertainties, became less popular.

But these factors may work in favour of gold...

You see, although the vaccine looks in sight now, the economic impact that the coronavirus pandemic has made on the global economy is unlikely to fade away any time soon in the foreseeable future.

As you might be aware, even during the pre-COVID times, the global economy was grappling with the problem of higher debt and lower growth. To support economic recovery, globally, the central banks have been synchronically pumping in significant liquidity in the system. As a result, the indebtedness of some major countries of the world is expected to skyrocket. As per the Institute of International Finance (IIF), global debt may surge to a record high of US$ 277 trillion by the end of the year thereby representing a global debt-to-GDP ratio of 365%.

As the U.S. moves closer to announcing another stimulus package of U.S. $900 billion to curb the ill-effects of the pandemic, investors are becoming more optimistic about economic recovery. But the real question is how the stimulus package, which is largely aimed at providing support to the unemployed, will drive economic recovery. On the contrary, it is likely to be inflationary, weaken the greenback, and may add to sovereign debt.

Besides, geopolitical equations may continue to remain tense across the many parts of the world-in the U.S., U.K., China, India, North Korea, South Korea, and in particular the MENA (the Middle East and North African) region. Any escalation of bi-lateral or multi-lateral issues may be a huge negative for the prospects of the global economy.

A weaker dollar and strong emerging markets have been the popular trade for global institutional investors so far. However, piling debt, soaring equity valuations, and limited upside in high-quality bonds might make a compelling case for gold in the future. Since currency reserves have been fetching near-zero returns, global central banks may become more active in the gold market.

SHOCKING: The Secret Profit-Potential of Investing in "Safe Wealth Creators"

All these factors would not only limit the price of gold from falling much, but could also possibly help climb up or rally once again.

In my view, it makes good sense to buy gold strategically and be a smart investor. The long-term secular uptrend gold has exhibited is something that invites attention and highlights the importance of owning gold in the portfolio with a longer investment horizon.

The investment demand has been fairly strong in India. Between November 2019 and November 2020, the AUM of gold ETFs in India jumped from Rs 5,515 crore to Rs 13,240 crore. And as you may know, the response to Sovereign Gold Bond Scheme has been overwhelming too.

The relatively less severe pandemic situation in the rural areas and bumper harvests in kharif and rabi seasons may offer tailwinds for gold demand from these areas.

Hence, it would be unintelligent to follow the short-term negative trend and sell your gold at this juncture. It may continue to lose sheen for some more time, but as soon as investors come to terms with growth dislocations, they are likely to take refuge under the precious yellow metal.

You see, gold plays its role as an effective portfolio diversifier, a store of value during economic uncertainty, safe haven, and a shield against inflation in the long run. A point to note is: Unlike financial assets, gold is a real asset. This means, gold does not carry credit or counterparty risk and is usually supported by high inflation. This is why gold has demonstrated its appeal and fared well over the long-term.

Allocate around 10-15% of your entire investment portfolio to gold and holding it with a long-term investment horizon ...that will be a smart and sensible strategy. Invest in gold the smart way through gold Exchange Traded Funds (ETFs), gold savings funds, and/or Sovereign Gold Scheme.

I have said this before, but I will say even now: Go ahead and buy gold.

Happy Investing!

PS: If you wish to select worthy mutual fund schemes, I recommend that you subscribe to PersonalFN's unbiased premium research service, FundSelect.

Additionally, as a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

PersonalFN recommendations go through our stringent process that assesses both quantitative and qualitative parameters, providing you with Buy, Hold, and Sell recommendations on equity and debt mutual fund schemes.

If you are serious about investing in a rewarding mutual fund scheme, Subscribe now!

Author: Rounaq Neroy

This article first appeared on PersonalFN here.

PersonalFN is a Mumbai based personal finance firm offering Financial Planning and Mutual Fund Research services.

The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.

Tanushree has identified a massive wealth creation opportunity in the stock market. Read on...

The new NSE financial services index provides traders a good opportunity to make fast profits.

HDFC Mutual Fund has informed its investors about the conversion of its close-ended scheme - HDFC Housing Opportunities Fund - Series 1 into an open-ended scheme

After a stellar 2020, will stocks underperform fixed deposits in 2021?

Using seasonality analysis we can make fast profits in the stock market.

More Views on NewsMy outlook for gold and silver prices in 2021.

Dec 16, 2020The smallcap rally has enough steam left in it. If you haven't joined yet, it is still not too late.

Rahul Shah discusses how a crash indicator that predicted two of the biggest crashes previously is flashing a danger sign Line below the Image.

Dec 10, 2020The EV disruption is here to stay. Certain smallcaps will be big beneficiaries of this megatrend.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!