The market was caught in a bear trap following panic selling in global peers on fears of a new strain of coronavirus found in the United Kingdom. The benchmark indices registered the biggest single day loss since May 4 this year due to correction across the board.

The BSE Sensex tanked 1,406.73 points or 3 percent to close at 45,553.96, while the Nifty50 fell 432.10 points or 3.14 percent and closed at 13,328.40, erasing gains of last 11 days and formed Long Black Day candle on the daily charts.

"Since the market has formed higher bottom at 12,790 on November 26, the market has never given any decisive candlestick pattern on daily basis. Even though the trend was upward and gained 1,000 points in 15 days Nifty made multiple indecisive candles in between. The same indecisiveness finally resulted in Monday's vertical fall. It's a bearish reversal formation in the short term," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities told Moneycontrol.

According to him, Nifty could slide to either 13,000 levels, where it has support as per options data or 12,500, which was the highest of the previous upmove (all-time highest levels on Nifty till January 2020). On the higher side, 13,400/13,500 would be hurdle zone. Reduce weak long positions between 13,400/13,500 levels. Only strong markets can cross and close above 13,500 levels," he said.

The broader markets plunged around 5 percent amid weak breadth. More than six shares declined for every share that rose on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 13,047.43, followed by 12,766.47. If the index moves up, the key resistance levels to watch out for are 13,693.43 and 14,058.47.

Nifty Bank

The Nifty Bank plunged 1258.20 points or 4.10 percent to close at 29,456.50 on December 21. The important pivot level, which will act as crucial support for the index, is placed at 28,902.57, followed by 28,348.73. On the upside, key resistance levels are placed at 30,308.87 and 31,161.33.

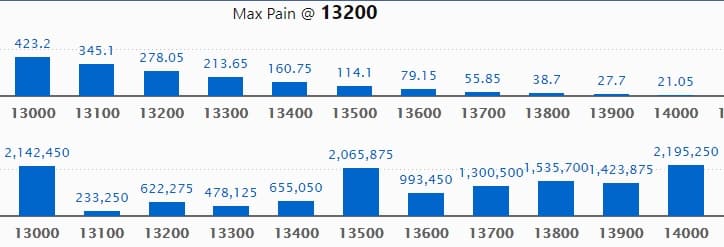

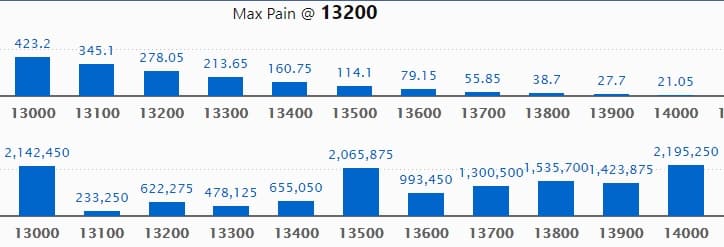

Call option data

Maximum Call open interest of 21.95 lakh contracts was seen at 14,000 strike, which will act as a crucial level in the December series.

This is followed by 13,000 strike, which holds 21.42 lakh contracts, and 13,500 strike, which has accumulated 20.65 lakh contracts.

Call writing was seen at 13,800 strike, which added 3.02 lakh contracts, followed by 13,600 strike which added 2.09 lakh contracts and 13,500 strike which added 1.75 lakh contracts.

Call unwinding was seen at 12,500 strike, which shed 25,050 contracts, followed by 13,000 strike which shed 24,150 contracts.

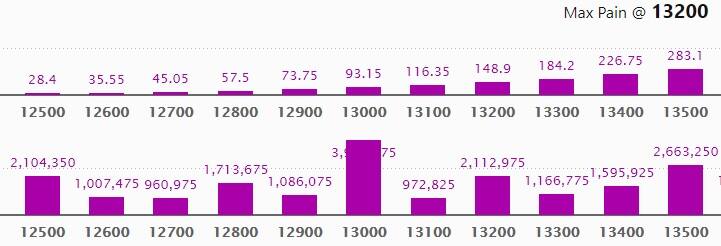

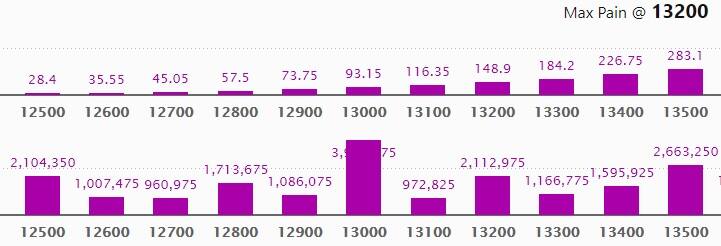

Put option data

Maximum Put open interest of 39.75 lakh contracts was seen at 13,000 strike, which will act as crucial level in the December series.

This is followed by 13,500 strike, which holds 26.63 lakh contracts, and 13,200 strike, which has accumulated 21.12 lakh contracts.

Put writing was seen at 12,500 strike, which added 84,750 contracts, followed by 12,800 strike, which added 55,350 contracts and 12,700 strike which added 12,000 contracts.

Put unwinding was seen at 13,200 strike, which shed 9.34 lakh contracts, followed by 13,500 strike, which shed 6.67 lakh contracts, and 13,300 strike which shed 5.38 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

No long build-up

Not a single stock has seen a long build-up on December 21.

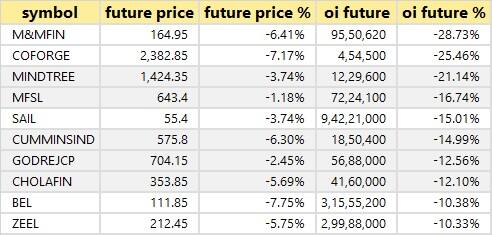

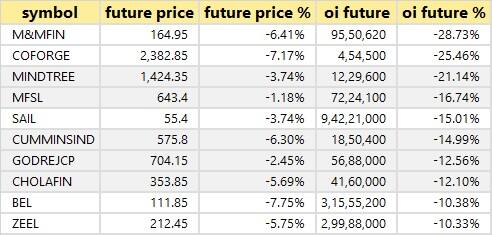

108 stocks saw long unwinding

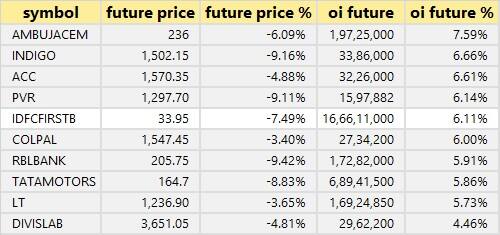

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

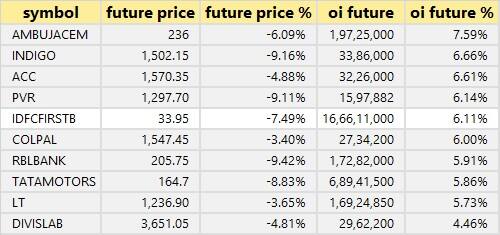

30 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

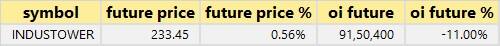

One stock witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here is the one stock in which short-covering was seen.

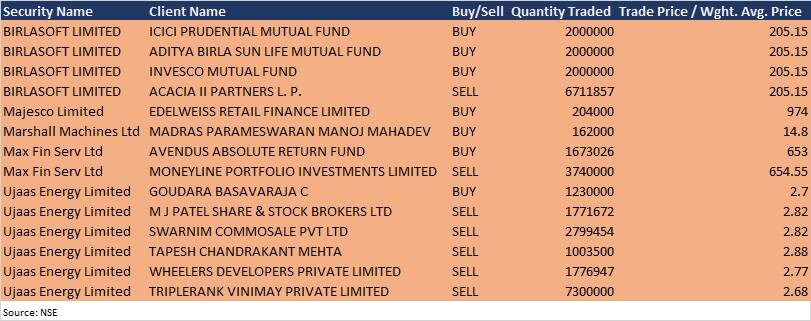

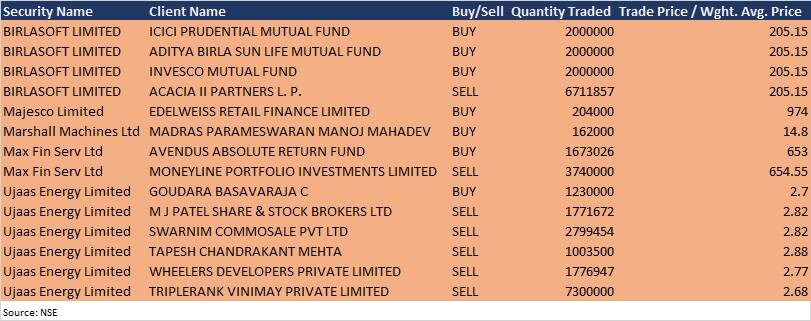

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Puravankara: Company's officials will interact with Spark Capital Advisors (India) on December 22.

Balaji Amines: Company's officials will interact with BOB Capital Markets on December 22.

Sudarshan Chemical Industries: Company's officials will interact with Franklin Templeton on December 22, Enam AMC on December 23 and Dolat Capital on December 23.

JTL Infra: Company to consider the fund raising by way of issue of securities on preferential basis to certain strategic investors, on December 26.

WeP Solutions: Company is scheduled to consider and approve the scheme of amalgamation of subsidiary WeP Digital Services with WeP Solutions on December 28.

Nestle India: Company will consider its December quarter earnings on February 16, 2021.

Stocks in the news

Tata Motors: Company to increase prices of commercial vehicles starting January, due to rise in input cost, forex impact.

Wendt: Promoters will sell up to 4.74% stake in company via OFS during December 22-23, floor price set at Rs 2,200 per share.

Lupin: Company received US FDA nod for generic of Banzel oral suspension.

Thermax: First Energy becomes wholly owned subsidiary of Thermax.

Asian Paints: Promoter entity Smiti Holding and Trading Company released pledge on 9 lakh shares.

GTPL Hathway: Company increased shareholding in subsidiary GTPL Abhilash Communication.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 323.55 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 486.12 crore in the Indian equity market on December 21, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks - Canara Bank, Punjab National Bank, SAIL and Sun TV Network - are under the F&O ban for December 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

_2020091018165303jzv.jpg)