The Beauty Of Helen Of Troy

Management has done a yeoman's job, increasing revenues and earnings during the pandemic when the beauty and personal care business is slumping.

They are aware of the dangers ahead and will not make forecasts, but the emergence of vaccines and private equity might make Helen more desirable to others.

The share price seems to overvalue the company and is not a good buy for retail investors. But hold 'em if you own 'em and know when to fold 'em.

Hold ‘Em And Fold ‘Em

I was drawn to the remarkable Helen of Troy Ltd. (NASDAQ: HELE) years ago. I bought and sold shares between $15 and $20 where the price languished for decades. I presented Helen as a case study to my business class of undergraduates and wrote an article for The Jerusalem Post Business and Finance Section. Eventually, the stock hit ~$55 per share and I bought 100 shares. I do not recommend retail value investors buy shares today because by every putative measure they are overvalued at ~$221. If you own shares, this is a good time to hold some and sell the rest.

The mythological Helen’s beauty increased her value to the kingdom attracting a plethora of suitors. Perhaps the current share price reflects potential competition among suitors for Helen’s hand in marriage through abduction or elopement? HELE is the apotheosis of the American family story of immigrants who founded and built a small business. They dutifully educated their children who transformed the business into a wildly successful contender by brand-building and fearlessly selling into markets dominated by behemoths: housewares, health and home products, beauty, personal care, and wellness products. HELE has a market cap of $5.6B.

Her Beauty Keeps On Giving

Helen of Troy is a relatively small but successful player among major leaguers. The top eight in the beauty products industry have an average market cap topping $14B. Meantime, HELE management keeps surprising Wall Street. The company for Q2 beat non-GAAP EPS estimates by $1.15 and beat GAAP EPS estimates of $3.43 by $1.44. It beat revenue estimates of nearly $531M by about $91M at a time the pandemic drove sales down in beauty and personal care in double-digits.

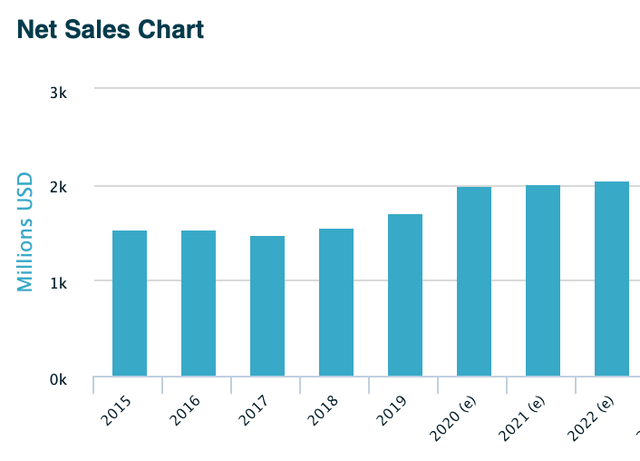

Source: Infrontanalytics.com

Source: Infrontanalytics.com

Suffice to say, Helen reported in October Q2 net sales growth of 28.2% and sales growth in its organic business of almost 26%. During the first six months of the fiscal year, net cash from operations was $186.3M. Operating margins (GAAP) increased for all product segments: housewares from 21.3% (FY’20) to 22.5% (FY’21); health and home from 7.8% to 16%; and beauty products from 7.3% to +17% in FY’21. The company holds almost $150M in cash and short-term assets. The debt to equity ratio is ~24%; debt and interest payments are well-covered by operating cash flow.

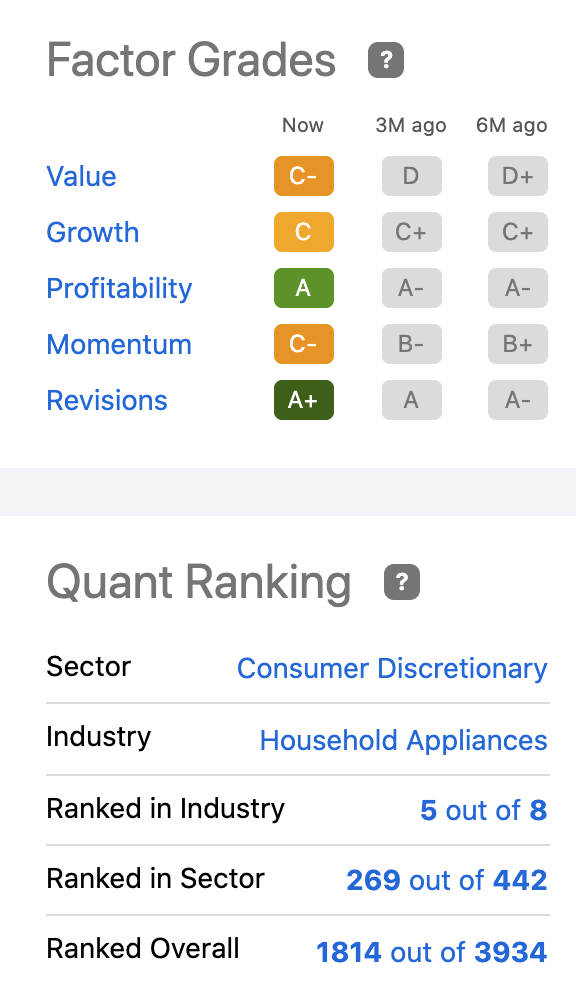

Helen made early investments in developing its online presence. That has paid off during the pandemic, as consumers moved from brick-and-mortar shopping to online. Online sales increased in Q2 reportedly by about 32%. It is a trend likely to continue well into the future. Wall Street remains bullish on HELE per the Seeking Alpha Ratings Summary but the mix of SA authors writing about HELE, including me, are, as a group, more neutral or ambivalent about potential growth in the share price. SA gives Momentum a C- Factor Grade. Short Interest is holding above the ten percent threshold at 11.25%. It’s unlikely there will be any sustained significant drop in the share price, though there was a dip into the $190 range last October. The current stock price is unattractive as a buy for retail investors on ratios of price-to-book, price-to-earnings (+20), and price-to-sales.

Source: Seeking Alpha

Beauty And Personal Care Are In The Essential Industry Category

Beauty and personal care products are not normally considered in the essential industries to prioritize investments during a pandemic that I refer to in other articles (marijuana, food and beverage, military and cyber defense, biotech, and pharma). Beauty and personal care products are essential to more than half the population. But with unemployment continuing to surge and the pandemic forcing women to leave their jobs in greater numbers than expected, spending on beauty and personal care products appears to be dropping in 2020 from a 2019 banner year: average revenue per capita is expected in 2020 to drop by 6.5%. Total revenue for the U.S. industry is expected to come in nearly -6% Y/Y.

This dissonance is making it difficult to make forecasts. HELE management is making the following moves to stave off pandemic effects on its industry:

- To preserve cash by stepping back salaries to pre-COVID-19 levels

- Selectively making investments in new activities, products, and capital expenditures

- Expanding marketing but not in order to “drive incremental short-term demand”

The Takeaway

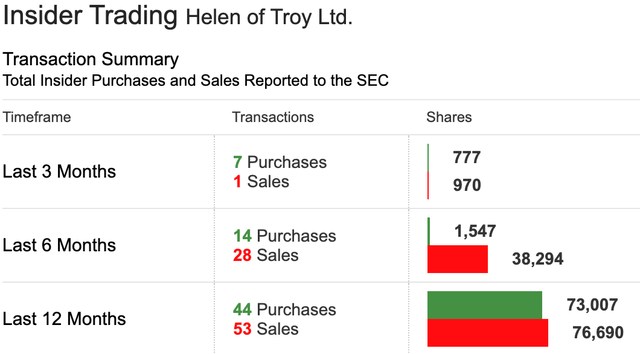

Other factors are heightening my ambivalence about the HELE share price. For example, individual insiders and companies have been selling shares at above the $200 price. Six of the top eight institutions and money management companies also reduced their holdings.

Source: Wall Street Journal

Helen of Troy is a well-managed stable company manufacturing and marketing brand names in the beauty, health, wellness, and home products business that lets me classify it, inter alia, as in an essential industry. The pandemic might slow down sales but the company has the wherewithal to preserve cash and protect earnings. The primary concerns are the high share price that makes the stock appear overvalued and sales of shares by insiders and companies.

Investors owning shares might want to hold some and sell others to pocket some profits but hedge on greater revenues as vaccines coming on market breathe life into industry sales that in turn will expand Helen’s sales.

There was a lot of M&A momentum in 2019 (+20% Y/Y) in the beauty and personal care sector but it collapsed in the first half of 2020. With the future appearing brighter in the fight against C-19, the industry is expecting post-pandemic deals to pick up. The size and profitability of HELE make it a target for industry leaders that might find Helen alluring and desirable with the re-emergence of private equity activity. Meanwhile, pocket some profits like The Gambler said, “If you’re gonna play the game…You’ve got to know when to hold ‘em, Know when to fold ‘em…”

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.