WESCO Is Firing On All Cylinders

We continue our coverage of WESCO International by going through its third-quarter results and highlighting key milestones achieved during the quarter.

This was WESCO’s first full quarter of results after completing the acquisition of Anixter.

The company increased its expected cost synergies to $250 million from its previous $200 million.

At 12x forward earnings, WESCO still looks slightly undervalued if compared to its median P/E multiple of 15x.

We continue our coverage of WESCO International (WCC) by going through its third-quarter results and highlighting key milestones achieved during the quarter.

The company is firing on all cylinders considering the drag of COVID on the business. “WESCO's new era is off to an absolutely exceptional start,” said John Engel, President, and CEO at the start of the conference call. This was WESCO’s first full quarter of results after completing the acquisition of Anixter in June, and it didn’t disappoint. Management is keeping its promise in reducing its debt load, which we believe was one of the major concerns the market had following the $4.5-billion acquisition.

The market is now bidding up the company, sending WESCO shares up over 100% in the last 6 months and up 29% year to date. The latest push might also be attributed to a broad industrial sector rally, as seen by the Industrial Select Sector SPDR ETF (XLI), which is up 28% in the last six months. The confluence of better-than-expected results plus overall optimism for a broad-based market rebound following the news of the COVID vaccine had WESCO breaking its 5-year resistance level.

From a valuation perspective, the company is trading at a forward earnings multiple of 12x following upward revisions in the consensus EPS number. Analysts are now predicting mid-to-high double-digit growth rates in EPS. At 12x forward earnings, WESCO still looks slightly undervalued if compared to its median P/E multiple of 15x. Achieving cost synergy targets and paying down debt to more comfortable levels could re-rate WESCO at its historical earnings multiple. We believe there is upside potential and remain bullish on the company.

Third-quarter organic sales were down, but margins improved from cost reduction efforts

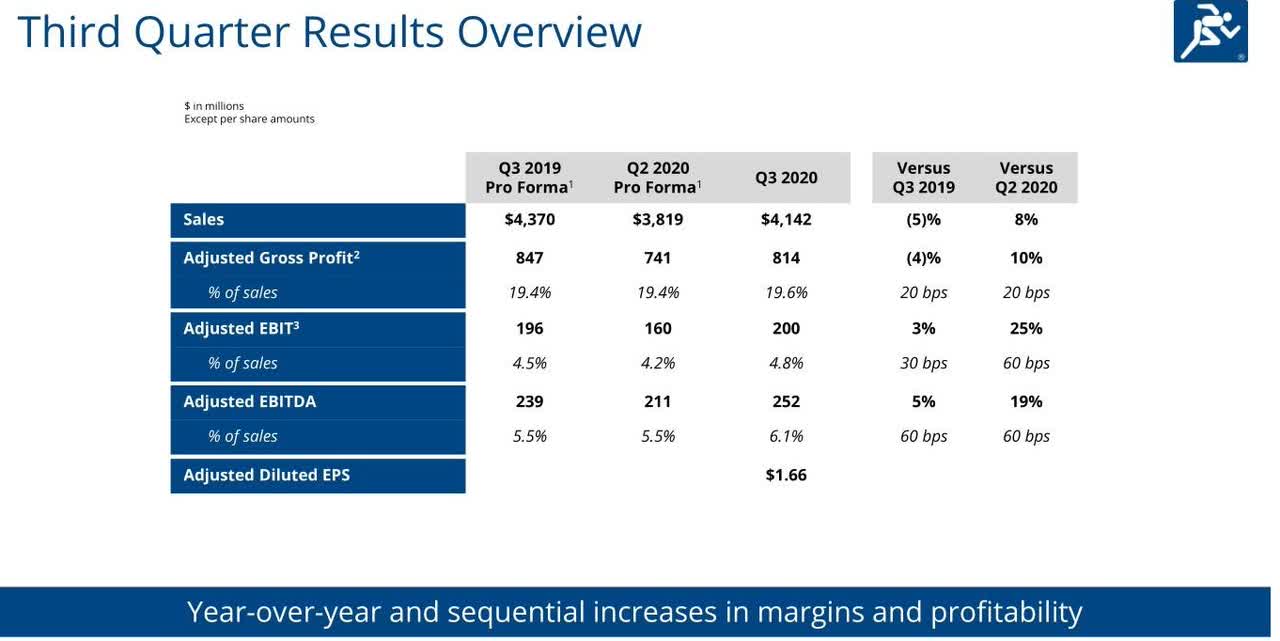

Source: Investor Presentation

WESCO reported third-quarter sales of $4.1 billion, down approximately 5% on a year-over-year basis using pro forma figures, and up approximately 8% sequentially from Q2. “Starting with sales, demand continued to improve, and we believe we've taken share,” said WESCO’s CFO Dave Schulz in its prepared remarks during the last conference call. The company ended the quarter with an all-time record third-quarter backlog as business momentum continues to improve.

While sales were down for the quarter, adjusted gross margins (which excluded merger-related fair value adjustments of $28 million) was 19.6%, up 20 basis points versus the prior-year period as the company continues to deploy Anixter’s gross margin improvement programs across the business. Legacy WESCO delivered approximately $28 million in COVID-related cost savings in the third quarter out of the expected $50 million in total savings.

Adjusted EBITDA was $252 million for the quarter, up 5% from last year and 19% higher on a sequential basis, with margins improving 60 basis points to end the quarter at 6.1%. EBITDA margins improved across all WESCO’s business units even as sales faced headwinds. For example, sales in WESCO’s ESS segment were down 10% during the quarter but EBITDA margins were up 70 basis points. The company’s CSS segment saw EBITDA margin improvement of 80 basis points with sales down 2%, and its UBS segment saw margins expand by 100 basis points while sales were down 2% versus last year.

Cost synergies in play

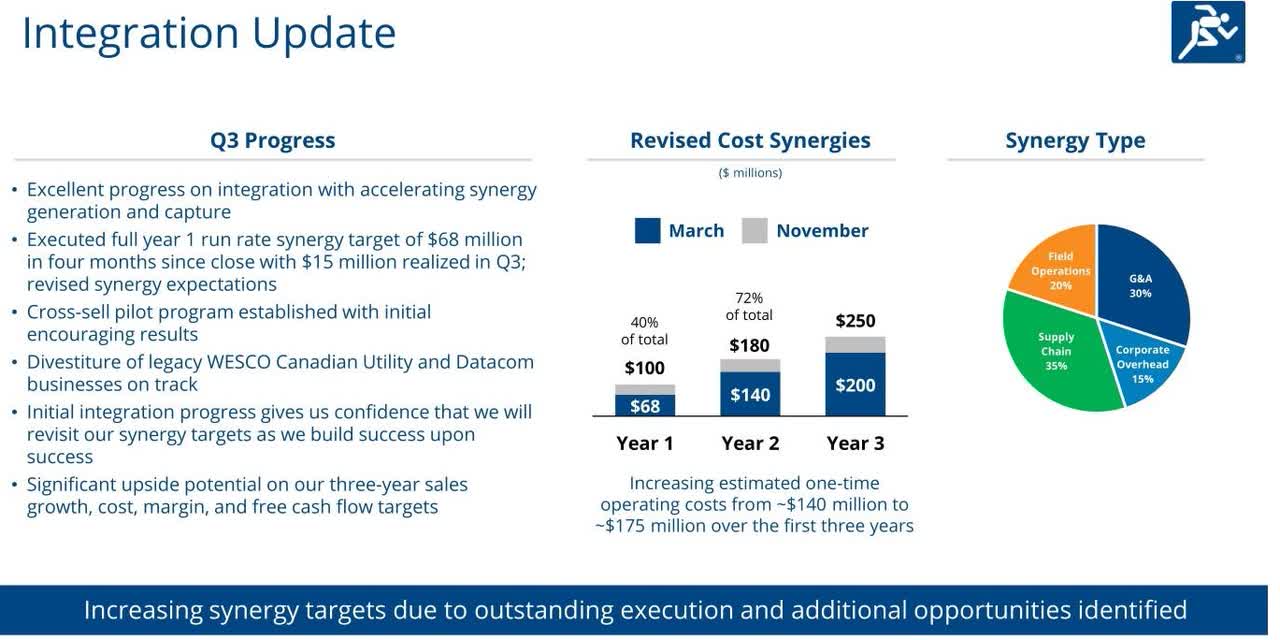

Source: Investor Presentation

WESCO’s third quarter marked the first full quarter since the acquisition of Anixter. When the acquisition was made, management set a target for cost synergies of $200 million within a three-year timeframe. Now, with one full quarter under its belt, management is getting a better understanding of the day-to-day operations of the combined entity. That has allowed them to increase the expected cost synergies to $250 million. As explained by management during its conference call, the decision to disclose a higher cost synergy target was due to two factors:

First, we set internal goals that are higher than we announced publicly, and our teams are delivering. Second, there were specific areas where detailed information and analytics could not be completed until after we close the transaction. We are finding upside to our initial estimates in all 4 buckets of synergies and are particularly excited about the incremental synergy opportunities in the areas of supply chain and SG&A, giving us confidence to take up our target. – Q3 call

During Q3, the company realized $15 million of cost synergies for a total of $68 million in the first 4 months since the integration of Anixter. WESCO now expects to realize $100 million in cost synergies for its year-1 target.

Strong cash flows

In our first coverage of WESCO, we highlighted the counter-cyclical nature of WESCO’s cash from operations and highlighted the fact that the company has generated positive cash flows throughout economic cycles from proper management of its working capital, which consists primarily of inventory levels. This time is no different.

The company generated a free cash flow of $307 million during the quarter or an FCF conversion of approximately 315% to adjusted net income. Again, this highlights the countercyclical cash flow generation of the company, which helps them to reduce debt levels throughout all phases of the economic cycle. Case in point, the company reduced net debt by $280 million during the quarter bringing its leverage ratio to 4.8x on an adjusted EBITDA basis. We find comfort in knowing that debt repayment is the number #1 capital allocation priority:

Our priority is to rapidly delever the balance sheet and be within our long-term target leverage range of 2 to 3.5x net debt-to-EBITDA by the end of year 3 in June 2023. – Q3 call

What’s next

Source: Investor Presentation

Although the electric distribution market remains highly fragmented, we believe the new WESCO has such scale, it would not have trouble getting new business. We talked about cost synergies, but another key aspect of the merger was the highly compatible product portfolio of both entities, which is starting to create sales synergies, as the company leverages its expanding global footprint and cross-sells its broader product portfolio and services. WESCO could become the one-stop-shop for many of its customers, and management’s comments about them taking market share during the quarter could be proving that hypothesis true.

The build-out of 5G and the need for more data centers as e-commerce and the cloud continues to penetrate the market, remain growth markets for WESCO.

The Bottom Line

The key risk remains the full integration of Anixter. With the upgraded cost synergy target, management has put more pressure on themselves and the market’s positive reaction has increased expectations. A small misstep or getting behind schedule could deflate expectations and with it, investor’s willingness to pay more for WESCO’s earnings.

While the margin of safety is not as big as when we first covered the company, we believe WESCO still offers moderate upside opportunity. The company is trading at 12x forward earnings compared to its median P/E multiple of 15x. If the company continues executing on its cost synergies and reduces its debt load, the market might reward WESCO with a higher earnings multiple. We remain bullish.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.