United Natural Foods: Strong Free Cash Flow Generation And Divestitures To Substantially Reduce Net Debt

The acquisition of Supervalu provided management with more possibilities to optimize the economics and fundamentals of the business.

Management expects to announce an extension of the partnership with Whole Foods Market early 2021.

Net debt to be significantly reduced over the next few years.

The stock carries a very low forward P/FCF ratio of just 2.7, providing ample upside potential.

In today's stock market, you will be hard pressed to find a stock that has been beaten down to an unusually low forward P/FCF ratio of 2.7x. United Natural Foods (UNFI), America's premier grocery distributor, is such an exception. What's more, if investors would take the effort to listen to the company's latest earnings call, they'd discover management wants to announce some very positive news early next year.

With a market capitalization of $895 million, future free cash flows of $330 million a year as estimated by analysts, management's expectation of net debt falling to $2.4 billion by the end of FY 07/2021 and a short interest of 23 percent, the S&P SmallCap 600 member may be an excellent value play.

In this article I'll try to highlight some of the most important issues currently surrounding the stock, and why UNFI deserves to be on the watchlist of investors.

I think the stock is very undervalued and so I recently started buying shares, at an average stock price of $17.68. I may add to my position if the price falls further.

How common is a forward P/FCF multiple of 2.7 in today's stock market?

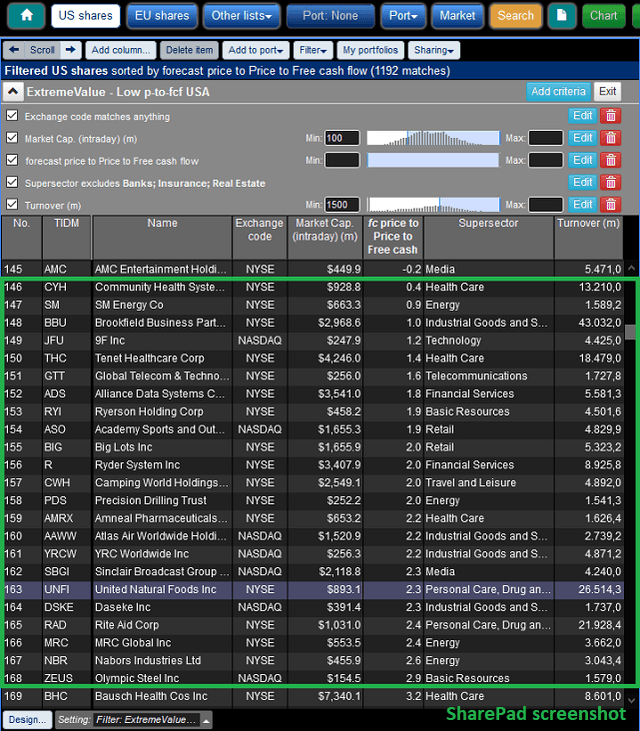

According to SharePad, an investment data platform I use, there are currently approximately 1,192 publicly traded companies with a listing on a US stock exchange (foreign companies included), that generate revenues of at least $1.5 billion and have a market capitalization of at least $100 million. Banks, insurers and real estate companies are excluded from this custom screen. FCF estimates are not available for 145 stocks on that list. Interestingly, out of the 1,047 stocks, only 23 carry a forward P/FCF multiple of between 0 and 3. United Natural Foods is one of them. FCF estimates in SharePad are provided by S&P Capital IQ and are not as reliable as those provided by Refinitiv, but the screen is certainly useful for finding value and separating the wheat from the chaff. The multiple of 2.7 mentioned in the header above is based on consensus estimates taken from Refinitiv Eikon.

My point is, unless UNFI needs a huge capital increase or goes bankrupt, it's hard to imagine the stock will continue to hover at unusually low valuation levels.

Acquiring Supervalu made the company stronger

Acquiring Supervalu made the company stronger

While many shareholders have been criticizing management for paying $2.9 billion to take control of competitor Supervalu back in 2018, I tend to take a more positive view. Strategically, the acquisition was a very smart move. The deal was simply necessary to lessen UNFI's reliance on customer Whole Foods Market. Before the acquisition, Whole Foods Market accounted for 37 percent of UNFI's revenues. Now the customer's share of sales is down to 18 percent. That's definitely a positive. In addition to that, management foresaw that the assortment UNFI offered was not diverse enough in order to remain competitive. By acquiring Supervalu, UNFI would be able to offer many more products to both existing and newly acquired customers. From now on, the company could start to benefit from cross-selling, creating synergies and optimizing its distribution centers and thus drive down costs. In fact, during the last quarterly earnings call we learned that UNFI exceeded its four-year target of $185 million in synergies in just two years. On top of that, free cash flow reached a record of $284 million in FY 07/2020. It just seems that management has more possibilities to optimize the economics and fundamentals of the business, thanks to the acquisition of Supervalu.

Of course, the acquisition has put a large amount of debt on the balance sheet, but management seems to be very focused now, doing the right things in order to deleverage while strengthening the competitive advantages.

Agreement with Whole Foods Market in the pipeline

The current partnership with Whole Foods Market expires in 2025. That's five years from now. Five years of contributions to the free cash flows, that's certainly helpful when you want to deleverage. Much speculation has been going on as to a potential extension to the partnership. Finally, during the last earnings call management sounded optimistic about this. In the call, CEO Steven Spinner said they expect they will be able to announce a formal extension of their partnership early 2021. Spinner also said Whole Foods Market has every expectation that this is going to get done in the first part of 2021. If this comes true, the news could be well received by investors, sending the stock price to higher levels.

Expanding the profit margins

Also during the last earnings call, management announced a next round of transformational productivity and efficiency work streams that should "position UNFI for future sales growth". Management believes "these initiatives will also contribute to future bottom line growth, margin expansion and generate meaningfully incremental free cash flow" by the end of FY 07/2023. These are the kind of words shareholders like to hear of course, and I actually do believe UNFI does have opportunities to improve its financial metrics. For instance, the company is in the process of consolidating, automating and optimizing its distribution centers. So there really exist opportunities to optimize efficiencies and reduce costs.

How will future free cash flows look like?

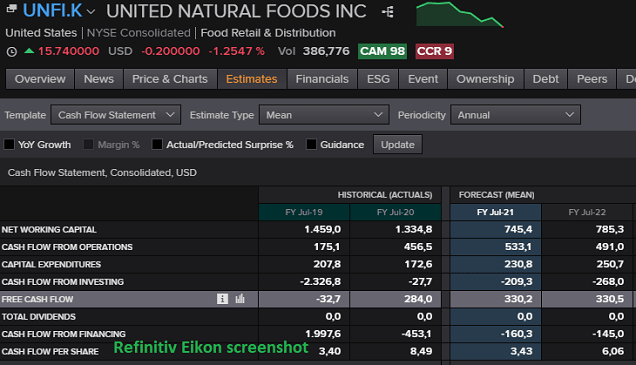

A successful recovery of the stock will depend on how much free cash the company will be able to throw off in the future. According to Refinitiv, analysts expect UNFI to generate $330 million and $331 million of free cash flow in FY 07/2021 and FY 07/2022 respectively. These estimates do not take into account a potential loss of cash flow related to the absence of the company's own store network in case of a divestiture of its Cub Foods and Shoppers chains. The company is trying to spin off these operations, a process that seems difficult given the coronavirus pandemic.

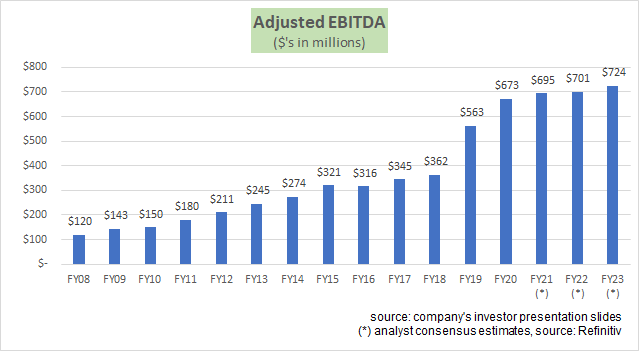

So, how do we know how much free cash flow will be left over after the own stores have been sold? The answer is, we don't know. The only bit of information we have is that the retail operations generated $86 million in adjusted EBITDA out of a total of $673 million for the whole company in the latest fiscal year. That means 12.8 percent of the company's total adjusted EBITDA comes from the own store chains. So my guess is that the retail operations achieve a free cash flow of ~$55 million on a standalone, debt-free basis. To be honest, this number is a very rough estimate, based on a simple calculation: 12.8 percent of $466 million is $60 million, with $466 million being the sum of $284 million of free cash flow plus $182 million of interest payments (FY 07/2020).

So, how do we know how much free cash flow will be left over after the own stores have been sold? The answer is, we don't know. The only bit of information we have is that the retail operations generated $86 million in adjusted EBITDA out of a total of $673 million for the whole company in the latest fiscal year. That means 12.8 percent of the company's total adjusted EBITDA comes from the own store chains. So my guess is that the retail operations achieve a free cash flow of ~$55 million on a standalone, debt-free basis. To be honest, this number is a very rough estimate, based on a simple calculation: 12.8 percent of $466 million is $60 million, with $466 million being the sum of $284 million of free cash flow plus $182 million of interest payments (FY 07/2020).

Going forward, UNFI as a pure-play distributor should be able to throw off free cash of $300 million on a yearly basis. Taking into account management's self-declared ongoing focus on reducing costs, expanding margins and increasing free cash flows, as well as lower interest payments resulting from debt reductions, the number of $300 million could eventually evolve into $350 million over the long term if everything goes well. For the current fiscal year 07/2021 the company expects adjusted EBITDA to be in the $690-$730 million range.

Net debt going down rapidly

In a press release from October 2020 regarding the closing of a $500 mio notes offering, UNFI's CFO John Howard reiterated that the company is working towards a long-term net debt/EBITDA ratio of 2.0x to 2.5x, which may correspond to a net debt level of $1.30 to $1.63 billion, based on my own $650 mio EBITDA estimate (taking into account the factors I mentioned in the previous paragraph).

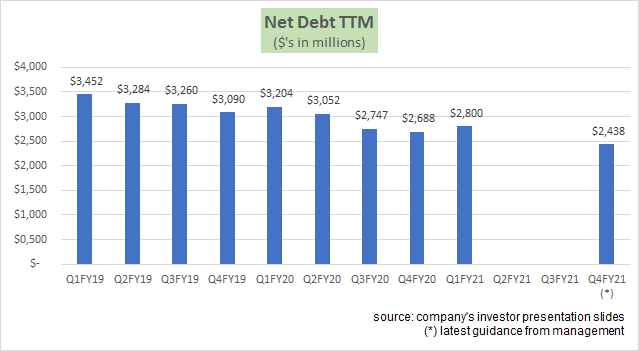

According to its latest quarterly earnings release, UNFI expects to reduce net debt to $2.44 billion by the end of FY 07/2021, excluding any proceeds from potential divestitures. During the last earnings call, management said they expect to achieve net debt to adjusted EBITDA leverage of approximately 3.5 times by July 2021. In comparison, the leverage ratio was 5.5x at the end of October 2019.

During FY 07/2022 the company will probably divest its retail division and monetize owned real estate related to this division. At least, that's the expectation of the CEO. In my opinion these transactions could result in total proceeds of $500 to $600 million ($300 to $400 million from the spin-off of the Cub Foods and Shoppers operations, and a further $200 million from related real estate sales). This means that net debt, with the help of further free cash flow generation (let's say $200 million), could fall to $1.69 billion by the end of calendar year 2022. Personally, I think that's still a high level, so I hope the company will use another two years of free cash flow generation to bring down net debt to a sufficiently low level. As a reminder, at the end of October 2019 net debt stood at a peak of $3.5 billion.

What could happen after the company has managed to achieve a net debt/EBITDA ratio of 2.0 to 2.5? Firstly, the board could distribute dividends or launch a share buyback program. I'm not so fond of the former, because I think the latter would create much more shareholder value. Secondly, they could go on the hunt for bolt-on acquisitions. That would be fine with me as long as they are free cash flow positive. Thirdly, the board might hire an investment bank and put the company up for sale. Fourthly, a competitor or private equity investor may try to take over the company. Fifthly, the company could use excess cash to further reduce net debt. So far, investors don't have a clue as to what will eventually happen. However, the company clearly has some options for increasing shareholder value over the long term if they succeed in finding a healthy balance between net debt and free cash flows.

What could happen after the company has managed to achieve a net debt/EBITDA ratio of 2.0 to 2.5? Firstly, the board could distribute dividends or launch a share buyback program. I'm not so fond of the former, because I think the latter would create much more shareholder value. Secondly, they could go on the hunt for bolt-on acquisitions. That would be fine with me as long as they are free cash flow positive. Thirdly, the board might hire an investment bank and put the company up for sale. Fourthly, a competitor or private equity investor may try to take over the company. Fifthly, the company could use excess cash to further reduce net debt. So far, investors don't have a clue as to what will eventually happen. However, the company clearly has some options for increasing shareholder value over the long term if they succeed in finding a healthy balance between net debt and free cash flows.

Don't overlook the high short interest

Despite all the positive elements discussed above, I have to mention that there are some risks you have to be aware of when you consider buying shares of this stock. The short interest amounts to 23 percent according to Seeking Alpha, so obviously some speculators have their reasons to be pessimistic. So what are some of the main risks? First of all, the divestiture of the retail operations may realize lower proceeds than anticipated. This means deleveraging would take more time. Secondly, there's still a chance United Natural Foods and Whole Foods Market fail to reach an agreement regarding the extension of their partnership. Thirdly, as I mentioned earlier, a disposal of the retail operations would probably have a negative impact on free cash flows. Fourthly, UNFI's customers operate in a very competitive landscape and some of them may quit the scene somewhere in the future. And lastly, because of the razor-thin margins of the company, free cash flows may fluctuate wildly or decline to insufficient levels.

Despite the fact that UNFI's market capitalization is very low, potential shareholders should be aware of these risks as they can significantly affect future free cash flows and net debt levels, possibly leading to a situation where the company is unable to satisfy its creditors. Personally, I don't think this scenario has any chance to become reality though.

Conclusion

There are good reasons to assume United Natural Foods is on the right path to become a stronger business and create massive shareholder value in the next few years because of a substantially higher intrinsic value. I believe the possible rewards outweigh the risks, but I do not recommend allocating a very large part of your portfolio to UNFI. However, the current stock price of ~$15.94 is a very attractive entry point, and I would advise to add to your position only when good news comes along and the stock price is lower than your average purchase price.

Disclosure: I am/we are long UNFI. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.