ETF Insights: ARKQ's Fabulous 2020 Will Be Hard To Repeat

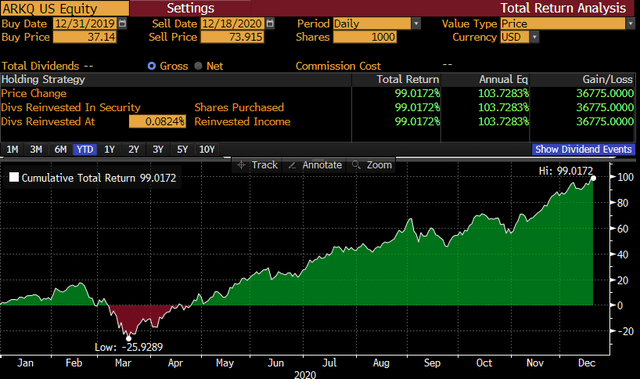

ARKQ has gained almost 100% through 2020.

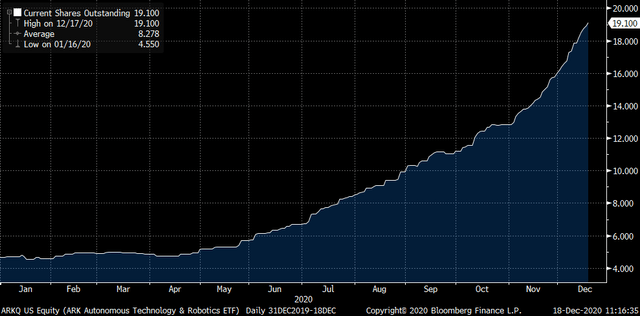

ARKQ's strong performance has attracted strong inflows.

Tesla's astounding year has been the primary driver of gains in 2020.

Tesla's contribution to ARKQ vs its weight does not match up.

ARKQ's future performance will be tied to identifying and overweighting next generation tech leaders.

The ARK Autonomous Technology and Robotics ETF (ARKQ) has been one of the standout performers in the ETF space. At the time of writing, the ETF had appreciated by 98% through a turbulent 2020. ARKQ is an actively managed ETF offered by ARK Funds. The ETF seeks to generate long-term capital growth by investing in companies focused on autonomous technology and robotic application. ARKQ has the ability to invest globally in its quest to uncover disruptive companies which fit the autonomous technology and robotics theme.

Source: Bloomberg

ARKQ's performance has not gone unnoticed as investors have flooded into this vehicle. The number of units outstanding in ARKQ have increased by an astounding 410% in 2020 alone.

Source: Bloomberg

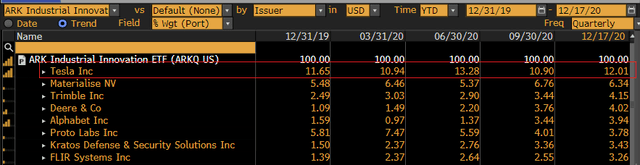

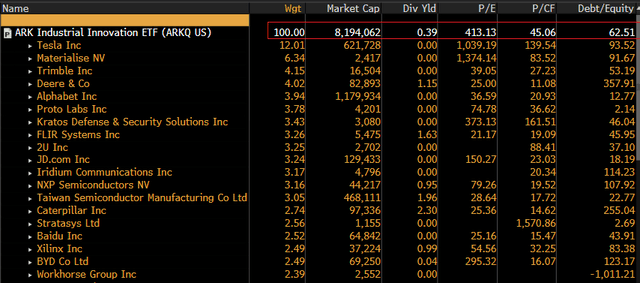

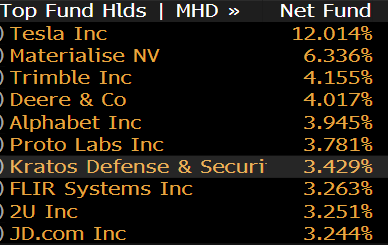

A look under the hood is required in order to understand the constituents driving the performance. Recall that the ARKQ is an actively managed ETF and as a result, there is no passive benchmark that ARKQ is beholden to. The current composition of ARKQ is heavily weighted towards Tesla (TSLA), followed by Materialise NV (MTLS), Trimble (TRMB) and Deere (DE). Tesla represents 12% of the ETF while the top 10 holdings represent ~47% of the ETF.

Source: Bloomberg

We all know that Tesla has had a remarkable year in 2020. The stock has appreciated almost 684% through 2020 as of December 17 2020. Using simple math, a 12% allocation towards Tesla and a 88% allocation towards cash would lead to an overall portfolio appreciation of 70%. Recall that ARKQ has appreciated by 98% through Dec 17. As for the remaining 88% of the portfolio, it has generated approximately 28% of 2020 returns.

ARK Funds has regular disclosures for the components within their ETFs including the ARKQ ETF. A link to these disclosures can be found here. I used the daily reported weights of the ARKQ constituents in order to come up with the average portfolio weight of each holding. This allows us to see the quantum of contribution of detraction from individual components. When we break down the performance of ARKQ's into it's constituent's, we indeed do see Tesla contributing a bulk of the ETF's performance. The surprising revelation is that Tesla has only contributed under 40% of overall performance despite an average weight of 11.5% through 2020. A pure buy and hold of Tesla with a 11.5% weight from the beginning of the year would have led to Tesla contributing closer to 78.7% vs the 39.2%.

Source: Bloomberg, ARK Funds

During the individual quarters of 2020, Tesla's weight has not deviated too much from its current 12%. Other components such as Trimble, Deere and Alphabet have seen meaningful changes to their weight, but not Tesla. This makes me wonder if the "active" portion of the ETF management has perhaps created the deviation between expected (~79%) and actual (39%) contribution seen from Tesla. Materialise (MTLS) on the other hand has appreciated ~155% YTD. It's average weight has been 6% in the portfolio and its contribution to the performance is at 8.6% (6% * 1.55), within 0.7% of where it should be.

The most likely explanation for this deviation the portfolio managers deciding to aggressively trim Tesla every time the shares exceeded a self-imposed threshold. This would explain the near constant weight of Tesla through the year despite its outlandish price performance. If my reasoning is incorrect, I would welcome ARK funds to help explain this deviation to me and the SA readers.

Source: Bloomberg, ARK Funds

ARKQ's 2020 will be difficult to repeat in 2021. As I demonstrated above, a vast majority of the ETF's performance came from a single stock. This stock, Tesla represents 12% of the portfolio has delivered almost 40% of the ETF's overall gains. Mathematically speaking, for ARKQ to have a similar year, it would need for its top 20% of holdings to return well in excess of 500%.

Now we all know that 2020 has been a rather strange year as far as investing goes. A rather small subset of the technology sector has dominated the rest of the market. Looking within the remaining components of the ETF, it is clear to see that we are not dealing with a value oriented product here. The average P/E of the ARKQ portfolio is north of 413x. The price to cash flow multiple is north of 45x. There is no dividend to speak of. It is difficult to envision a reality where these companies grow fast enough to backfill these sort of outlandish valuations in uncertain economic times. A scenario which is even more difficult to comprehend is one where multiple expansion alone drives prices higher - like it has in 2020. For multiple expansion to deliver the near 100% return, the ARKQ portfolio's average P/E ratio will have to rise from the ultra-rich 413x multiple to north of 800x. Similarly, the price to cash flow multiple would have to increase to 90x from the current 45x. And we are speaking for the entire portfolio here and not a hypergrowth company.

Source: Bloomberg, ARK Funds

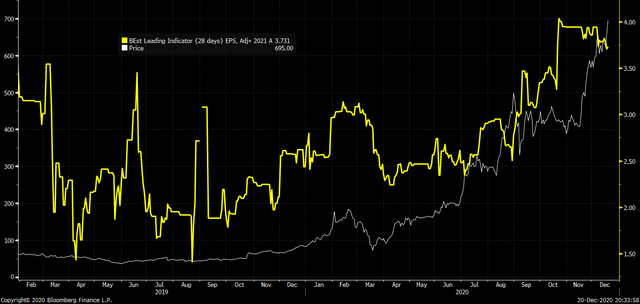

All the hype around its price increase aside, Tesla's earnings are not projected to grow anywhere near as quickly as its 700%+ YTD gain. In fact, the 2021 earnings estimates for Tesla have recently increased to the levels where they were at 2 years ago:

Source: Bloomberg, analyst consensus estimates

We are not in a normal market.

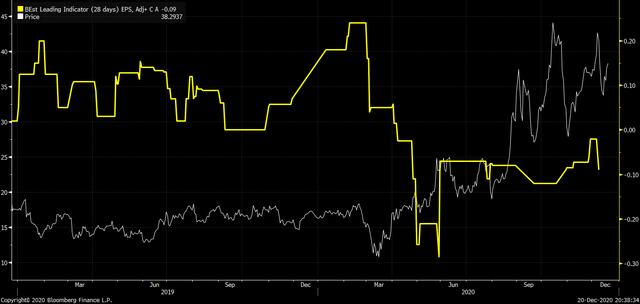

Materialise, the second largest weight in the ETF faces an even more difficult path. While its shares have increased by 155% in 2020, its earnings estimates have actually come down.

Source: Bloomberg, analyst consensus estimates

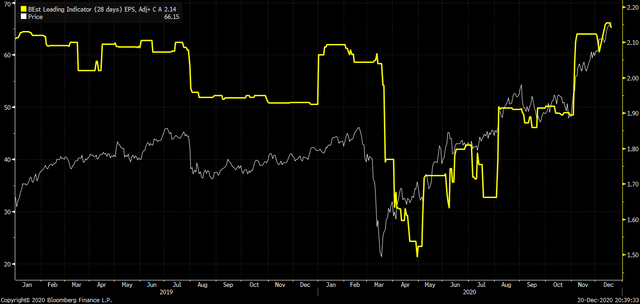

The same challenge is faced by Trimble. It's earnings, are also in dissonance versus its meteoric rise in price.

Source: Bloomberg, analyst consensus estimates

I can keep going down the list here, but I would just keep making the same point. And that point is that there is a clear and obvious disconnect between price and any measurable metric of profits.

Even Tesla, which has had a standout 2020, has not been immune to large drawdowns in the past as a result of sales misses or delayed rollouts. In today's reality, however, growth is scarce. Growth oriented companies with themes such as robotics, artificial intelligence, automation, green energy and renewables are highly sought after today. The scarcity of high growth companies has led to a concentration of capital within a small group of companies. If there is a long term weakness to ARKQ's strategy, it would be the emergence of high earnings growth in sectors outside of technology. As the vaccine rollout accelerates, it is possible that there will be other pockets of growth that emerge out of beaten down sectors creating competition for investor dollars. In the near term, the biggest worry for ARKQ's investors should be squarely pinned on the Icarus-like ascent of Tesla. A company with a ~0.7% global market share with slightly better margins than Volkswagen (OTCPK:VWAGY) and GM (GM) is worth more than the Toyota, Honda, Volkswagen and GM combined.

Companies which trade at exorbitant multiples to future expectations often face a day of reckoning when the expected growth fails to materialize. If you are a believer in things reverting to the mean, the reversion which has to play out for ARKQ's components is that of prices reverting closer to the reality reflected by the underlying components profits. Given the ARKQ portfolio's valuation in excess of 400x P/E and 45x P/CF, I would reckon that correction might play out sooner rather than later. A shift in investor sentiment could be devastating for this ETF. ARKQ is an actively managed products. I hope that ARKQ's portfolio managers are ready for a timely pivot.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.