Regenxbio: Championing Gene Therapy

Back in 2019, the Zolgensma approval validated Regenxbio's NAV technology platform for gene delivery. Despite a slow start, Zolgensma recently hit $1B in cumulative sales.

Regenxbio's organic pipeline is advancing rapidly with RGX-314. And, you can expect an early data release in the next few months.

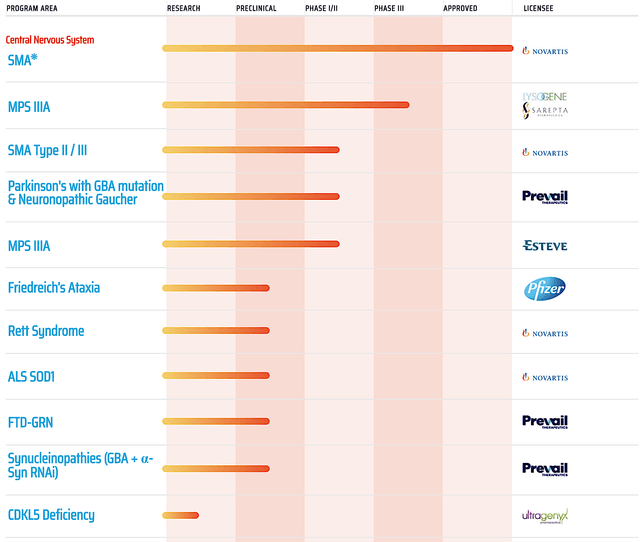

Other organic pipeline assets are also progressing at a rapid pace. At the same time, the partnered programs are concurrently maturing.

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." - Warren Buffett

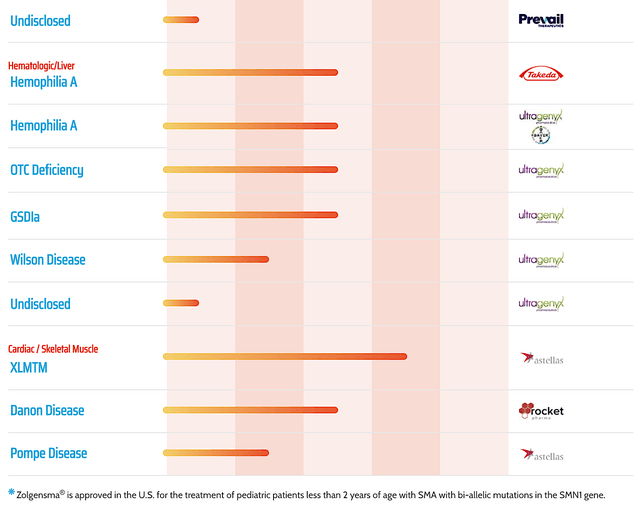

Amid this raging bull market, you're enjoying the golden ride toward more profits. That's because the coronavirus pandemic has nearly broken all normal market behaviors. In other words, the stock market quickly transitioned from a corona bear in March to an uber bull market within the same year. Though most stocks will rally in a bull market, certain growth stocks will give you outsized gains.

Over many years of doing market research, I've followed many stocks. And, I noticed that niche leaders usually give you the most outsized gains in the long haul. For instance, you saw CRISPR Therapeutics (CRSP) appreciated over 7-folds since I first featured it in 2017. That's the leading company for gene-editing. Now the crowned champion in my book for gene therapy is Regenxbio (RGNX). Intriguingly, Regenxbio hasn't gained that much like CRISPR. Nevertheless, I believe that Regenxbio is a powerful stock whose time has come. In this research, I'll feature a fundamental update on Regenxbio and provide my expectation for this Philip Fisher growth equity.

Figure 1: Regenxbio chart (Source: StockCharts)

Figure 1: Regenxbio chart (Source: StockCharts)

About The Company

As usual, I'll deliver a brief corporate overview for new investors. If you are familiar with the firm, I suggest that you skip to the subsequent section. Headquartered in Rockville, Maryland, Regenxbio is focusing on the innovation and commercialization of gene therapy. Leveraging the power of the genes, Regenxbio is poised to fill the unmet needs in retinal, metabolic, and neurodegenerative diseases.

Powering Regenxbio is the gene delivery platform dubbed NAV. Of note, NAV uses highly advanced adeno-associated viral (AAV) vectors which confers improved therapeutic success. Specifically, NAV overcame all the setbacks like low efficacy and toxicity that hindered earlier generation AAVs.

In fact, NAV works so well that Regenxbio is able to license the technology to over 20 different companies. Among the licensees, AveXis got acquired by Novartis (NVS) for $8.7B. Better yet, its drug Zolgensma is already approved and being commercialized for spinal muscular atrophy.

Figure 2: Therapeutic pipeline (Source: Regenxbio)

Zolgensma's $1B Milestone Hit

As you can see, the first step to success for a biotech company is in getting its lead drug through the clinical trial. The second step is to gain FDA approval, which is a more challenging step. The third and most difficult step is to generate blockbuster sales. On this note, Regenxbio succeeded on nearly all fronts. Subsequent to approval and a year into launch, Zolgensma achieved over $1B in cumulative sales for Novartis.

The aforesaid milestone is imperative to Regenxbio because it validates the NAV technology. More importantly, it signifies success to come for other pipeline assets. In other words, the success of one molecule significantly lowers the hurdles for other developing drugs.

Now, I know there are arguments that Zolgensma can be pricy. Be that as it may, the strong sales traction for Zolgensma signals that there is a strong demand for gene therapy. And with that, gene therapy is here to stay. Resonating optimism about the future, the President and CEO (Kenneth Mills) enthused:

"The overall progress of gene therapy treatments continues to be encouraging, as we see additional patients around the world treated with Zolgensma, the first approved gene therapy based on Regenxbio's NAV Technology Platform. We maintain our focus on our important relationships with partners and licensees in the gene therapy space, with a strong focus on patient needs and innovative approaches to treat disease."

RGX-314 Progress

Shifting gears, you should check the developmental progress of the crown-jewel, RGX-314 (i.e., 314). As a gene therapy targeting VEGF, 314 is being developed as a one-time treatment for wet age-related macular degeneration (i.e., wet-AMD), diabetic retinopathy, and other chronic retinal conditions.

Regarding wet-AMD, Regenxbio already dosed the first patient in the Phase 2 (AAVIATE) trial for suprachoroidal delivery of 314. Enrollment for the first group should be completed by now. And, you can expect preliminary data released in early next year.

If positive, that would add tremendous value to this stock. And, you can anticipate a huge rally. Based on my forecast, there is a 65% (i.e., more than favorable) chance of positive data release. Given that I'm highly conservative in my forecast, my 65% chances equates to others 85% odds. Asides from the suprachoroidal delivery, the company will start the pivotal program for subretinal injection of 314 in 1Q 2021.

As to 314's treatment for diabetic retinopathy (i.e., DR), Regenxbio recently dosed the first patient in the Phase 2 (ALTITUDE) trial. Therefore, you can expect interim data sometime in 2021. Again, I also ascribed the 65% chances of success for this franchise.

Furthermore, it's interesting that Regenxbio is tinkering with 314 for treating neurodegenerative diseases. On that note, the company is collaborating with Neurimmune AG in targeting 314 to both tau protein and alpha-synuclein. Additionally, the firm is advancing this drug as a potential treatment for hereditary angioedema ("HAE").

Of these later franchises, you can expect additional information from Regenxbio next year. I would need more information to size up their chances of success. At this point, I'm neutral on these developments. But if they hit, you can see the tremendous value-added to this blockbuster in the making, 314. As he gives more colors to the recent development, CEO Mills remarked:

"We have made several important advancements in our clinical pipeline during 3Q2020, with continued focus on execution during the COVID-19 pandemic. I'm pleased that two Phase 2 trials are underway for the treatment of wet AMD and DR using the suprachoroidal approach for the delivery of 314. In addition, we have expanded our RGX-121 program for patients with MPS II to gain additional insight into the potential treatment effects of this one-time gene therapy candidate in more patients, and we have dosed additional patients in the second cohort of the ongoing Phase 1/2 trial. I look forward to providing additional updates on all of our clinical programs in 2021, as we continue to focus on the significant unmet medical needs in both large indications and rare diseases."

Financial Assessment

Just as you would get an annual physical for your well-being, it's important to check the financial health of your stock. For instance, your health is affected by "blood flow" as your stock's viability is dependent on the "cash flow." With that in mind, I'll analyze the 3Q 2020 earnings report for the period that concluded on September 30.

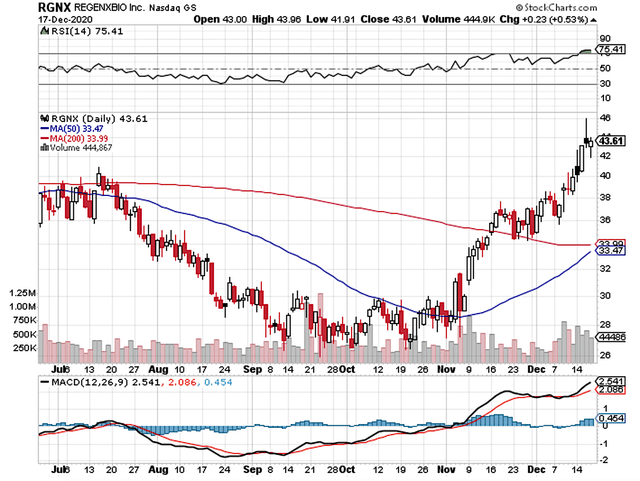

As follows, Regenxbio procured $98.9M compared to $14.7M for the same period a year prior. As such, the top-line grew by 572.7%. And, this is due to the royalty relating to the increasing Zolgensma sales. Precisely speaking, Regenxbio received the $80.0M for $1.0B cumulative sales milestone.

That aside, the research and development (R&D) for the said periods registered at $43.9M and $35.6M, respectively. I view the 23.3% R&D increase positively because the money invested today can turn into blockbuster profits in the future. After all, you have to plant a tree to enjoy its fruits.

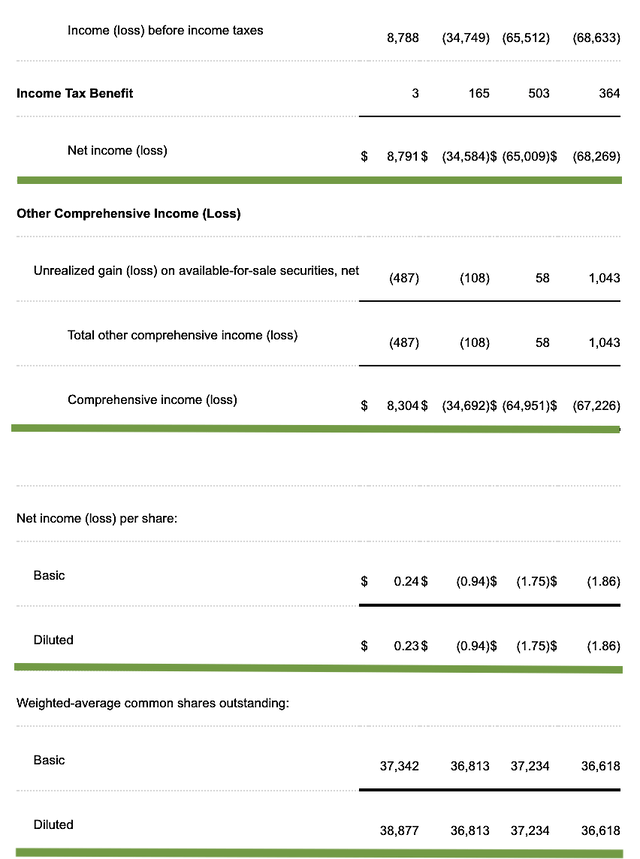

Furthermore, Regenxbio posted $8.3M ($0.23 per share) net loss versus $34.6M ($0.94 per share) decline for the same comparison. On a per-share basis, the bottom line improved by 75.5%. For a young commercial-stage company, it's a great sign to see the loss narrows. That signifies either their drug and/or technology is gaining traction.

Figure 3: Key financial metrics (Source: Regenxbio)

Figure 3: Key financial metrics (Source: Regenxbio)

About the balance sheet, there were $289.8M in cash and equivalents. On top of the $80M milestone payment, the cash position is strengthened to $369.8M. Based on the $84.9M quarterly OpEx, there should be adequate capital to fund operations into 3Q 2021. You can see that's my calculations. And yet, the company believes that its cash runway can last as long as mid-2022.

While on the balance sheet, you should check to see if Regenxbio is a "serial diluter." After all, a serially diluted company will render your investment essentially worthless. Given that the shares outstanding increased from 36.8M to 38.8M, my math reveals a 5.4% annual dilution. At this rate, Regenxbio easily cleared my 30% dilution cutoff for a profitable investment.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are "growth-cycle dependent." At this point in its life cycle, the biggest concern is whether RGX-314 will post positive data for the wet AMD franchise and DR. As I'm confident in its chances of success, I ascribed the 35% chances of clinical failure. In such an event, you can expect your stock to tumble over 50% and vice versa.

Moreover, other molecules (i.e., RGX-111, -121, -181, -381) might not generate good clinical results. Nevertheless, they won't cause Regenxbio to tumble as much as if 314 fails. As a young company, Regenxbio can grow too aggressively and thereby runs into the potential cash flows constraint.

Conclusions

In all, I maintain my strong buy recommendation on Regenxbio with the 4.75 out of five stars rating. As a leading gene therapy innovator, Regenxbio packs a mean punch. Specifically, the company has ownership of a powerful gene therapy platform technology, NAV. It's a stellar technology that enticed over 20 different companies to license it for their own therapeutic development. The most advanced licensee got bought out by Novartis. This year, Zolgensma just hit its $1B cumulative sales milestone. Despite being a new and exotic technology, NAV medicine is seeing strong sales ramp up.

In the coming years, you can expect several gene therapies to generate blockbuster sales. That makes sense because the medical community will be more knowledgeable and receptive to gene therapy. After all, it takes time to get used to a novel treatment.

Riding Regenxbio's organic and out-licensed pipelines, you can expect multiple blockbusters to be available on the market in the coming years. For instance, the most promising molecules (RGX-314) would become one such blockbuster. Even for wet-AMD alone, the market is projected to hit $16.3B by 2028. Eylea garnered $8B in peak sales. Hence, 314 should have a very good shot at procuring at least $2B. That's because 314 is an excellent drug with a similar mechanism of action as Eylea: it's just a novel form of delivery via gene therapy for suppressing VEGF. As such, your Regenxbio investment is most likely to increase multiple folds like other niche leaders (i.e., CRISPR).

Asides from 314, Regenxbio is advancing various assets (RGX-111, -121, -181, -381) for rare diseases. Orphan disease investment is a lucrative niche due to the premium reimbursement to warrant innovation. If any one of these molecules become a blockbuster, you're looking at at least one-fold increase in Regenxbio's value.

Thanks for reading! Please hit the orange "Follow" button on top for more. Don't miss out on the most profitable content (i.e. higher-level intelligence) inside IBI. Here's what members said:

Dr. Tran's analyses are the best in the biotech sphere, well worth the price of a subscription.

Very professional, extremely knowledgeable, and very honest… I would highly recommend this service, and his stock picks have been very profitable.

Not satisfied? See countless testimonies here.

I'm so confident in the value of my service that I'm giving you a 2-week FREE trial, money-back guarantee.

GET YOUR FREE GIFT NOW!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: As a medical doctor/market expert, I’m not a registered investment advisor. Despite that I strive to provide the most accurate information, I neither guarantee the accuracy nor timeliness. Past performance does NOT guarantee future results. I reserve the right to make any investment decision for myself and my affiliates pertaining to any security without notification except where it is required by law. I am also NOT responsible for the actions of my affiliates. The thesis that I presented may change anytime due to the changing nature of information itself. Investment in stocks and options can result in a loss of capital. The information presented should NOT be construed as a recommendation to buy or sell any form of security. My articles are best utilized as educational and informational materials to assist investors in your own due diligence process. That said, you are expected to perform your own due diligence and take responsibility for your actions. You should also consult with your own financial advisor for specific guidance, as financial circumstances are individualized.