Where to Buy the Dip in FedEx After Pullback on Earnings

After a stellar run over the past few months, FedEx (FDX) - Get Report shares were down about 5.5% on Friday.

It’s FedEx’s largest decline since Nov. 9, and came despite the company reporting better-than-expected earnings.

In its fiscal second quarter, FedEx generated an adjusted profit of $4.83 a share on revenue of $20.6 billion. Analysts were expecting earnings of just $4.01 a share on revenue of $19.46 billion.

However, management didn't provide guidance for the fiscal year as uncertainty remains high during the coronavirus pandemic.

It’s clear FedEx and United Parcel Service (UPS) - Get Report, which was down 1.4% on the day, are busy due to the holidays and elevated e-commerce sales. Unfortunately, that wasn’t enough for investors to chase FedEx after earnings.

Given the earnings and revenue beats, many investors are disappointed with the post-earnings reaction. Is the dip an opportunity?

United Parcel Service is a holding in Jim Cramer's Action Alerts PLUS member club. Want to be alerted before Jim Cramer buys or sells UPS? Learn more now.

Trading FedEx

From late June to mid-October, FedEx stock went on a mammoth run. Seriously, this is the type of move one would expect from a high-growth tech stock, not a logistics and delivery company.

Amid that rally, shares climbed more than 120% over 112 days, rising in 15 of 16 trading weeks.

In a span of roughly four months, FedEx stock climbed every week with the exception of one time, where it lost 0.57% one week in July.

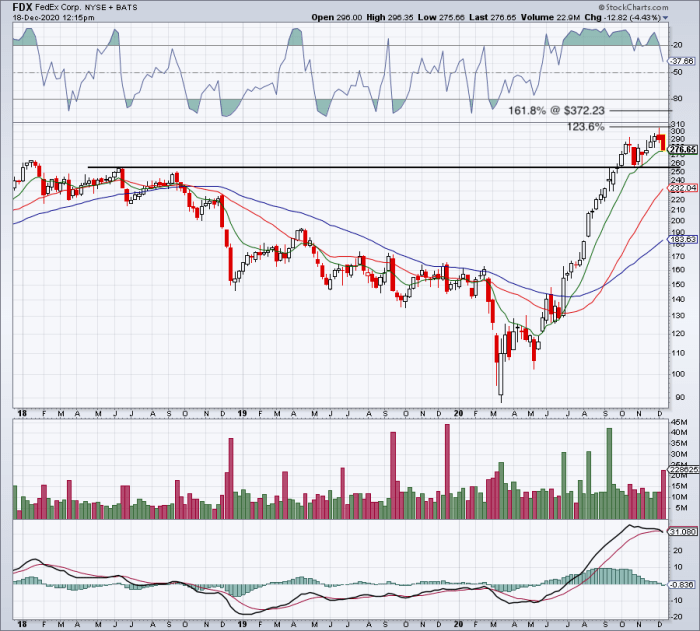

When shares finally pulled back to the 10-week moving average and the $255 area — the prior all-time high from 2018 — bulls quickly gobbled up the stock. Shares then rallied to the 123.6% extension last week, before being rejected.

FedEx is working on its second straight weekly decline, but is again falling into the 10-week moving average. If this level holds, bulls will look to buy the dip, likely eyeing that $300 to $305 area as their target.

On a close over $305, bulls will have breakout on their mind and may shift to a longer-term target closer to $370, near where the 161.8% extension rests.

A close below the 10-week moving average that is not quickly reclaimed could result in additional selling pressure. Specifically it may put the $255 area back in play, which could be another buying opportunity should FedEx find its footing and hold it as support.