For investors, calender 2020 has been a year of highest of highs and lowest of lows. After crashing to multi-year lows in March, benchmark indices have seen an unprecedented bull run which has now lead it to record-high levels. The breadth of the market has also been resilient with broader markets currently sitting near their January 2018 peak levels.

The BSE Sensex, as well as Nifty50, rallied around 13 percent each, while the BSE Midcap and Smallcap indices outperformed frontliners, rising 19 percent and 30 percent respectively. All the leading sectors, except Bankex, participated in the run.

With governments around the world opening taps in terms of the stimulus measures to combat the COVID-19 pandemic, immense liquidity flowed into the equity markets. Other reasons for the rally were the signs of economic recovery, better-than-expected September quarter earnings, RBI's accommodative stance to keep lower rates for a longer period of time, falling COVID-19 infections count, vaccine progress and easing NPA concerns for banks.

"Investors had a tough year in markets. Indices dropped to multi-year low level only to bounce to record life time highs. Despite very high volatility due to COVID-19 pandemic in March, Nifty index managed to register a V-shape recovery on the back of timely push by govt and phase-wise reopening of the economy aided equity markets comeback," Prashanth Tapse, AVP Research at Mehta Equities told Moneycontrol.

After falling 40 percent from its previous record high levels seen in January due to COVID-19 crisis, the market rebounded sharply to register over 82 percent gains.

With the sharp recovery from lower levels and broader space participation following leaders, 65 percent stocks of BSE500 index quoted in the green towards the end of year 2020.

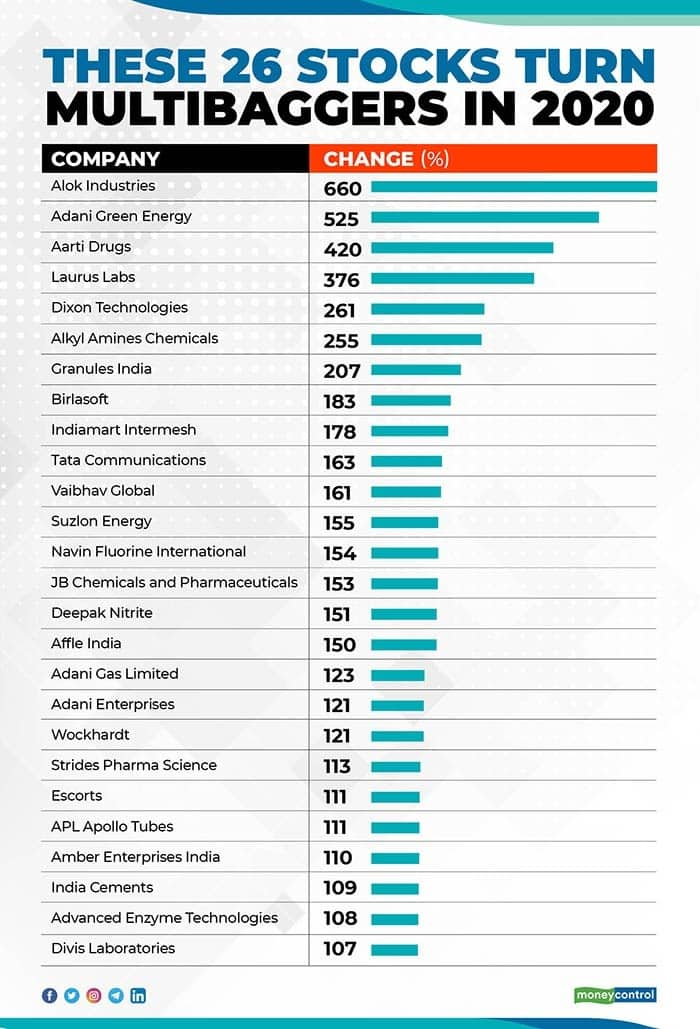

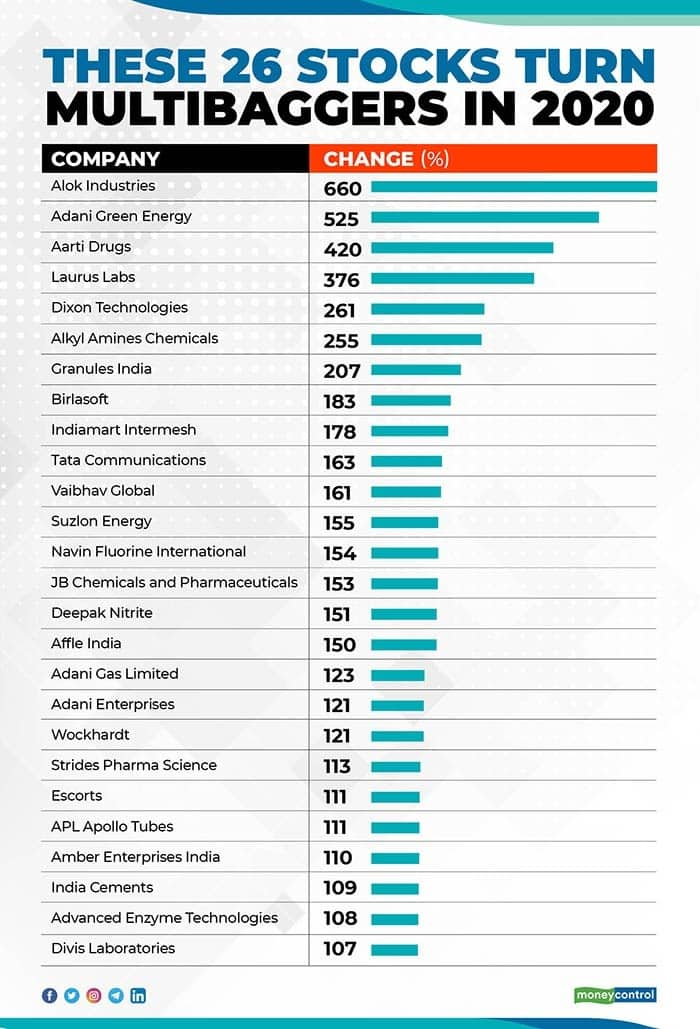

Out of total index stocks, 50 percent registered double-digit return, of this, top 26 stocks reported triple-digit gains or turned multi-baggers during the year.

Adani Green Energy, Aarti Drugs, Laurus Labs, Dixon Technologies, IndiaMART InterMESH, Navin Fluorine International, Affle India, Adani Gas, Escorts, APL Apollo Tubes, Amber Enterprises, India Cements, Advanced Enzyme Technologies and Divis Laboratories are among these 26 stocks.

Given the strong return, experts are of the view that investors can book profits now partially, though some counters can be held in the coming year as well.

"At this juncture, we advise investors to use the rally as an opportunity to book (50 percent of holding) and enjoy profits at every high level," Tapse said.

Among the multibaggers, he is still bullish on stocks like Granules India, Aarti Drugs, Laurus Labs, Tata Communications, Strides Pharma, India Cements and Escorts.

Gaurav Garg, Head of Research at CapitalVia Global Research believes that specialty chemical stocks including Alkyl Amines Chemicals, Navin Fluorine International, Deepak Nitrite along with Advanced Enzyme Technologies might continue to shine in 2021.

He feels technology space is one of bigger opportunity to look for the year 2021. Hence, he really sees an opportunity to invest stocks like Dixon Technologies, Tata Communications, Birlasoft, Affle India for the long-term.

India Cements, Escorts, Amber Enterprises India and APL Apollo Tubes might surprise D-street in 2021, he said, but he advised profit-booking in selective pharma stocks like Aarti Drugs, Laurus Labs, Granules India, JB Chemicals and Pharmaceuticals, Strides Pharma Science and Wockhardt which are showing signs of fatigue after partying hard.

Adani stocks have given extensive returns in 2020, but value still persists in Adani Green Energy and Adani Gas, Gaurav Garg feels. However, he advised avoiding Alok Industries, Vaibhav Global, GMM Pfaudler and Suzlon Energy.

After above top 26 stocks, next 68 stocks provided more than 50 percent gains during the year including Tata Elxsi, GMM Pfaudler, Alembic Pharmaceuticals, Persistent Systems, Aurobindo Pharma, Ipca Laboratories, L&T Infotech, Cadila Healthcare, Mindtree, Dr Reddyss Laboratories, Bajaj Electricals, Jubilant Foodworks, Tata Chemicals, Apollo Hospitals Enterprises, Jindal Steel & Power, Balkrishna Industries, JK Cement and Vodafone Idea.

On the losing side, hotels, PSU banks, textile, NBFCs, real estate, multiplex etc sectors are still laggards and have not fully participated in the run seen from March-end.

Future Retail, Arvind Fashions, Raymond, Omaxe, Canara Bank, Chalet Hotels, Punjab National Bank, Union Bank of India, Spandana Sphoorty Financial, Shoppers Stop, PVR, Inox Leisure, IndusInd Bank, Bank Of Baroda, Greaves Cotton, Equitas Holdings, Indiabulls Housing Finance, Edelweiss Financial Services, Lemon Tree Hotels, Coal India etc lost more than 25 percent in 2020.

If we take the journey from March lows, then 99 percent of BSE500 stocks turned positive and nearly 2/5th of stocks turned multibaggers. In fact, all sectors indices reported double-digit gains from March lows.

_2020091018165303jzv.jpg)