COVID-19 had a big impact.

My portfolio is down about 16% from the start of the year, but has recovered most of the drop in March.

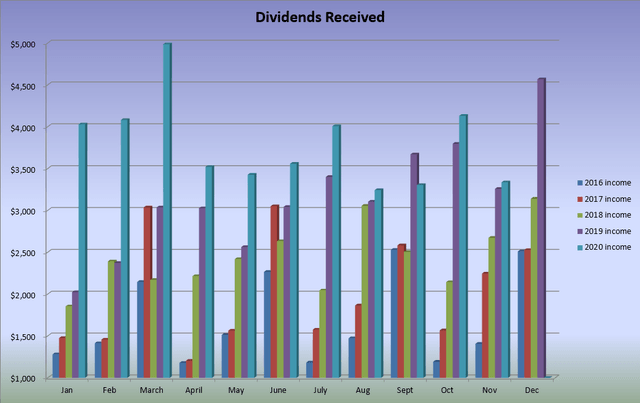

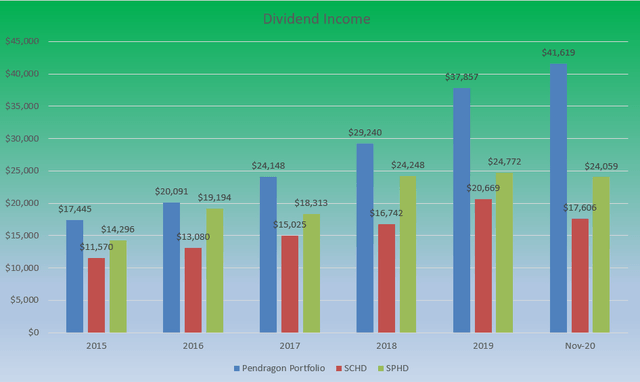

My dividend income is up for the year.

What did I Think at My Last Portfolio Review?

Source: Broker Records

2020 started out pretty optimistically, and even though by the time I wrote about my portfolio's performance in 2019 it was early March, no one had any idea of how bad things would go later in the month.

Source: Broker Records and Author's calculations

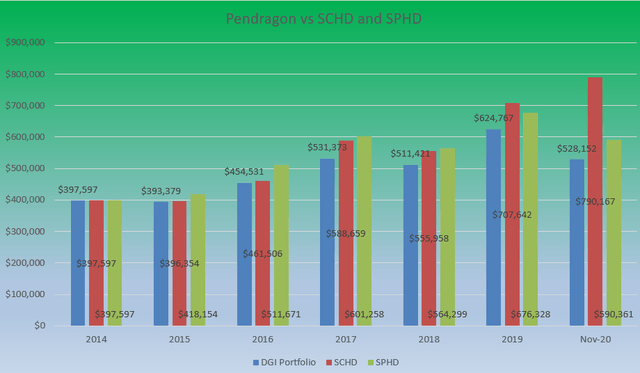

2019 was generally a very good year. Dividends grew far in excess of my target growth rate of 12% hitting $37,857. My portfolio value also hit $624,767, well above the approximately $511K 2019 start. Even in early March, I remained pretty optimistic about the impact of COVID-19. I looked forward to growth in both my dividend income and my portfolio value.

What has happened since?

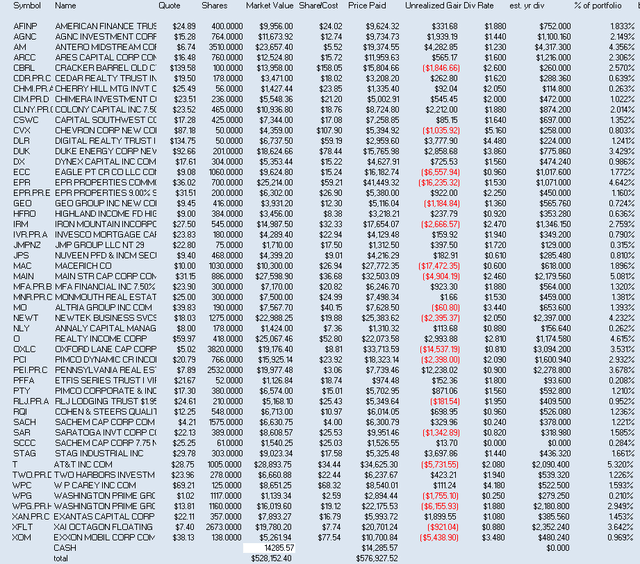

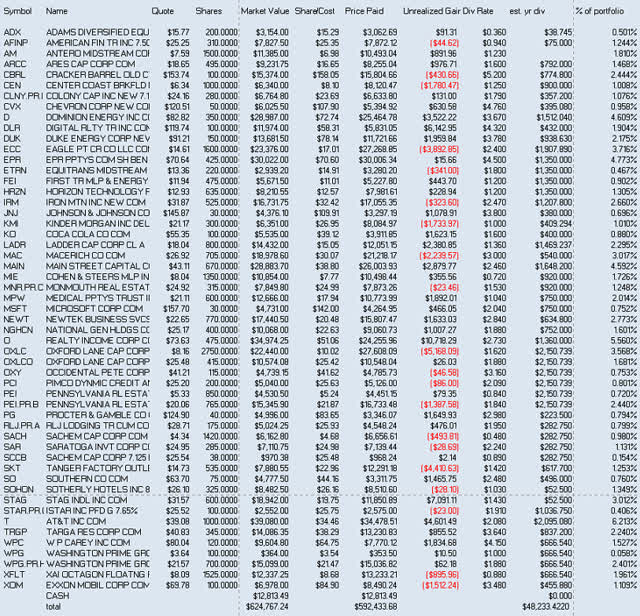

Well, as anyone knows who hasn't been asleep for the last 9 months or so, COVID-19 happened and had a big impact on the market. Once fairly stodgy preferred issues had huge amounts of volatility as a liquidity crisis cause huge sell-offs all across the market. So here is what my portfolio looks like as of the end of November.

At this point, nearly all of the gains in portfolio value from 2019 have been lost. The market value of the portfolio value is now $528, 152. About $17K above where it started 2019 from. The cash (other than about $400 from dividends paid on November 30) is being used to secure some short puts. Roughly a third of that cash secures short puts on WPG (and paid me more then 2 years worth of dividends based on the original dividend before the cuts of this year), and a third also secures 2 short put contracts on shares of AT&T (T), which also paid me far more than the actual dividend I would have collected by going long.

Source: Broker Records and Author Calculations

So cutting to the chase, so far this year I have collected more dividends than last year, despite a number of companies I own or owned cutting their dividends. As of the end of November, I am up 25% on dividends collected YTD versus this time last year.

Back when I was full of optimism and COVID-19 was still largely confined to China, I projected a dividend income from my portfolio of $50,000. I will clearly fall short of that this year. I will however still exceed my normal goal (needed to get to $100K of dividend income by the time I hit full retirement age) of 12% growth.

Normally I include a list of all the trades I made in the portfolio since the last article, but given the amount of time since that article and the number of trades, I have posted that information in a separate blog post.

One thing I have done a lot over the last year, particularly with preferred issues is to trade back and forth between the different issues of preferred shares from the same company. The broker just records the price I paid to get the current shares, so the price paid column in the table above may not reflect the true cost of the position. The preferred shares from PEI are a good example of this. PEI has 3 preferred issues that I have owned and swapped back and forth between the B issue, the C issue, and the D issue.

At the start of the year, I was in the B issue (PEI.PR.B) at a cost of $16,733. At the end of November, I owned 2532 shares of the C issue (PEI.PR.C) at a reported cost of $3.06 a share. With a closing price of $7.89 at the end of November 2020, that looks like a huge gain. However, that doesn't really account for my true costs of getting those shares as I traded back and forth between the 3 preferred issues. My true cost starts with the $16,733 I paid to get the original C issue shares I started the year with. I then over the course of multiple trades from one issue to the other and also adding more shares I spent an additional $8,047 to get my current position. So my total actual cost of the shares was $24,780. That is just under $5K below the market value of the shares at the market close on November 30. I have also received some $1400 in dividends and expect to get quite a bit more as even though the dividend is currently suspended, the preferred shares do have cumulative dividends (so I will get any deferred dividends as long as I still own shares when payments resume). Also, the share price has gone up significantly since PEI exited the prepackaged bankruptcy it filed recently.

Let's Look at the Benchmark Data

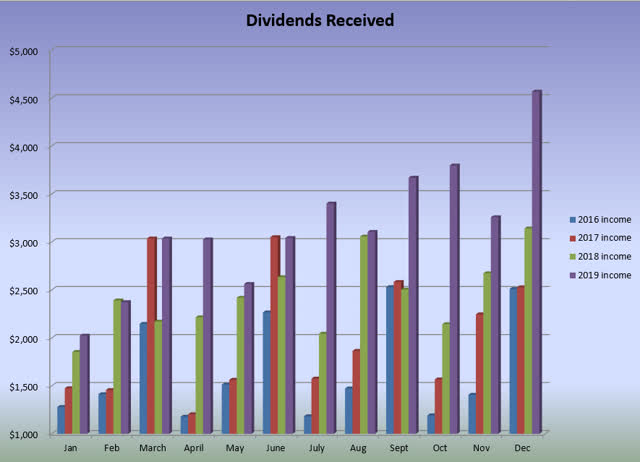

The data presented in this article, just like prior articles on my DGI portfolio, is data from a real portfolio actually owned by me and held in an IRA. I use two ETFs as benchmarks (well of a sort anyway, mostly just so I have data to answer questions on how I did versus a benchmark). I use Portfolio Visualizer to model them as I do not actually own shares in either. I use the ETFs Invesco S&P 500 High Dividend Low Volatility Portfolio ETF (SPHD) and Schwab Strategic Trust - Schwab U.S. Dividend Equity ETF (SCHD) because they are dividend focused and their method of stock selection bears some resemblance to how I select stocks.

Source: Broker Records and Author calculations

My DGI portfolio certainly took a hit on market value. It has actually recovered quite well as at one point all my gains since 2014 had been erased. SCHD did quite well on a portfolio level metric. But how did the 3 portfolios do on the metric most important to me?

Source: Broker Records and Author calculations

One month remains in the year, and all 3 portfolios have additional dividends payments in December. Last year as of the end of November, my DGI portfolio had received $30,033 in dividend payments, so I am ahead of last year's pace by approximately 25%. So despite far more companies cutting or suspending dividends than I would like I will hit my long-term goal of 12% income growth. I will however fall short of the target I set this year. SCHD and SPHD, while doing quite nicely on a total return basis, have performed significantly poorer on an income and income growth basis. Neither of those two model portfolios has exceeded the dividends they paid last year, although they may do so when the December payments are included.

So what am I going to do in 2021?

COVID-19 caused a lot of problems for the country and many of the companies in my portfolio. My plan last year was to buy more preferred issues to improve the safety of my dividend stream. I shall continue to do that this year as well.

In the past, I haven't been too concerned with whether or not the dividends from a preferred issue were cumulative or not. I figured that I wanted to own companies that wouldn't have to suspend dividends and so that feature wasn't something I wanted to pay for. However, in uncertain times, it is clear that having cumulative dividends can make a big difference.

Exantas Capital Corp. 8.625% CUM PFD C (XAN.PR.C) was one preferred issue I bought that pays cumulative dividends. Like many mREITs, it ran into liquidity issues in March and had to suspend the dividend. But they have realigned their portfolio and resolved many of their issues so that the preferred shares could resume paying the dividend. So I collected 3 quarters worth of dividend on October 30, even though I bought the majority of them after they announced the dividend would be resumed.

The PEI preferred shares I talked about earlier also pay cumulative dividends, and I expect them to possibly resume paying dividends in 2021 (probably not before summer at the earliest though).

As of the end of November, I have collected $41,619 in dividends. I expect approximately $3600 of dividend payments in December ( as of December 16, I have collected $1550). That should give me approximately $45K. That is below my original goal of $50K but still above the 12% gain I need to hit my income goal by my normal retirement date. If I continue to grow the dividend by 12% a year, I will need approximately 7 years to hit my income goal. That will get me to my goal two years ahead of schedule.

A Note on How I Manage the Portfolio

I buy securities to get an income stream. My long term goal is to use this cash flow to replace the income from my job when I retire. I determine the maximum price I am willing to pay based on my expectations for that dividend stream. When I make a trade, I look to do some combination of increasing my income, increasing the safety of that income, or increasing the rate of growth of that income. While many of the metrics I use to determine how much of a dividend can be paid and how safe that dividend is are the same metrics that others use to guess where the price might go in the future, future prices are not part of my investment thesis.

The unrealized gain column of the display for my current portfolio shows a number of positions that have unrealized losses. To some, this might be taken as an indication that those picks either failed or under-performed. I don't see it that way. My plan doesn't require that I sell shares I own at a price higher than I bought them, and lower share prices can allow me to use the income I get from dividends to buy more shares at an even better yield. I only worry about prices when I am buying or when I am selling. Yes, I was nervous about my portfolio value back in March, but I focused on the dividends and most of that drop is gone.

Like most people, I figure I have little to no chance of buying a stock at its absolute bottom. So I don't try to do that. Instead, I buy when the price of the shares on the market is less than the NPV (Net Present Value) of the dividends I expect. Part of the reason I was able to increase my dividends this year even when lots of companies I own cut or eliminated the dividend is that I used those dividend payments to buy more shares of companies when the prices were very low.

Conclusions

I set a very ambitious goal for dividend growth this year. And I did fall short of that goal. However, I also exceeded the increase I needed to make for my long term goal of hitting $100,000 in dividend income by the time I reach my full retirement age of 67. That was one reason I set so aggressive a goal for this year. Shoot high and you might still clear the bar if you fall a bit short.

High Dividend Opportunities, #1 in Dividend Stocks

HDO is the largest and most exciting community of income investors and retirees with over 4,400 members. Our Immediate Income Method generates strong returns, regardless of market volatility, making retirement investing less stressful, simple, and straightforward.

Invest with the Best! Join us to get instant-access to our model portfolio targeting +9% yield, our bond and preferred stock portfolio, and income tracking tools. Don't miss out on the Power of Dividends! Start your free two-week trial today!

Disclosure: I am/we are long PEI.PC, XAN.PC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: All securities mentioned in various graphics and tables were bought or sold during 2020 by me.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.