The Nifty Realty pack, despite its recent gains, looks set to end the calendar year 2020 as an

underperformer but the road ahead too comparatively better, especially for a few players from the sector.

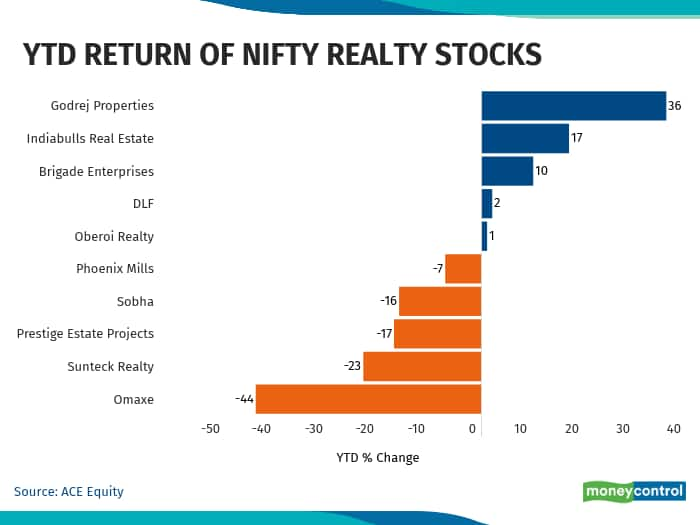

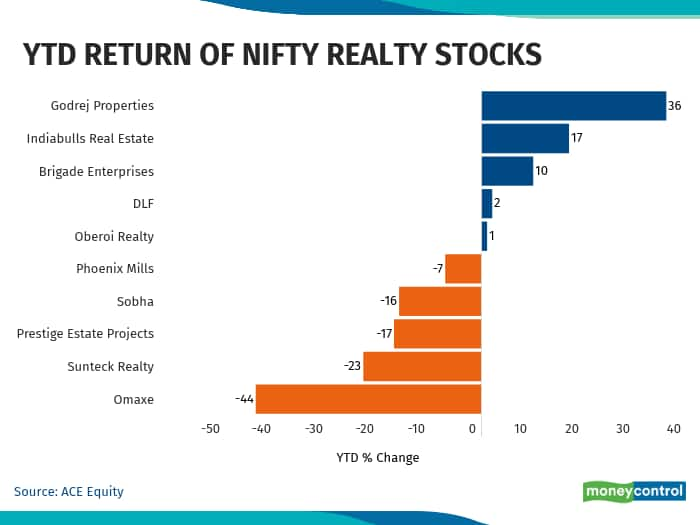

As of December 16 close, Nifty Realty is up just about 2 percent against a healthy 12 percent gain in the benchmark Nifty.

While most sectors rallied after the March selloff triggered by the outbreak of COVID-19, realty remained tepid and like PSU bank stocks, witnessed cold responses from investors.

In the last few weeks, some realty stocks start to soar especially due to favourable government policy but the question remains whether the demand will sustain or not.

High debt, unsold inventories, a slowdown in the economy are among the top factors that weighed on realty stocks.

"One of the factors contributing to the fall in real estate stocks is attributable to the high debt of companies over a few years, mainly due to the delay in completion of projects and unsold inventory," said Ashis Biswas, Head of Technical Research, CapitalVia Global Research.

"Due to regulatory complexities, Indian real estate projects take longer to complete. Many Indian companies are in deep trouble, rendering this sector less attractive while other sectors are recovering well," said Biswas.

Brokerage firm Prabhudas Lilladher pointed out that the realty sector has underperformed in the year and it was, anyway, not a favorite sector due to poor sales. Last year, there were many reports of scams which also made this sector of least choice for investors, said the brokerage.

The road ahead

Prabhudas Lilladher believes the sector is picking up so select stocks from this sector should continue to soar high in 2021.

"Godrej Prop, Oberoi Realty, Sobha for the long-term and DLF would be a good trading bet," said Prabhudas Lilladher.

India is likely to have 100 new malls by 2022, according to the property consultancy, Anarock.

Biswas of CapitalVia Global Research pointed out construction is the fourth largest sector in terms of FDI inflows, according to data released by the Department for the Promotion of Industry and Internal Trade Policy (DPIIT).

"Several steps have been taken by the Government of India and the respective states' governments to facilitate development in the sector. A prime opportunity for real estate companies in the Smart City initiative, with a proposal to create 100 smart cities," said Biswas.

Biswas expects 2021 will be relatively better for the sector and starting a turnaround.

Realty stocks have comfort on the front of valuations as most of them are available at a cheaper valuation.

"If one looks at valuations for the industry as a whole, one can get an idea that stocks are cheaper than historical valuations. Considering the industry's short- to medium-term prospects, few stocks are priced

attractively," Biswas said.

"Sobha Developers, Godrej Properties, and Indiabulls Real Estate are trading at a valuation level that makes these stocks a good bet," said Biswas.

Santosh Kumar Singh, Head of Research, Motilal Oswal Asset Management Company, believes real estate may outperform in 2021.

"This is one sector which has been under stress for a better part of the last decade. We have seen massive consolidation in the residential real estate markets. With (a) low-interest rates (b) high liquidity (c) flat property prices for almost 6 years (d) better regulations and (e) better quality corporates, this sector seems primed for a revival," Singh said.

Brokerage firm ICICI Securities underscored while COVID-19 concerns may linger in 2021, the broader theme of consolidation in favour of large, organised developers may accelerate in 2021 as a number of unlisted developers continue to remain in financial trouble and grapple with stalled projects.

"Q2FY21 residential sales bookings for our coverage universe stood at 70-100 percent of Q2FY20 sales, which points to continued consolidation and market share gains. For 2021, all listed developers have a number of planned launches and continue to focus on monetisation of ready inventory," ICICI Securities said.

"For office leasing, while 2020 may see a 50 percent YoY decline in demand, we expect leasing momentum to bounce back in 2021. With two REITs already listed in India (Embassy REIT and Mindspace REIT), this opens the door for more potential REIT listings by other large annuity asset developers," ICICI Securities said.

The brokerage firm has a 'buy' call on DLF (target price: Rs 240), Oberoi Realty (target price: Rs 457), Brigade Enterprises (target price: Rs 272), Phoenix Mills (target price: Rs 804), Sunteck Realty (target price: Rs 303), Sobha (target price: Rs 382), Embassy Office Parks REIT (target price: Rs 408) and Mindspace Business Parks REIT (target price: Rs 358).

It has an 'add' on Prestige Estates Projects (target price: Rs 291) and a 'sell' on Godrej Properties (target price: Rs 826).

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

_2020091018165303jzv.jpg)