Waste Management: Paying A Premium For Steady Dividend Income

Waste Management is the largest waste disposal service in the United States.

The company has seen very consistent financials over the past decade due to a the inelastic industry the company operates in.

Strong free cash flow growth offers room for the dividend to grow for the future but like many other well known dividend income stocks there is a premium.

Introduction

Everyone in the United States has to take out the garbage, from your kids at home to the custodians at work, garbage needs to be disposed of. As such a vital service, the industry is ripe for dividend-paying companies. The article will discuss the largest waste disposal company in North America, Waste Management (WM), and look at the viability of an investment in the company based on a dividend growth strategy. With almost the largest network of landfills, transfer stations, and recycling operations across North America, Waste Management has seen a very steady stream of revenue over the past decade. The company's consistent operations have allowed the company to grow the dividend each year for the last fifteen years at a 5% growth rate. But despite this, Waste Management, like many other well-known dividend stocks, has a lofty valuation with a 29x P/E, a 5x PEG, and a $43 fair value using the Gordon Growth Model.

A Decade Of Consistency

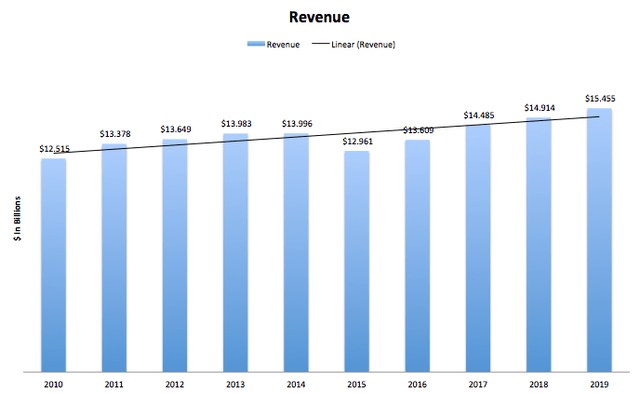

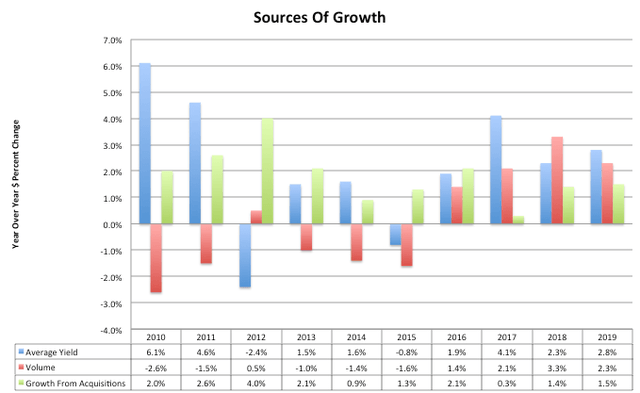

Source: SEC 10-K's

As can be seen above, Waste Management has a consistent stream of recurring revenues. Over the last decade, the company has grown revenue at a rate of 2.13%. Although the trend has not been linear, Waste Management's revenue is very stable, and I would expect this growth rate to continue. The second graph above shows the breakdown of the growth from year to year. What can be seen is that Waste Management has had much success from organic growth as well as acquisitions. With the size of the company, it is impressive to see consistently positive average yield and stable volume growth year over year. The recent uptick in revenue since 2015 can be seen in this graph too, which shows that increasing volumes have had much to do with this better performance. I like to see volume growth for mature companies over price growth as higher volume shows increasing in demand for the service. These last five years have seen that increase in demand with climbing pricing. Acquisitions have also boosted the growth over the past ten years and should be key to future growth as the company's size continues to increase.

Source: SEC 10-K's

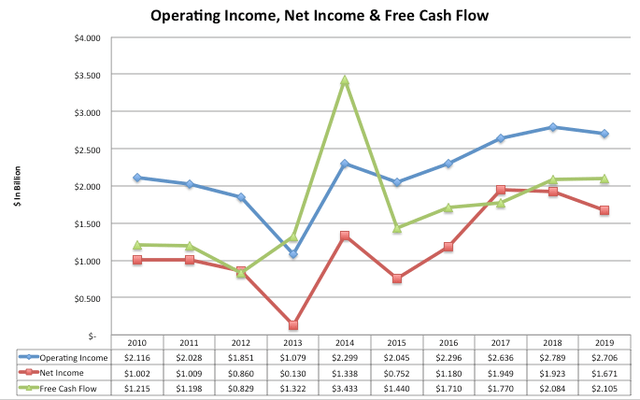

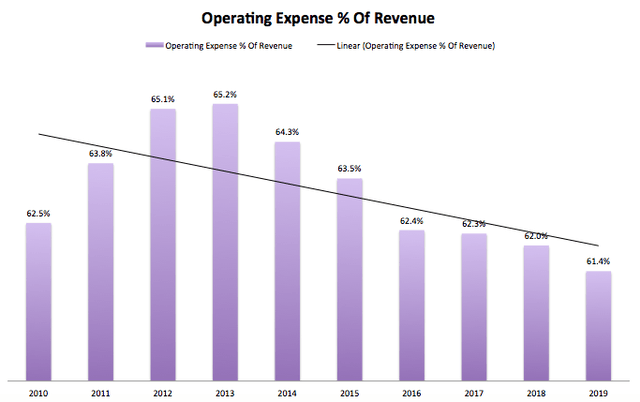

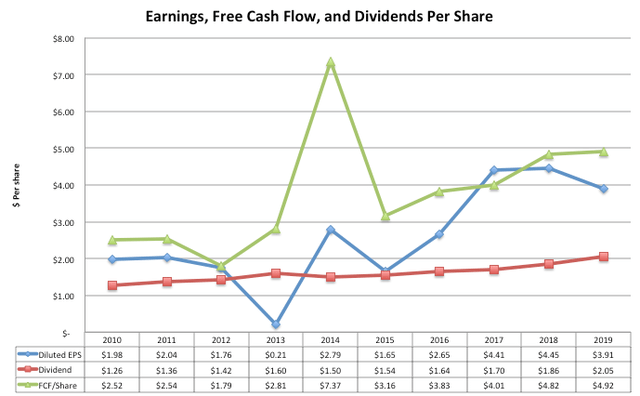

But if I'm looking to invest in Waste Management for the dividend, the bottom half of the income statement is much more important. Operating income at Waste Management has seen the same CAGR as revenue, at a rate of 2.49%. Net income on the other hand has grown a bit faster at a rate of 5.25% per year. Neither the operating income nor net income has grown linearly but instead have seen stronger growth since 2013. This is due to operating expenses as a percent of revenue decreasing by almost 3% since 2013. This shows the company has improved operational efficiency, which will benefit the bottom line for years to come. The most important statistic to look at above is the growth of free cash flow. While earnings can be a good measure of dividend-paying ability, free cash flow is a much better gauge. Waste Management's free cash flow has grown at 5.65% per year and has grown in a much more consistent fashion.

Stable Balance Sheet

To add to a stable and consistent income statement, Waste Management also has a good balance sheet. The company has ample liquidity with a current ratio of 1.20x, meaning Waste Management has 20 cents extra for each dollar of short term liabilities. Waste Management also isn't over-leveraged, with a 2.64x debt-to-equity ratio. Although not technically balanced sheet metrics, the company sports a ten-year average return on assets and return on invested capital of 5.25% and 9.33%. Overall, Waste Management has a healthy financial standing with ample liquidity, lower leverage, and solid profitability.

A Bad Year

While over the past decade, financial results have been consistent, 2020has been an outlier, to say the least. So far the company has only reported three-quarters worth of results, but it looks as growth this year will be hard to come by. Over the past nine months, Waste Management has seen revenue decrease by 3.95% compared to 2019, while operating income has declined by 13.2% and 13.6%. This is attributable directly to the pandemic and shutdowns across the world. These shutdowns caused volume to drastically drop as many commercial customers were closed, therefore not needed trash removal. This volume decrease happened over quarter two and three, which extend from March to September, the main period of COVID-19 related closures. In quarter two, volume decreased by 10.3% and in quarter three by 5%. This totaled a decrease in volume by 5.1% for the nine months, offset by a 0.9% increase in average yield.

Valuation & Dividend

Source: SEC 10-K's

Source: SEC 10-K's

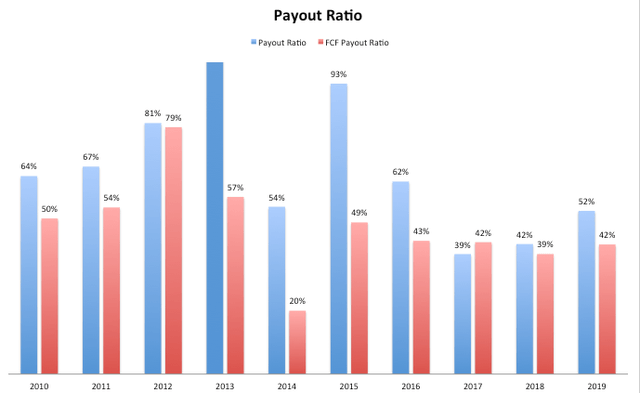

Due to this abnormally poor year, Waste Management has seen minimal increases in the price of the stock. So far, the price per share has only increased by 2.46%. Companies like Waste Management typically become overvalued as investors buy these stocks for the steady stream of income and tend to disregard prices. So what does the valuation look like, and does the dividend have room to grow? Waste Management has increased its dividend payment for the last fifteen years and has an average CAGR of 4.99% over the last ten years. The current dividend yield is only 1.75% but has room to grow. As can be seen above, the payout ratio is 52%, while the free cash flow payout is just 42%. Over the last decade, the average free cash flow payout has only been 47%, meaning that Waste Management has room to increase dividends each year for a while.

As for the valuation, the ten year average EPS for Waste Management is $2.59, meaning the company trades at a whopping 45x P/E. When using an EPS of $4.00 (around what the company has averaged over the past four years) the P/E is 29.25x. As much as I like to use a longer-term average EPS to even out the business cycle and irregularities any given year, I believe Waste Management can sustain a $4.00 EPS for the forthcoming years. But using this current P/E and extrapolating the 5.65% net income growth rate, the PEG is high at around 5x. Even Using the Gordon Growth Model with a 10% rate of return (long-term stock market growth rate) and a 5% dividend growth rate, the fair value is just $43. Taking all these measures together it does seem that Waste Management is overvalued.

Conclusion

Waste Management is the largest waste disposal services in North America, which has provided the company with a steady stream of revenue, income, and cash flow. These three factors are why the business has the potential to be a great dividend growth stock. Looking back, this has been just the case with Waste Management paying a dividend for the last fifteen years at a CAGR of 5%. Strong free cash flow growth has kept the payout ratio in check and offers investors room for more dividend growth. But it always boils down to if it is worth it. Waste Management trades at a P/E around 29x and a PEG of 5x. This is on a dividend yield of only 1.75%. To add to this, when I do a Gordon Growth calculation, the fair value comes to just $43 per share. Taking these valuation metrics altogether, it does seem Waste Management is overvalued.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.