The Markets Just Can't Be Stopped Right Now (Technically Speaking For 12/17)

The Fed raised its 2021 growth projections.

Stimulus talks might last through the weekend.

The markets continue to move higher.

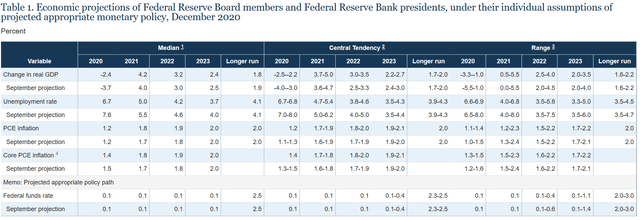

The Fed raised its growth projections:

The Fed raised its growth projections: The median change in GDP is higher across the board while the unemployment rate is lower. The central tendencies and total range of projections have also improved.

The median change in GDP is higher across the board while the unemployment rate is lower. The central tendencies and total range of projections have also improved.

We can also expect the Fed to keep rates low for an extended period. The dot plot released with the latest policy statement indicated that all members of the Fed believe interest rates will remain at current levels through 2021. The following statement from Powell's opening statement at yesterday's press conference confirms that assessment (emphasis added):

Our ability to achieve maximum employment in the years ahead depends importantly on having longer-term inflation expectations well anchored at 2 percent. As we reiterated in today’s statement, with inflation running persistently below 2 percent, we will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. We expect to maintain an accommodative stance of monetary policy until these employment and inflation outcomes are achieved.

The Fed wants inflation to run a bit hot to increase longer-run inflation expectations.

Google faces another anti-trust case (emphasis added):

Ten state attorneys general on Wednesday accused Google of illegally abusing its monopoly over the technology that delivers ads online, adding to the company’s legal troubles with a case that strikes at the heart of its business.

The state prosecutors said that Google overcharged publishers for the ads it showed across the web and edged out rivals who tried to challenge the company’s dominance. They also said that Google had reached an agreement with Facebook to limit the social network’s own efforts to compete with Google for ad dollars. Google said the suit was “baseless” and that it would fight the case.

This is a very complicated case that will take years to resolve and will likely be settled out-of-court. From an investing perspective, a negative settlement could have negative ramifications, especially if it results in breaking up the company. But that's potentially a very long way off.

Stimulus talks might last through the weekend (emphasis added):

Negotiators were hoping to resolve all of their differences and pass matching bills through the House and the Senate by Friday night, in order to marry the stimulus bill with a must-pass government funding package. The funding bill must be signed into law by Friday at midnight in order to avoid a government shutdown. But lawmakers are now running out of time to resolve their differences and could be forced to pass a short-term spending bill to buy them more time, dragging negotiations into the weekend or Christmas week.

Hardly a shocking development. The good news is the parties are still talking.

Let's take a look at today's performance tables:

The small-caps are still leading the market higher. Micros are at the top of the table, with a gain of 1.48%. Small and mid-caps round-out the top four, rising 1.19% and 0.84% respectively. Large-caps also rose, but the gain was smaller. The long end of the Treasury curve continues to lose money.

The small-caps are still leading the market higher. Micros are at the top of the table, with a gain of 1.48%. Small and mid-caps round-out the top four, rising 1.19% and 0.84% respectively. Large-caps also rose, but the gain was smaller. The long end of the Treasury curve continues to lose money. Only two sectors lost ground today. The XLC (communication services) was off 0.55% while energy was down marginally. The top three slows are dominated by defensive sectors; health care and real estate are number two and three on the list.

Only two sectors lost ground today. The XLC (communication services) was off 0.55% while energy was down marginally. The top three slows are dominated by defensive sectors; health care and real estate are number two and three on the list.

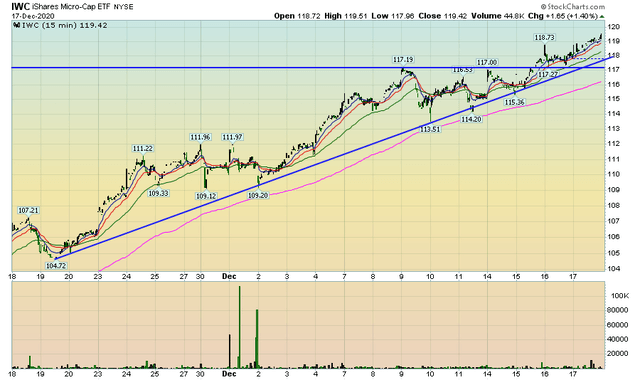

Right now, the main story is the continued upward trend in the major indexes. IWC 30-day

IWC 30-day

Micro-caps are in a 30-day rally. The index moved through the 117 level early this week and has continued to move higher. IWM 30-day

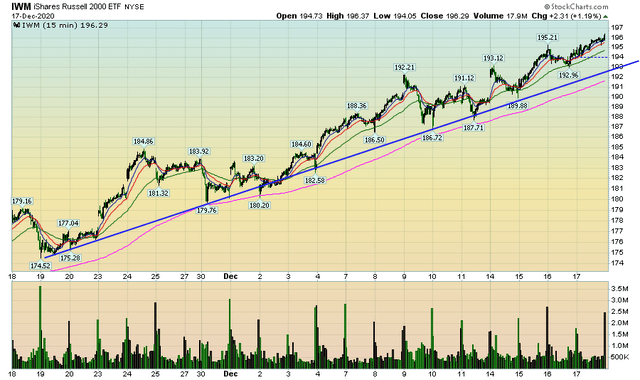

IWM 30-day

The IWM (Russell 2000) continues to be the big winner. It's also in a solid 30-day uptrend and, in fact, is at a 30-day high. IJH 30-day

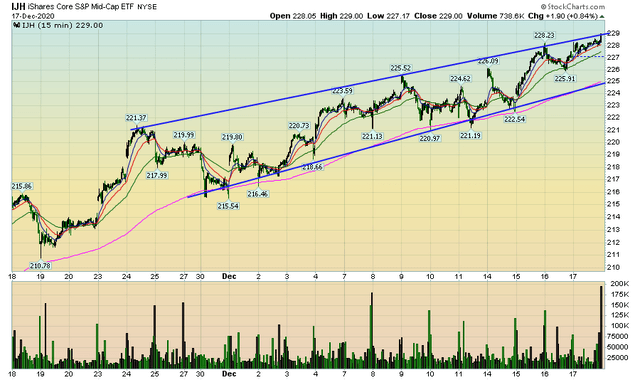

IJH 30-day

The IJH is in an upward sloping channel and is currently trading at the top of the range. Notice the large volume spike at today's close. QQQ 30-day

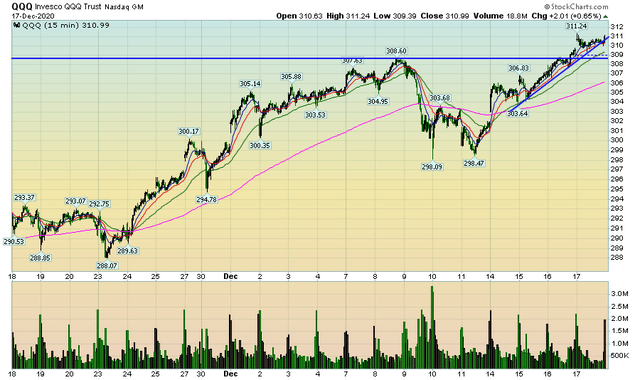

QQQ 30-day

The QQQ moved through the 308.6 level yesterday and is near a 30-day high.

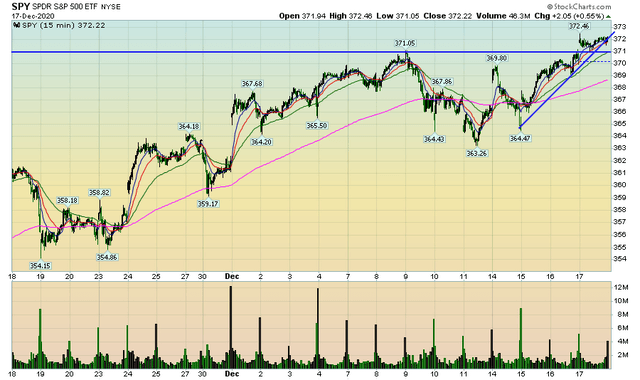

SPY 30-day

The SPY is also near a 30-day high.

The combination of the vaccine roll-out, stimulus talks, and very dovish Fed are all supporting the rally. Let's see how the markets react on Friday.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.