The market after its four-day consolidation gained strength to climb new life high on December 16, following positive global cues amid US stimulus hopes.

The BSE Sensex jumped 403.29 points to 46,666.46, backed by almost all sectors barring banks, while the Nifty50 rallied 114.80 points to 13,682.70 and formed a small-bodied bullish candle on the daily charts.

"A small positive candle was formed with long lower shadow. Nifty closed above the last four sessions' upper range of 11,590 levels. Technically, this pattern indicates an upside breakout of the small range at 13,600," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"The short-term trend of Nifty is positive and one may expect further upmoves in the coming sessions. The next upside levels to be watched around 13,900-14,000 in the next two weeks. Immediate support is now placed at 13,580," he said.

The overall market breadth was positive and broad market indices like Nifty Midcap 100 and Smallcap 100 have closed higher by 1.15 percent and 1.05 percent respectively. This is a positive indication, Shetti feels.

We have collated 14 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 13,628.7, followed by 13,574.7. If the index moves up, the key resistance levels to watch out for are 13,714.5 and 13,746.3.

Nifty Bank

The Nifty Bank underperformed Nifty50, rising 7.35 points to 30,698.40 on December 16. The important pivot level, which will act as crucial support for the index, is placed at 30,546.27, followed by 30,394.13. On the upside, key resistance levels are placed at 30,891.37 and 31,084.33.

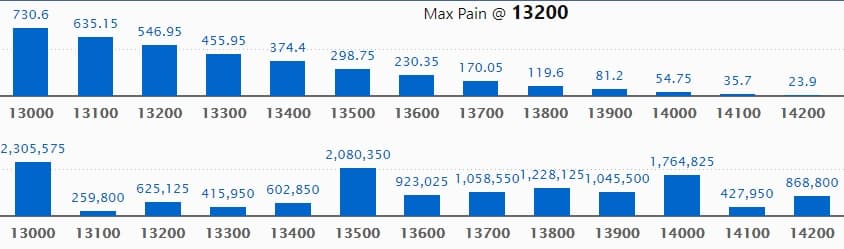

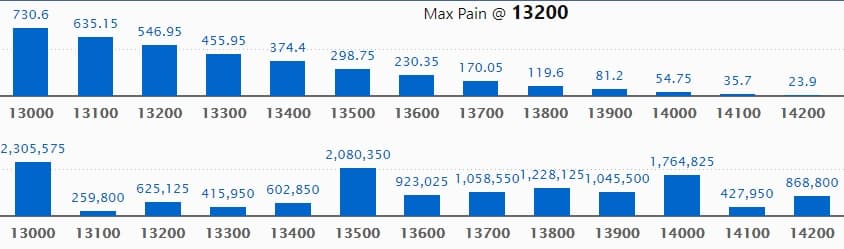

Call option data

Maximum Call open interest of 23.05 lakh contracts was seen at 13,000 strike, which will act as a crucial level in the December series.

This is followed by 13,500 strike, which holds 20.80 lakh contracts, and 14,000 strike, which has accumulated 17.64 lakh contracts.

Call writing was seen at 14,200 strike, which added 1.87 lakh contracts, followed by 14,100 strike which added 94,725 contracts and 14,300 strike which added 79,050 contracts.

Call unwinding was seen at 13,500 strike, which shed 1.31 lakh contracts, followed by 13,600 strike which shed 90,825 contracts.

Put option data

Maximum Put open interest of 42.75 lakh contracts was seen at 13,000 strike, which will act as crucial support in the December series.

This is followed by 13,200 strike, which holds 30.96 lakh contracts, and 13,500 strike, which has accumulated 24.35 lakh contracts.

Put writing was seen at 13,500 strike, which added 5.42 lakh contracts, followed by 13,600 strike, which added 4.41 lakh contracts and 13,700 strike which added 2.58 lakh contracts.

A Put unwinding of 91,725 contracts was seen at 12,800 strike on December 16.

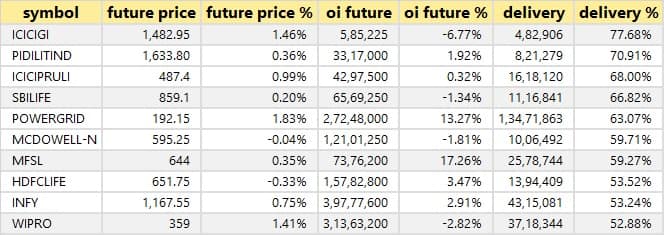

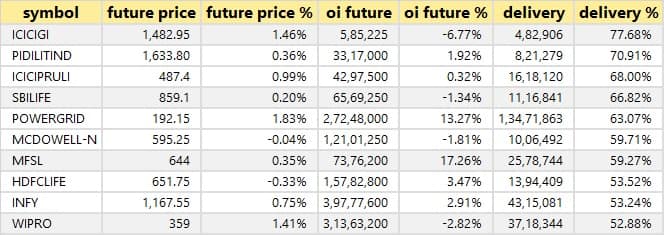

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

40 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

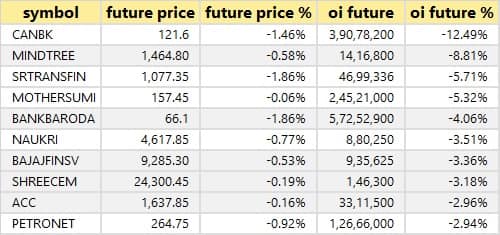

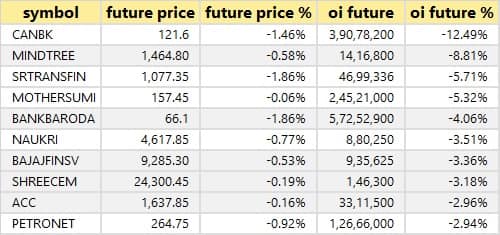

22 stocks saw long unwinding

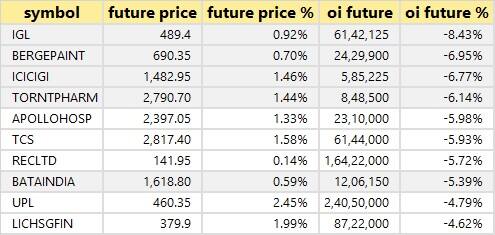

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

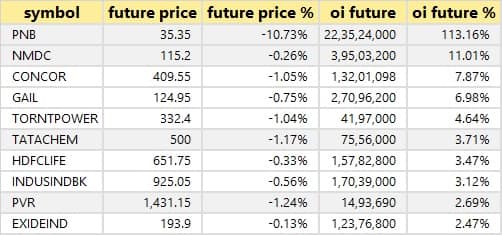

21 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

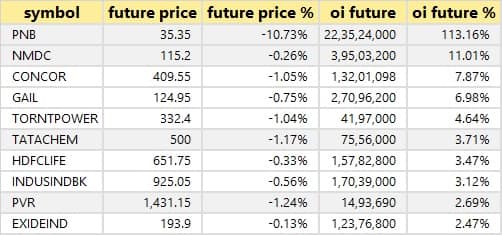

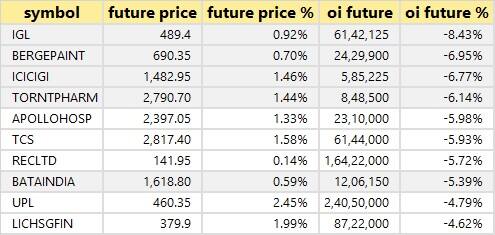

54 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

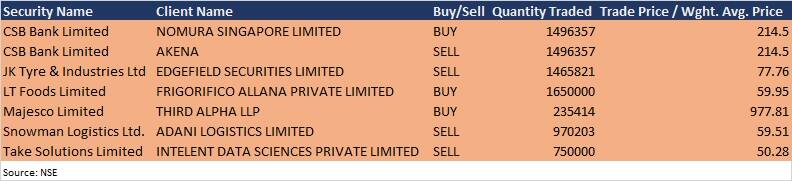

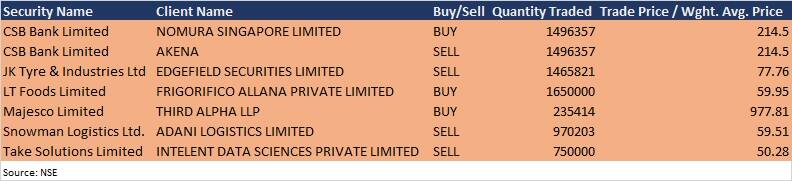

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Colgate-Palmolive (India): Investors' call is scheduled to be held on December 18.

Stocks in the news

Navin Fluorine: The board approved capital expenditure (to be undertaken at Dahej through wholly owned subsidiary Navin Fluorine Advanced Sciences) of Rs 195 crore for the purpose of setting up a multi-purpose plant.

Wipro: The company completed the acquisition of 83.4 percent equity stake in Encore Theme.

Siti Networks: The board approved the acquisition of 51 percent equity stake in E-Net Entertainment.

Sugar stocks in focus: The Cabinet approved Rs 3,500 crore subsidy for sugar farmers and Rs 6,000 per tonne subsidy for sugar exports to be given for 60 lakh tonnes of sugar exports.

Aster DM Healthcare: The company through its subsidiary, Aster DM Healthcare FZC, has acquired a company in the Grand Cayman, Cayman Islands - Aster Caribbean Holdings Ltd.

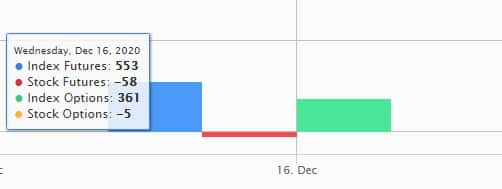

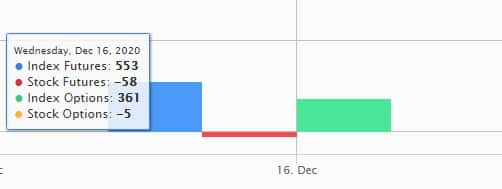

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,981.77 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 1,718.45 crore in the Indian equity market on December 16, as per provisional data available on the NSE.

_2020091018165303jzv.jpg)