Green Light To A Greener Economy: 3 Investment Trends

This year, several major governments designed their economic recovery programs to be more digital and sustainable, with "Net Zero" widely adopted as a motto.

We expect President-elect Joe Biden will enhance the country's green efforts, with important implications for the renewable energy industry and the full ecosystem around it.

Along with increasing support from governments focusing on Net Zero, growth in renewable energy may be driven by falling costs.

While many may remember 2007 as the year the global economy slid into a massive financial crisis, it was arguably the launch of the iPhone that revolutionized the way many people work and live today. Similarly, and in hindsight, 2020 may be remembered as the year the world finally took decisive steps to address climate change and shift toward a greener future. This shift will have significant consequences for markets and investors.

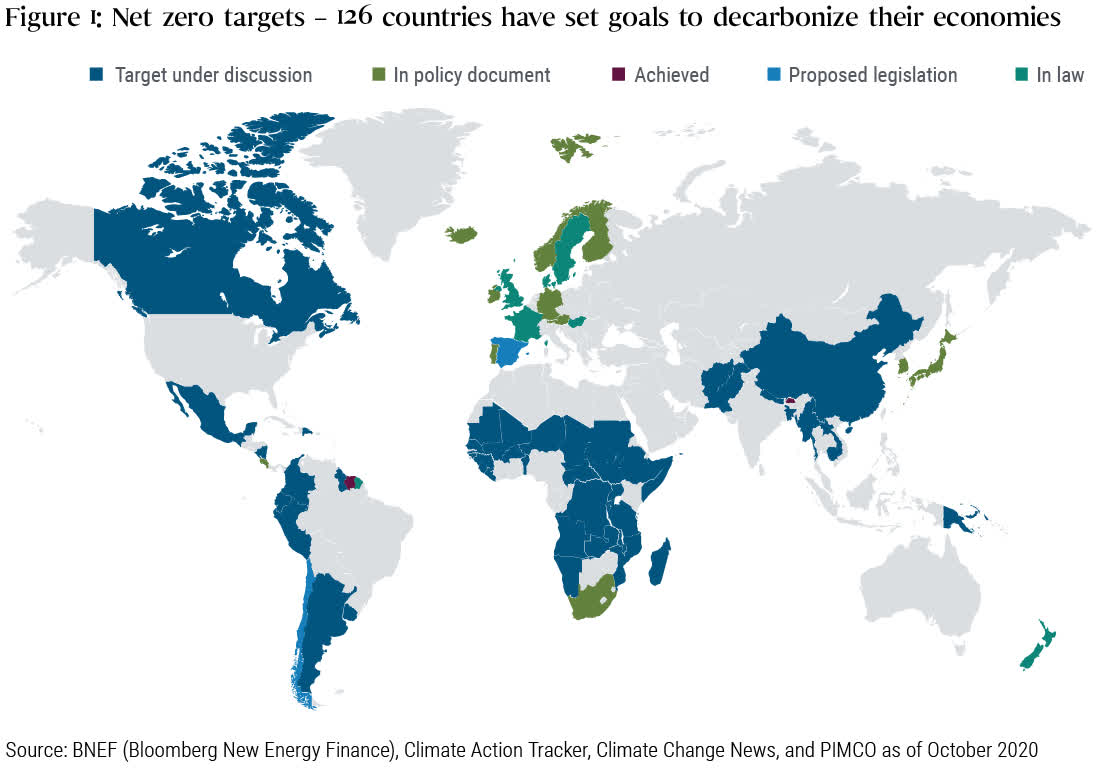

This year, several major governments designed their economic recovery programs to be more digital and sustainable, with "Net Zero" widely adopted as a motto. Climate change is likely to become a major theme and factor in the global power competition, with Europe and China promoting green strategic efforts such as hydrogen energy, and the U.S. likely to join the race. Whether it's due to countries pursuing geopolitical domination, or because of good-hearted intentions, or just due to the need to preserve limited resources, the green wave has turned into a tsunami, as the following facts signal:

- China: The country is making significant investments in green technology, and it aims to peak its carbon dioxide (CO2) emissions by 2030 and achieve carbon neutrality by 2060.

- Japan: The fifth-largest global CO2 emitter has pledged carbon neutrality by 2050. Since 87% of Japan's current energy needs are met by fossil fuels, the task ahead is substantial. To help reach this goal, the country recently proposed a 10% tax deduction toward producing goods that decarbonize the economy.

- Europe: Though the target is not yet finalized, the European Union (EU) Parliament has voted a CO2 emission reduction target of 60% by 2030 (relative to the 1990 level), exceeding the EU Commission's recommendation of 55%. Germany's lower house recently approved a tax on greenhouse gas emissions, to begin in 2021, which will increase the prices of heating oil, car fuels, and natural gas. Additionally, Spain joined other European countries by allocating 70% of its 2021-2023 stimulus budget to green and digital projects. Even the sacrosanct European Common Agricultural Policy (CAP) is getting a major overhaul: From now on, farmers, even small ones, who fail to meet requirements in support of the EU climate target will become ineligible for aid.

- U.S.: We expect President-elect Joe Biden will enhance the country's green efforts, with important implications for the renewable energy industry and the full ecosystem around it. As one of his first moves, Biden has said he will have the U.S. rejoin the Paris Climate Agreement, a landmark multinational accord to fight climate change. And if the U.S. joins the "Net Zero" club, then 60% of world GDP would be devoted to the cause (see Figure 1).

Investment implications: three sectors

"Following the money," in this case the digital and sustainable themes at the heart of the ongoing fiscal and secular trends, may open up opportunities for investors as some assets may be revalued. In this sense, we see significant potential in three sectors (some green, others simply positioned to benefit from a greening economy) where we might see double-digit growth over the next few years:

- Solar and wind power: Along with increasing support from governments focusing on Net Zero, growth in renewable energy may be driven by falling costs. The International Energy Agency recently said that solar power continues to take over from coal as the cheapest source of electricity in more and more regions. In fact, wind and solar are now the cheapest new sources of power in countries that represent around 75% of global GDP.

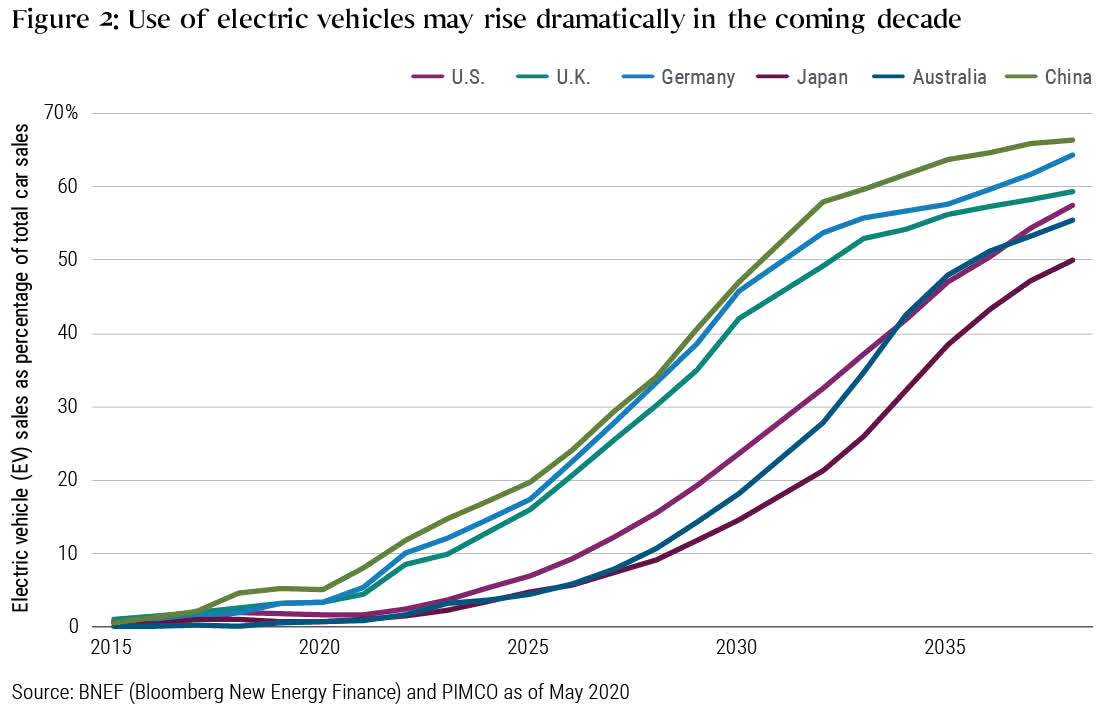

- Electric vehicles (EV): Penetration in Europe and the U.S. - currently less than 10% of new vehicle sales - could increase significantly, given increased affordability, efficiency, climate awareness, subsidies, and more charging stations. EV penetration may increase to more than 50% over the next five to 10 years, according to Bloomberg (see Figure 2; EVs include battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs)). The Chinese State Council, for instance, recently approved a plan for EV transition that could see penetration rise to an estimated 20% by 2025 and 50% by 2035. More recently, the UK joined Ireland and the Netherlands in signaling a ban on sales of new petrol and diesel cars by 2030, while France and Spain, like California, are targeting 2035.

- Semiconductors: Assets that have both a green and a digital edge may do well in the years to come, as these are the areas underpinning some of the world's biggest growth models. (Learn more about this cyclical shift in our recent blog post, "Cyclicals 2.0: Green and Digital.") As a key enabler of the current economic recovery, semiconductors may benefit from several trends:

- Increased EV production: EV cars use three times more semiconductors than combustion engine cars. Also, driverless cars (a possible trend over the supersecular horizon) use even more microprocessors.

- 5G: Devices designed for 5G communications tend to have two or three times as many semiconductors as similar 4G devices.

- Robotization and the "internet of things" (IoT): The automation of many tasks via digital networks involves more semiconductor use.

- Power efficiency: Cleaner manufacturing processes require cleaner tools, which need more and better chips to regulate voltage and save power.

In conclusion, going green may not only be the responsible and sustainable thing to do - it may also be a compelling investment.

DISCLOSURES

Socially responsible investing is qualitative and subjective by nature, and there is no guarantee that the criteria utilized, or judgment exercised, by PIMCO will reflect the beliefs or values of any one particular investor. Information regarding responsible practices is obtained through voluntary or third-party reporting, which may not be accurate or complete, and PIMCO is dependent on such information to evaluate a company's commitment to, or implementation of, responsible practices. Socially responsible norms differ by region. There is no assurance that the socially responsible investing strategy and techniques employed will be successful. Past performance is not a guarantee or reliable indicator of future results.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Outlook and strategies are subject to change without notice.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.