According to the initial projections, corporate tax collected till December 15 stood at Rs 2.26 lakh crore and personal income tax stood at Rs 2.57 lakh crore.

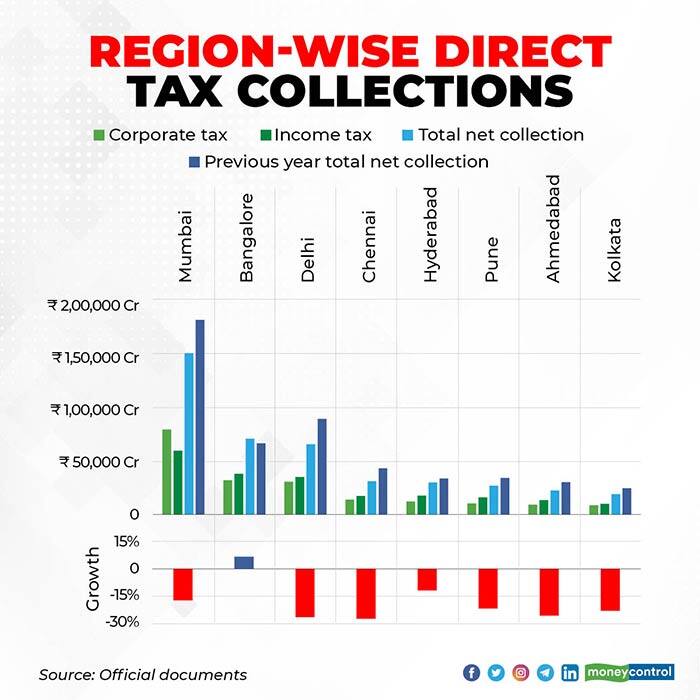

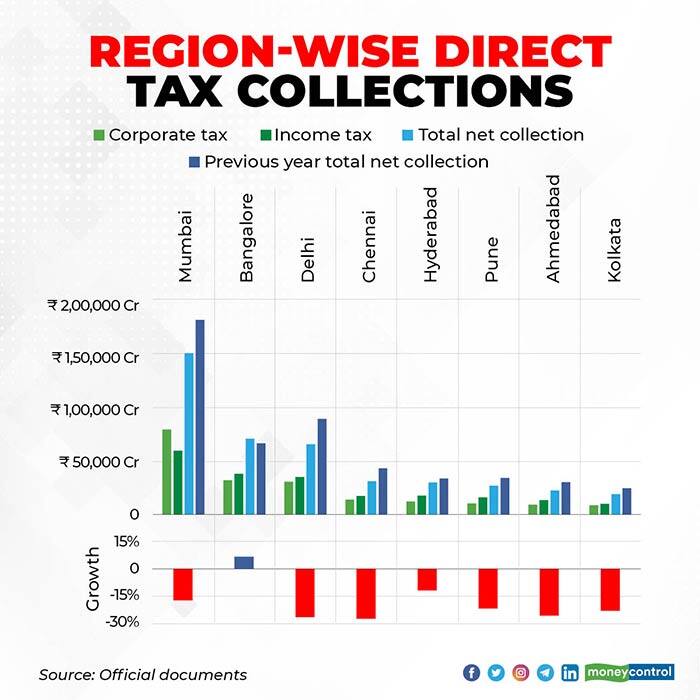

All major Indian cities, but Bengaluru, have reported negative growth in total direct tax collections in FY21.

Looking at the region-wise total net direct tax collected till December 15, only Bengaluru clocked a growth of 6.6 percent in FY21.

While Mumbai's collection dropped 17.2 percent, Delhi recorded a drop of 26.4 percent. Chennai and Kolkata saw their collections decline by 27.3 percent and 22.9 percent, respectively.

The Centre's total net direct tax collection, which includes advance tax, dropped 17.6 percent in FY21 till December 15, Moneycontrol has learnt from government sources. Direct tax collected up to December 15 stood at Rs 4.95 lakh crore as against Rs 6.01 lakh crore for the same period a year ago.

These figures are based on initial projections, and the numbers are subject to change as and when more data comes in from the banks. The tax department received the third installment of advance tax on December 15.

Bengaluru collected Rs 32,184 crore in corporate tax and Rs 38,074 crore in income tax. Delhi collected Rs 30,578 crore in corporate tax and Rs 35,021 crore in income tax. Mumbai's total corporate tax collection came in at Rs 79,473 crore and income tax at Rs 59,870 crore. Total corporate tax collected by Chennai came in at Rs 14,016 crore and income tax at Rs 17,373 crore.

According to the initial projections, corporate tax collected till December 15 stood at Rs 2.26 lakh crore and personal income tax stood at Rs 2.57 lakh crore.

"The drop in growth is due to the uncertainty around the COVID-19 pandemic and the recovery path is still uncertain," a finance ministry official told Moneycontrol.

The government had reduced the corporate tax rate for existing and newly incorporated companies to 25 percent and 15 percent, respectively, last year, after the September 15 deadline for advance tax payment was over.

According to the government data released in October, fiscal deficit rose to Rs 9.14 lakh crore, about 114.8 percent of the annual budget estimate, during the first six months of the current financial year, mainly on account of poor revenue realisation.

The revenue realisation during the current fiscal suffered on account of the lockdown imposed by the government to check the spread of the coronavirus pandemic.

_2020091018165303jzv.jpg)