Aerojet Rocketdyne Breaks Out Of Downward Trend

Aerojet Rocketdyne had been trending lower since February, but a rally that started at the beginning of November appears to have broken the downward trend.

Solid earnings and revenue growth should help move the stock higher in the coming quarters.

There is a sense of pessimism from short-sellers and the short interest ratio is higher than the average stock.

Very few stocks have been trending lower throughout 2020, especially stocks with good fundamentals and especially since March. Aerospace and defense company Aerojet Rocketdyne (AJRD) is one company that had been bucking the trend as it had seen a downwardly sloped trend channel form over the last six months, but it appears to be breaking out of its downward trend at this time.

Aerojet Rocketdyne was formerly known as GenCorp, but changed its name in 2015. The company offers aerospace and defense products and systems for the United States government, including the Department of Defense, the National Aeronautics and Space Administration, and aerospace and defense prime contractors. This segment provides liquid and solid rocket propulsion systems, air-breathing hypersonic engines, and electric power and propulsion systems for space, defense, civil, and commercial applications; and armament systems. The company also has sizable land holdings in California.

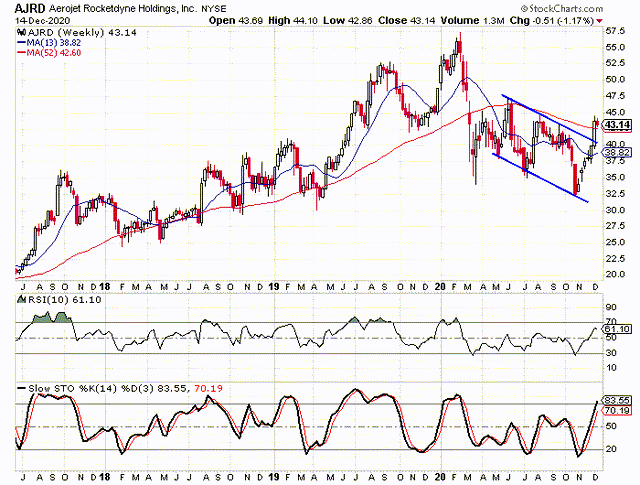

If we look at the weekly chart for the stock, we see that it peaked at over $57 in February and recently fell as low as $32.15. What really jumped out at me was the series of lower highs in June, August, and September and how neatly they connected to form a downwardly sloped trend line. As I looked closer, there also appeared to be a lower trend line that looked like a lower rail, although the lows didn’t connect quite as well.

We see that the stock has rallied nicely since the beginning of November. From the beginning of the year through the end of October, Aerojet Rocketdyne lost 29%, but has since rallied 33%. The latest surge higher in the past week has pushed the stock above the upper rail of its trend channel.

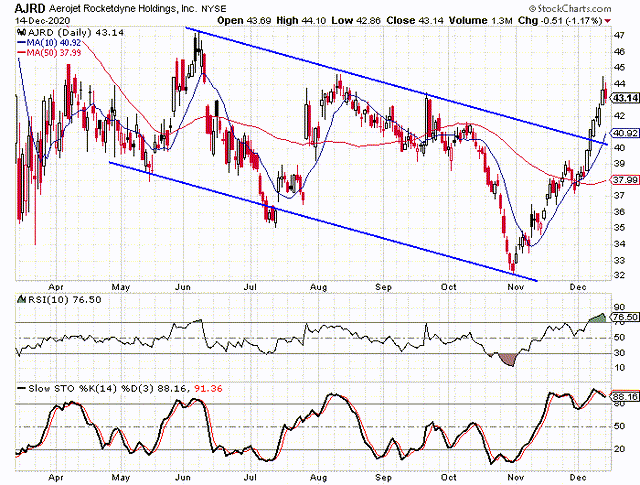

I found it encouraging that the weekly overbought/oversold indicators weren’t in overbought territory yet, even after the big rally in the last month and a half. I did pull up the daily chart and drew the channel on it as well. The OB/OS indicators on the daily chart do show as being overbought at this time and that suggest we could see a short-term pullback in the coming weeks. As long as the pullback doesn’t bring the stock back down into the channel, it could present a buying opportunity on the stock.

Given the Company’s Fundamentals, the Decline was Surprising

I have only been watching Aerojet Rocketdyne for four or five months now, but the stock got on my radar because of the company’s fundamentals. I was surprised at how the stock continued lower with pretty strong fundamental indicators. I was especially surprised when I watched so many other companies with poor fundamentals jumped at the same time.

The company has seen earnings grow by 22% per year over the last three years and that is pretty solid growth. Earnings were up 9% in the third quarter and are expected to increase by 7% for 2020 as a whole. Analysts expect earnings to grow by 16.7% in 2021.

Revenue hasn’t been growing as fast as earnings, but it has been growing nevertheless. It increased by 10% in the third quarter and is expected to increase by 4.3% in the fourth quarter and it’s expected to grow by 4.0% for 2020. Both of those growth rates are above the annual rate of 2% the company has seen over the last three years.

Aerojet Rocketdyne’s return on equity is above average at 27.74%, but its profit margin is a little below average at 9.68%. The operating margin is decent at 12.14%. As for the current valuations, the trailing P/E 28.5 and the forward P/E is 21.5, so about average at this point in time. The company doesn’t pay a regular dividend at this time.

Overall, the fundamentals for the company are above average with a few areas that really stand out - the ROE and the earnings growth. Improved revenue growth and an increased profit margin would help the stock going forward.

Not Much Attention from Analysts, but Short-Sellers are Skeptical

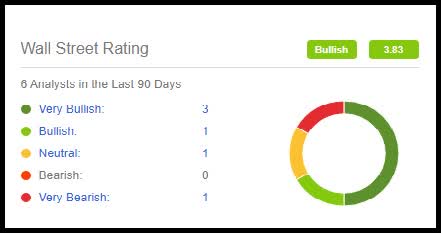

Aerojet Rocketdyne isn’t getting much attention from analysts with only six covering the stock. There are four “buy” ratings, one “hold” rating, and one “sell” rating at this time. The buy percentage of 66% is in the average range, but it loses a little of its impact because there are so few analysts covering the stock. If additional analysts start covering the stock and issue “buy” ratings, it could help push the stock higher.

Short-sellers are showing a little more attention to the stock than the average stock. The short interest ratio is at 5.8 currently and that is above average. There are 4.26 million shares sold short at this time and that is a pretty big jump from the 3.71 million shares that were sold short at the end of October. If the stock continues to rally, short-sellers could add buying pressure as they get squeezed out of their positions.

One sentiment indicator that surprised me was the put/call ratio. It is extremely low at 0.36 with 5,110 puts open and 14,062 calls open at this time. The low ratio is indicative of bullish sentiment and that runs counter to the high short interest ratio. The overall open interest represents about 2.5 days of average volume, so it is a relevant amount.

The overall picture for Aerojet Rocketdyne is bullish in my view. The fundamentals are better than the average stock, the recent break above the downwardly sloped trend line, and the sentiment indicators all suggest that the worst is behind the stock.

There are a few concerns, but there are far more positives than negatives. The overbought status on the daily chart is a minor concern and so is the current put/call ratio. A small pullback would move the daily overbought/oversold indicators out of overbought territory and could provide a nice buying opportunity. I think anything in the $39-$41 area would be a slightly better price than the current price. You might even watch the daily chart to see if the stochastic indicators reach oversold territory and then make a bullish crossover. That was a great signal in early November.

I can see the stock making a run at the $55-$57.50 area within the next nine to 12 months.

If you would like to learn more about protecting and growing your portfolio in all market environments, please consider joining The Hedged Alpha Strategy.

One new intermediate to long-term stock or ETF recommendation per week

One or two option recommendations per month

Bullish and bearish recommendations to help you weather different market conditions

A weekly update with my views on the market, events to keep an eye on, and updates on active recommendations

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.