Papa John's: Long-Term Outlook Remains Weak On Fundamentals - Reiterate Sell Rating

Purported dramatic growth over recent quarters was insufficient to beat peak levels.

PZZA’s internal business dynamics and competitive environment are unfavorable for significant post-pandemic growth.

To maximize shareholder returns, PZZA should sell itself to the highest bidder.

Revising 3-year Price Target to $49/share from the prior $48/share. Reiterate Sell Rating.

Investment Conclusion

Although Papa John’s (PZZA) revenues and net income have remained below levels experienced during the era of its founder, John Schnatter, they have nevertheless improved significantly over the previous two quarters. The company, with a view to benefit from what it considers heightened customer demand for its product, has revealed plans to accelerate new unit development across the globe.

Based on a larger footprint, we expect PZZA to experience growth levels sufficient to sustain its fourth position in the quick service restaurant pizza market. Even though the potential expansion in revenues, net income, and free cash flows, will be moderately higher than that experienced during the firm’s peak growth year, representing some improvement from current levels, the growth will be substantially below levels witnessed during the pandemic, in our opinion.

However, given that F3Q2020 financial results represented a second quarter of strong quarterly performance, we’re slightly less bearish on the firm, and expect retail sales to expand at a higher rate than our previous estimate. Factoring in an increase in our retail sales growth rate and adjusting for other quarterly changes to financial statements, we arrive at our new 3-year Price Target of $49/share for PZZA. Reiterate Sell Rating. (Please go through our initiation report “Papa John’s: Fundamentally Flawed Company – Sell On Valuation” for our long-term opinion on the stock).

The predominant element surrounding the PZZA story is related to the magnitude of growth the firm can ignite considering the challenging business dynamics and fierce competitive environment. Our thesis is driven by concerns we’d outlined in our initiation report on PZZA and is bolstered by limitations associated with the firm’s recent plans to advance growth by rapidly expanding its geographic footprint. Overall, based on factors presented below, we expect limited retail sales growth reflecting in moderate expansion in revenues, net income, and free cash flows, over the long term.

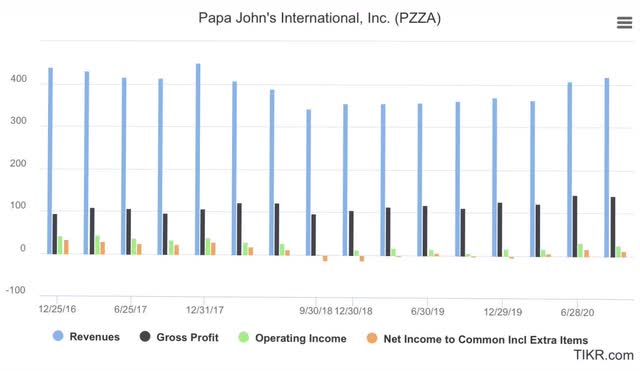

Financial Performance Remains Below Peak Growth Levels. Although undoubtedly pandemic conditions favorable to quick service restaurant pizza supported PZZA’s retail sales growth, it is noteworthy that because the outperformance was also driven by easier comparables due to declines suffered in recent years, the arguably strong performance was insufficient to beat prior peak growth levels experienced by the firm. The combination of lighter comparables and highly unusual supremely favorable conditions should have reflected in significantly higher growth than that experienced by the firm.

Pandemic Growth Although Dramatic Is Below Peak Levels Source: TIKR.com; Seamist Capital Presentation, December 2020

Source: TIKR.com; Seamist Capital Presentation, December 2020

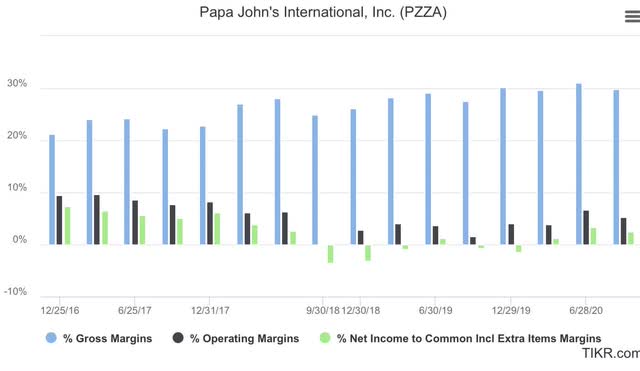

Profit Margins Over Recent Quarters Have Been Below Peak Levels Source: TIKR.com; Seamist Capital Presentation, December 2020

Source: TIKR.com; Seamist Capital Presentation, December 2020

That Domino’s Pizza (DPZ) with relatively difficult comparables and substantially higher historic retail sales, evidenced growth levels which were competitive or ahead of PZZA, signifies the challenges the firm’s business is experiencing in creating and sustaining customer demand for its product. Across the board, pandemic: revenues, margins, profits, and adjusted free cash flows were below peak levels. Financial results over F2Q2030 and F3Q2020 hardly instill confidence that PZZA can experience strong growth following the pandemic.

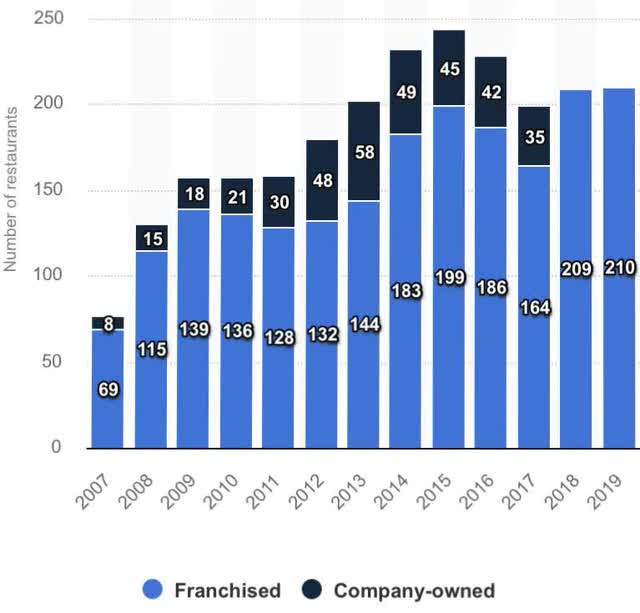

Results From Previous Efforts To Derive Growth From Foreign Markets Have Been Mixed. Given that PZZA shuttered its operations in India and sold its Chinese business to franchisees after undergoing substantial losses, highlights the risk associated with the firm’s international expansion plans. PZZA has revealed plans to launch an additional ~1,200 restaurants in foreign countries by 2026.

In regards to location, based on management commentary, it appears the firm has plans to significantly expand its footprint in China, where the firm currently has ~210 restaurants. In that context, it is noteworthy that DPZ through its minority interest in Dash Brands expects to add 1,000 new restaurants in China by 2025. In addition, Yum Brands (YUM) has 17% or ~2,200 of its Pizza Hut restaurants based in China. Given that both DPZ and YUM have the corporate muscle and resources to outwit and outspend PZZA, we believe the firm will find it challenging to succeed in China.

Previous Efforts To Develop Presence In Chinese Markets Failed Source: Statista.com; Seamist Capital Presentation, December 2020

Source: Statista.com; Seamist Capital Presentation, December 2020

In addition, barring some foreign territories such as South Korea, the United Kingdom, Russia, and Chile, where PZZA has succeeded, performance in alternate international geographies has been lackluster. In comparison to PZZA’s plans to expand its international presence by ~1,200 stores by 2026, DPZ has indicated plans to launch ~5,200 new restaurants in regions outside the U.S. by 2025, growing its international unit count to ~17,000 stores. Given the dynamics, we’d be surprised if PZZA can garner outstanding growth from the potential rapid expansion in the number of its foreign restaurants. Interestingly, the firm’s domestic retail sales growth has outperformed international retail sales growth over recent years.

DPZ’s Looming Dominant Presence At Home And Abroad Could Hamper PZZA’s Progress. DPZ plans to open ~2,000 new restaurants in North America by 2025 while PZZA has indicated a target of 180 new stores in the U.S. by 2026. In addition, based on net new openings data on unit development, it appears that PZZA from 2018 through 2020, permanently shuttered roughly the same number of stores it plans on adding by 2026. Moreover, DPZ’s potential 8,000 store domestic footprint will focus on carry-out along with delivery, further improving the value aspect of its menu offering, which when compared with PZZA’s premium pricing will incrementally improve DPZ’s competitive positioning.

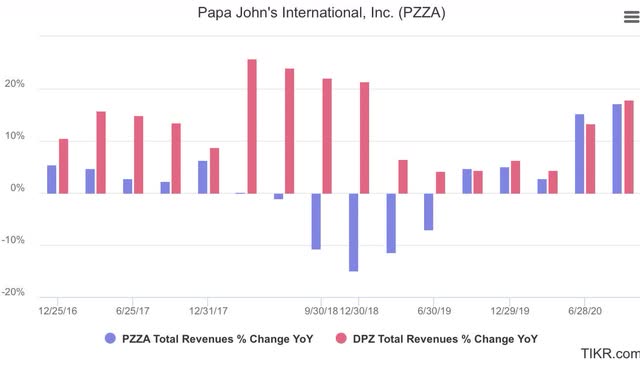

Further, given that DPZ offers new franchisees higher average sales per store and better unit economics, PZZA’s new unit development might suffer in regions DPZ decides to penetrate. Overall, in the face of DPZ’s constant efforts to innovate its business to increase customer demand and profits, PZZA’s initiatives to ignite growth are likely to fall short of management objectives. In that regards, it is important to note that DPZ beat PZZA on revenue growth, margins, and customer satisfaction scores, over the pandemic-ridden quarters.

Overall DPZ Beat PZZA On Revenue Growth And Margins Over Recent Quarters

Source: TIKR.com; Seamist Capital Presentation, December 2020

Source: TIKR.com; Seamist Capital Presentation, December 2020

PZZA’s Polarizing Corporate Identity Could Limit Customer Demand. PZZA has always been a polarizing force, with data from a 2018 report demonstrating that the firm was more popular with Republicans than Democrats by 24 percentage points of net favorability. However, since 2018, the scenario has gradually shifted with PZZA’s growing popularity among Democrats due to left-leaning strategies the firm has implemented. It signed on Shaquille O’Neal as a key spokesperson for the brand compensating him with $4.1 million in cash payments and $4.4 million in PZZA’s stock. In addition, the firm instituted a “Power of Perseverance” scholarship to support minority students to pay for college.

Prior To 2018 PZZA Was More Favored By Republicans Than Democrats Source: morningconsult.com; Seamist Capital Presentation, December 2020

Source: morningconsult.com; Seamist Capital Presentation, December 2020

Moreover, it pulled advertisement funding from Fox News' Tucker Carlson’s show over his opinions on Black Lives Matter riots. Further, based on statistical data, it appears that during recent political campaigns, PZZA employees donated to substantially more Democrats than Republicans and with higher value contributions. Furthermore, with a view to mitigate the impact of cultural holdouts from John Schnatter’s era, the firm is instituting a reorganization, terminating the services of a substantially large fraction of top leadership, shifting its corporate headquarters from Louisville, Kentucky to Atlanta, Georgia, where Shaquille O’Neal is the owner and operator of nine PZZA restaurants.

PZZA Employees Leaned Democratic During Recent Political Campaigns Source: opensecret.org; Seamist Capital Presentation, December 2020

Source: opensecret.org; Seamist Capital Presentation, December 2020

The organization has clearly shifted leftwards, favoring Democrats over Republicans, which will likely drive conservative customers to DPZ, which appears politically neutral. In that regards, it is noteworthy that activist brands like Starbucks (SBUX) and Nike Corporation (NKE) have not evidenced material impact from their political views, because their products are well differentiated with little competition, while PZZA competes with DPZ, which provides superior service and cheaper product.

Balance Sheet Appears Strong. At the end of F3Q2020, the company had an unrestricted cash and cash equivalents balance of ~$140 million and long-term debt of ~$328 million (vs. ~$347 million a year ago) on its balance sheet. Management announced a dividend of $0.225/share for F4Q2020 and a $75 million share repurchase program. In regards to available funding, PZZA has $395 million remaining from the $400 million it previously borrowed under variable funding notes. Given these factors, we believe that the company will handily maintain liquidity over the final months of the pandemic.

Minor Model Updates. We have adjusted our 5-year Discounted Cash Flow model to account for our improved outlook on revenue growth, increasing the item to 6% from the previous 5%, and to reflect the quarterly change in the number of shares outstanding to ~33 million from the prior ~31.8 million. Based on these minor updates, we arrive at our slightly revised 3-year Price Target of $49/share versus the prior $48/share for PZZA. Reiterate Sell Rating.

Bottom Line

Although we agree that PZZA’s poor performance from 2018 until the pandemic is history, we disagree in regards to the likelihood that the company’s fortunes can shift sufficiently to knock its stronger competitors off their market positions, and reward it with the top spot.

Our conviction that PZZA is likely to remain in fourth position is based on the reality of the company’s internal limitations and the presence of competitors that are not only far ahead but also sufficiently nimble, better resourced, with enough scope and scale as well as funds to handily destroy any challenges PZZA might pose.

Therefore, the most appropriate path forward for the firm is within a conglomerate such as Restaurant Brands International (QSR), as one of their leading brands. In alternate terms, for PZZA’s shareholders to secure highest returns on the investment, it is imperative that the company gets acquired.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.