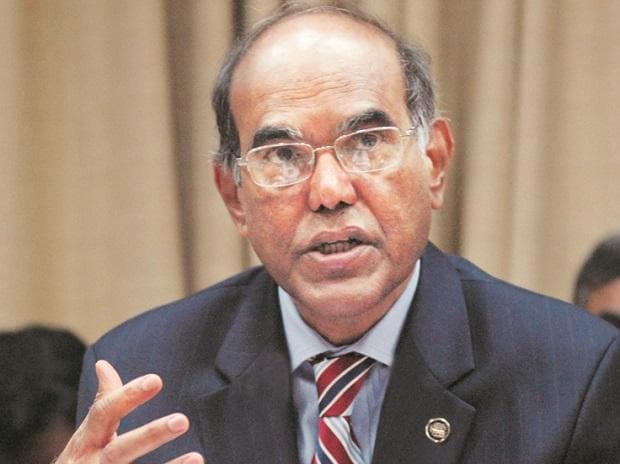

Former Reserve Bank of India (RBI) governor D Subbarao indicated that it could become a challenge for the central bank to wind down liquidity going forward, given the excessive liquidity in the system due to monetary easing.

At an event organised by the Confederation of Indian Industry (CII), Subbarao said that a roadmap for fiscal consolidation starting 2022 would be a prudent move. He said though expansionary fiscal policy is the need of the hour, the government spending on health and education would only be beneficial for the economy.

He also said that the Centre's fiscal deficit could be double of the fiscal deficit. The deficit was projected to be 3.5 per cent of the country's gross domestic product in the Budget.

The former RBI governor said the central bank was successful in preserving the financial stability of the economy during the present crisis. He said the RBI did so by taking a three-pronged approach. The first was the extraordinary injection of liquidity through open market operations, cut in cash reserve ratio and statutory liquidity ratio.

The second was the easing of the financial conditions through lowering of policy rates, reverse repo rates, targeted long term repo operations for specific sectors and thirdly through introduction and extension of the loan moratorium.

Former chief economic advisor Shankar Acharya, who moderated the session, found RBI to be a little on the optimistic side when it expected the economy to recover to pre-Covid level in Q3 and Q4 showing marginal positive growth rate year-on-year.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU