Schweitzer-Mauduit International: Performing Well Despite COVID-19

Schweitzer-Mauduit International has performed strongly in the challenging economic environment which COVID-19 has caused.

It has a steady dividend and a decent balance sheet.

It currently trades at a 15% discount to fair value.

Schweitzer-Mauduit International (SWM) is a terrific special materials company which has undergone the same trial by fire that the entire global economy has passed through in the current financial year, and yet has managed to hold up very well. That makes it a tempting choice for long-term investors at its current valuation.

The carnage wreaked on the global economy by the COVID-19 pandemic has been considerable, and the U.S. has certainly been no exception to this rule. With the closure of much of the U.S. economy, real GDP growth fell 31.40% during Q2 2020, and unemployment hit 14.7% earlier in the year - one has to go back to the Great Depression to find comparable figures.

Obviously, many business sectors were adversely affected, as demand for crude oil declined due to the economic standstill and air traffic has declined as governments grappled with the problem of halting the spread of the virus. However, not every individual company has suffered the same issues that beset the oil sector or the airline industry, and Schweitzer-Mauduit International is one of those exceptions, as is clear from its 13.52% operating margin, reported free cash flow of $131.7 million, and the quarterly revenue and net income figures it has reported over the course of the current financial year.

| 2020 Quarter | Revenue ($) | Net Income ($) |

| Q1 | 262.1 million | 22.2 million |

| Q2 | 255.2 million | 21.2 million |

| Q3 | 280.2 million | 24.2 million |

| Total | 797.5 million | 67.6 million |

Figures collated from annual reports available on Schweitzer-Mauduit International's investor relations page.

How has Schweitzer-Mauduit International performed so well under such trying conditions? It is helped by the diversity of its portfolio, and the fact that many of its products remained in high demand. The firm divides its portfolio into two segments: advanced materials makes resin-based films, nets, and related products which have applications in construction, filtration, industrial and medical fields; and engineered paper sells cigarette paper and reconstituted tobacco leaf to manufacturers of cigars and cigarettes.

Schweitzer-Mauduit International has weathered COVID-19 due to its diverse portfolio. Image provided by Filtrexx Sustainable Technologies.

Of the two segments, advanced materials has proven the stronger. In fact, its medical sub-sector has seen strong demand throughout this period, which has seen its niche woundcare and hospital products performing well (e.g. N-95 facemasks, disposable facemasks, diagnostic test strips, finger bandages, advanced woundcare etc.). The engineered papers section did experience a bumpier ride, as its Ancram site in NY and three French facilities all closed during Q1 and some manufacturing issues arose while adjustments were made to the supply chain. However, all of these issues were overcome by Q2.

Overall, 2020 looks set to match the overall productivity and profitability that Schweitzer-Mauduit International has exhibited in previous years. The outlier among these figures is not 2020, but 2017, when a one-time non-cash tax expense of $40 million was paid due to the Tax Cuts and Jobs Act being signed into law in December 2017. Otherwise, performance has been strong.

| Year | Revenue ($) | Net Income ($) |

| 2015 | 775.2 million | 90 million |

| 2016 | 845.8 million | 82.3 million |

| 2017 | 981.7 million | 34 million |

| 2018 | 1.04 billion | 94.2 million |

| 2019 | 1.02 billion | 85.2 million |

Figures collated from annual reports available on Schweitzer-Mauduit International's investor relations page.

Shareholders have also benefited from Schweitzer-Mauduit International's strong performance, as is clear from the 14.56% return on equity and the dividend it has consistently paid since at least 1996. The dividend has not been raised this year after being consecutively raised for eight years previously, a prudent move in the midst of COVID-19. That said, the 61.80% payout ratio shows that there is scope for the dividend to be raised going forward.

Schweitzer-Mauduit International has rewarded shareholders with steady dividends since 1996 at least. Image provided by Schweitzer-Mauduit International.

That the firm is in decent shape to raise its dividend and perform strongly going forward is borne out by its balance sheet, as long-term debt of $558 million is offset by a net worth of $596 million and total current liabilities of $157.6 million are offset by total current assets of $427.5 million, cash-on-hand worth $103 million, and total accounts receivable of $155.7 million. However, growth going forward is not projected to be strong as earnings-per-share growth (3-5 year CAGR) is estimated to be 6.00%. This makes it necessary to get Schweitzer-Mauduit International at a decent price, and it currently looks as though it is trading at just such a price.

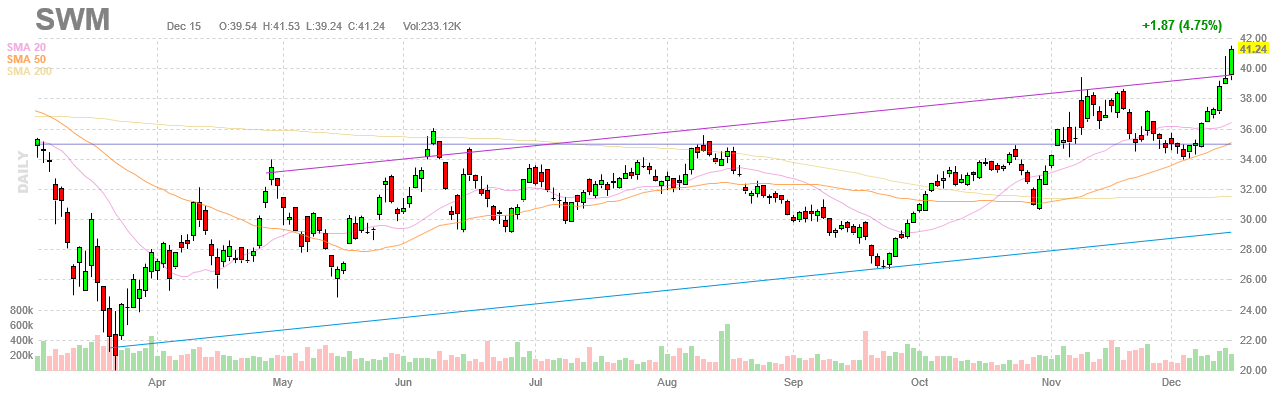

At close of market on 12/15/2020, Schweitzer-Mauduit International traded at $41.24 per share. Chart generated by FinViz.

At close of market on 12/15/2020, Schweitzer-Mauduit International traded at $41.24 per share. Chart generated by FinViz.

At close of market on 12/15/2020, Schweitzer-Mauduit International traded at a share price of $41.24 with a trailing price-to-earnings ratio of 14.71 based on trailing earnings-per-share of $2.80 and a forward P/E of 11.03 based on forward earnings-per-share of $3.74. Both metrics are lower than the five-year average P/E of 16.19, and the current dividend yield of 4.27% is higher than the five-year average dividend yield of 4.63%. All told, Schweitzer-Mauduit International appears to be trading at a discount to fair value - but what is fair value here?

To determine fair value, I will first divide the trailing P/E by the historical market average of 15 to get a valuation ratio of 0.98 (14.71 / 15 = 0.98) and divide the current share price by this valuation ratio to get a first estimate for fair value of $42.08 (41.24 / 0.98 = 42.08). Then I will divide the trailing P/E by the five-year average P/E to get a valuation ratio of 0.91 (14.71 / 16.19 = 0.91) and will divide the current share price by this valuation ratio to get a second estimate for fair value of $45.32 (41.24 / 0.91 = 45.32).

Next, I will divide the forward P/E by the historical market average of 15 to get a valuation ratio of 0.74 (11.03 / 15 = 0.74) and divide the current share price by this valuation ratio to get a third estimate for fair value of $55.73 (41.24 / 0.74 = 55.73). Then I will divide the forward P/E by the five-year average P/E to get a valuation ratio of 0.68 (11.03 / 16.19 = 0.68) and divide the current share price by this valuation ratio to get a fourth estimate for fair value of $60.65 (41.24 / 0.68 = 60.65).

Next, I will divide the five-year average dividend yield by the current dividend yield to get a valuation ratio of 1.08 (4.63 / 4.27 = 1.08) and divide the current share price by this valuation ratio to get a fifth estimate for fair value of $38.19 (41.24 / 1.08 = 38.19). Finally, I will average out these five estimates for fair value to get a final estimate for fair value of $48.39 (42.08 + 45.32 + 55.73 + 60.65 + 38.19 / 5 = 48.39). On the basis of this estimate, the stock is undervalued by 15% at this time.

In summary, Schweitzer-Mauduit International is a tough company with a diverse portfolio that has allowed it to perform strongly in the challenging economic environment caused by the COVID-19 pandemic. It maintains a strong dividend, has a decent balance sheet, and currently trades at a 15% discount to fair value - all of which make it a stock worthy of consideration for a prospective investor's portfolio.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.