Gogo has cleaned up its operations by selling its Commercial Aviation unit and entering into a 10 year network services agreement.

The revaluation of the debt is a short-term catalyst to propel the stock higher.

Gogo offers an interesting recovery play for flight and in general.

Thesis

Gogo (GOGO) has cleaned up its operations and balance sheet in 2020 and offers an interesting recovery play with its connection to flights and travel. The two catalysts to watch are the reopening trade, which should benefit Gogo and new debt refinancing.

With over 40% of the float short, Gogo can spike on the short and medium term trends with positive vaccine news, better travel news, earnings, and a 2nd re-rating of debt. I see the upside as vastly outweighing the downside and recommend a long position here.

Catalysts

I see several short-term catalysts that should propel Gogo higher. First, S&P Global upgraded Gogo to a B- on the sale of its commercial business, understanding that the cash flows are less strained. Specifically, the agency raised the senior secured tranches to B- from CCC+, and its unsecured debt to CCC from CCC-. I believe other agencies like Moody's will follow suit, which will poise the stock for a re-rate upwards.

The stock reacted poorly to the debt upgrade and participated in the general market rotation back to stay at home names. I believe this move in the short term does not make sense. A debt upgrade can only be good news and the operational efficiencies can only be a positive. The story is also cleaner and easier to understand, which should eventually attract new retail investors once this stock starts to rip.

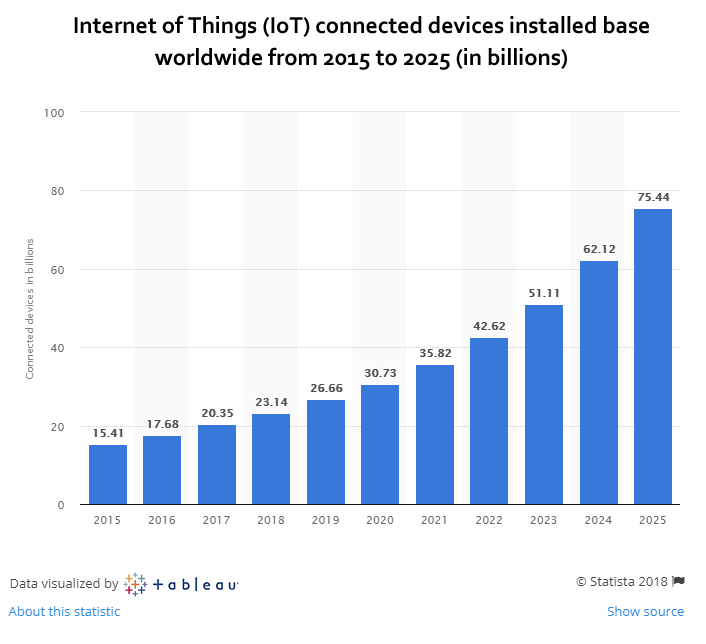

On the medium term, Gogo benefits from the reopening trade and there are many headlines which can help the company here. First, new vaccine news and higher numbers of flights will directly benefit the Gogo product pipeline. Second, the expansion of IoT and new devices in planes positions Gogo to innovate and add new devices and grow average revenue per device within the plane. Its real core advantage is the relationships Gogo has developed within the aviation space and its trusted brand within WiFi.

Source: Statista

Liquidity

I believe the additional $50 million of financing that Gogo recently secured also helps the cash position of the business. The CEO recently stated that they are burning $40 million without the deal closing, which would mean the company is in a positive cash flow position with the financing.

The CFO cited a lot of new customers in Q3 and the strength in the Business Aviation segment. He mentioned the strong upgrade cycle which will benefit Gogo in any market and in the medium term.

Market Changes

COVID will affect behaviors for flights in ways we have not yet anticipated. Although there is a dampening this year, I believe the YoY comps will be easier to bet next year, which flows down to Gogo.

Management believes that there have been more private fliers this year and going forward, which means more planes, and more demand for the types of services Gogo offers in-flight. This is a new secular tailwind that can drive additional demand in the long term that is not priced into the stock and the perpetuity growth.

Second, demand for air connectivity will only grow. The growth in smart devices and phones means that the percentage of travelers that are looking to stay connected is growing. I believe this also represents a tailwind, and that the norms of connected travel are changing in a positive way for Gogo.

Risks

Travel has been affected badly and that will hit short-term comps for Gogo. Gogo's refinance is still in the BBB area and is not a simple investment. The bull case for secular growth in connectivity is based on a belief at best.

There are several risks with this investment that are all warranted. But I believe the upside catalysts, change in story, and the recovery trade are all powerful upside catalysts. I believe that will result in a re-rating of the stock and Gogo will benefit with airlines and the rest of ancillary travel. I do think one has to carefully vet management, which has made the right moves to streamline the business and refinance its debt in recent years. I believe it can further refinance its debt and streamline operations, and focus on growth areas that are higher margin.

Sizing

Given the nature of the investment, I recommend sizing into it over time. Start with a small 0.5%-1% position and add over time on the dips. I believe the new debt upgrade will happen in the next 6 months given that the S&P just re-rated the debt. That will be a major catalyst for the stock and an investor in this name wants to be there in size for that repositioning when it happens to benefit from all the story changes at that time. I believe it is good to add at that point as the reopening trade happens throughout 1H'21 and more people get vaccinated.

Disclosure: I am/we are long GOGO. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.