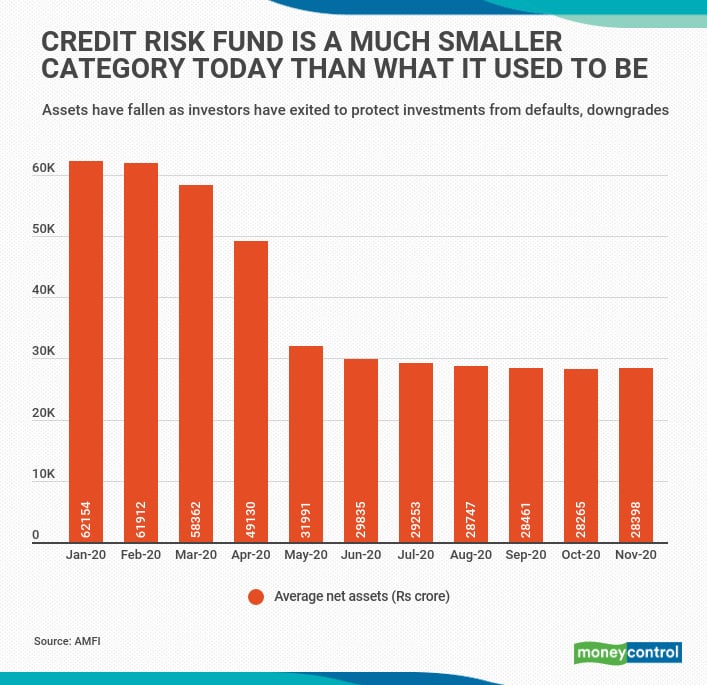

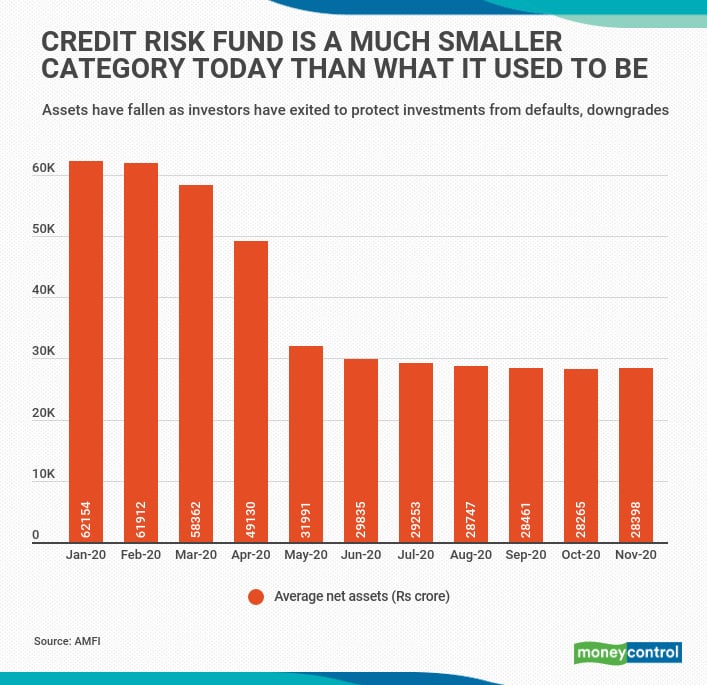

The credit risk fund category’s fortunes seem to have plummeted, what with assets declining from Rs 62,154 crore in January 2020 to Rs 28,000 crore currently. Defaults in corporate bonds and rating downgrades have impacted value of investments held by these schemes.

This sharp fall in assets was set in motion, in the aftermath of the IL&FS crisis and more recently with the shutting down of Franklin Templeton’s debt schemes. There have been steady outflows in the credit risk fund category.

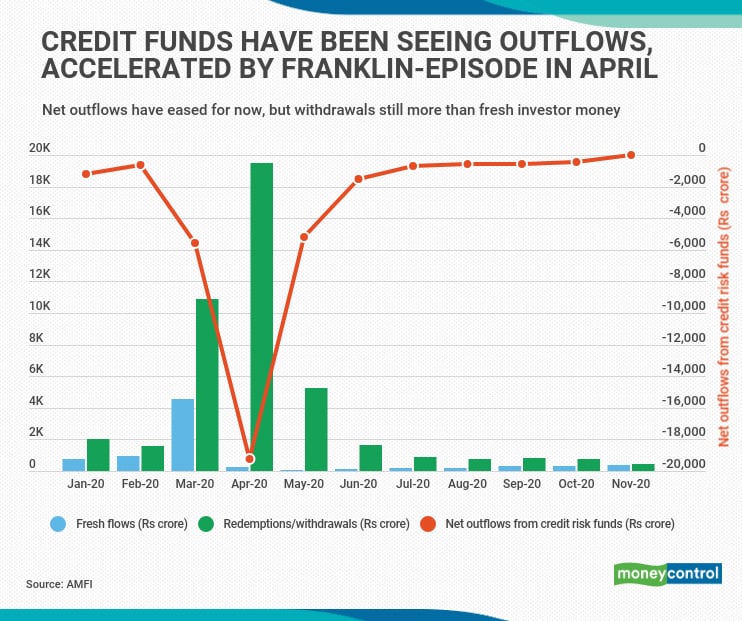

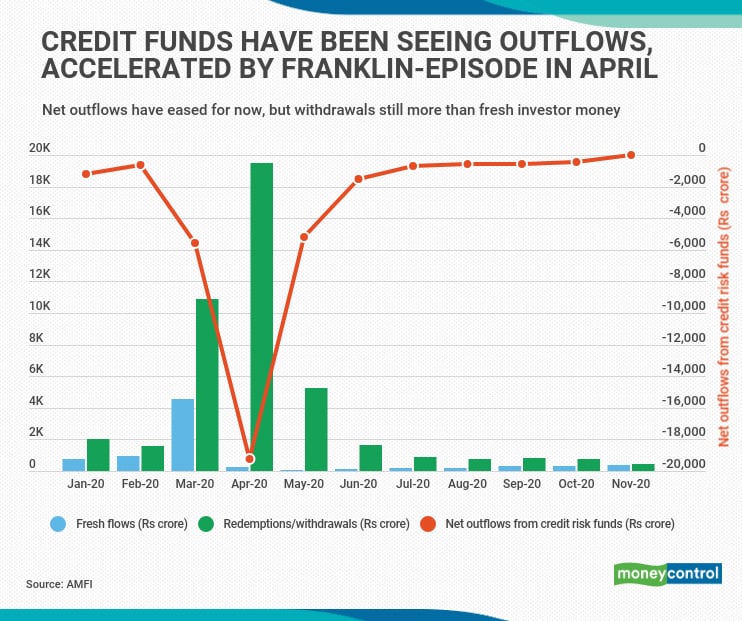

Since AMFI to disclose detailed data on flows in April, 2019, there hasn’t been a single month when the category has seen net inflows.

While redemptions showed signs of easing in November 2020, the net outflows have continued. Net outflows indicate that there are more withdrawals than fresh investor funds coming in.

In November, the redemptions in credit risk funds were 43 percent lower than in the previous month. As a result, the net outflows dropped to Rs 15 crore. In the current calendar year, credit risk funds have seen net outflows of Rs 35,513 crore.

Holding on to cash

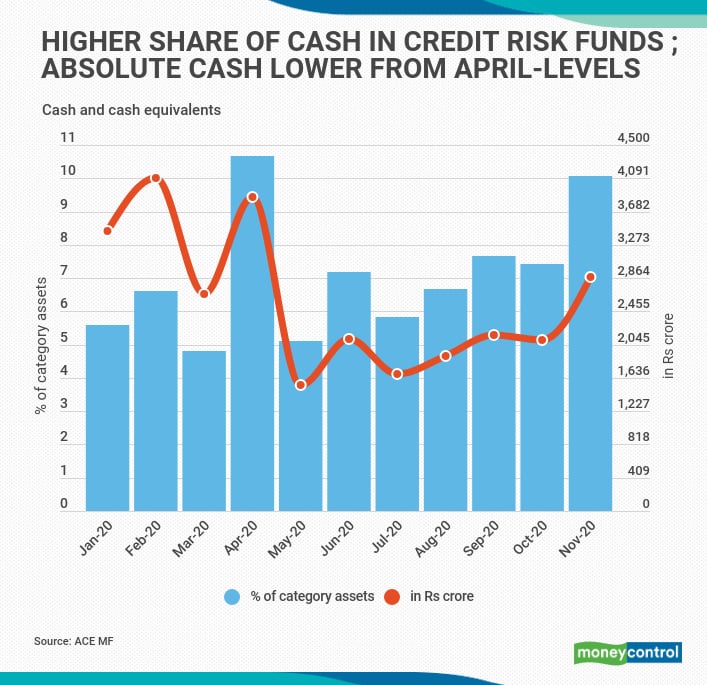

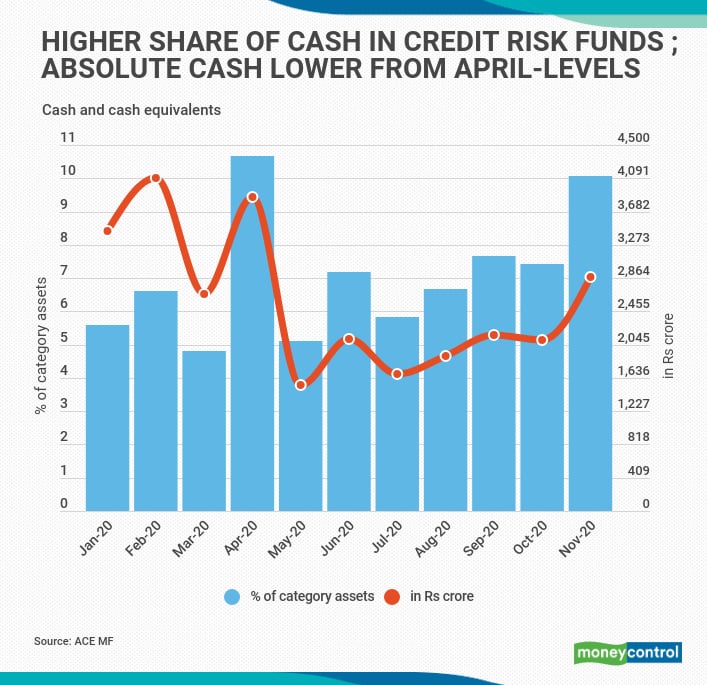

Data collated from ACE MF shows that as of November 30, 2020, credit risk funds had around 10 percent of investments in cash and cash-equivalents. Cash-equivalents are investments that can be easily sold in the markets, as they are highly liquid. These include investments such as government securities and treasury bills.

“Fund managers are being conservative as redemptions in credit risk funds have continued since April, following the Franklin Templeton episode. Also, there has been a lack of fresh issuances of good-quality credit papers,” says a fund manager, requesting anonymity.

The rise in cash can also be attributed to credit risk funds receiving coupons or repayments on their bond investments, but not re-deploying this cash.

“Fund managers want to ensure there is enough liquidity if redemptions continue. At the same time, there is a lack of investment opportunities. The yields on AA-rated papers have shrunk to 6-7 percent as debt markets have been sharp jump in liquidity following the steps taken by the RBI and government,” says another fund manager, requesting anonymity.

“The rates can go up if there is withdrawal of liquidity from the system. The portfolios may have kept cash to catch any spike in yields that may be seen in the next few months,” says Amit Bivalkar, director at Sapient Wealth.

Fund managers also don’t want to take risks in lower-rated papers, where yields are high, but these also carry higher risks.

There is also a technical issue here. To participate in credit investments, a fund manager needs to trade in higher lot sizes (of Rs 25-30 crore), as these investments are less liquid. In more liquid debt instruments such as government securities or bonds of government-owned companies, a fund manager can transact in smaller lot sizes.

Due to drop in asset sizes of several credit risk funds, there are schemes that don’t have enough cash to pick-up higher lot sizes.

So in certain cases, the share of cash has gone up due to fall in overall asset size, but this cash is still not much in absolute terms.

Moneycontrol’s take

It is fine for a scheme to keep cash in the portfolio. Lack of liquidity in debt markets can make it difficult for schemes to sell their investments in open markets, to honour redemptions. Such a forced sale can impact the net asset value of the scheme, and hurt the value of investments for the remaining investors. But, an adequate amount of cash can help in avoiding such outcomes.

At the same time, an investor needs to keep track of the cash holdings. If a large part of your fund is exposed to cash all the time, it means your fund manager is shying away from taking any calculated risks to help the scheme generate returns.

Credit risk funds charge a total expense ratio (TER) of 1.5-1.8 percent to investors, shows data from ACE MF. This includes asset management fees and other expenses for running of the scheme.

As these schemes charge the highest TER among debt funds, investors should keep track of the cash holdings in these funds.

_2020091018165303jzv.jpg)