HealthEquity, Inc.: Antidote For Health Savings

One of the largest providers of health savings accounts.

Assets grow as individuals become more responsible for healthcare spending.

Building scale through a recent acquisition.

Courage taught me no matter how bad a crisis gets ... any sound investment will eventually pay off.

- Carlos Slim Helu

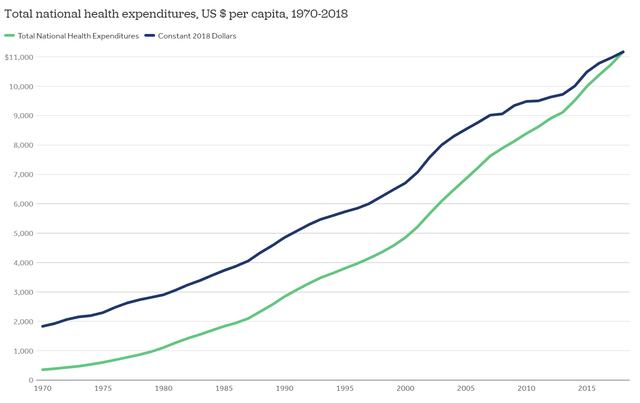

We all wish the graph below depicted our own personal portfolio growth! Unfortunately, it shows how fast per capita health expenditures have been growing in the United States. The rise is staggering, with per capita spending increasing from $355 per person in 1970 to $11,172 in 2018.

Source: Peterson Center on Healthcare and Kaiser Family Foundation

Rise of high deductible plans and health saving accounts

One implication, and sometimes proffered solution, of increased health spending is to push more responsibility back on the consumer. Hence the rise of high deductible health plans under which consumers are responsible for paying a larger portion (the deductible) of healthcare costs before plan coverage kicks in. To help consumers save enough funds to cover escalating deductibles, health savings accounts have become more popular.

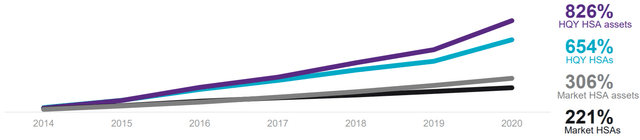

HealthEquity, Inc. (HQY) is one of the top administrators of Health Savings Accounts (HSAs). In 2020, the company estimates it has the #1 market share by HSA accounts and #2 by HSA assets. HQY has secured these top spots by growing faster than the market, with an 826 percent growth in HSA assets from 2014 to 2020 compared to 306 percent growth in the overall market, as shown below.

Leading provider of accounts

In the most recent quarter, HSA assets grew at a faster pace than accounts, with a 19 percent year-over-year growth in HSA assets to $12.4 billion total. HSA accounts totaled 5.5 million, with 11 percent year-over-year organic growth. HQY also provides flexible spending and health reimbursement arrangements (FSAs and HRAs), Consolidated Omnibus Budget Reconciliation Act (COBRA) administration, commuter, and other benefits. HQY reported 7 million accounts across these other products.

Financial performance

HQY earns revenues from recurring monthly account fees (service revenues), custodial revenue, and interchange revenues from merchant fees paid when members use physical payment cards. For the most recent quarter, revenue grew 14 percent to $179 million, despite a substantial reduction in revenues from suspended commuter accounts due to participants working from home. EBITDA increased 10 percent year over year with a 36 percent margin.

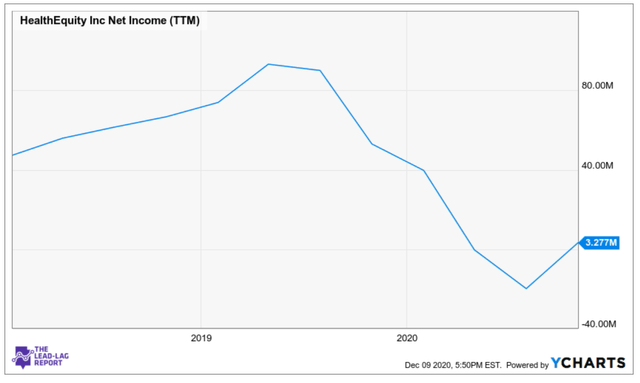

Net income of $1.8 million for the quarter was improved from a loss of $32 million in the year-ago period. HQY’s profitability has declined since late 2019, as illustrated below, due to a jump in interest expense after $1.2 billion of debt was issued to fund the acquisition of WageWorks on August 30, 2019. The company has identified roughly $80 million of synergies from the merger, of which approximately $55 million have been achieved as of the most recent quarter.

Business outlook

Management expects to roughly break even for the current fiscal year ending January 21, 2021, guiding somewhere between a net loss of $5 million and net income of $2.0 million. Guidance is for revenues in the range of $725-731 million, equating to over 30 percent growth.

Valuation

Analysts expect the company to return to profitability in the coming year with a forward PE ratio of 41 times. This compares favorability to valuation before the acquisition when HQY traded in the range of 60-90 times price-to-earnings. I believe the acquisition was a good move as scale is beneficial in the business of administering accounts.

Risks to ownership

- Longer-term impacts on HQY’s business from the COVID-19 virus could be harmful, such as if consumers will have fewer funds to save in HSAs, if employees reduce the amount they contribute to HSAs, or if commuter accounts will decrease.

- The healthcare business, including HSAs, may face increased regulation over time.

Summary

HQY is a leader in its products and I always appreciate investing in the best-in-class business. Over time, recurring revenues for HQY should continue to grow as more consumers move to HSAs and it becomes a more popular vehicle for increased savings. The recent acquisition of WageWorks builds economies of scale and projected earnings after the deal is absorbed implies an attractive valuation for HQY.

*Like this article? Don't forget to click the "Follow" button above!

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.