Southwest Gas Holdings: BofA Downgrade, Arizona Rate Decision Are Curious And Relevant

On Dec 10, 2020, Bank of America downgraded Southwest Gas to “Underperform,” or code word for sell.

The Arizona utility commission ruled on a May 2019 rate request, and it was not all favorable for the utility on several fronts.

While Arizona is an important state for Southwest Gas, the underlying population and economic growth profile, added to its utility construction business, outweighs the ACC rulings.

Southwest Gas Holdings (SWX) is a natural gas local distribution utility with a very active utility construction subsidiary. Last week, the public utility board of Arizona, Arizona Corporation Commission, ACC, ruled on a May 2019 rate request for Southwest Gas Holdings, and it was not in the company’s favor. The fallout was quick as Bank of America (BAC) cut SWX rating to “Underperform,” which in many investors' outlook is a sell signal. However, I am not overly concerned and am using share price weakness to add to my position, especially below $60 a share.

Southwest Gas offers natural gas service to around 2 million customers in Arizona, Nevada, and parts of far eastern California. SWX also operates a full-service construction company, Centuri Group, specializing in leak-prone natural gas pipe replacement and electric distribution repair and maintenance, such as storm damage in the Southeast. SWX is the largest gas utility in Arizona, serving the Phoenix and Tucson metro areas and the largest gas utility in neighboring Nevada serving Las Vegas and northern portions of the state. SWX service territory sneaks across the state line into Lake Tahoe, California. In 2019, the utility segment generated 44% of corporate revenues and 76% of net income while Centuri generated 56% of total revenues and 24% of net income.

Of Southwest Gas 2 million LDC customers, 53% are in Arizona, 37% are in Nevada, and 11% are in California. 85% of SWX gas utility customers are residential and small commercial and 12% represent transportation clients, such as natural gas-powered buses. These customers historically pay slightly higher prices than large volume industrial users and during the pandemic residential business offered many utilities a more stable base of users. The Arizona utility segment generates around 38% of total companywide earnings, represents about 44% of SWX total regulated rate base, and is an important contributor to SWX’s earnings. Hence, any changes to SWX’s Arizona utility rates have an impact on the company’s overall profitability.

According to the company’s website, Arizona’s allowed ROE is 9.50%, Nevada’s allowed ROE is 9.25%, and California’s allowed ROE is 10.10%. The weighted average allowed ROE for its utility business is 9.55%, and lines up with the nation’s average of around 9.50% to 9.75% allowed ROE. These allowed ROE levels support the “Average” rating for utility regulatory environment by Regulatory Research Associates, a service of S&P Global, for each of the three states.

In addition, CFRA rates Southwest Gas as an "A" for 10-yr consistency in earnings and dividend growth. Within the utility sector, only 18 companies have earned similar or higher ratings for rewarding shareholders through consistent growth.

Southwest Gas service territory has been, and will continue to be, a hot bed of US population growth and increasing economic activity. This is showing up as a consistent 1.8% annual growth in the number of natural gas hookups and is one of the larger customer growth rates of the sector. With an annual customer growth rate of 35,000 to 40,000 new hookups, SWX underlying service expansion should persist for the foreseeable future as population trends continue to favor the southwest.

Southwest Gas filed for a periodical rate increase in March 2019, and like most utility commissions, the process to a decision creates what is called “regulatory lag,” or the time between the spending and the time before that expense is incorporated into customer’s bills. As with most utility negotiations, the company requests higher rates and utility prices than the commission finally approves. In early 2019, Southwest Gas requested the Arizona Corporation Commission to approve a 15.6% increase in utility rates and to approve the addition of specific investments into the rate base. This amounted to a rate request increase of $81 million to its Arizona revenues. A few weeks ago, the commission’s Arizona Administrative Law Judge reviewing the request issued a recommendation of a $52 million rate increase. Last week, the Arizona Corporation Commission issued their decision, and it was not in the favor of SWX. Most interestingly, the ruling came with some peculiar provisions.

The ACC decided on a $38 million increase in utility rates, or a 9.7% increase. Plus, the ACC ruled to disallow Southwest Gas leak-prone pipe replacement program in Arizona, and its $100 million annual capital investment. In addition, the ACC severely cut a companion program replacing the customer-owned yard gas lines from the street to residential meters.

In Jan. 2020, the National Association of Regulatory Utility Commissioners published a report titled Natural Gas Distribution Infrastructure Replacement and Modernization: A Review of State Programs. As outlined in the report, the US has a very expensive problem of failing and leak-prone cast iron and bare steel gas distribution pipes in need of replacement. To counter this lethal exposure, gas utilities across the country are methodically replacing older leak-prone gas pipes. As described in the summary, replacing leak-prone pipes may not be viewed with the same investment criteria as new service infrastructure.

Utility commissions across the country have reviewed and continue to review infrastructure modernization programs to replace aging natural gas delivery infrastructure. In certain states, the programs are a result of regulatory filings, whereas in others, modernization and replacement policies were developed pursuant to legislative action. The goal of each of these programs is the same: to ensure that the infrastructure upgrades and/or replacements necessary for the safe, efficient, and reliable delivery of natural gas are completed. Utility accounting does not always allow cost recovery for projects that do not generate revenue. A gas distribution company can only earn a return on investment on infrastructure projects that can be seen as “used and useful.” An investment in upgrades, although useful, does not create infrastructure that is used.

According to the Pipeline Hazardous Materials Safety Administration, Arizona still has 465 miles of leak-prone steel distribution pipes, no cast iron pipes, and almost 7,000 residential bare steel service lines. While other states have a substantially higher number of miles of leak-prone gas pipes, the urgency of replacement has not diminished. In 2012, the ACC approved a new program offered by Southwest Gas for bare steel pipe replacement and the replacement program was reapproved in a 2016 rate request. It seems to me quite odd that with hundreds of miles of leak-prone pipes still in need of replacement, and the danger still quite real, the ACC would disallow any future investment in SWX’s Vintage Pipe Replacement (VPR).

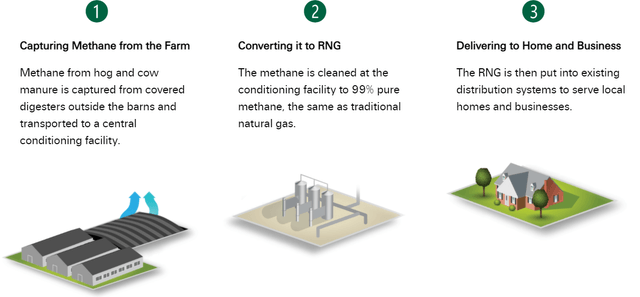

In addition, Southwest Gas has requested approval to develop and implement a farm-based “renewable natural gas” RNG project that is gaining popularity with other natural gas utilities. Dominion Energy (D) and others are developing anaerobic digesters that will turn cow and pig manure into a renewable natural fuel, as described in the graphic above from Dominion’s website. Dominion is investing $200 million to capture manure methane from farms in Colorado, Utah, New Mexico, Georgia, Maine, and Nevada and convert it into natural gas. SWX requested approval for a similar pilot project in Arizona but was denied by the ACC. In its place, the ACC approved conducting “workshops” to further examine the practice.

On the heels of the ACC ruling, Bank of America (BA) cut its recommendation for Southwest Gas to “Underperform.” Since there are seldom any official Sell recommendations from Street analysts, many investors, me included, take this rating as a recommendation to exit the stock. As thefly.com reported on Dec 10:

Southwest Gas cut to Underperform at BofA after AZ rate case decision: BofA analyst Richard Ciciarelli downgraded Southwest Gas to Underperform from Neutral with a $60 price target. The analyst is citing the outcome of the Arizona rate case, in which the ACC moved to a post-test year-plant of 6-months from 11-months, cut the $20M per year Customer-Owned Yard Line program in half, and disallowed the $100M per year of Vintage Steel Pipe program rider capital spending. Ciciarelli adds that since Southwest Gas management has recently stated that it has no plans to reduce capital spending or change its "regulatory filing cadence", he sees a "clear downside" to the company's earnings outlook.

I believe this analysis is a bit hasty in its conclusion. As situations change, so does management’s reactions. While pre-ruling comments indicate SWX’s preference of maintaining its capital spending profile including the leak-prone pipe replacement program and its current pace of rate requests, I believe management will alter both based on recent ACC decisions. There is also the legislative alternative to ACC’s denial of continuing SWX’s safety protocol.

Compared to their electric brethren, natural gas utilities have fewer capital investment opportunities. Electric utilities expand their rate base by building more power plants, improving the efficiency of the power grid, and expanding renewable energy profiles. Many gas utilities view leak-prone pipe replacement as their equivalent of “electric grid upgrades.” The removal of additional leak-prone pipe replacement expenses in the Arizona rate base creates the potential for a slightly smaller growth profile for Southwest Gas in the state. Within the bigger picture of $700 million in annual companywide utility-related capital expenditures over the next two years, the discontinuation of the Arizona pipe replacement program represents around 15% of total expected company budgets.

Southwest Gas is one of only 12 publicly traded pure natural gas utilities. According to an article by S&P Global Market Intelligence, natural gas utilities historically trade at a premium to electric utilities. However, recently gas utilities have swung to trading at a discount. As of Oct 1, S&P noted local distribution companies moved from a relative 9% PE premium over S&P Utilities to a 14% discount. Since July 2020, an index of gas utilities has declined 7% vs. a 5% gain for the mostly electric utilities index.

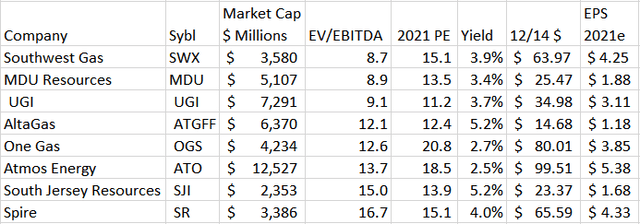

The table below outlines seven LDCs' trading characteristics as of Dec 14.

Using the recent utility merger valuation range of 12x to 15x enterprise value divided by EBITDA as a yardstick, Southwest Gas's current price offers both an adequate yield and a discount to many utility peers, both natural gas and electric.

While Arizona is an important state for Southwest Gas, the utility still offers both an above average growth profile and a very active, and profitable, utility construction segment. Unlike some states in the US, the southwest area should have ample future supplies from both a Utah-based pipeline network and west Texas. In addition, of the natural gas utility stocks listed above, only SWX, UGI (UGI) and Atmos Energy (ATO) have earned an “A” or “A+” rating. Of these three, SWX offers the best current value.

Investors need to be aware of both a growing national anti-natural gas sentiment and an increasing focus on ESG investing. LDC utilities usually are not included in industries which qualify for ESG inclusion. The Arizona rate case’s deferral of SWX’s RNG pilot project does not coincide with the available and improving technology of creating a renewable source of natural gas. While RNG will not generate sufficient volumes to replace most well-generated natural gas, it is a step in the right direction.

While a bit more concerned with the utility regulatory environment and anti-gas stance in Arizona than I was previously, Southwest Gas’s investor benefits outweigh these added risks. I used the recent decline to under $62 to add to my SWX position and plan on repeating the process if it dips below $60. With its current 3.9% yield, Southwest Gas fits nicely in my investment bucket titled “Equities Bought Primarily for Income.”

Author's note: Please review my SA profile for disclosures.

Disclosure: I am/we are long SWX, D. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.