A wave of investment in emerging-market exchange-traded funds is about to erase pandemic-driven outflows of as much as $20 billion earlier in the year.

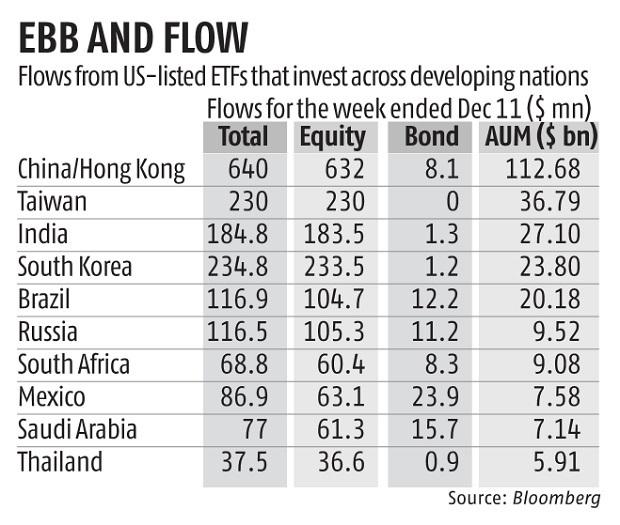

US-listed ETFs that invest across developing nations as well as those that target specific countries received $2.17 billion in the week ended December 11, according to data compiled by Bloomberg.

That was the sixth straight week of inflows in a $11.5 billion streak that has trimmed the year-to-date outflow to $1.42 billion.

Inflows were led by the $65.9 billion iShares Core MSCI Emerging Markets ETF, the second largest of its kind, as it received $1.2 billion last week, the largest investment in a year.

Russia was the highlight among country-specific ETFs, as the top $1.7 billion VanEck Vectors Russia ETF, or RSX, received a $81 million inflow, the seventh in a row.

Meantime, the pace of inflows to China-focused funds slowed down as the $3.6 billion. The pick up in emerging-market ETF flows comes as the MSCI Emerging Markets Index is about to surpass its 2018 high, which would take the gauge to a 13-year record.

Signs of progress for a US stimulus deal and hopes that Covid-19 vaccination campaigns will give the global economy a boost next year are driving investors into riskier assets.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU