National Oilwell Varco's Valuation Is Compelling

NOV's Q3 revenue fell 6% Q/Q. EBITDA margins improved amid cost containment efforts.

Oil markets appear to be perking up as the economy slowly reopens. NOV should benefit from rising oil prices.

At 6.3x EBITDA, I believe NOV's valuation is compelling. Buy NOV.

Source: National Oilwell Varco

Source: National Oilwell Varco

For years, I have been bearish on the global economy and cyclical names like National Oilwell Varco (NYSE:NOV). OPEC supply cuts and Pfizer's (NYSE:PFE) prospects for an effective COVID-19 vaccine have helped drive Brent oil above $45. The outlook for oil-related names has brightened now that the economy could reopen sooner than expected. In Q3, National Oilwell reported revenue of $1.4 billion, down 7% sequentially and down 35% Y/Y.

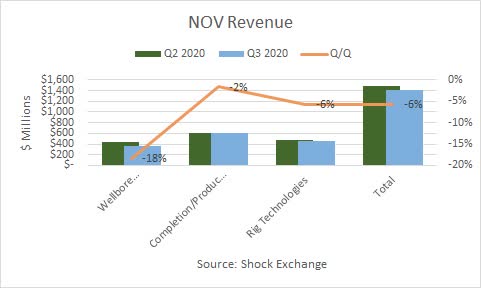

Q3 product sales were negatively impacted by the knock-on effects of the pandemic. Each of the company's product segments experienced a decline in revenue. Wellbore Technologies generated revenue of $361 million, down 18% Q/Q, due to a sharp decline in North America drilling activity and international drilling activity.

Q3 product sales were negatively impacted by the knock-on effects of the pandemic. Each of the company's product segments experienced a decline in revenue. Wellbore Technologies generated revenue of $361 million, down 18% Q/Q, due to a sharp decline in North America drilling activity and international drilling activity.

Completion/Production activity only fell 2% Q/Q as execution on National Oilwell's international and offshore project backlog helped offset declines in shorter-cycle businesses. Rig Technologies revenue declined 6% Q/Q on lower equipment sales and declines in parts and services. Offshore E&P may not show a meaningful improvement unless oil prices rise into the $65-$70 range. Rig Technologies could lag National Oilwell's other segments for the next few quarters.

The U.S. rig count improved by 15 for the week ending December 11th, implying E&P for North America land drilling could perk up. This makes sense given the rise in oil prices. National Oilwell's shorter-cycle businesses (Wellbore Technologies, Completion/Production) represented 68% of total revenue during the quarter. They could show signs of life in the first half of 2021. I expect the performance of short-cycle businesses to drive the narrative going forward.

Margin Improvement

National Oilwell and other oil services firms have cut costs to help offset declines in revenue. Cost containment efforts helped National Oilwell improve its margins. In Q3 gross margin was 10%, up from 9% in Q2. Gross profit on a dollar basis was $139 million, up 1% sequentially. SG&A expense was $213 million, down 10% sequentially.

Management has proven the ability to navigate the company through volatile oil markets. The pandemic caused demand destruction for oil, requiring aggressive cost reductions by management:

For the past few quarters, we sought to be clear and transparent in our communications with you on what we are doing to navigate this historic downturn, namely: one, aggressively and proactively downsizing and reducing costs; two, reducing working capital and CapEx to maximize cash flows; three, maximizing liquidity; and four, continuing to invest in research and development and new products to position the company for the inevitable upturn.

I'm pleased to report that we continue to exceed our targets on cost reductions. We have reduced our global facility footprint, workforce and support services, making our operations leaner and more efficient. We also continue to prune businesses that are not yielding adequate returns.

The fallout was that EBITDA of $9 million was favorable compared to the $18 million EBITDA loss reported in Q2. EBITDA margin was 1% and will likely improve if National Oilwell can generate positive revenue in the first half of 2021. It could take another quarter for revenue to stabilize. By Q1 the company could report outsized growth in EBITDA on any modest recovery in revenue.

NOV's Valuation Is Compelling

It is paramount for National Oilwell to maintain ample liquidity amid an uncertain economy. The company finished Q3 with $1.5 billion in cash and $3.5 billion in working capital, down from $3.9 billion at year-end. Free cash flow ("FCF") through the first nine months of 2020 was $567 million, up from $74 million in the year earlier period. As the business retrenches, National Oilwell should be able to monetize working capital to drive FCF. This is a positive effect of decline revenue.

For now, working capital appears to be stable enough to support the company for several quarters. NOV has an enterprise value of $5.9 billion and trades at 6.3x last 12 months' ("LTM") EBITDA. This is much less than Schlumberger (NYSE:SLB), which trades at around 9.4x EBITDA. The offshore segment could face headwinds unless oil prices rise another $15 to $20. However, I believe the valuation is compelling, especially since the economy and oil markets could continue to recover early next year.

Conclusion

NOV is off over 40% Y/Y. I rate the stock a buy amid a potential recovery in oil markets.

I also run the Shocking The Street investment service as part of the Seeking Alpha Marketplace. You will get access to exclusive ideas from Shocking The Street, and stay abreast of opportunities months before the market becomes aware of them. I am currently offering a two-week free trial period for subscribers to enjoy. Check out the service and find out first-hand why other subscribers appear to be two steps ahead of the market.

Pricing for Shocking The Street is $35 per month. Those who sign up for the yearly plan will enjoy a price of $280 per year - a 33% discount.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in NOV over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.