Don't Expect Much Through Year End (Technically Speaking For 12/13)

The QQQ and SPY both had large outflows last week.

A hard Brexit seems likely.

The markets will likely meander for the rest of the year.

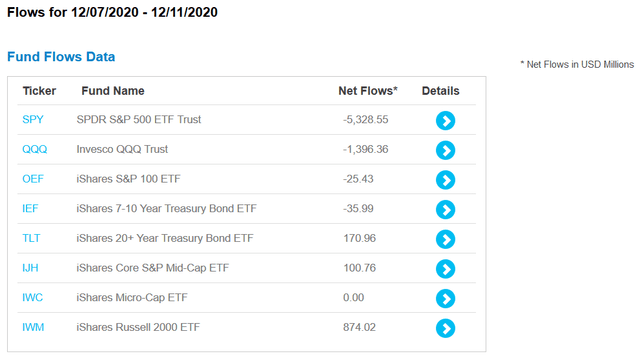

Let's start with the usual starting point -- last week's fund flows from ETF.com:

Let's start with the usual starting point -- last week's fund flows from ETF.com: The SPY had a pretty big net outflow - - $5.3 billion. The QQQ also lost a decent amount of cash: $1.4 billion. This is probably due to end-of-the-year profit-taking. But small-caps saw a net inflow, continuing the "reflation" trade. The long-end of the treasury market had a modest inflow.

The SPY had a pretty big net outflow - - $5.3 billion. The QQQ also lost a decent amount of cash: $1.4 billion. This is probably due to end-of-the-year profit-taking. But small-caps saw a net inflow, continuing the "reflation" trade. The long-end of the treasury market had a modest inflow.

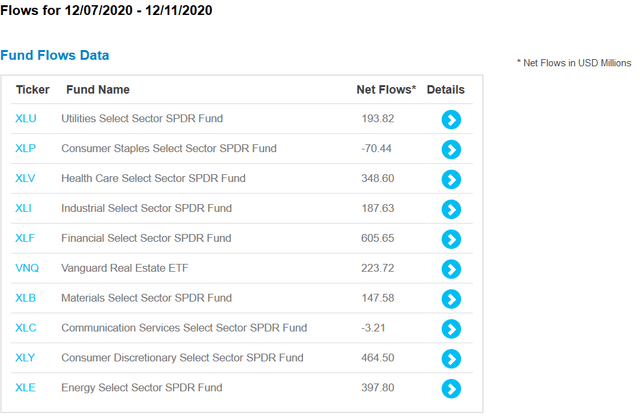

Only two sector ETFs -- consumer staples and communication services -- lost cash, and then the amount was negligible. Financial services had the biggest inflow -- slightly over $600 million. Three other sectors -- health care, consumer discretionary, and energy -- had a decent amount of new investment.

Only two sector ETFs -- consumer staples and communication services -- lost cash, and then the amount was negligible. Financial services had the biggest inflow -- slightly over $600 million. Three other sectors -- health care, consumer discretionary, and energy -- had a decent amount of new investment.

This week, there are three key economic releases. The first is industrial production. I took an in-depth look at this number on Friday. Here's the macro-level data:  Industrial production quickly regained about half its losses. The data has been trending sideways for the last few months but the last reading sent the number to a recovery high.

Industrial production quickly regained about half its losses. The data has been trending sideways for the last few months but the last reading sent the number to a recovery high.

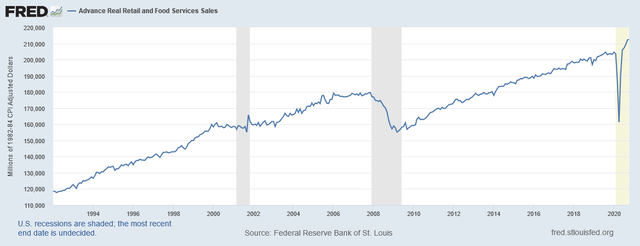

Retail sales are doing very well:

Retail sales have regained all their lockdown losses. However, the expiration of unemployment benefits combined with Congress' difficulty in passing a second stimulus bill might hamper growth in the next few months.

Retail sales have regained all their lockdown losses. However, the expiration of unemployment benefits combined with Congress' difficulty in passing a second stimulus bill might hamper growth in the next few months.

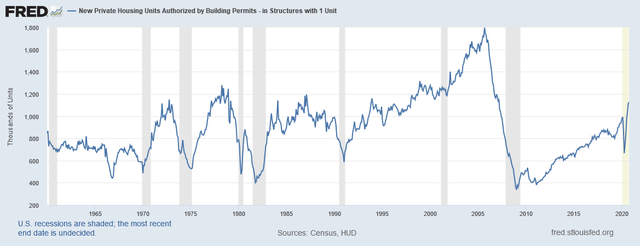

Finally, there are building permits:

Like retail sales, building permits quickly rebounded as well. Housing has been one bright spot during the recovery.

Like retail sales, building permits quickly rebounded as well. Housing has been one bright spot during the recovery.

The Brexit drama continues (emphasis added):

Still, British Prime Minister Boris Johnson, in a TV address, did not sound optimistic. "I'm afraid we're still very far apart on some key things," he said. "But where there is life, there's hope; we're going to keep talking to see what we can do. The U.K. certainly won't be walking away from the talks."

Johnson warned "the most likely" outcome would see Britain depart the European Union without a deal, leaving it to trade on what the prime minister insists on calling "Australian terms," which really means defaulting to do business by the rules set by the World Trade Organization.

The sarcastic part of my personality says that a no-deal Brexit would be the perfect way to end a rather chaotic 2020.

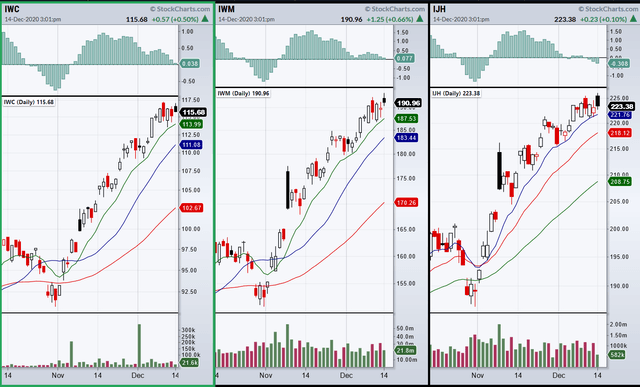

I'm not expecting much to happen for the rest of the year, barring, of course, an unforeseen event. First, this is the last full week of trading for 2020: the next two weeks have holidays at the end of the week, making both 3-day work weeks. As I noted most of last week, there are a number of signs that a short-term top is in (see here, here, and here). And momentum is weaker. Let's start with the smaller-cap indexes: Above are two-month charts for the IWC (left), IWM (middle), and IJH (right). First, note that all three had a great November as traders engaged in the "re-flation" trade. Second, notice the histogram in the top panel, which is a proxy for momentum and has been decreasing since mid-November. That means that upward price pressure is decreasing.

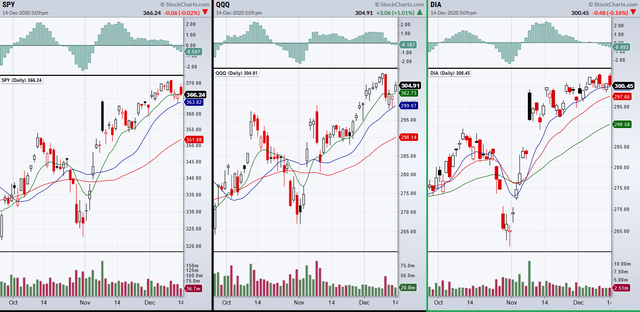

Above are two-month charts for the IWC (left), IWM (middle), and IJH (right). First, note that all three had a great November as traders engaged in the "re-flation" trade. Second, notice the histogram in the top panel, which is a proxy for momentum and has been decreasing since mid-November. That means that upward price pressure is decreasing. Above are 2-month charts for the SPY (left), QQQ (middle), and DIA (right). All three indexes have the same momentum issue. Furthermore, both had sharp sell-offs last week (notice the large red bar on all three charts) that effectively ended short-term rallies.

Above are 2-month charts for the SPY (left), QQQ (middle), and DIA (right). All three indexes have the same momentum issue. Furthermore, both had sharp sell-offs last week (notice the large red bar on all three charts) that effectively ended short-term rallies.

This doesn't mean I think a large sell-off is coming. As I've noted, the fundamentals are fairly bullish. While there are some concerns (with the labor market, industrial production, and further stimulus), the overall picture is fairly good. I think the most likely direction is an overall meandering into the new year as the market digests November's gains.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.