Lovesac: Okay, Now I'm Sold

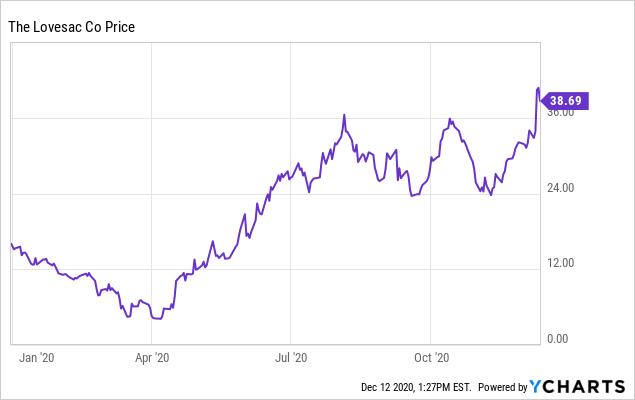

Shares of Lovesac have rallied on recent fundamental strength.

Lovesac has enjoyed the same demand boost that other furniture stocks like Wayfair and Restoration Hardware have benefited from this year.

In the company's most recent quarter, revenue growth accelerated from 28% y/y to a stunning 42% y/y.

Lovesac's margin profile has also dramatically elevated, positioning the company for GAAP profitability.

Over the past year, I've opted to stay on the sidelines for Lovesac (LOVE), a fast-growing casual furniture maker that targets modular furniture toward affluent millennials. The company's sleek and modern designs have earned it a spot in the pricey (yet not too expensive) furniture segment, elevating it above bargain staples like IKEA, and more and more Lovesac showrooms are popping up in high-traffic retail corridors across the U.S.

Initially this year, things weren't looking good for Lovesac. The pandemic initially hurt sales due to closures of Lovesac's retail showrooms (which are a big driver of traffic for the Lovesac brand, despite the company's e-commerce focus), and ongoing tariff pressures constrained Lovesac's gross margin growth.

Lovesac, however, appears to have emerged from the pandemic stronger. Despite the current second wave of lockdowns, recent top-line strength and a greater propensity to spend on home products (as we have spent more time cooped up at home, affluent customers are shelling out more and more money to make their homes more livable, creating an unexpected boom for home goods products) will position Lovesac for strong growth once we exit the pandemic.

Shares have been on an upward tear over the past month, bringing the stock's year-to-date rally up more than 2x:

Yet in my view, I still think there is more room for upside in this stock heading into 2021 as I revise my view from a prior neutral stance to a bullish one.

In particular, here's what I like about Lovesac now:

- E-commerce growth driving market share gains. Lovesac has always been a proponent of an online-first business model (its retail showrooms are meant to get people familiar with the product, as many people still won't buy furniture sight unseen - but it fully intends to close sales online). Yet this year, Lovesac's online-first mentality has driven tremendous success in sales, with Q3 e-commerce revenues growing at a blazing 125% y/y pace. This has positioned Lovesac to capture significant market share in a very fragmented and crowded industry for furniture.

- Possibility for product category expansion. Right now, Lovesac is still very much a small cap stock (at least in the furniture space), generating only about ~$75 million in quarterly revenue. The bulk of Lovesac's revenue comes from its flagship Sactionals product, but in the future the company has plenty of opportunity to use its brand name to expand into other furniture categories.

- High gross margins for a product company. As of Q3, Lovesac has returned to gross margin growth. For a consumer products company, Lovesac's mid-50s gross margins is impressive and speaks to the company's long-term scalability.

- Lovesac has been able to drive accelerating growth in spite of winding down discounting. Lovesac has curtailed excessive discounting in the wake of the pandemic, and yet the company has been able to drive strong growth. This lessening of promotions has helped Lovesac offset the margin hit from ongoing China tariffs (which may get overturned under a Biden presidency, another potential plus for the company).

I now view Lovesac as an exciting, emerging consumer brand that has fully capitalized on strong demand for home products in the wake of the coronavirus. The company has a solid diving board from which to continue executing well in 2021. Investors should continue to ride Lovesac's momentum upward.

Q3 download

Let's now review Lovesac's third-quarter results ini greater detail.

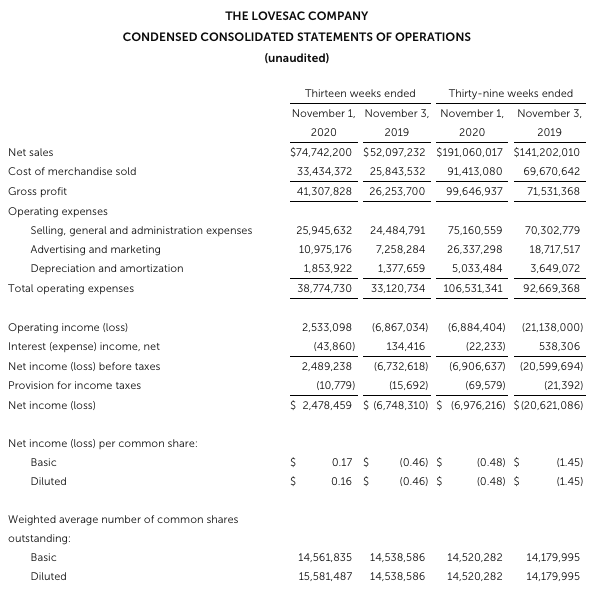

Figure 1. Lovesac Q3 earnings results

Source: Lovesac Q3 earnings release

The biggest highlight for Lovesac in Q3: the company managed to grow its revenue at a 42% y/y pace to $74.7 million, absolutely decimating Wall Street's expectations of $66.1 million (+27% y/y), which would have been more in line with Lovesac's Q2 growth rates. Lovesac accelerated its revenue growth by fourteen points relative to 28% y/y growth in Q2.

Moreover, Lovesac even exceeded its pre-pandemic growth rate of 33% y/y in Q1, and this was the best quarter since the prior Q3, where Lovesac had only grown slightly stronger at 44% y/y. This speaks volumes to how Lovesac has leaned on its e-commerce expertise to drive sales in a challenging retail environment. On a channel basis, Lovesac's showroom sales declined -20% y/y (as expected - though 100% of Lovesac's showrooms are open for walk-ins, limited operations have hurt sales), but e-commerce revenues grew like a startup at 125% y/y.

Recognizing the importance of e-commerce in its success, Lovesac rolled out a new online store mid-summer, which the company has credited for improving conversion rates. Jack Krause, Lovesac's COO, noted as follows on the Q3 earnings call:

First, e-commerce since launching our new e-commerce platform in mid August, we have experienced improved conversion driven by both mobile and desktop. In addition, we have seen an increase in attachment rates, which are now 40% versus prelaunch of about 34% of Sactionals purchases, included accessories. Accessories are now part of the purchase process, the customer builds their own setup. Continuous improvement and functionality has been added to the site since launch, including faster load time, the configurator pages appointment scheduling for showrooms, save configuration functionality and additional customer experience improvements."

Another thing that has helped Lovesac drive growth in spite of continued retail challenges has been expanded retail partnerships. Lovesac optimizes on its sales and marketing costs by operating "pop up" locations at other retailers. Macy's (M) is one of Lovesac's key partners, and the company noted that Macy's locations continued to perform well. In addition, Lovesac has expanded its relationship with Best Buy (BBY), which the company noted as "continuing to meet or exceed our expectations."

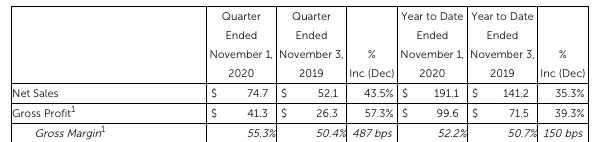

One more key thing to note this quarter: Lovesac has cut back on its discounting practices, and in spite of that was able to maintain strong growth. As a result of selling more items at full price, as well as more favorable product mix, Lovesac managed to increase gross margins by 487bps to 55.3% in Q3, offsetting a ~50bps rise in tariff-related headwinds. This is a much, much better showing than Q2, when Lovesac's gross margins had peeled back ~30bps to 50.1%. This rapid turnaround in margin performance is the key reason why I've upgraded my view on Lovesac to a bullish one.

Figure 2. Lovesac gross margins

Source: Lovesac Q3 earnings release

Source: Lovesac Q3 earnings release

Lovesac's revenue strength and gross margin expansion has flowed nicely into bottom-line metrics. Lovesac drove $6.0 million of adjusted EBITDA (at a roughly 8% EBITDA margin) in Q3, despite a loss in the prior year. Another driver behind this profitability expansion has been a reduction in selling, general, and administrative costs, which reduced by twelve points as a percentage of revenue due to reduced headcount and rent costs associated with maintaining its retail footprint.

Figure 3. Lovesac adjusted EBITDA

Source: Lovesac Q3 earnings release

Source: Lovesac Q3 earnings release

The good news continues: Lovesac expects continued EBITDA expansion in Q4, with the company guiding to 50-60% y/y adjusted EBITDA growth in Q4, versus $8 million in the prior-year Q4 (which would imply an adjusted EBITDA margin profile in the low teens - which isn't bad at all for a company growing north of 40% y/y).

Key takeaways

Lovesac's sturdy execution after the passing the worst of the pandemic has driven a surprise rally in its stock - yet with the company just beginning to turn its bullish levers for 2021 (continued strong demand for furniture products, broad retail expansion driven by store partnerships, and robust margin/EBITDA expansion), I think there's still room for outperformance for the stock next year.

For a live pulse of how tech stock valuations are moving, as well as exclusive in-depth ideas and direct access to Gary Alexander, consider subscribing to the Daily Tech Download. For as low as $17/month, you'll get valuation comps updated daily and access to top focus list calls. This newly launched service is offering 30% off for the first 100 subscribers.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in LOVE over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.