Why You Should Care About Equity Residential's Most Recent Acquisition

Equity Residential's portfolio of multifamily properties is the most urban relative to all other pure multi-family REIT plays.

Its properties in urban markets like San Francisco, Boston and New York have underperformed relative to more suburban areas.

Equity Residential's acquisition of Notch Apartments, in Newcastle, WA, is an indicator that the REIT assesses the underperformance in its urban core markets may continue beyond the pandemic.

Notch Apartments is located in a zip code that is 4.5x less dense than the average zip code in the Equity Residential portfolio. This purchase is a departure from the REIT's previous acquisition strategy targeting high density urban centers that began with the disposition of 72 properties to Starwood Capital in 2015.

The Most Urban Pure Multi-Family Play

Equity Residential (EQR) is the most urban pure multi-family publicly traded REIT. In previous analysis published on Seeking Alpha in Q2 2020 we analyzed zip codes where REITs owned properties and classified each zip code as urban, suburban or rural. We determined that 69% of the zip codes where EQR owned a property were classified as urban, more than 2/3 of zip codes in the EQR portfolio. EQR is by far the most urban REIT relative to its peers and competitors.

Source(s): Figure 1 created by Author with data from ACS 5yr (2014-2018 ZCTA) & REIT Data Market analysis. See our article for detailed explanation of our methodology.

Source(s): Figure 1 created by Author with data from ACS 5yr (2014-2018 ZCTA) & REIT Data Market analysis. See our article for detailed explanation of our methodology.

Before the pandemic this concentration in the dynamic urban cores and densely populated areas of the United States was seen as an asset to the REIT. In its November 2019 Investor's Update, EQR stated, "we continue to see robust demand to live in the vibrant urban and dense suburban centers in the cities in which we operate". The logic underpinning their strategy was well articulated. These markets are characterized by supply constraints, high single family home prices, class A properties receive premium rents and their tenants are some of the most educated and therefore well-off in the country. No doubt these are all positive underlying conditions and justified EQR's strategy to concentrate in these areas. In fact, EQR's focus on U.S. urban markets is a long arc and part of a purposeful strategy to position the REIT in these markets. Long-term EQR shareholders remember the disposition of 72 properties to Starwood Capital in the fall of 2015. Former EQR CEO David J. Neithercut said at the time about the Starwood deal,

"This is an extremely opportune time for Equity Residential to monetize our investments in this portfolio of assets," said David J. Neithercut, Equity Residential’s President and CEO.

"In doing so, [...] we have also narrowed our focus which will now be entirely directed towards our core, high-density urban markets that will fulfill our strategic vision and drive EQR performance for many years to come".

EQR continued to pursue this strategy over the years shedding properties in Denver, Phoenix and Florida along the way.

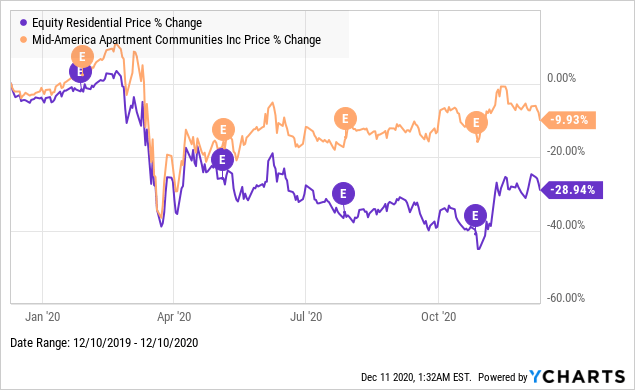

Skip five years to 2020, however, and this focused urban posture has left EQR vulnerable to the pandemic and its 2nd order effects. The chart below compares the performance of EQR and Mid-America Apartment Communities (MAA). Comparing these two REITs specifically is a good proxy for comparing the impact of urbanicity on price change within the COVID context. As shown in Figure 1, MAA is one of the most "suburban REITs," and its size in terms of both owned real estate and market capitalization provides an apples- to-apples comparison with EQR. Readers will observe two takeaways from the chart: 1) these REITs tracked closely until Q1 Earnings 2020, and 2) as the impacts of COVID on urban economies became apparent, there is clear separation between the two REITs. MAA has performed much better relative to EQR over the course of the pandemic.

Data by YCharts

Data by YCharts

Urban vs Suburban Redux

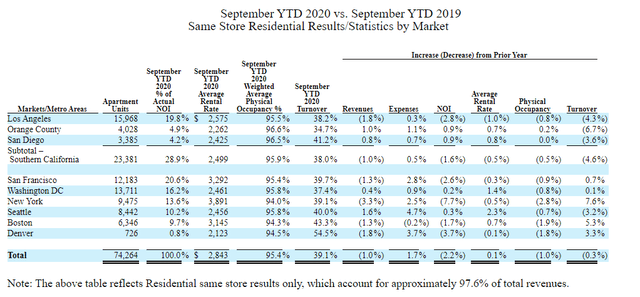

In their Q3 earnings call, EQR leadership provided context to the decline in urban markets in the U.S. EQR CEO Michael Manelis noted, "Suburban assets are holding up relatively well while our urban assets are producing higher turnover leading to decreased rental rates, increased use of concessions, and lower occupancy". To be more specific, the declines are most pronounced in New York, Boston and San Francisco markets. Figure 2 from EQR's Q3 10Q provides a Year-over-Year (YOY) comparison of Same-Store performance broken down by metro area (as defined by EQR).

Source: Figure 2 Pg. 42, EQR Q3 2020 10Q

Source: Figure 2 Pg. 42, EQR Q3 2020 10Q

Ignoring Denver (which is a minor part of the EQR portfolio, and the return to the Denver market is another discussion), New York, Boston and San Francisco, the most high-density urban locales in the EQR portfolio, were EQR's worst performing markets. Interesting to note, the data for the San Francisco market likely includes EQR-owned communities in the surrounding counties (based on the total Apartments units EQR provides in Figure 2), and therefore the performance of EQR communities located within San Francisco city limits are likely performing even worse (in aggregate) than the data provided in Figure 2. In fact, EQR indicated only 87% occupancy for downtown San Francisco assets. Because Figure 2 strongly indicates EQR is mixing county and metro area data, we provide for reference, Figure 3, which counts the total number of zip codes per county classified as urban and suburban.

Source(s): Figure 3 created by Author with data from REIT Data Market analysis. See our article for detailed explanation of our methodology. Please see County_Urbanicity.csv for reference. Built in python using Seaborn.

Source(s): Figure 3 created by Author with data from REIT Data Market analysis. See our article for detailed explanation of our methodology. Please see County_Urbanicity.csv for reference. Built in python using Seaborn.

The breakdown in Figure 3 provides additional context to Figure 2. San Diego is one of EQR's better performing markets, and that is likely because its properties are located almost exclusively in suburban zip codes. Orange County, CA, is also one of EQR's better performing markets in terms of turnover, average rent and occupancy. Figure 3 shows EQR's properties in Orange County are far more balanced between urban and suburban as compared to the three markets discussed in the previous paragraph. Not surprisingly in its Q3 earnings call, EQR described these two more suburban markets as "resilient". Interestingly, there is one urban market, Seattle, that has performed well compared to high density markets of San Francisco, New York and Boston. Despite a dip in occupancy, EQR's Seattle properties saw increases in average rent, though EQR indicated in the call that their Seattle properties showed weakness as the quarter came to a close. Nonetheless, EQR,"[expects] this market to quickly bounce back post pandemic". In a quiet year for acquisitions EQR acquired a property in the Seattle metro area in Q3 2020. This shows their confidence in this market. This acquisition is interesting because its location departs from EQR's acquisition strategy since 2015. This acquisition could be a sign of things to come and mark a strategic shift away from the post Starwood Capital strategy of focusing their portfolio in high density urban and suburban markets.

Acquisition of Notch Apartments

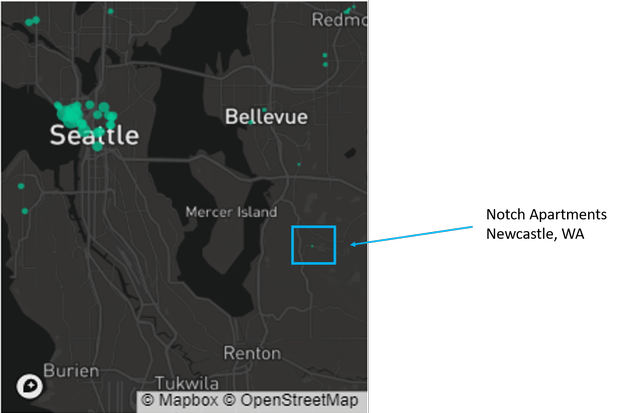

In Q3 2020, EQR purchased Notch Apartments (pictured below). As of 1 Oct 2020, this purchase is EQR's only acquisition of the year. Notch Apartments are located in Newcastle, WA (zip code 98059), where EQR did not own a property until this acquisition. What really makes this purchase stand out is that household density in this zip code is estimated at 686 households per square mile. In other words, Newcastle, WA is very suburban. Comparing the household (NYSEMKT:HH) density of Newcastle, WA to the EQR’s portfolio in Q2 2020, Notch Apartments are located in a zip code 10x less dense than the mean HH/sqmi of the Q2 2020 EQR portfolio (shown in Figure 2). Notch Apartments is located in the least dense zip code of all zip codes where EQR owns a property within the Seattle-Tacoma Metropolitan Statistical Area (NYSE:MSA).

Source: Picture of Notch Apartments from Equity Residential's website.

Source: Picture of Notch Apartments from Equity Residential's website.

Source: Figure 4 Created by Author with data from REIT Data Market analysis.

Source: Figure 4 Created by Author with data from REIT Data Market analysis.

Figure 4 shows a map of EQR properties located in the Seattle-Tacoma, WA MSA. Each "green dot" on the map represents the location of an EQR property and is sized by zip code HH density per square mile. Figure 4 clearly shows that Notch Apartments is located in the outer suburbs of the Seattle metro area, closer to the Bellevue, WA job market than Seattle's and it's small size reflects the low HH density for the zip code where Notch Apartments is located.

Indications of a Strategic Shift

We think the purchase of Notch Apartments in "very suburban" Seattle delineates a change in direction for EQR, possibly an indication of a strategic shift in the overall direction of the REIT. Of course, one could make the counter argument that we use data to tell a predetermined story that over hypes a single real estate transaction as evidence of significant change. However, we don't think we are being hyperbolic for the reasons discussed below.

The geography of Notch Apartments is clearly distinct from the rest of EQR's acquisitions since its disposition of 72 primarily suburban properties in 2015. With so much attention paid to "urban flight" and the reported under performance of urban properties, if EQR remained dedicated to its previous commitment to urban cores, we suspect they could probably pick up properties in urban locales at a discount. But instead, they acquire a newly built, class A property located in the outer suburbs of Seattle, WA. These are the type of properties that the current dynamics would suggest are the most in demand, and accordingly priced at a premium. To us, this is a clear indication of EQR moving away from a 5-year strategy concentrated on high density urban centers; adapting its business model in the post-COVID reality to focus on less dense suburbs located near urban centers. Performance of EQR’s traditional high density urban core markets is weak. Moreover, the pandemic is not the only headwind. EQR admits in its Q3 2020 earnings call that, “remote work is certainly a fascinating new trend, whose long-term impact is difficult to gauge". Finally, there is the uncertainty of the long term impact of civil unrest in high density markets where EQR owns properties.

So what does this mean for REIT investors? First, EQR will continue to "balance its portfolio" away from high density urban locales. This implies that EQR leadership's assessment is that urban markets will take time to recover. EQR's over-exposure to these markets has implications for the relative short to medium term recovery of its share price. Again it comes down to something we have said before, if you think the decline in urban markets is short-lived, EQR is the option to take advantage of a recovery in high density urban markets. But if you take the other side of that argument, EQR's most recent acquisition provides evidence to support a "wait and see" approach.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.