TCF Financial: The Increase In Criticized Loans Keeps Me Sidelined

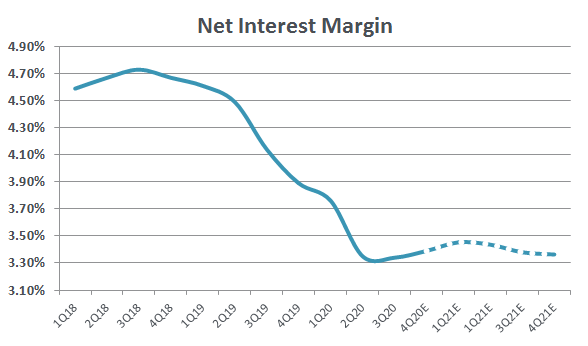

The margin looks to be bottoming out near current levels.

Any future profitability improvement is likely to only come from cost-cutting efforts.

The recent credit trends relative to its valuation premium to peers are what keep me on the sidelines.

Investment Thesis

Based in Detroit, Michigan, TCF Financial Corporation (NASDAQ:TCF) is a $47.6 billion asset holding company and parent to TCF National Bank. From the combination of legacy TCF and Chemical Bank (August of 2019), this new and improved TCF Bank was born. The bank now has 503 branches located throughout the upper Midwest (states like Minnesota, Wisconsin, Illinois, and Michigan) along with Denver, CO, and a handful in Ohio.

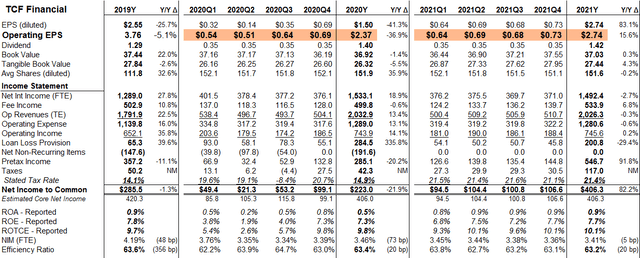

When digging into the lending portfolio, one can see some pretty standard items like Traditional C&I along with a few non-standard lending items like "Inventory Finance". From a breakdown perspective, Commercial Real Estate accounts for 29.6% of the portfolio (ex-PPP loans), Capital Solutions accounts for 18.4%, Consumer is 32%, Traditional C&I makes up 13.5%, and Inventory Finance rounds out the remaining 6.4%.

Prior to the combination of TCF and Chemical Bank, I thought of them both as being "better than average". That said, I think the current near-term outlook for this new and improved TCF Bank is only average relative to peer banks (thus my neutral stance). The bank is still integrating from its merger of equals, and the profitability outlook only appears better than average due to looming expense reductions (rather than revenue growth).

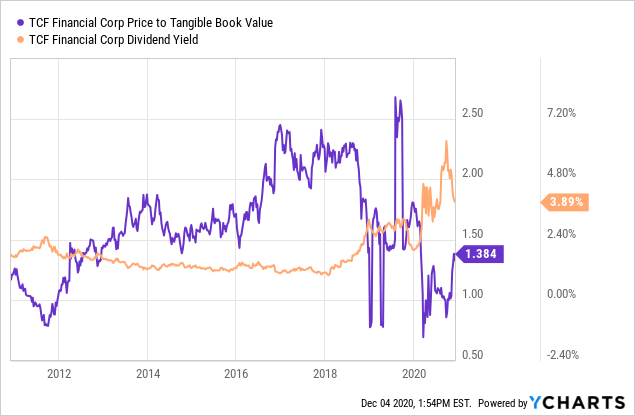

TCF has a legacy of delayed credit problems and the current lending portfolio is starting to slip a little, leaving me unconvinced that we are completely in the clear in terms of credit problems. The current valuation on a price to tangible book value per share is slightly above the all-bank average (TCF is 1.38x vs. Bank average of 1.33x per share), which in my mind leaves little room for error.

Data by YCharts

Data by YCharts

Revenue Outlook

When looking at the spread revenue from quarter to quarter, it makes sense to back out non-core items. When I was looking into TCF, I noticed that the third-quarter net interest income was $377.2 million, down $1.2 million from the second-quarter levels. However, embedded in the quarterly amounts was purchase accounting accretion (it's easiest to think it as accounting rules associated with a merger and expected loan on loans). Since accretion is typically not viewed as being "core", one should back out the $0.5 million difference. When doing so, the third quarter "core" results were down just $0.7 million from second-quarter levels.

When I was reviewing all the puts and takes from the quarter (and backing out the accretion in the margin), one can see that the core net interest margin (NIM) was down 1 basis point from the second quarter into third.

Outside of net interest income, noninterest income (also known as "fee income") was also down linked quarter. Third-quarter fee income of $118.8 million marked a $14.2 million decrease from the second-quarter levels. However, in the second quarter, TCF sold its entire Arizona-based operations to Alaska Federal Credit (which carried a $14.7 million gain on sale). While there were a few other items, when backing out all the "non-core" or merger-related items, third-quarter fee income results were $119 million while the second quarter produced $127.2 million.

Source: SEC Filings and Author's Estimates

Being that TCF does not have a large mortgage operation, I don't believe it is likely to see a material headwind when it starts lapping next year's revenue results. Also, I believe we are likely to see some material cross-selling of fee income products (like wealth management, leasing revenue, etc.) from the combination of the two legacy bank customers.

That being said, I don't think the NIM is likely to see much lift from current levels. While TCF did not have a sizable about of PPP loans, I just am very unconvinced that any margin upside in the near-term is sustainable. Driven by its portfolio and deposit positioning, I think we are likely near the NIM floor, but I wouldn't expect any sizable recovery until interest rates (or Libor) start to increase again.

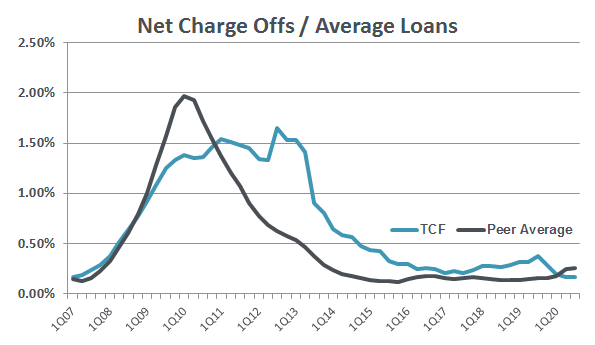

Credit Consideration

As one can see from the chart below, while TCF did have a slightly better-than-average credit experience in the last recession, the credit events were rather delayed and drawn out. From my experience in working for banks, I think this is a net positive for the long-term fundamentals and strategy, but it could cause an overhang on the stock. Once there is a clear line of sight for sustainable economic activity, I think TCF's stock will grind higher.

Source: SEC Filings

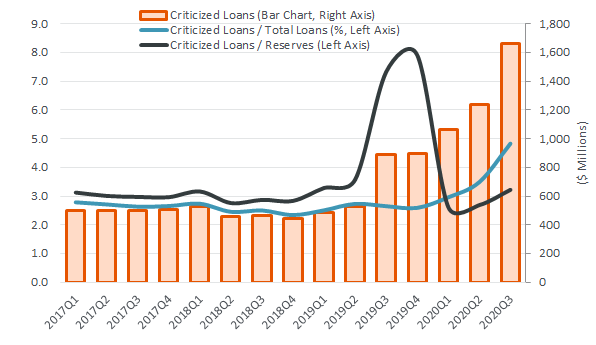

What gives me the most concern and prevents me from being "bullish" on the stock is the chart below.

Source: SEC Filings

As one can see from the orange bars, criticized loans have increased materially. While it makes sense to give a "free pass" to the 1H19 increase in total dollars due to the merger of equals, the most recent acceleration higher is a little concerning.

While I don't believe that TCF is likely to incur substantial credit pain/losses relative to peer banks, I do believe that if the criticized loan bucket continues to get larger (like it has been), future provision expenses are likely to eat into profitability upside opportunities.

While the total amount of criticized loans has increased, so has "criticized loans to total loans" (blue line). However, the one line that matters the most, "criticized loans to reserves", remains steady because the most recent provision expense was elevated. While the third-quarter increase in provision helped the bank's positioning from a credit perspective, it hindered the quarter's profitability.

Concluding Thoughts

Whenever I think about TCF, I think about the two legacy banks that formed this new and improved TCF. Both of them had strong franchises, upper Midwest footprints, loyal customers and clear growth opportunities. I consider this new and improved bank to be one to keep on the radar if the price falls a bit from current levels. TCF finds itself in a great position relative to peer banks, due to its cost-cutting opportunity which would grow earnings without getting revenue support.

While I don't think that the credit picture looks to be outright ugly, the current trend prevents me from getting excited about the shares (given the current peer like valuation). If TCF can put together a quarter that produces a smaller criticized loan (i.e. less criticized loans than the previous quarter), I would be a buyer - until then, I think it trades in line with peer banks.

Source: SEC Filings and Author's Estimates

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.