GW Pharmaceuticals: The One 'Cannabis Stock' Everyone Should Own

GW Pharmaceuticals Plc is a pharma company and a global leader in developing cannabinoid-based medicines.

Its multiple sclerosis drug nabiximols (brand name Sativex) was the first natural cannabis plant derivative to gain FDA approval.

2020’s US election night was a potential tipping point for easing CBD regulations and legalizing cannabis.

Amid CBD’s astronomical growth projections, GW Pharmaceuticals continues to see significant returns, revenue growth, and bullish projections.

Editor's note: Seeking Alpha is proud to welcome Colin Sullivan as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Editor's note: Seeking Alpha is proud to welcome Colin Sullivan as a new contributor. It's easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

As we look towards four years of a Joe Biden presidency, one could easily make the case that cannabis (and related stocks) could enjoy some of the best growth numbers. Especially companies focused on research, development and building protectable intellectual property portfolios, such as GW Pharmaceuticals (NASDAQ:GWPH). Last year's FDA approval of Epidiolex marked the second time cannabis (or a derivative) was approved by a regulatory body for prescription use (the first being Sativex, also by GWPH). As stigmas around cannabis continue to decrease, governments continue to reduce regulation, more and more patients and physicians will replace older, less effective and more dangerous therapeutics with cannabis and its derivatives. With all signs pointing to a greener future, I firmly believe GWPH is the safest cannabis stock with the highest ceiling and the highest floor.

Arizona, New Jersey, South Dakota, Montana, and Mississippi all legalized some form of marijuana use on election night. Since 2012, a total of 15 states and Washington DC have now legalized cannabis for recreational use, while 36 states have now legalized medical marijuana. This means that the majority of Americans now have some form of access to cannabis - medically or recreationally.

According to Avis Bulbulyan, CEO of SIVA Enterprises, "[the 2020 election] is a tipping point for drug policy absent any federal reform."

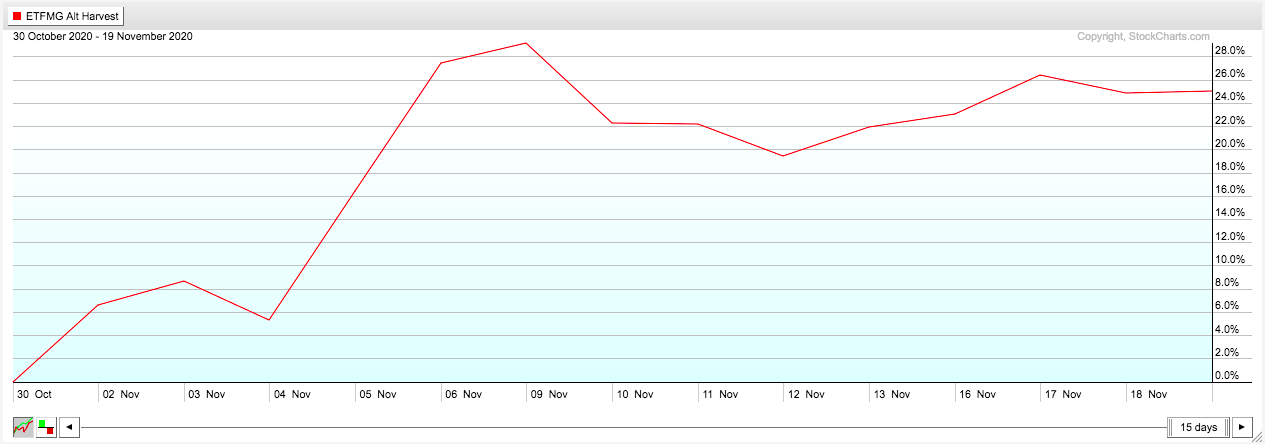

Furthermore, President-elect Biden and the Democratic Party are considered to be considerably more cannabis-friendly than their Republic counterparts. While the broader market has certainly rallied post-election, cannabis-related stocks have surged. Just take a look at the returns since election week for this comprehensive cannabis-related ETF, the ETFMG Alternative Harvest ETF (NYSEARCA:MJ).

Chart 1. Alternative Harvest ETF returns since election. (Source: Author render via StockCharts)

In November alone, this ETF has rocketed nearly +24%.

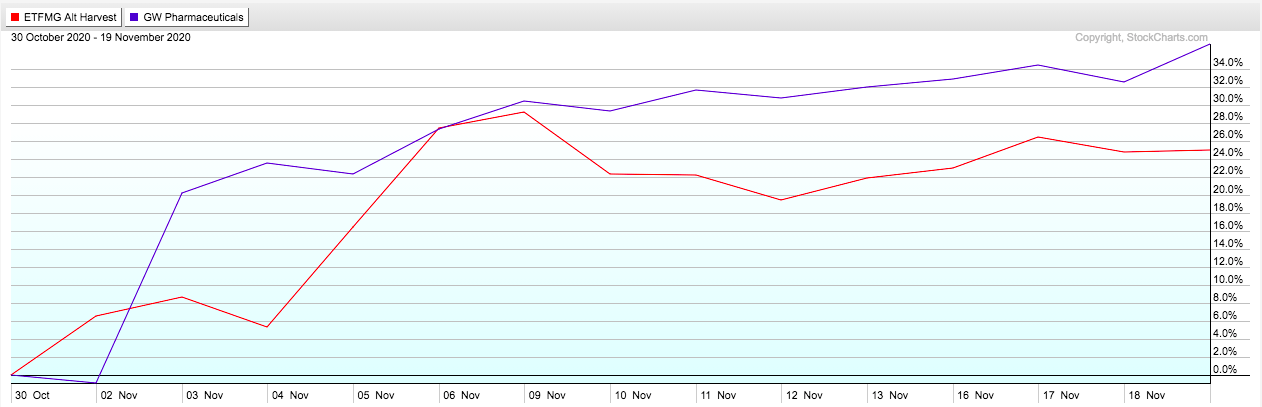

However, while the general sentiment is positive for cannabis due to election night, there is potentially a much larger growth trend within the cannabis space, specifically CBD-based pharmaceutical companies such as GW Pharmaceuticals. Take a look below at how well its stock performed compared to the MJ ETF since election week alone.

Chart 2. GW Pharmaceuticals (Purple) vs Alternative Harvest ETF (Red) performance over the month since the 2020 President Election. (Source: Author render via StockCharts)

A True Pioneer Properly Positioned For Growth Beyond The Next "Green Rush"

GW Pharmaceuticals prefers not to be considered a cannabis company. Rather, this is a company that has pioneered the medical use of pharmaceutical-grade CBD, the non-psychoactive compound found in cannabis plants. GW is a biotech company and the global leader in developing cannabinoid-based pharmaceuticals. GW's multiple sclerosis drug nabiximols (brand name Sativex) was the first cannabis-derived medicine to gain FDA approval.

GW Pharmaceuticals' CBD-based Epidiolex, a medicine used to treat rare forms of childhood-onset epilepsy and tuberous sclerosis complex, has also performed exceptionally well, with sales forecasted to jump over 50% in the next year.

However, when looking at the broader CBD market's growth potential, these forecasted growth numbers look to be quite conservative. As cannabis-related products become more accepted by medical professionals and governments, demand has surged with more opportunities for growth and development on the horizon. According to a new report from Global Market Insights, the CBD Market size exceeded USD 2.8 billion in 2019 and is set to grow at around a 52.7% CAGR between 2020 and 2026, with a global market valuation exceeding $89 billion by 2026.

A different report focused specifically on the U.S. market makes a more bullish call on CBD through 2023. According to Brightfield Group, CBD will see a product sales growth in the United States of 706% through 2023. Additionally, the report notes that CBD revenue was only about $620 million in 2018. As this revenue is forecasted to grow to $23.7 billion by 2023, this nets a five-year CAGR of 107%. While THC-based cannabis offerings typically garner most of the attention compared when compared to CBD, cannabis' CAGR of around 25% over the same period simply does not compare.

Surprise Earnings Report Last Quarter

Although GW Pharmaceuticals' EPS is still negative, revenue has grown steadily over the past several quarters. Its most recent Q3 report showed very encouraging numbers for investors and significantly beat expectations.

In Q3 2020, GW Pharmaceuticals' revenue increased to $137 million versus the consensus estimate of $125.97M, with sequential growth of 13% over the prior quarter and 51% over the prior year's quarter. Additionally, GW Pharmaceuticals' net loss of $12.2M was down ~11% from the previous quarter while the EPS loss was 50% less than expected at -$0.03 per share versus an expected -$0.06. As cannabis becomes more broadly legalized and accepted, and GW Pharmaceuticals continues to invest in its future, this figure should turn positive by Q1 of next year.

Strong Pipeline and Projected Growth

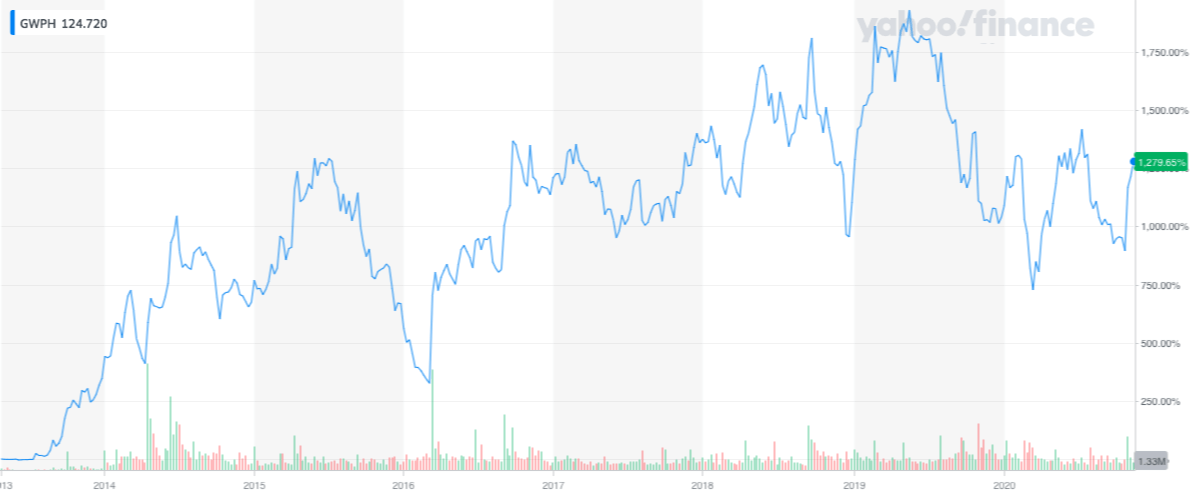

GW Pharmaceuticals has a strong offering of drugs on the market and pipeline of drugs in development - a very crucial indicator of any pharma company's strength and outlook. Since the stock went public in 2013, it has skyrocketed by nearly 1,280% - and over 1,930% at its peak in September 2019.

Chart 3. GW Pharmaceutical price since IPO. (Source: Yahoo Finance)

As the company continues developing and growing its pipeline, while cannabis becomes increasingly legalized, revenue and earnings are projected to grow exponentially. As it is, its Epidiolex drug sales alone are expected to jump over 50% in the next year. Aside from Epidiolex sales alone, a handful of other indicators show just how robust GW Pharmaceuticals' growth potential is.

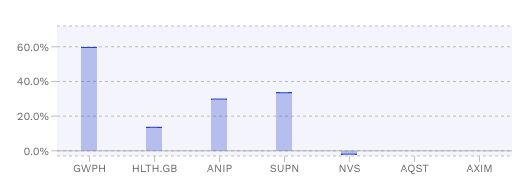

Firstly, its revenues. According to FinBox, GW Pharmaceuticals' revenue has a five-year CAGR of 59.6%. This figure alone is impressive, but when you consider how it compares next to several of GW Pharmaceuticals' top competitors, you can truly see impressive this company's outlook is.

Chart 4. GW Pharmaceuticals five-year CAGR as a percentage versus competitors. (Source: FinBox)

Sales are also forecasted to grow by 30.80% by the end of the current quarter, 30.70% by the end of the next quarter, and 43.90% by next year.

Furthermore, although the company's current EPS remains negative, this is not projected to last much longer. In the last three quarters, GW Pharmaceuticals crept closer towards profitability and witnessed upside earnings surprises of 71.80%, 61.90%, and 56.60%. Additionally, for the next quarter's earnings projections, there were seven analyst upgrades to go along with zero downgrades. The company is expected to post positive EPS by Q1 next year, with a projected EPS growth of 168.20% by the end of 2021. Not to mention, GW Pharmaceuticals also has forecasted earnings growth of 159.40% over the next five years (per annum).

Keep in mind - as more and more of GW Pharmaceuticals existing drugs increase in popularity, all the while its drugs in development hit the market, revenues will continue to increase and development costs will continue to decrease. Surely, this will also help earnings reach positive figures sooner rather than later.

Potential Risks with GWPH

COVID's Second Wave: This is a macro-level risk affecting the broad market. Although GWPH withstood the initial wave well, there is no telling what damage this second wave of COVID could do to stocks.

Valuation Risk: This is something to be mindful of not just for GW Pharmaceuticals, but for all cannabis-related stocks. Stocks such as GWPH have grown so rapidly over the last seven years that its stock price more so reflects projected growth rather than its intrinsic value. Valuing stocks based on projections rather than profits is always a gamble. Simply put, GWPH is not yet profitable, which makes assessing its proper valuation a challenge. GWPH, for example, has a negative P/E ratio and a negative PEG ratio.

Analysts Are Increasingly Bullish On This Stock

Although GW Pharmaceuticals' earnings are still negative due in large part to investments and development costs, analysts love this stock for the aforementioned macro factors, its revenue growth, and its drug pipeline. As mentioned in the previous section, both GW Pharmaceuticals' projected revenue growth and EPS growth are stunning. As a result, the company has seen numerous projected EPS upgrades and zero downgrades. Furthermore, the company keeps receiving raised price targets. According to the Wall Street Journal, GW Pharmaceuticals, which is currently pricing around $125 per share, has a median price target of $181.50, an average price target of $184.00, and a high price target of $270.00. With the high price target, this gives GW Pharmaceuticals an analyst upside price target of just over 52%.

My Valuation

I am going to push the envelope here a bit and assign GWPH a 12-month price target of $275. From a high level, this target is driven by easing federal regulations, improving stigma and expanding market share for both Epidiolex and Sativex. For this valuation, I ran a discounted cash flow model with a discount rate of 10%. I looked at total patients in 2019 with Dravet, Lennox-Gastaut, Tuberous Sclerosis, and other epilepsy syndromes in both the United States and European Union as a starting point.

United States | European Union | |

Dravet Syndrome | 20,904 (1:15,700 incidence, 328.2mn population) | 28,516 (1:15,700 incidence, 447.7mn population) |

Lennox-Gastaut | 47,400 (source) | 102,000 (3% of 3.4mn children and adults with epilepsy) |

Tuberous Sclerosis | 60,000 (approximately 40,000 to 80,000 patients) | 24,667 (1:18,150 incidence in 447.7mn population) |

Other Epilepsy | 3.47mn (source) | 6mn (source) |

Table 1. Patients with target illnesses in the United States and the European Union.

I then assumed 1% growth of patients year over year, varying associated death rates and varying penetration rates based on GWPH's previous metrics.

United States | European Union | |

Dravet Syndrome | 69% | 12% |

Lennox-Gastaut | 69% | 12% |

Tuberous Sclerosis | 32% | 7.3% |

Other Epilepsy | .34% | .05% |

Table 2. Five-year forward average rates of penetration based on syndrome and country.

On a revenue per patient basis, we can take GWPH's 2019 revenue from Epidiolex of $296mn from 23,500 patients yielding $12,651/patient. Through the first three quarters of growth in 2020, GWPH has already surpassed the entirety of its 2019 Epidiolex sales, logging $379mn.

2021E | 2022E | 2023E | 2024E | 2025E | 2026E | 2027E | 2028E | 2029E | |

Free Cash Flow ($mn) | $276.9 | $395.1 | $507.4 | $617.5 | $719.3 | $826.2 | $916.9 | $1,030.9 | $1,144.5 |

Net Present Value of Free Cash Flow ($mn) | $251.7 | $326.5 | $381.2 | $421.8 | $446.6 | $466.4 | $470.5 | $480.9 | $485.4 |

Table 3. Free cash flow and net present value projections 2012-2029.

I then proceeded to calculate the terminal value 2030E of both free cash flow and present value of cash flow assuming a 0% terminal growth rate.

Terminal Value 2030E | |

Free Cash Flow ($mn) | $11,445 |

Present Value of Free Cash Flow ($mn) | $4,412.5 |

Table 4. Terminal value 2030E of free cash flow and present value of free cash flow.

Leveraging a discounted cash flow methodology, assuming starting patient levels, patient growth, patient discontinuation, revenue per patient and net cash ($480.3mn), I reach an equity value of $8,623.5 (millions). This yields an equity value per ADR (each consisting of 12 shares) of $275 for 2021.

Summarizing the financials and valuation level

GW Pharmaceuticals' financials show a company experiencing significant growth, while simultaneously displaying strong financial health. We have already discussed GW Pharmaceuticals' prominent position as a pioneer in CBD-based pharmaceuticals, and GW's strong returns not only over the last month but also over the entire period of its public existence.

Looking closely at its financials paints quite a rosy picture; do not be deceived by its negative earnings. This can be seen as a growth company, investing in itself and its future - as it should. GW Pharmaceuticals holds more cash than debt on its balance sheet and is financing its business with more equity than debt as indicated by its strong debt-to-equity ratio of 5.4%. Furthermore, the company's current ratio and quick ratio indicate that it can easily meet all of its short-term obligations, with figures of 5.1 and 4.0 respectively. Additionally, the company has an Altman Z-Score of 8.4, which indicates that it is very well managed and has an incredibly low risk of bankruptcy.

Bottom line for investors

For investors looking to bet on arguably the safest most lucrative company within the cannabis industry, GWPH is a strong play. When compared to other major drug companies, its therapeutics have a relatively low cost of production and its drugs are safer than competing drugs in the treatment categories. Epidiolex specifically treats children afflicted with Dravet syndrome, a debilitating seizure disorder that is incredibly difficult to treat. Until Epidiolex reached the market, a previously banned drug fenfluramine offered the only form of treatment. Fenfluramine is a dangerous drug, hence its banned status outside of Dravet, and its side effects include heart failure, worsening seizures, nausea, vomiting and blurred vision. When you compare those to Epidiolex's side effects of agitation, chills and cough you begin to see it for the game changer it truly is.

If there was a blue chip category of cannabis-related companies, GWPH would certainly be one. This company has been researching and developing cannabis therapeutics for nearly 30 years is an industry pioneer and leader. This 30 years of research finally culminated in its first sale just last year - this is only the beginning.

If you want to invest in the projected growth and acceptance of cannabis, while avoiding investing in a typical "weed stock," GWPH is the best play. While there are risks to be concerned about, GWPH's growth until now is undeniable. Its existing products are popular and growing robustly, with more products in the pipeline. If you believe that cannabis has medical benefits, GWPH is the stock for you. The company has very little debt, strong analyst upside, and a macro-environment with surging demand for CBD that's becoming more cannabis friendly. Negative earnings with this high of a stock price are concerning- but simply put, that is the price you pay sometimes for future growth potential. Just look at the performance of stocks such as Shopify (NYSE:SHOP) for example that only recently turned profitable. This is surely a bullish call on this stock.

Authors Note: Thanks so much for reading my article. If you enjoyed reading, please click the like button and give me a follow for more great content.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GWPH over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I bought GWPH at IPO, sold near its 2019 peak, re-entered and exited before the election. I plan to re-enter my position at some point between now and the inauguration on January 20th.