Target Hospitality: Debt Levels Are Concerning

Target Hospitality's net income figures have been flat over the past few years despite increasing the number of available beds by more than double.

The company's current debt levels will impact future ability to perform acquisitions.

Target Hospitality relies heavily on the performance of a select few locations and faces heavy competition.

Target Hospitality (NASDAQ:TH) is a specialty hospitality services company that manages the entire end-to-end accommodations process, including designing, building, and operating rental properties. The company had almost 14,000 beds within 25 locations at the end of 2019. The company mainly serves the oil and gas sector but also works with the government to provide premium accommodations.

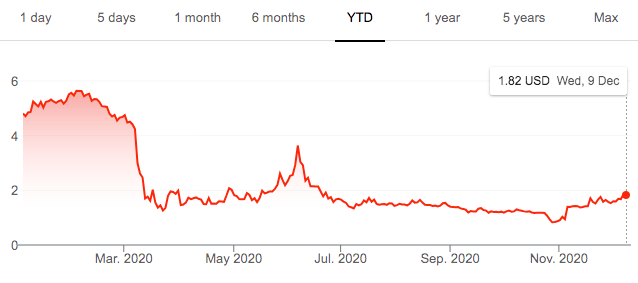

The company’s stock has fallen substantially from its 52-week high price of $5.77. Since the stock crashed in March, the price has stayed relatively flat. We possess a bearish view of the company as net income figures within the past few years have been poor and the company relies on several key customers that are subject to macroeconomic risks.

(Target Hospitality - Google Market Chart, 2020)

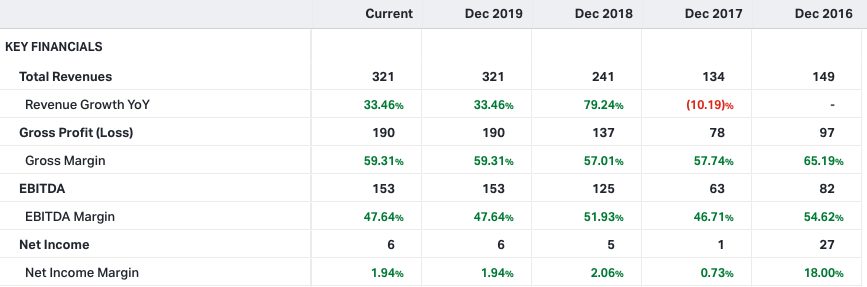

Overall performance has been subpar over the last few years

Despite many efforts to grow the company’s business organically, as well as 3 acquisitions in as many years, the company continues to post subpar earnings figures. The company’s number of available beds was only 6,770 before September 2018 and has more than doubled since then.

Pre-COVID and since 2017, the company saw 3 consecutive years of rapid revenue growth partly fueled by acquisitions, yet total net income has not changed much and margins are razor-thin. The company was hit very hard by COVID, as 3Q/20 revenue fell 40.8% Y/Y. Net income has been negative two quarters in a row, despite the company’s “significant steps to reduce our costs [...] including reducing headcount, temporarily closing and consolidating several of our communities, [and] salary reductions (Target Hospitality 10-Q).” The positive thing is that communities have begun reopening and consumer demand is picking back up slowly. Moreover, the company has modified several contracts with customers in the natural gas industry to preserve revenue in the long term.

Debt will have a significant impact on future performance

In 2019, the company received $336.7M of proceeds from borrowings and in 2020 so far, the company has received $42.5M of proceeds from borrowings. Currently, the company has a total of $325M of long-term debt as well as a $70M credit facility obligation. This is troubling as in 3Q/20, interest expense was approximately $10M, which represented 85% of 3Q/20 quarterly gross profit. By taking 2019 figures and interpreting a more normalized setting, 3Q/19 gross profit was $38M and operating income was $23M. Even if the company were to return to pre-COVID revenues and margins, interest expense could represent up to 50% of operating income. Therefore, the company’s cash flow may not be ideal if it wants to reduce competition by pursuing further acquisitions.

We believe that it may take a while for revenue to recover fully as 73% of revenues come from customers operating in the energy sector. Since many of Target Hospitality’s clients are O&G companies, demand is subject to fluctuation as although Target Hospitality is not affected directly by oil prices, customers may change on-site expenses and initiatives depending on these prices.

Target Hospitality relies heavily on a specific number of key customers and faces price competition from rivals

Currently, there are several locations that account for a large portion of Target Hospitality’s total revenue pool. Although revenue is not directly correlated on a per-bed basis, beds are a major key in determining contract revenues given that the company also provides service offerings within the locations. The Dilley location accounts for 18.5% of all beds, and the top 3 locations account for 37% of all beds.

(Target Hospitality 10-K, 2020)

The company also receives a large portion of its revenue from the government for its services related to the South Texas Family Residential Center. This is a residential compound that hosts detained immigrant families. Target Hospitality is exposed to the uncontrollable risk of potential government changes favouring immigrant families, which in turn reduces demand for the company’s services. According to the Wall Street Journal, “The Biden team has discussed creating humanitarian exceptions to [an immigration] policy, such as for children.” Other sources, including Washington Post, Forbes, and CNN, indicate that Biden does want to change immigration policies in the long run, which obviously affects the government’s need for the South Texas Family Residential Center.

The company believes that the market it operates in is highly competitive. Rivalrous factors include quality, service offerings, contractual terms, and ultimately price. Within the Oil and gas industry, 42.7% of the accommodations market is owned by the company. However, an increase in market share does not automatically lead to more profits as pricing pressure from competitors, whether it be from local or national players, could hurt the company’s already-concerning financial position.

Current market share position could help drive growth long term

Within its industry, Target Hospitality does have a very large network, which can be leveraged to help scaling initiatives. Some of the company’s exclusive long-term contracts with customers have been modified to better support the customer but at the end of the day, average contracts are 6 years in length, which provides a stable view of projected future revenues. This helps create clear plans for debt paybacks and future acquisitions. The company also has a contractual renewal rate of over 90%, which speaks to its quality of services, but also the customer's perceived sunk cost of committing to one hospitality company over the long term.

In summation, we believe that although the company has a strong market share position, long-term debt and uncontrollable risks will have a tremendous impact on the company’s ability to create shareholder value.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.