ProShares S&P Midcap 400 Dividend Aristocrats ETF: More Attractive Than The Large-Cap Alternative

Mid-cap dividend growers are a special breed as they tend to balance both growth expectations and income expectations adroitly.

REGL offers better yields, owns companies with higher earnings potential, is cheaper, and has a more attractive sector mix than NOBL.

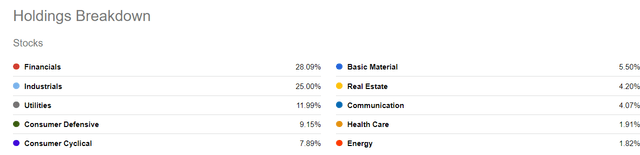

REGL offers considerable exposure to cyclicals such as financials and industrials but is also significantly underweight energy.

"And I had an old-fashioned idea that dividends were a good thing."- James MacArthur

Big picture case for REGL

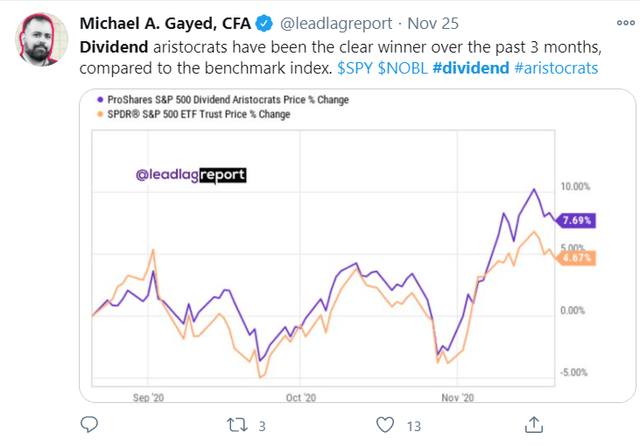

Patrons of The Lead-Lag Report would note that over recent weeks, I've been commenting about the recent outperformance of dividend-themed ETFs. As mentioned in the timeline of The Lead-Lag Report, the major dividend growers of the S&P 500 have beaten the index over the last month. If this is a space you want to explore, investors may consider looking at the ProShares S&P Midcap 400 Dividend Aristocrats ETF (REGL). Unlike the ETF in the image above which tracks the largest dividend-paying companies in the S&P 500 (NOBL), REGL tracks the S&P MidCap 400 Dividends Aristocrats Index; incidentally, this is the only ETF that focuses exclusively on this index.

To qualify for this index, it is not enough for companies to only have paid dividends, but to also have grown them for 15 successive years! 15 is quite a difficult barrier to pass, more so for mid-caps. Large-caps tend to be in a more mature state in their growth profile and often tend to have more resilient balance sheets, so a 15-year track record of growing cash distributions is not too challenging a mark for these large-caps.

For a mid-cap to have grown dividends for 15 years implies a degree of confidence with the sustainability of the business model and the balance sheet. If your revenue and earnings are volatile, you're not going to be able to keep up a dividend growth track record for 15 years. Also relative to small-caps, mid-caps, in general, are less volatile, and also tend to have more diversified end-markets/regions, and less concentration with the customer base. This lends even further credibility to the operational sturdiness of the business models of mid-caps vis-à-vis small-caps. Also relative to large-caps, the ceiling of growth for mid-caps is a lot higher.

Key features and sector exposure

Access to the ETF is not particularly cheap, with an MER of 0.41% which is slightly higher than NOBL which has an MER of 0.35%. From a dividend angle, you currently get to pocket a yield of 2.2%. That said, the dividend payout track record over the last couple of quarters has not been great with the dividend being cut by c.5% in Q2 and c.9% in Q3. Going forward, you may see the Q4 dividend being cut to normalize the current yield and bring it in line with the historical 4-year average of 1.9%.

As I mentioned earlier, it is uncommon to see too many mid-caps maintain such a long dividend track record, and hence an investment in REGL will give you access to a little over 50 names. Despite such a limited pool, REGL does not come across as a particularly concentrated bet with the top-10 only accounting for 22% of the total holdings and no single stock accounting for more than 2.5% weight.

Source: Seeking Alpha

From a sector perspective, there are some good and bad facets to this ETF. There are some dominant cyclical names such as financials and industrials that account for more than half the holdings. At this stage of the economic cycle, I would welcome such strong exposure. Those who follow my commentary in The Lead-Lag Report would recollect that I've been highlighting the underlying strength in Treasury yields which bodes well for the long-term prospects of the financials space (REGL weight-29%); 10-year yields have almost doubled since the 0.5% level seen in early August.

In 2021, as confidence returns with the penetration of the vaccine, asset quality conditions are also likely to improve. We could then see banks loosen some of the previous tight lending standards which will provide a fillip to credit growth. I also expect some of the previously high elevated provisioning to be dialed down and this should help boost the earnings. In addition to that, the financials space has generally tended to be one of the most reliable sectors when it comes to shareholder income.

Industrials hold the second-largest weight. US Industrial production has been declining for 14 months now but there is some evidence of a sequential improvement. Manufacturing is a key component of industrials and manufacturing PMIs often serve as useful leading indicators of future industrial momentum. The most recent reading for November came in at 56.7, the highest figure in more than six and a half months. So far, much of the industrial strength has been driven by light-manufacturing segments, but with the growing prospect of more stimulus, I would expect the heavy manufacturing segment too to start contributing.

In my opinion, at this stage of the economic cycle, REGL's dominant sector exposure is preferable to the dividend aristocrats' ETF of the S&P 500 (NOBL), where the financials segment is only the 5th largest sector with a much lower weight of 10%, whilst something like a defensive play - consumer staples, has a sizeable weight at 20%. As I mentioned in the 'Leaders-Laggers' section of this week's Lead-Lag Report, unless there's an unforeseen risk event, defensive segments such as staples have limited allure. Worth noting that a ratio that measures consumer staples performance to the S&P 500 (XLP: SPY) has now reached its lowest point in over a year reiterating the ongoing weakness.

Source: Stockcharts

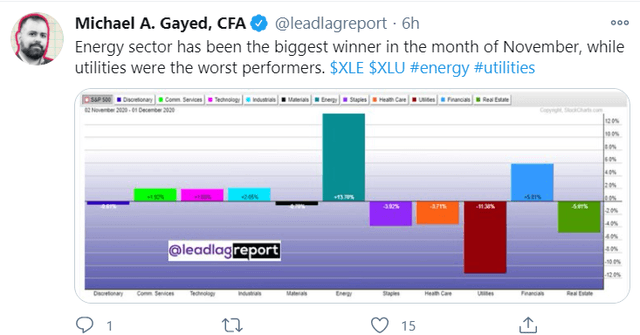

That said, going forward, what might also potentially hurt REGL is the limited exposure to energy which is the lowest at only 1.82%. Those who've been following my tweets would note that I've been flagging the prolonged weakness here all through the year, but over the past month or so, sentiment has definitely perked up, and as highlighted by my recent tweet, was the best-performing sector by far (the only sector to deliver double-digit returns in November). The OPEC's recent decision to only resort to modest output increases should aid oil prices. Demand conditions too should be much better in 2021 with the potential normalization of previously stagnant activities in leisure, travel, etc.

Conclusion

The performance of dividend-themed stocks in 2021 will likely be closely related to the performance of key cyclical segments. Mid-cap dividend aristocrats are a rare breed, and exemplify a certain resilience, as they are companies that adequately balance the expectations of high-growth prospects alongside a strong commitment to rewarding shareholders via income. At the moment, I believe these mid-cap dividend aristocrats (REGL) offer more value than the large-cap dividend aristocrats.

You currently get a slightly better yield on REGL- 2.18%, vs 2% for NOBL. Besides, mid-caps have better future earnings growth prospects. As per Ycharts estimates, the constituents of REGL are forecasted to deliver 5-year earnings growth of 9.4%, vs. 7% for NOBL. Interestingly despite these higher earnings expectations, REGL currently trades at a lower forecasted P/E of 17.5x vs. 19.5x for NOBL. I also think the broad sector exposure of REGL is more suited to the cyclical recovery than NOBL's sector exposure.

*Like this article? Don't forget to click the Follow button above!

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you'll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.