SPDR S&P 500 Value ETF: Still Confident In Outperformance

The SPDR S&P 500 Value ETF has been having a great few months, as the markets anticipate one or two years of early-stage economic recovery.

Despite recent momentum in value, a longer-term look reveals that the outperformance may have been merely the tip of the iceberg.

A simple return to the "old normal" of the mid-to-late 2010s probably means that a fund like SPYV will outperform in the foreseeable future.

Value, represented in this article by the SPDR S&P 500 Value ETF (NYSEARCA:SPYV), has been having a great few months - following about 20 years of consistent underperformance. By my estimate, value's recent three-month spike relative to large-cap growth (see graph below) has been the sharpest since mid-2008.

Here and there, I catch a market expert stating that a correction or consolidation in value stocks is imminent. This may very well be true in the next few weeks. But I believe that value still has quite a ways to go before a longer-term state of balance between it and growth can be reached - something that may not happen until later in 2021 or even 2022.

Data by YCharts

Data by YCharts

What is SPYV?

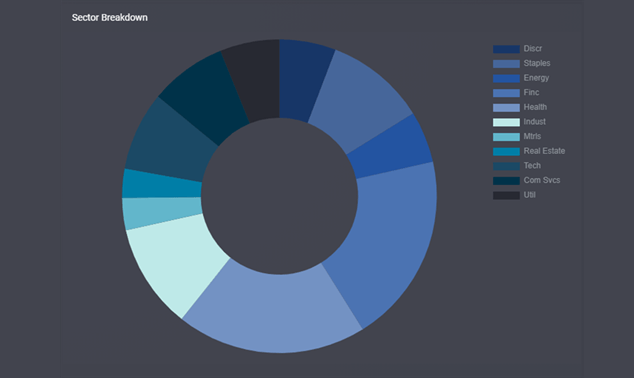

To be sure everyone is on the same page first, let me briefly review the key characteristics of the SPDR S&P 500 Value ETF. SPYV invests in nearly 400, primarily U.S.-based companies that check the "value box": stocks that exhibit the strongest value characteristics based on (1) price to book, (2) price to earnings and (3) price to sales ratios.

The sector split is consistent with what one would expect of a value fund (see doughnut chart below). Financial services account for the largest sector allocation, at nearly 20%. Other low valuation multiple sectors, including energy and industrials, are much more significantly represented compared to the S&P 500 (SPY), let alone the Nasdaq (QQQ).

Source: Etfrc.com

Cycle and valuation

The first reason why I believe in the strength of value in the next several months is our current position in the economic cycle. Following a highly disruptive period of global pandemic and "flash crash" in economic activity, I find it much more likely that 2021 will be a year of recovery rather than contraction.

Despite some dysfunction seen lately at the federal government level, fiscal and monetary policy will probably be very supportive of economic expansion. Meanwhile, the rollout of the coronavirus vaccine should slowly restore business activity to some sort of normal.

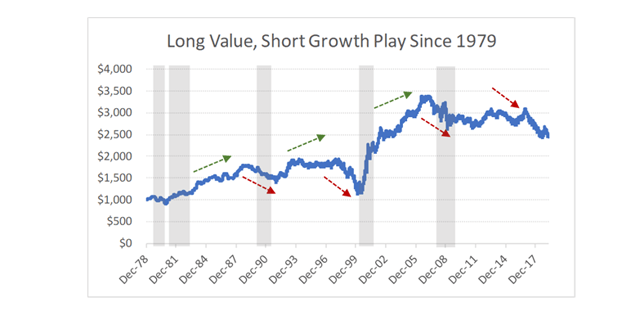

The graph below shows how value tends to outperform either during or immediately after recessions. The blue line represents a hypothetical long value, short growth portfolio. Other than in the decade following the Great Recession of 2008-2009, when Big Tech dominated the economy and the equities market, the cycles have been very consistent over the past 40 to 45 years at least.

Source: DM Martins Research, using data from the Federal Reserve Bank

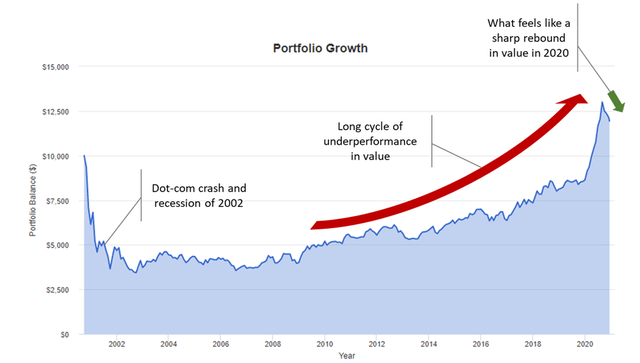

The second piece of the argument has to do with valuation. It is easy to get distracted by the fact that value has beaten growth by nearly 10 percentage points since the start of September 2020. But a step back reveals that the outperformance may have been merely the tip of the iceberg.

The graph below contextualizes the recent momentum in value. The chart is now flipped and represents a hypothetical long growth, short value strategy. Notice that the late 2020 rebound in the latter pales in comparison to how growth has outperformed in the past 20 years. By this measure, in fact, value continues to be just about the cheapest relative to growth since the dot-com bubble burst days of the early 2000s.

Source: Portfolio Visualizer

Last few words

Will banks, oil and gas producers, and airlines become the new engines of the U.S. economy, while Big Tech companies like Alphabet (NASDAQ:GOOG) (NASDAQ:GOOGL) and Amazon (NASDAQ:AMZN) sunset and lose their relevance? Highly unlikely. For this reason, I do not expect growth stocks to crash relative to value, as they did two decades ago.

Still, a mere return to the "old normal" of the mid-to-late 2010s probably means that a fund like SPYV will still outperform the broad market, and growth stocks more specifically, in the foreseeable future.

Join our community

Stocks have been on a choppy ride this year, and the future still looks uncertain. But all my SRG portfolios have been beating the S&P 500 in 2020 and since inception by producing far superior risk-adjusted returns. To find out how I have created a better strategy to growing your money in any economic environment, click here to take advantage of the 14-day free trial today.

Disclosure: I am/we are long AMZN, CALL OPTIONS ON SPY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.